1. Outlook

1. Macro-level summary and future forecasts

The U.S. Customs and Border Protection announced on the evening of the 11th local time that the federal government has agreed to exempt electronic products such as smartphones, computers, and chips from so-called reciprocal tariffs. Affected by the U.S. announcement that some goods are exempt from reciprocal tariffs, market panic has dissipated, and documents released by the Customs and Border Protection show that these products are excluded from the so-called reciprocal tariffs imposed by the government on trading partners. The documents show that the exempted products apply to electronic products entering the United States after April 5, and the reciprocal tariffs already paid can be refunded. The easing of the so-called reciprocal tariff policy in the United States has temporarily relieved the market. After the Trump administration exempted popular consumer electronics and key components, the U.S. technology industry has temporarily escaped the brink of collapse.

Influenced by positive sentiment, global financial markets are expected to see a retaliatory rebound this week.

2. Cryptocurrency market changes and warnings

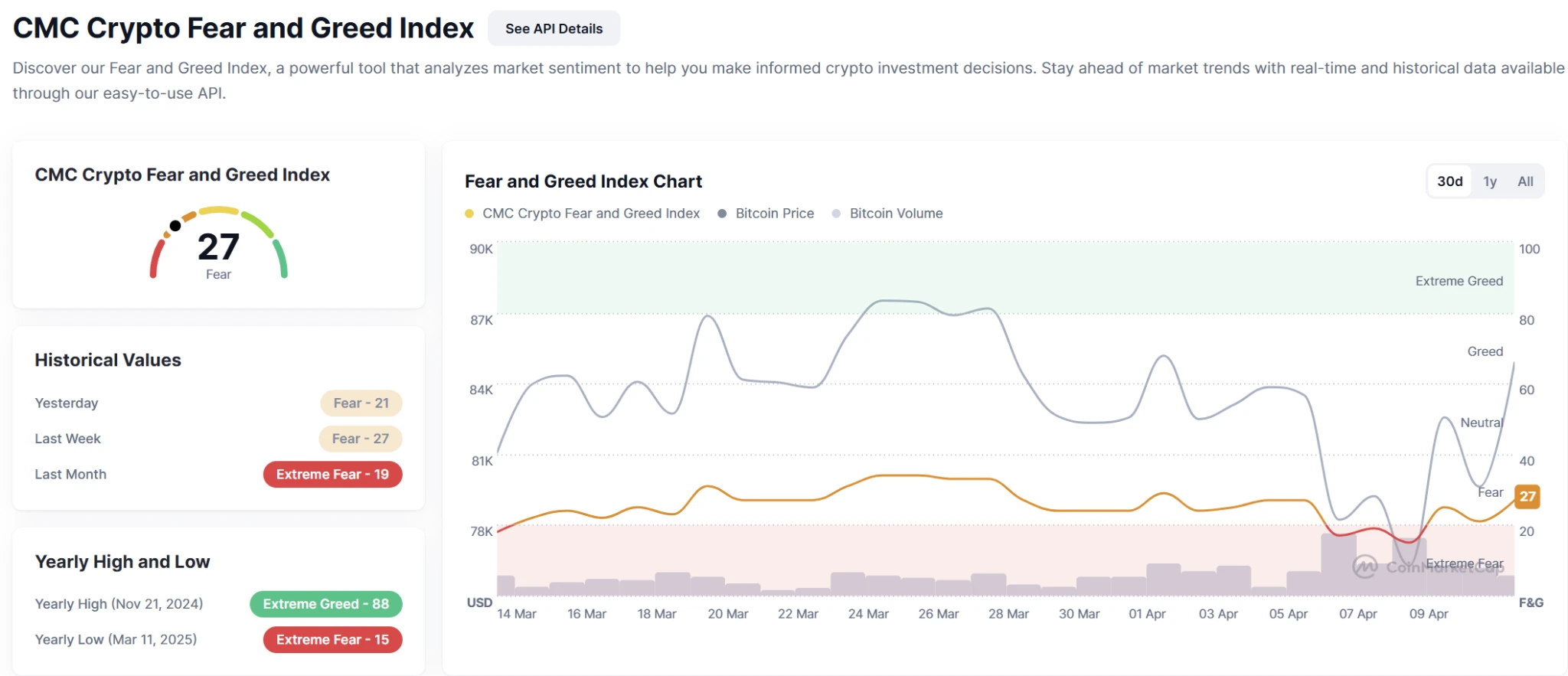

Affected by the above-mentioned positive factors, BTC rose by more than 6% and returned to the level of 80,000 US dollars. The sustainability of this momentum depends on the continued clarity of the macro economy, technical strength and market sentiment. It is predicted that the BTC price may fluctuate between 80,000 and 85,000 US dollars. If risk appetite continues, the bullish direction will be pushed to 89,000 US dollars; if uncertainty reappears, it may fall back to 78,000 to 79,000 US dollars. Industry users should take risk prevention measures.

3. Industry and track hot spots

Last week, the stablecoin engine CAP provided users with a new option that does not rely on endogenous models. It opens up a hidden field of returns for users.

P2P.me eliminates the need for custody by leveraging zk proofs to meet KYC standards and fiat transfer needs, thereby becoming a fully decentralized protocol governed by the collective interests of users.

PumpBTC, Babylon’s liquidity staking solution, aims to introduce decentralized finance (DeFi) into the Bitcoin ecosystem, relying on an ecosystem-centric approach and supported by experienced DeFi experts and industry-leading partners.

Arcadia Finance allows everyone, whether professional market makers or ordinary users, to earn returns by leveraging automated market makers (AMM) liquidity positions. It supports virtual liquidity and pooled liquidity positions and integrates with major decentralized exchanges (DEX) such as Uniswap, Aerodrome and Alienbase.

2. Market hot spots and potential projects of the week

1. Potential track performance

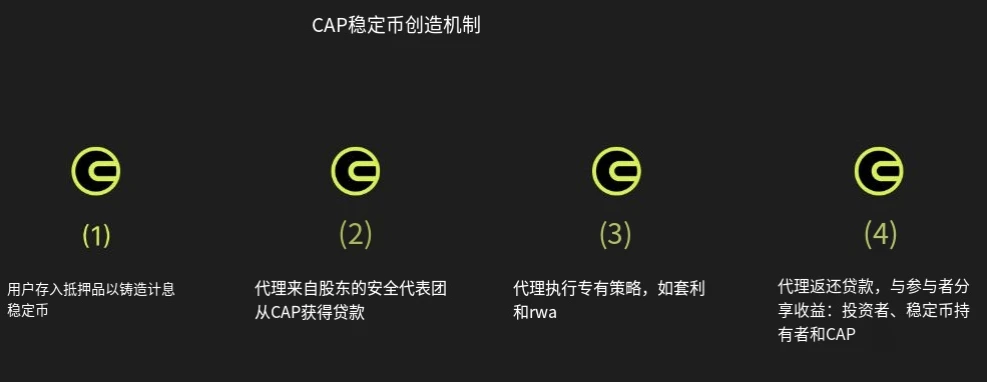

1.1. Analysis of how CAP, a stablecoin engine that raised $8 million and broke the crypto class income structure, realized the WEB3 vision

CAP offers users a new option that does not rely on endogenous models. It opens up a hidden realm of returns for users that was previously only accessible to wealthy insiders and their institutions. Exogenous sources of returns, such as arbitrage, are among the most profitable business models in the crypto space. However, due to their complexity, only a few players dominate this space. With CAP, any user will be able to access this scalable, adaptable native return.

