Original article by @BlazingKevin_ , the Researcher at Movemaker

At a time when the industry is accelerating its exit, Circle chose to go public. Behind this is a seemingly contradictory but imaginative story - the net profit margin continues to decline, but it still has huge growth potential. On the one hand, it has high transparency, strong regulatory compliance and stable reserve income; on the other hand, its profitability is surprisingly mild - the net profit margin in 2024 is only 9.3%. This apparent inefficiency does not stem from the failure of the business model, but reveals a deeper growth logic: in the context of the gradual fading of high-interest dividends and the complex distribution cost structure, Circle is building a highly scalable, compliance-first stablecoin infrastructure, and its profits are strategically reinvested in market share improvement and regulatory bargaining chips. This article will take Circles seven-year road to listing as a clue, from corporate governance, business structure to profit model, to deeply analyze its growth potential and capitalization logic behind the low net profit margin.

1. Seven-year IPO race: a history of the evolution of crypto regulation

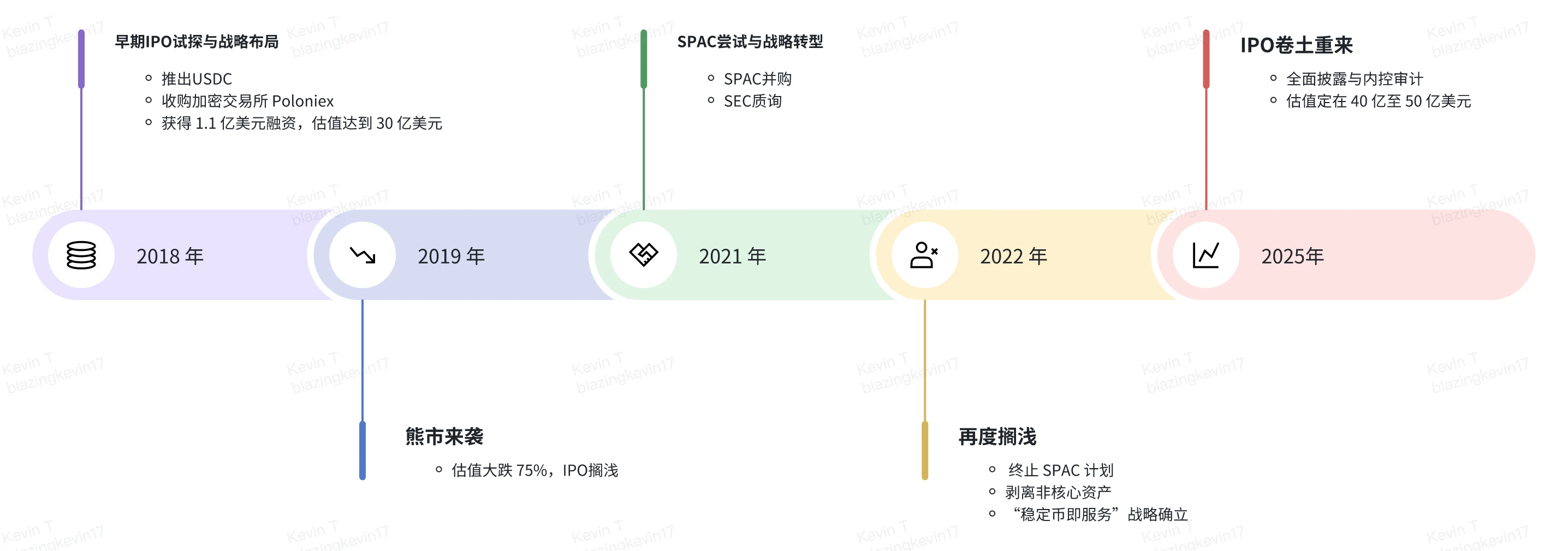

1.1 Paradigm shifts in three capitalization attempts (2018-2025)

Circles journey to the public market is a living example of the dynamic game between crypto companies and regulatory frameworks. The first IPO attempt in 2018 was during the period when the US Securities and Exchange Commission (SEC) was unclear about the nature of cryptocurrencies. At that time, the company acquired the Poloniex exchange to form a payment + trading dual-wheel drive, and obtained $110 million in financing from institutions such as Bitmain, IDG Capital, and Breyer Capital. However, the regulators doubts about the compliance of the exchanges business and the sudden impact of the bear market caused the valuation to plummet 75% from $3 billion to $750 million, exposing the fragility of the business model of early crypto companies.