Technical Details

Solution:CAP

CAP is a stablecoin engine designed to free users from the cycle of endogenous models. It achieves this goal by not relying on suboptimal traditional financial solutions and predatory token pump designs.

CAPs stablecoin engine will issue redeemable stablecoins in multiple denominations such as USD, Bitcoin, and Ethereum. Its goal is to democratize yield opportunities that were previously limited to a small number of savvy and wealthy participants. This includes deep sources of yield such as arbitrage, maximum extractable value (MEV), and real world assets (RWA).

At no point are users directly exposed to custodians, centralized exchanges, cross-chain bridges, or other infrastructure associated with yield generation. CAP underwrites the risks of these operations through an innovative implementation of a shared security network.

1. Benefits

CAP stablecoin is designed to provide competitive returns in any market environment. Due to its competitive agency model, the strategy will continue to change as the market develops. Stablecoin holders only need to choose the stablecoin denomination they wish to hold, and the returns will be generated in the background.

2. Scalability

A competitive network of agents will execute returns based on independent strategies. These strategies must continuously adapt to market conditions to exceed the median benchmark yield established by agent performance. This will enable CAP to continuously provide competitive returns regardless of market conditions and remain stable as it scales. Because the protocol does not rely on slow infrastructure like off-chain legal agreements and internal human dependencies, CAP is ready to scale with deposits.

3. Stability

CAP stablecoins are redeemable for the collateral behind them. Users can choose the stablecoin denomination and collateral basket they wish. This ensures predictability of stablecoin prices and provides diversified directional risk exposure.

4. Censorship Resistance

CAP is opening up a new application scenario for shared security networks such as EigenLayer. By leveraging an overlay model of security delegation, CAP will protect end users (stablecoin holders) from the risk of proxy-generated returns. This innovative arrangement will allow re-stakeholders and agents to collaborate and jointly evaluate the risks and rewards of all strategies that drive CAP value creation.

Alternatives to Stablecoins

CAPs unique unlocking feature

Adaptive returns: CAP stablecoin does not rely on a single strategy or a manual team to adjust the strategy. Returns are a competition, and only the best strategies can survive.

High-frequency strategy: By leveraging the high speed of MegaETH, the CAP strategy will interact with native decentralized applications (dApps) to ensure that users have an efficient decentralized finance (DeFi) experience. This includes market making operations on GTE, liquidation of lending markets, and arbitrage on new applications.

Protected Agents: All active agents must obtain a security delegation from a re-stakeholder to participate in the network. This will involve a careful vetting process of participating agents and their strategies by re-stakeholders and risk managers.

Evergreen Protocol: Because CAP does not rely on master agents, off-chain legal agreements, or other centralized execution components, it is able to continue to grow and thrive without a human team.

Mega Mafia

A small group of highly skilled teams have come together to develop new applications on MegaETH, taking advantage of the chains high speed and low latency. These projects are fully supported by MegaETH and have established a mutually beneficial relationship.

The CAP stablecoin will be integrated with all protocols using stablecoins on MegaETH and play a key role in the TVL launch strategy.

Risk Highlights

Slashing Execution Risk: Slashing functions regulate activity within CAP, protecting the protocol and users from malicious agents and force majeure events related to yield generation. The effective execution of these functions relies on timely implementation of slashing when necessary. Such operations may face multiple potential obstacles, such as the risk of delegating tokens, especially when interacting with liquidity re-staking token projects. Codebases exposed to EigenLayer and other shared security markets may also pose potential risks to slashing execution.

Pre-existing exposure risk: Users need to make a decision and that is to choose the tokens they wish to be exposed to. The prices of these tokens may fluctuate, especially gas tokens like BTC and ETH.

Reviews

The CAP project provides users with a competitive and scalable stablecoin income platform through an innovative income model, decentralized protocol design, and deep integration with MegaETH. However, the complex technical architecture and high-frequency trading strategies make it subject to certain execution risks, and the token price volatility risks faced by users cannot be ignored. Overall, CAP has great potential in improving market efficiency and income competitiveness, but it also needs to ensure technical reliability and gradual market acceptance.

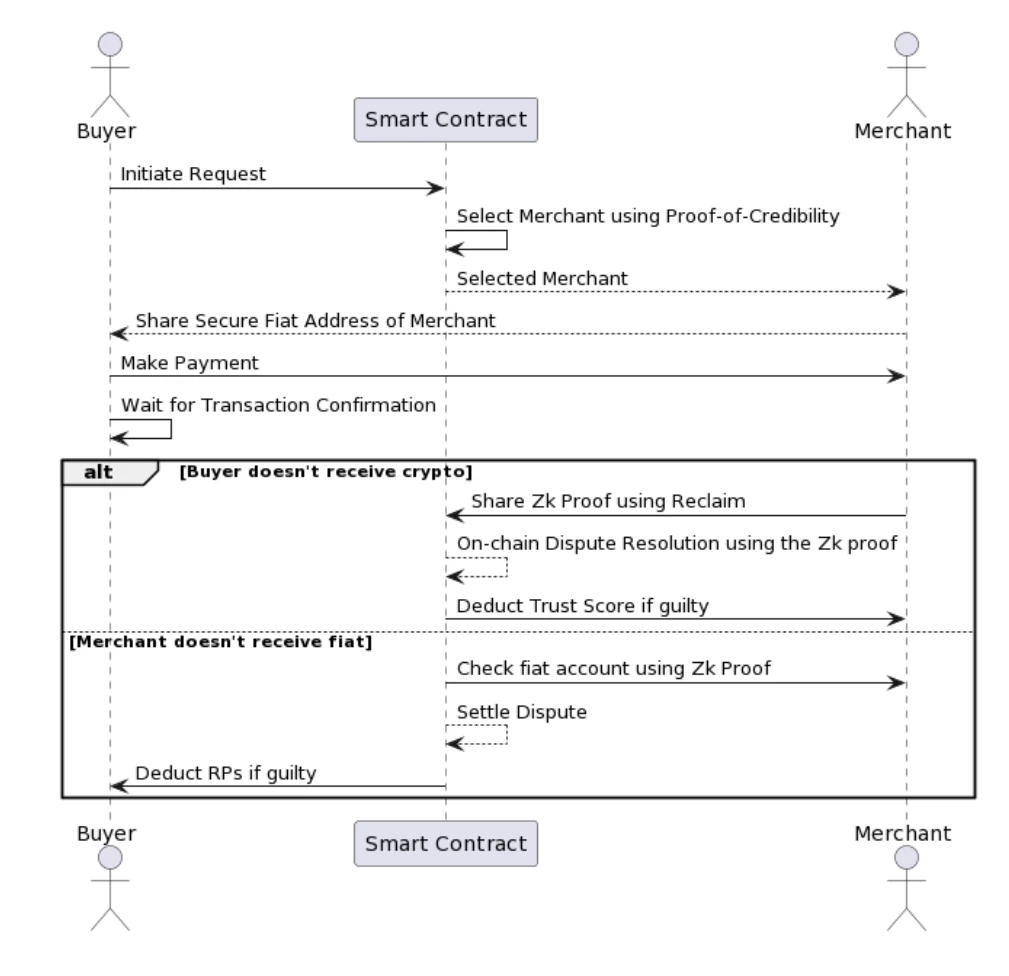

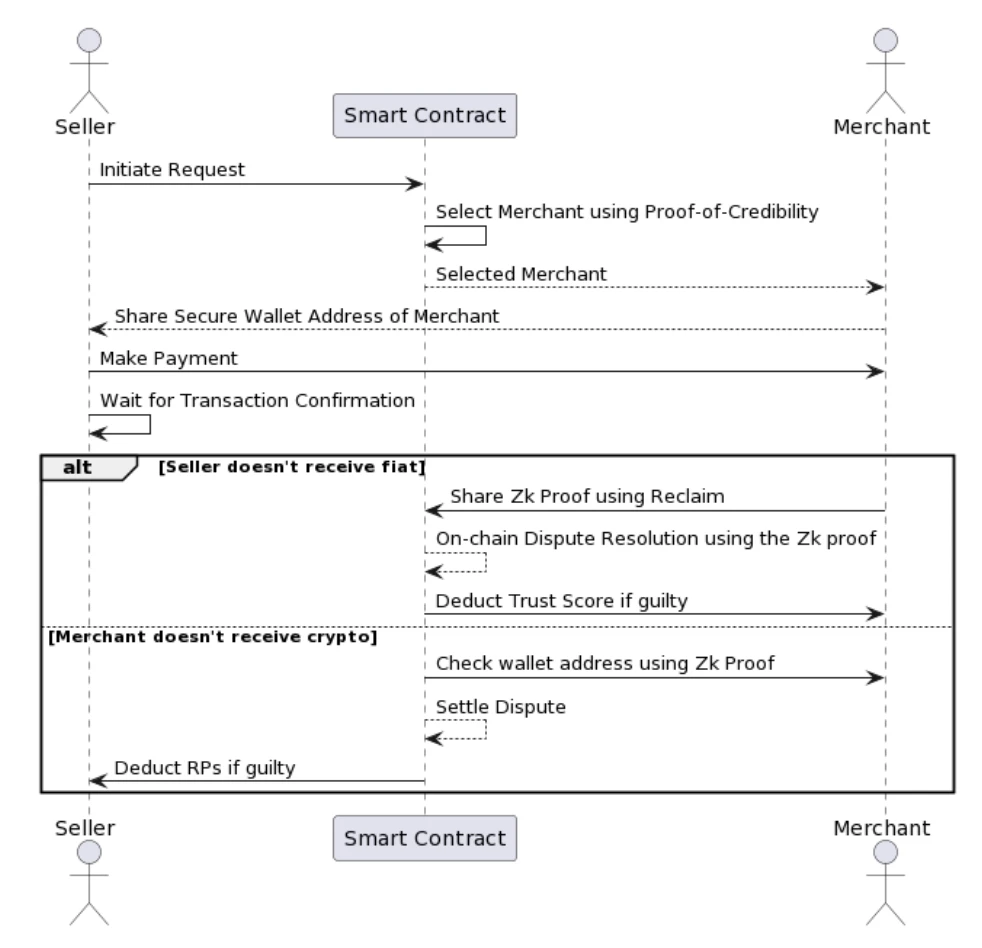

1.2. What are the characteristics of P2P.me, a decentralized transfer protocol led by Multicoin and Coinbase that uses ZK technology to eliminate the need for custody?

P2P.me eliminates the need for escrow by leveraging zk proofs to meet KYC standards and fiat transfer requirements, making it a fully decentralized protocol governed by the collective interests of users. In P2P.me, smart contracts trustfully match buyers with highly audited merchants with legitimate cryptocurrency assets through reputation scores.

P2P.me is based on the Base network and aims to facilitate the listing and delisting of stablecoins and fiat currencies through a fully decentralized protocol. The smart contracts that drive the protocol are built anonymously by a group of developers.

P2P.me also seeks to maintain an open protocol that continues to operate as a service in the public interest.

Architecture Overview

Below is an end-to-end visualization of the fiat to stablecoin deposit (and withdrawal) process performed via the P2P.me protocol.

Order:

After installing the P2P.me app on a mobile device, users tap the “Buy USDC” button (or “Sell USDC” for withdrawal transactions) to initiate an order request and then enter the desired purchase amount. Users can also import an existing Base USDC wallet address to start trading.

Order matching mechanism:

An innovative “proof of trustworthiness” algorithm maintains a list of rigorously audited stablecoin merchants waiting for order matching. A fiat payment address is shared through a smart contract, which is encrypted by the user’s key, ensuring data privacy. (In the case of a withdrawal transaction, the Base USDC wallet address is displayed.) The buyer then transfers the required amount to the provided fiat account and waits for the merchant to verify the transaction.

Processing orders:

Typically within a few minutes of placing the order, the buyer will receive confirmation that the transaction was successful. Their wallet address will show the updated USDC balance. If the buyer attempts to proceed without first completing the fiat transfer, they risk losing their 50 RPs - which involves more extensive dispute resolution.

Dispute Resolution:

In P2P.me, every data sharing is done through the use of Zk proofs. If one party files a dispute against another party due to lost funds or incomplete transactions, the latter (the prover) can confront the former (the verifier) by simply presenting and sharing the Zk proof of their transaction without submitting any additional data about their identity or the transaction itself. Smart contracts automatically resolve disputes based on the presence (or absence) of Zk proofs.

On-chain protocol operations:

The entire communication flow between merchants and buyers happens entirely on-chain. No off-chain operations are performed during the process, making the process more secure and fully decentralized. In addition, Zk proofs are also securely stored as on-chain credentials - a feat made possible by Reclaim.