The SPAC attempt in 2021 reflects the limitations of regulatory arbitrage thinking. Although the merger with Concord Acquisition Corp can circumvent the strict scrutiny of traditional IPOs, the SECs questioning of stablecoin accounting treatment hits the nail on the head - requiring Circle to prove that USDC should not be classified as a security. This regulatory challenge caused the transaction to fail, but it unexpectedly pushed the company to complete a key transformation: divesting non-core assets (such as Poloniexs sale to an investment group for $150 million) and establishing the strategic axis of stablecoin as a service. From this moment to today, Circle has fully invested in the construction of USDC compliance and actively applied for regulatory licenses in many countries around the world.

The IPO choice in 2025 marks the maturity of the capitalization path of crypto enterprises. Listing on the New York Stock Exchange not only needs to meet the full set of disclosure requirements of Regulation SK, but also needs to accept the internal control audit of the Sarbanes-Oxley Act. It is worth noting that the S-1 document disclosed the reserve management mechanism in detail for the first time: of the approximately US$32 billion in assets, 85% is allocated to overnight reverse repurchase agreements through BlackRocks Circle Reserve Fund, and 15% is deposited in systemically important financial institutions such as Bank of New York Mellon. This transparent operation essentially builds an equivalent regulatory framework to traditional money market funds.

1.2 Cooperation with Coinbase: From Ecosystem Co-construction to Delicate Relationship

As early as the launch of USDC, the two worked together through the Centre Consortium. When the Centre Consortium was established in 2018, Coinbase held a 50% stake and quickly opened up the market through the model of technology output in exchange for traffic entry. According to Circles IPO documents in 2023, it acquired the remaining 50% stake of Centre Consortium from Coinbase for $210 million in stock, and the profit-sharing agreement on USDC was also renegotiated.

The current profit-sharing agreement is a dynamic game. According to the S-1 disclosure, the two parties share a certain proportion of USDC reserve income (the article mentions that Coinbase shares about 50% of the reserve income), and the share ratio is related to the amount of USDC supplied by Coinbase. From Coinbases public data, it can be seen that the platform holds about 20% of the total circulation of USDC in 2024. With a 20% supply share, Coinbase took about 55% of the reserve income, which buried some hidden dangers for Circle: when USDC expands outside the Coinbase ecosystem, the marginal cost will rise nonlinearly.

2. USDC Reserve Management and Equity and Shareholding Structure

2.1 Tiered management of reserve funds

USDCs reserve management shows obvious liquidity stratification characteristics:

Cash (15%): Deposited in GSIBs such as Bank of New York Mellon to deal with unexpected redemptions

Reserve Fund (85%): Allocated through Circle Reserve Fund managed by BlackRock

Starting in 2023, USDC reserves will be limited to cash balances in bank accounts and Circle reserve funds, whose asset portfolio mainly includes U.S. Treasury securities with a remaining maturity of no more than three months and overnight U.S. Treasury repurchase agreements. The weighted average maturity of the asset portfolio in U.S. dollars does not exceed 60 days, and the weighted average duration of the asset portfolio in U.S. dollars does not exceed 120 days.

2.2 Equity Classification and Hierarchical Governance

According to the S-1 document submitted to the SEC, Circle will adopt a three-tier equity structure after listing:

Class A shares: Common stock issued during an IPO, with one vote per share;

Class B shares: held by co-founders Jeremy Allaire and Patrick Sean Neville, each share has five votes, but the total voting rights are capped at 30%, which ensures that the core founding team still has decision-making control even after the company goes public;

Class C shares: non-voting, convertible under certain conditions, ensuring that the corporate governance structure complies with New York Stock Exchange rules.