Deposit diagram

Withdrawal diagram

Some key considerations

The role of the merchant is to provide liquidity intermediary for transactions.

The responsibility of providing Zk proof always lies with the merchant.

Zk proofs perform trustless KYC (identity verification) for users.

Zk proofs automatically resolve disputes for users.

The Reclaim protocol securely encrypts all data transmitted via Zk proofs.

Reclaim supports the creation, storage, and transfer of Zk proofs.

Reviews

The advantage of the P2P.me protocol is that it provides a decentralized, secure and privacy-preserving trading platform, especially in handling disputes and KYC identity verification through Zk proofs, which significantly improves user trust and operational efficiency. However, its disadvantage is that it relies on the integrity of merchants, and the platform still faces certain challenges in terms of popularity, cross-chain compatibility, and the popularity and understanding of Zk proofs.

1.3. A brief analysis of the LST platform PumpBTC, which maximizes profits by staking BTC derivatives and relying on Babylon’s shared security

PumpBTC, as Babylons liquidity staking solution, aims to introduce decentralized finance (DeFi) into the Bitcoin ecosystem, relying on an ecosystem-centric approach and supported by experienced DeFi experts and industry-leading partners. By abstracting complexity, PumpBTC facilitates seamless cooperation between users and Babylon. Users only need to make one operation through PumpBTC to stake Bitcoin to Babylon and obtain liquidity tokens immediately without waiting.

PumpBTC is inspired by the “pump” culture in the Bitcoin community and aims to help Bitcoin holders maximize returns through Babylon’s liquidity staking - essentially rebuilding WBTC/BTCB with native returns.

Architecture Analysis

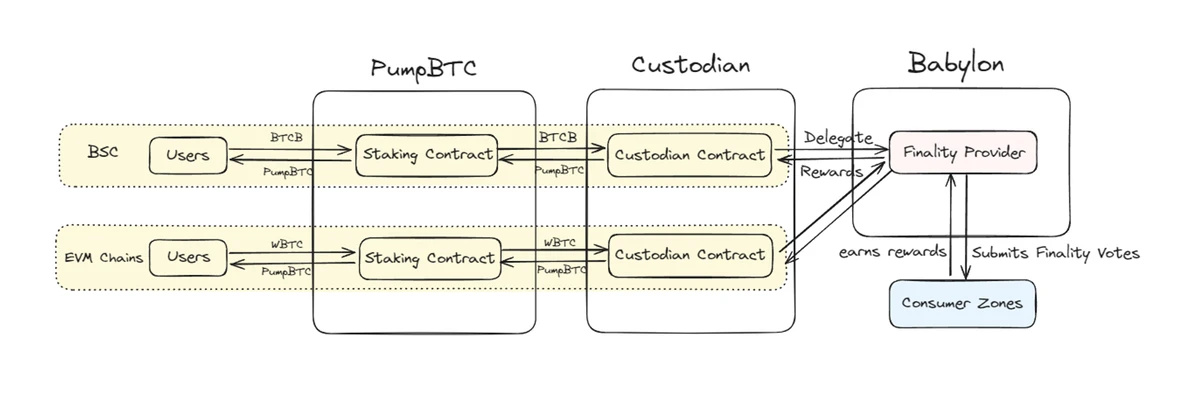

PumpBTC is revolutionizing how users can leverage Bitcoin across multiple blockchain networks. PumpBTC is first launched on Binance Smart Chain (BSC) with plans to expand to other EVM-enabled chains such as Berachain and Scroll. Users can stake various forms of Bitcoin (such as BTCB and WBTC) and receive $pumpBTC tokens in return. These tokens automatically accumulate yield from the Babylon protocol, providing a seamless staking experience.

PumpBTC puts security first. It does not hold user assets directly, but cooperates with professional licensed custodians such as Cobo MPC and Coincover. This approach significantly reduces the risks brought by traditional bridges (such as Multichain, Nomad, etc.) while still providing additional benefits.

Transparency is at the core of PumpBTC’s design, and the platform provides a real-time dashboard showing proof-of-asset data so users can monitor their staked Bitcoin at any time.

The custodian is responsible for entrusting the equivalent value of local Bitcoin to Babylons Finality Provider, allocating it on the Bitcoin mainnet and managing the distribution of rewards to users. This comprehensive system ensures that PumpBTC never directly handles user assets, thereby minimizing security risks while maximizing potential returns.

By combining multi-chain accessibility, professional-grade asset security, real-time transparency, and efficient yield generation, PumpBTC provides a unique solution in the DeFi space. It provides a secure and profitable way for Bitcoin holders to participate in Babylon staking across multiple blockchain ecosystems while maintaining the security, liquidity, and integrity of their original assets.

While staking directly on the Babylon chain offers attractive rewards, $pumpBTC takes your Bitcoin utility to a new level:

Enhanced liquidity: Unlike staking Bitcoin directly on Babylon, which may lock up assets, $pumpBTC provides greater flexibility. You can trade $pumpBTC on multiple decentralized and centralized exchanges, as long as there is sufficient liquidity. This feature allows you to quickly respond to market opportunities while maintaining exposure to the value of Bitcoin.

Simplified staking process: PumpBTC simplifies the BTC.B/WBTC staking experience, allowing you to stake BTC.B/WBTC directly on different chains. This approach leverages the EVM chains powerful DeFi ecosystem and proven security infrastructure, providing a familiar and reliable environment for your staking activities.

Amplified Yield Generation: By converting BTC.B/WBTC to $pumpBTC, you can earn multiple reward streams, as well as Babylons native rewards. This diversification can significantly increase your overall earnings potential, allowing you to maximize returns on your Bitcoin holdings.

Ecosystem Integration: $pumpBTC is a gateway to a wide range of DeFi protocols and applications built on Ethereum and other EVM chains. This integration expands your options in yield farming, lending, and other DeFi strategies.

Risk Mitigation: Fast Trading $pumpBTC provides an additional layer of risk management. In the event of volatile markets, you can adjust your positions quickly without facing the delays typically associated with the unstaking process on other platforms.

Compounding Growth Opportunities: The liquid nature of $pumpBTC enables easy reinvestment of earnings, enabling compounding growth strategies that could significantly increase long-term returns.

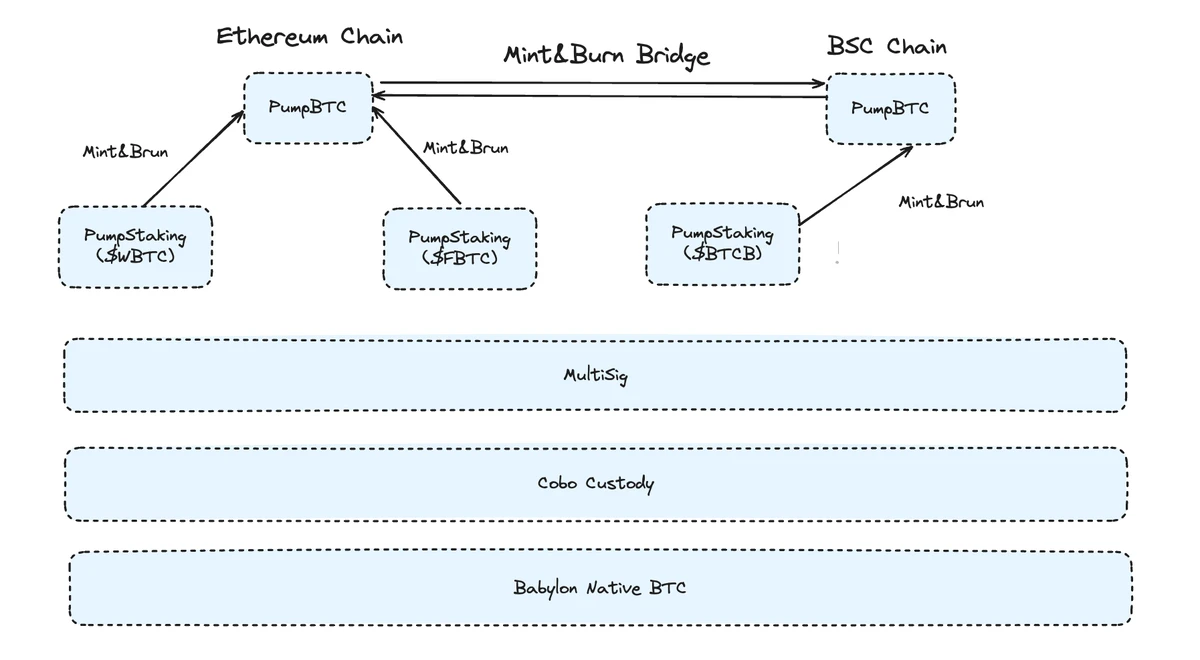

As you can see from this more intuitive diagram, assets are either in the EVM contract (as wrapped Bitcoin) or in Babylon (as native Bitcoin).

Intermediary layers such as MultiSig -> Binance -> Cobo custody are just channels and theoretically should not hold assets. The $pumpBTC contract is independently deployed on different chains. Each chain can mint $pumpBTC through the pledge contract and destroy $pumpBTC by revoking the pledge.

The total supply of $pumpBTC is equal to the sum of the supply of all on-chain $pumpBTC contracts. Each $pumpBTC is backed by a 1:1 local Bitcoin reserve. The PumpStaking contract acts as a deposit and withdrawal channel for wrapped Bitcoin tokens ($BTCB / $WBTC / $FBTC) on different chains.

The majority of assets are stored as local Bitcoin in Babylon, custodial via Cobo. A smaller portion of assets are stored in PumpStaking as Wrapped Bitcoin tokens.

PumpTokens can be transferred between different chains through a cross-chain bridge. The cross-chain process is as follows:

Source chain destroys $pumpBTC

Target chain minting $pumpBTC

This cross-chain approach does not affect the total supply, keeping each $pumpBTC backed 1:1 by local Bitcoin reserves.

Minting and destruction process

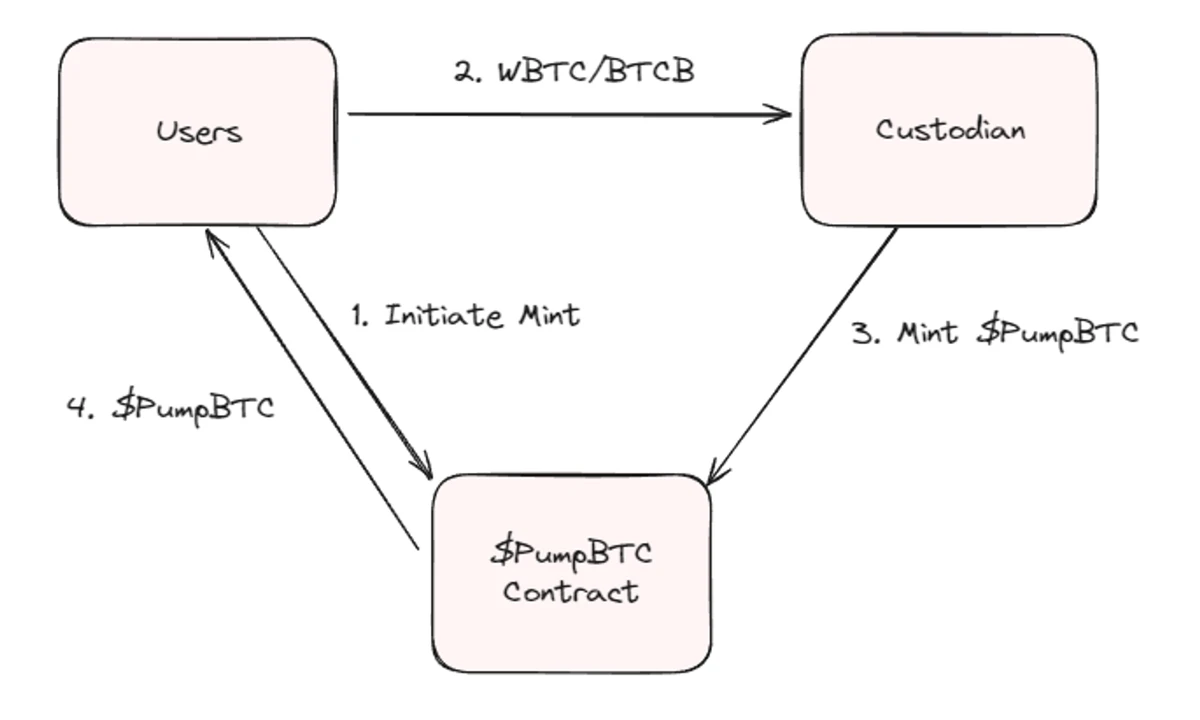

Casting process

The minting process in PumpBTC represents the creation of new wrapped tokens (specifically $pumpBTC). This process begins when a user deposits assets into the PumpBTC system. When a user submits assets, they are transferred directly to a cooperating custodian, rather than directly to PumpBTC itself. Once the custodian receives these assets, a minting transaction is triggered, converting the assets into $pumpBTC tokens and sending them to the PumpBTC smart contract. This action creates new $pumpBTC tokens at a 1:1 ratio. Finally, these newly minted $pumpBTC tokens are transferred back to the user.