The equity structure is designed to balance public market financing with the stability of the companys long-term strategy, while ensuring that the executive team has control over key decisions.

2.3 Distribution of shareholdings by senior executives and institutions

The S-1 document disclosed that the senior management team owns a large number of shares, and several well-known venture capital and institutional investors (such as General Catalyst, IDG Capital, Breyer Capital, Accel, Oak Investment Partners and Fidelity) hold more than 5% of the shares, and these institutions hold more than 130 million shares in total. An IPO with a valuation of 5 billion can bring them significant returns.

3. Profit model and revenue breakdown

3.1 Revenue model and operating indicators

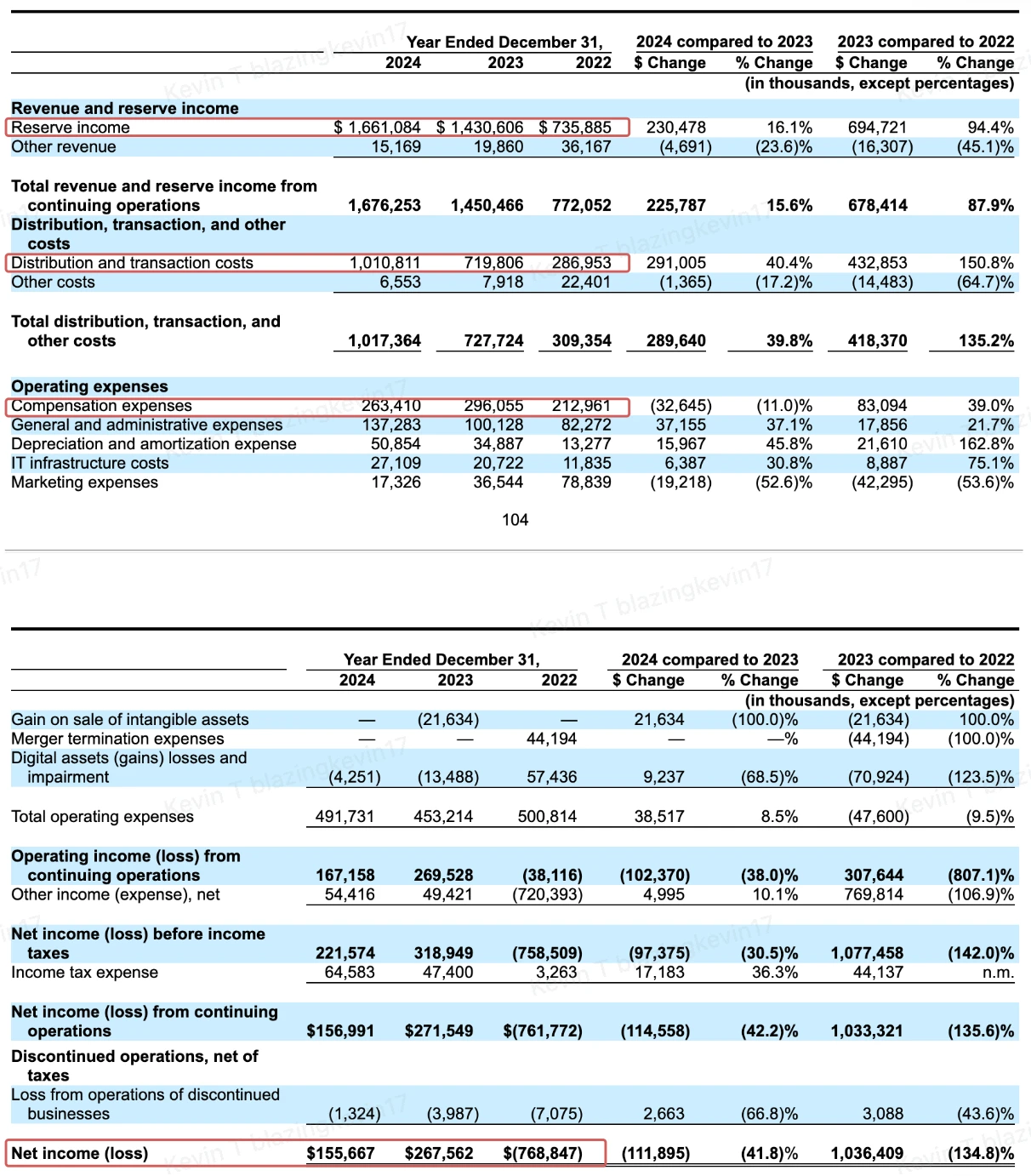

Source of income: Reserve income is Circles core source of income. Each USDC token is backed by an equal amount of U.S. dollars. The invested reserve assets mainly include short-term U.S. Treasury bonds and repurchase agreements, which can obtain stable interest income in high-interest cycles. According to S-1 data, total revenue in 2024 will reach US$1.68 billion, of which 99% (about US$1.661 billion) will come from reserve income.

Sharing with partners: The cooperation agreement with Coinbase stipulates that Coinbase will receive 50% of the reserve income based on the amount of USDC held, resulting in relatively low income actually belonging to Circle, which has lowered the net profit performance. Although this sharing ratio has dragged down profits, it is also a necessary price for Circle to build an ecosystem with partners and promote the widespread use of USDC.

Other income: In addition to reserve interest, Circle also increases revenue through enterprise services, USDC Mint business, cross-chain fees, etc., but the contribution is relatively small, only US$15.16 million.

3.2 The paradox of revenue growth and profit contraction (2022-2024)

There are structural reasons behind the apparent contradictions:

Converging from multiple to single core: From 2022 to 2024, Circles total revenue increased from US$772 million to US$1.676 billion, with a compound annual growth rate of 47.5%. Among them, reserve income has become the companys most core source of income, with the proportion of revenue increasing from 95.3% in 2022 to 99.1% in 2024. This increase in concentration reflects the successful implementation of its stablecoin as a service strategy, but it also means that the companys dependence on changes in macro interest rates has significantly increased.

The surge in distribution expenses squeezed the gross profit margin: Circles distribution and transaction costs rose sharply in three years, jumping from $287 million in 2022 to $1.01 billion in 2024, an increase of 253%. Such costs are mainly used for the issuance, redemption and payment and settlement system expenses of USDC. As the circulation of USDC increases, this expense will increase rigidly.

Since such costs cannot be significantly compressed, Circles gross profit margin will drop rapidly from 62.8% in 2022 to 39.7% in 2024. This reflects that although its ToB stablecoin model has scale advantages, it will face systemic risks of profit compression in the downward interest rate cycle.

Profitability turned from loss to profit, but the margin slowed down: Circle officially turned from loss to profit in 2023, with a net profit of US$268 million and a net profit margin of 18.45%. Although the profit trend continued in 2024, after deducting operating costs and taxes, the disposable income was only US$101,251,000, and after adding non-operating income of US$54,416,000, the net profit was US$155 million, but the net profit margin had dropped to 9.28%, a year-on-year decrease of about half.

Cost rigidity: It is worth noting that the companys investment in general and administrative expenses in 2024 will reach US$137 million, a year-on-year increase of 37.1%, and has increased for three consecutive years. Combined with its S-1 disclosure information, this expenditure is mainly used for global license applications, audits, and expansion of legal and compliance teams, which confirms the cost rigidity brought about by its compliance first strategy.

Overall, Circle completely got rid of the exchange narrative in 2022, achieved a profitability inflection point in 2023, successfully maintained profits in 2024 but at a slower growth rate, and its financial structure has gradually moved closer to traditional financial institutions.