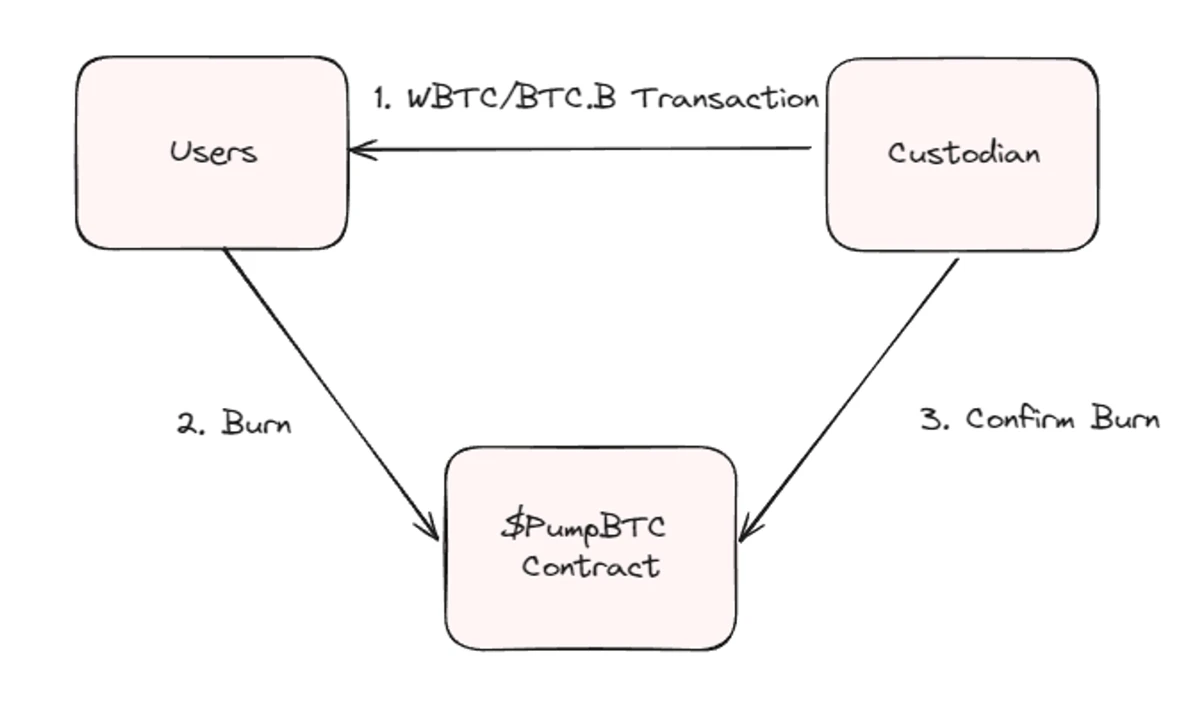

Destruction process

In the context of PumpBTC, destruction refers to the process of exchanging $pumpBTC tokens back to Bitcoin. This operation is essentially the reverse of the minting process and plays a key role in maintaining system balance and token integrity. By destroying $pumpBTC tokens, users can withdraw the corresponding amount of local Bitcoin, ensuring that each $pumpBTC token can maintain 1:1 local Bitcoin reserve backing.

Reviews

PumpBTC has obvious advantages in improving Bitcoin liquidity, simplifying the staking process, and expanding income opportunities through multi-chain integration. It is especially suitable for users who want to expand the utilization of Bitcoin assets in the DeFi ecosystem. However, it still relies on custodians, cross-chain bridges, and smart contracts, which may bring certain risks. Overall, PumpBTC provides Bitcoin holders with a more flexible and secure way to pledge, but users need to evaluate potential market and technical risks when using it.

2. Detailed explanation of the projects of interest this week

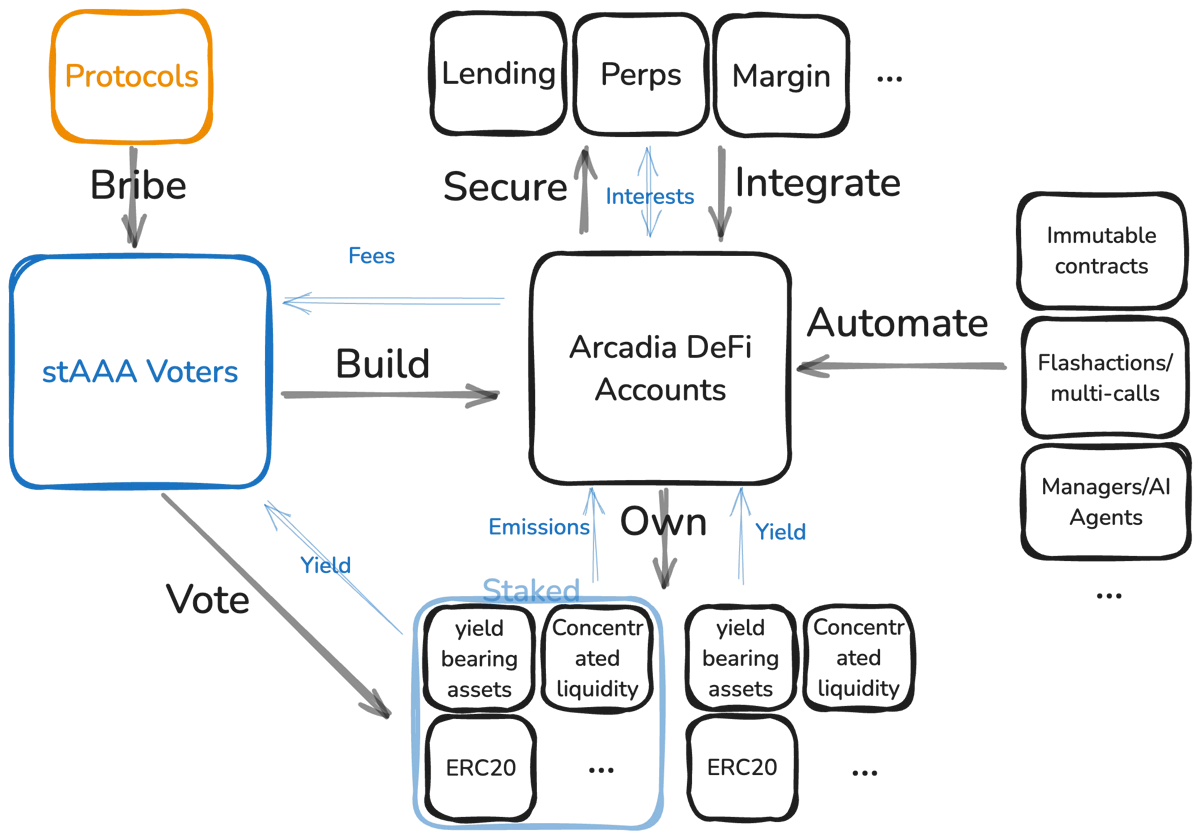

2.1. Detailed explanation of Arcadia Finance, a highly optimized yield strategy DeFi platform led by GFC and followed by Coinbase

Introduction

Arcadia Finance allows everyone, whether professional market makers or ordinary users, to earn income by leveraging automated market makers (AMM) liquidity positions. It supports virtual liquidity and centralized liquidity positions, and integrates with major decentralized exchanges (DEX) such as Uniswap, Aerodrome, and Alienbase. Arcadia Finance is the first user-facing application built on Arcadia Protocol, designed to showcase its power.