However, its revenue structure, which is highly dependent on the interest rate spread of US bonds and the scale of transactions, also means that once it encounters a downward cycle of interest rates or a slowdown in the growth of USDC, its profit performance will be directly impacted. In the future, if Circle wants to maintain sustainable profitability, it needs to seek a more stable balance between reducing costs and expanding volume.

The deeper contradiction lies in the flaws in the business model: when USDCs attributes as a cross-chain asset are enhanced (on-chain transaction volume of 20 trillion US dollars in 2024), its currency multiplier effect will weaken the profitability of the issuer. This is similar to the dilemma of the traditional banking industry.

3.3 Growth potential behind low net profit margin

Although Circles net profit margin continues to be under pressure due to high distribution costs and compliance expenses (net profit margin in 2024 is only 9.3%, a year-on-year decrease of 42%), there are still multiple growth drivers hidden in its business model and financial data.

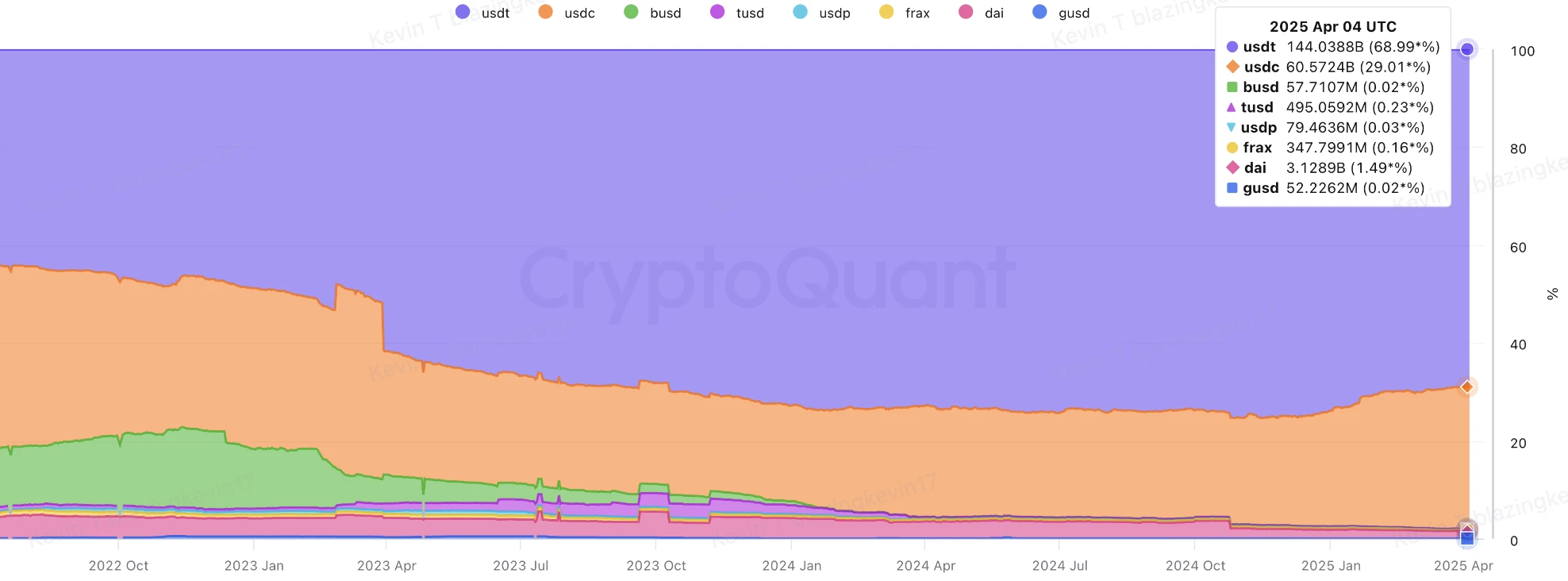

The continuous increase in circulation drives the steady growth of reserve income: According to CryptoQuant data, as of early April 2025, USDCs market value exceeded 60 billion US dollars, second only to USDTs 144.4 billion US dollars; by the end of 2024, USDCs market share has increased to 26%. On the other hand, USDCs market value growth in 2025 remains strong. In 2025, USDCs market value has increased by 16 billion US dollars. Considering that its market value was less than 1 billion US dollars in 2020, the compound annual growth rate (CAGR) from 2020 to April 2025 has reached 89.7%. Even if USDCs growth rate slows down in the remaining 8 months, its market value is still expected to reach 90 billion US dollars by the end of the year, and the CAGR will rise to 160.5%. Although reserve income is highly sensitive to interest rates, low interest rates may stimulate USDC demand, and strong scale expansion can partially offset the risk of interest rate downturns.

Structural optimization of distribution costs: Despite paying a high share to Coinbase in 2024, this cost is nonlinear with the growth of circulation. For example, the cooperation with Binance only paid a one-time fee of US$60.25 million, which increased the supply of USDC on its platform from US$1 billion to US$4 billion, and the unit customer acquisition cost was significantly lower than Coinbase. Combined with the cooperation plan between Cirlce and Binance in the S-1 document, Cirlce can be expected to achieve market value growth at a lower cost.