Technical Analysis

Arcadia Protocol is the next generation DeFi asset management protocol that powers Arcadia Finance. Through user-owned DeFi accounts, it provides:

With simple one-click trading, users can enter complex high-yield strategies usually only used by professionals.

Automate asset and risk management while maintaining self-custody.

Built-in margin.

An interface provided for third parties and AI agents to manage assets within the boundaries executable on the chain.

Pragma Labs is the research company developing the Arcadia Protocol and its underlying off-chain infrastructure.

Arcadia Protocol LLC develops, commercializes, and hosts user-facing applications built on the Arcadia Protocol.

1. Arcadia DeFi Account

Arcadia DeFi accounts are user-owned smart contracts that function similarly to self-custodial wallets, but with greater efficiency and automation. They allow users to batch execute multiple transactions and automate portfolio management, making complex DeFi operations seamless.

Operations that typically require multiple steps to complete — such as rebalancing liquidity positions, unwinding assets, or managing leverage — can all be performed in a single transaction through an Arcadia DeFi account.

There are two types of Arcadia accounts:

Spot Accounts

Create a liquidity provision (LP) position consisting of any asset.

No lending or leverage supported - just an optimal way to manage liquidity.

Margin Accounts

Leverage is supported through collateralized borrowing.

Liquidity providing positions can only be created using permitted assets.

The assets within an account contribute to its overall health, allowing for greater flexibility in liquidity management.

Both deposited assets and borrowed assets are counted as collateral.

Both account types benefit from Arcadia’s automated tools such as the Auto-Rebalancer, Auto-Compounder and Zaps, helping users to easily optimize their liquidity positions.

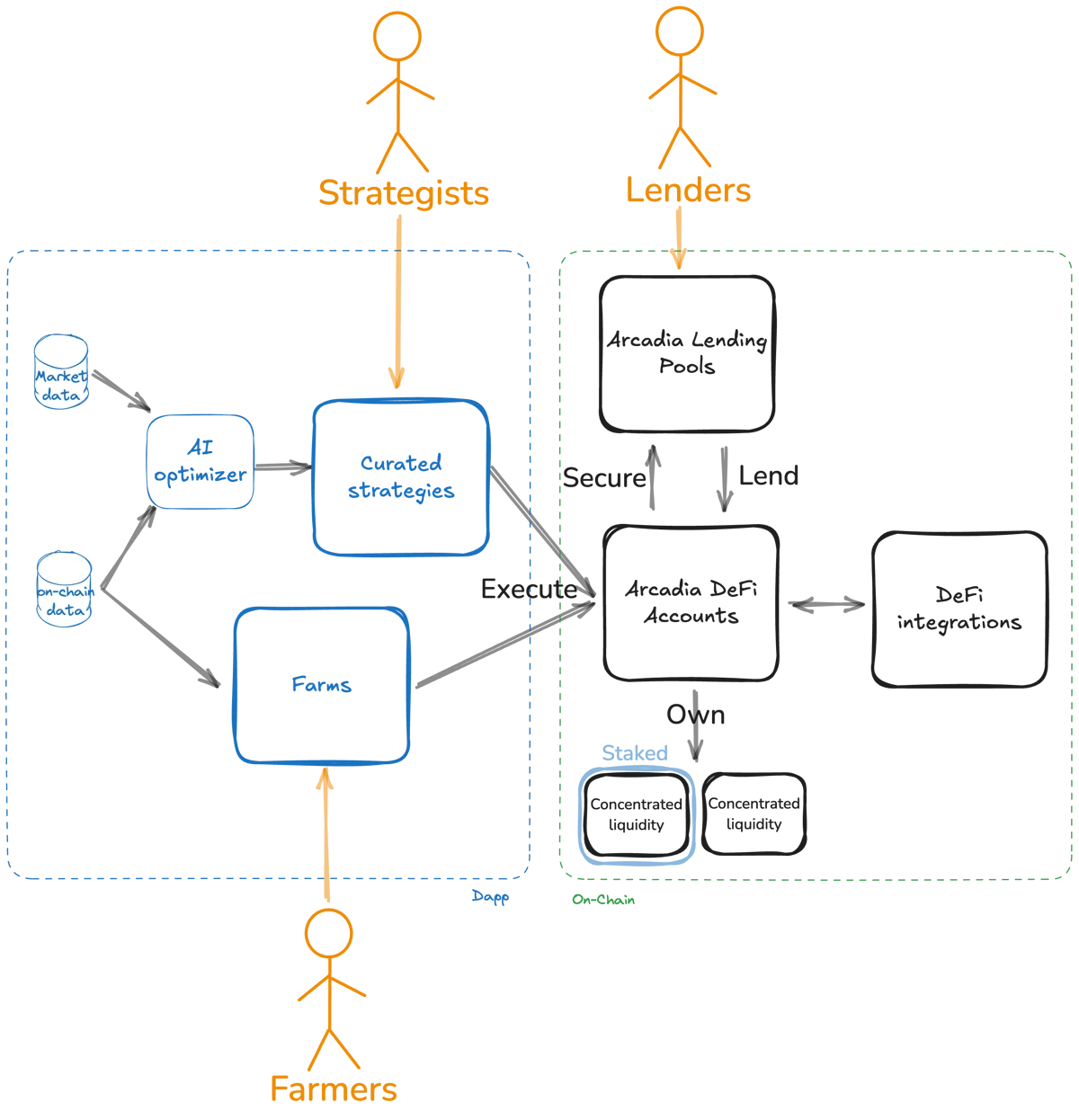

2. Arcadia Lending Pool

Arcadia Lending provides independent lending pools, allowing lenders to provide assets to the pool to earn passive income. Strategists and farmers can borrow from the lending pool, using their Arcadia account as collateral, and pay interest to lenders. Deposits in Arcadias lending pools can be protected from risks caused by smart contract vulnerabilities.

Currently, Arcadia supports USDC, wETH, and cbBTC lending pools, each operating independently. These pools follow the ERC-4626 reserve standard, making them compatible with platforms such as Superform and Vaults.fyi.

How it works

Lenders deposit assets and receive tokens that automatically generate yield.

Borrowers use Arcadia accounts to create leveraged liquidity positions on multiple decentralized exchanges (DEXs).