Conservative valuation does not price market scarcity: Circles IPO valuation is between $4 billion and $5 billion. Based on an adjusted net profit of $200 million, the P/E is between 20 and 25x. Similar to traditional payment companies such as PayPal (19x) and Square (22x), it seems to reflect the markets positioning of its slow growth and stable profitability, but this valuation system has not fully priced its scarcity value as the only pure stablecoin target in the US stock market. The only target in a segmented track usually enjoys a valuation premium, which Circle does not include. At the same time, if the stablecoin-related bill is successfully implemented, offshore issuers will need to significantly adjust their reserve structure, and the existing compliance structure can be directly transferred to form a regulatory arbitrage end dividend. The corresponding policy changes can bring significant market share gains to USDC.

The market value trend of stablecoins is more resilient than that of Bitcoin: the market value of stablecoins can remain relatively stable when the price of Bitcoin falls sharply, showing its unique advantage in the volatility of the crypto market. When the market enters the bear market phase, investors often seek safe-haven assets. The stability of the growth of the market value of stablecoins makes Circle a safe haven for funds. Compared with companies such as Coinbase and MicroStrategy that are highly dependent on market conditions, Circle, as the main issuer of USDC, relies more on the trading volume of stablecoins and the interest income of reserve assets, rather than being directly affected by the price fluctuations of crypto assets. Therefore, Circle has stronger risk resistance in a bear market and higher profit stability. This allows Circle to play a hedging role in the investment portfolio and provide investors with a certain umbrella of protection, especially when the market fluctuates violently.

4 Risks - Drastic changes in the stablecoin market

4.1 Institutional network is no longer a solid moat

The double-edged sword of interest binding: Although Coinbase takes 55% of the reserve income, it only holds 20% of the USDC. This asymmetric division stems from the legacy agreement of the Centre Alliance in 2018, which in disguise causes Circle to pay $0.55 for every $1 of additional revenue, which is significantly higher than the industry average.

Ecosystem lock-in risk: The advance payment agreement signed with Binance exposes an imbalance in channel control. If the leading exchanges collectively request to renegotiate the terms, it may trigger a vicious cycle of spiraling distribution costs.

4.2 Two-way impact of the progress of the stablecoin bill

Pressure to localize reserve assets: The bill requires issuers to hold 100% of reserves (cash and cash equivalents) and give priority to using U.S. federal or state-chartered depository institutions as custodians. Currently, Circle only has 15% of its cash deposited in domestic institutions such as Bank of New York Mellon. If compliance adjustments are made, hundreds of millions of dollars in one-time fund migration costs may be incurred.

5. Summary of Thoughts: Strategic Window for Game Changers

5.1 Core Advantages: Market Positioning in the Compliance Era

Double compliance network: Circle has built a regulatory matrix covering the United States, Europe, and Japan, which is an institutional capital that is difficult for traditional companies such as PayPal to replicate. After the implementation of the Payment Stablecoin Act, its compliance costs as a percentage of revenue are expected to be significantly reduced, forming a structural advantage.

Cross-border payment alternatives: The USDC instant settlement service launched in cooperation with Wise has significantly reduced the cost of cross-border payments for enterprises. If a portion of SWIFTs annual settlement volume is penetrated, it can bring considerable new circulation volume, completely offsetting the impact of falling interest rates.

B2B financial infrastructure: In Stripes e-commerce payment system, the proportion of USDC settlement has increased significantly, and its automatic fiat currency conversion protocol can significantly save foreign exchange hedging costs for enterprises. The expansion of this embedded finance scenario has enabled USDC to gradually move away from the simple transaction medium attribute and evolve towards the value storage function.

5.2 Growth Flywheel: The Game between Interest Rate Cycle and Economies of Scale

Emerging market currency substitution: In some areas with high inflation, USDC has occupied a part of the US dollar foreign exchange transactions. If the Feds interest rate cuts lead to accelerated depreciation of the local currency, this digital dollarization process may significantly promote the growth of circulation.

Offshore dollar repatriation channel: By working with BlackRock to explore tokenized asset-related projects, Circle is converting some offshore US dollar deposits into on-chain assets. The value of this fund pipeline has not yet been reflected in the current valuation.

RWA asset tokenization: The tokenized asset service launched after the acquisition of relevant technology companies has achieved initial management scale, with considerable annual management fee income.

Interest rate buffer period: The current federal funds rate is still high. Circle needs to accelerate internationalization to push the circulation volume to the key threshold before the expectation of interest rate cuts is fully priced in, so that the scale effect can cover the impact of the downward interest rate.

Regulatory window period: Before the Payment Stablecoin Act is finally implemented, use the existing compliance advantages to seize institutional customers, sign exclusive settlement agreements with many top hedge funds, and build exit barriers.

Deepening the enterprise service suite: Packaging compliance APIs and on-chain audit tools into the Web3 Financial Services Cloud, charging SaaS subscription fees to traditional banks, and opening up a second curve of non-reserve income.

Under the appearance of Circles low net profit margin, the essence is the profit for scale strategy it actively chose during the strategic expansion period. When the circulation of USDC exceeds 80 billion US dollars, the asset management scale of RWA and the penetration rate of cross-border payments achieve breakthroughs, its valuation logic will undergo a qualitative change - evolving from a stablecoin issuer to a digital dollar infrastructure operator. This requires investors to re-evaluate the monopoly premium brought by its network effect from a 3-5 year cycle perspective. At the historic intersection of traditional finance and the crypto economy, Circles IPO is not only a milestone in its own development, but also a touchstone for the revaluation of the entire industry.

Reference article: https://www.sec.gov/Archives/edgar/data/1876042/000119312525070481/d737521ds1.htm#rom737521_10 https://www.bloomberg.com/opinion/newsletters/2025-04-02/stablecoins-are-growing-up?embedded-checkout=true

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos Chinese ecosystem. As the official representative of Aptos in the Chinese region, Movemaker is committed to building a diverse, open and prosperous Aptos ecosystem by connecting developers, users, capital and many ecological partners.

Disclaimer

This article/blog is for informational purposes only and represents the personal opinions of the author and does not necessarily represent the position of Movemaker. This article is not intended to provide: (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Holding digital assets, including stablecoins and NFTs, is extremely risky and may fluctuate in price and become worthless. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial situation. If you have questions about your specific situation, please consult your legal, tax or investment advisor. The information provided in this article (including market data and statistical information, if any) is for general information only. Reasonable care has been taken in the preparation of these data and charts, but no responsibility is assumed for any factual errors or omissions expressed therein.