The interest rate adjusts based on the usage of the pool - the higher the demand for borrowing, the higher the return for lenders.

The liquidation mechanism ensures that unhealthy positions are closed before they become bad debts, and lenders receive a portion of the proceeds from the penalties paid on the liquidated accounts.

Arcadia charges no protocol fees, so lenders retain 100% of interest and liquidation rewards.

3. Arcadia Farms

Arcadia Farms simplifies liquidity provision on multiple leading decentralized exchanges (DEX) through an intuitive interface that combines basic pool data with flexible position management. Depending on the users strategy and risk tolerance, they can choose to use a margin account or a spot account to provide liquidity. Users using a margin account can only provide liquidity to pools that Arcadia Lending Pools allows them to use as collateral. As of now, more than 100 pools can provide margin liquidity.

On the other hand, users with spot accounts can create liquidity provision (LP) positions for any token, including speculative meme coins or community tokens. Since no leverage is used, the underlying asset does not need to be allowed as collateral.

Users retain full control over their liquidity provision positions, just as they would when interacting directly with a decentralized exchange. This includes adjusting position ranges, opening or closing positions, and modifying leverage ratios for margin positions. In addition to being a useful platform for beginner liquidity providers, it is also suitable for experienced liquidity providers who understand the mechanics of decentralized exchanges and want to maintain granular control in liquidity management across multiple platforms.

4. Arcadia Rewards System

Arcadia’s rewards system focuses on incentives to drive engagement and usage.

a. Lender

The protocol tracks all lending rewards through ERC 4626 yield-generating tokens that represent your share of the lending pool. These tokens accumulate value over time:

Rewards are automatically accumulated in real time.

Rewards automatically compound on your lending positions.

Interest

When users borrow assets from Arcadia’s lending pools, they pay interest based on usage. Unlike many protocols that charge fees, Arcadia distributes all of these rewards to lenders:

100% of the borrower’s interest payments go to the lender.

There are no hidden Arcadia fees, and the minimum amount you deposit is the minimum you can withdraw.

The protocol uses a dynamic interest rate model that reacts to market demand. The interest rate automatically adjusts based on pool usage to maintain optimal liquidity levels. This curve ensures that lenders earn more when demand increases, while borrowers receive reasonably priced loans under normal market conditions.

Liquidation Rewards

When a borrower is liquidated, a liquidation penalty of up to 6.5% is assigned to the lender.

AAA Emissions

In addition to all of the aforementioned rewards, Arcadia may decide to incentivize its USDC, wETH, or cbBTC pools with additional AAA emissions.

Additional Rewards

In addition to base protocol rewards, Arcadia is working with partners to provide additional earning opportunities:

Additional incentives from partnership agreements.

Special rewards during ecosystem promotions (such as super chain rewards).

b. Account

When liquidity providers provide liquidity on DEX, their accounts can earn multiple sources of rewards:

Transaction fees for standard liquidity positions.

Use AERO tokens earned when staking Slipstream positions.

For example:

A margin account user might provide ETH-USDC liquidity to the Aerodrome Staked Slipstream and use the borrowed funds to earn AERO instead of transaction fees and MERKL incentives.

A spot account user can do the same strategy without leverage and access more unique pairs such as VIRTUAL, AIXBT, TOSHI and other tokens that cannot be used as collateral.

Both account types can optimize their positions and claim rewards through the same mechanism, with rewards automatically collected when positions are adjusted or rebalanced.

5. Automated Market Maker (AMM)

Automated market makers (AMMs) are smart contracts that enable decentralized trading without order books. Instead of matching buyers and sellers to conduct trades, AMMs use liquidity pools — funded by liquidity providers (LPs) — to facilitate trades.

Traditional virtual automated market makers (vAMMs) distribute liquidity across all possible prices, ensuring continuous trading but resulting in capital inefficiency. Much of the liquidity is unused, especially between stable or correlated asset pairs. Pooled liquidity automated market makers (clAMMs) address this by allowing liquidity providers (LPs) to allocate funds within a specific price range. This can improve capital efficiency and increase fee income, but there are certain trade-offs.

No benefit outside the scope

If the market price moves outside the price range selected by the LP, their liquidity will no longer be active, meaning no fees will be earned until the price returns to the range or the position is adjusted.

Non-permanent loss (IL)

Impermanent loss occurs when the relative prices of assets in the pool change, causing LPs to end up holding more of the worse performing asset. In concentrated liquidity pools (CL pools), IL is amplified when narrow ranges are used, as price fluctuations can quickly push positions outside the range, forcing LPs to either take a loss or adjust the range at additional cost.

Although concentrated liquidity pools offer greater efficiency, they require active management to remain profitable. LPs must balance scope size, rebalancing frequency, and market volatility to minimize risk.

User operation process

Different types of users can earn income through the Arcadia protocol.

There are three different user groups. The following diagram illustrates how each user interacts with the Arcadia protocol.

Lenders

Lenders are the least complex users. They have no direct exposure to liquidity positions and only bear market or liquidation risk indirectly. Lenders only need to select the asset they want to lend and how much to lend.

Lenders deposit single assets into one of the Arcadia lending pools, which can be loaned out by strategists and farmers to build leveraged positions.

There are currently three available lending pools, with more to be added in the future. Current lending pools include:

USDC lending pool

WETH Loan Pool

cbBTC Loan Pool

Unless an auction is ongoing, lenders have no lock-up period or withdrawal fees. There is no impermanent loss.

Strategists

Strategists are a more complex type of user. They need to understand the risks of using AMM liquidity positions.

No technical knowledge or experience is required to select and manage a yield strategy. Strategists simply need to select one of four curated yield strategies. The dApp will use the data to optimize the pools, ranges, rebalancing frequency, etc. used in the curated strategy. Strategists are yield-seeking users who have specific goals and/or market outlooks and believe that AMMs are a good way to earn yield, but do not have the technical expertise and/or time to monitor and manage individual pools.

For such users, Arcadia provides a set of carefully curated, easy-to-use strategies that allow them to enter well-performing AMM liquidity pools with just a few clicks. These strategies only use stablecoins or tokens that are correlated with major assets such as ETH and BTC.

Currently, Arcadia offers four strategies:

Delta Neutral USD: Keep the USD value of the portfolio as stable as possible while earning a yield.

Delta Neutral ETH: Keep the ETH value of your portfolio as stable as possible while earning a yield.

Bullish on crypto: When the total market capitalization increases, the USD value of the portfolio increases, earning income at the same time.

Bearish Crypto: When the total market cap decreases, the USD value of the portfolio increases while earning income.

Farmers

Farmers are the most sophisticated user type. Farmers have complete flexibility in building and managing their yield portfolio. Farmers can select and combine liquidity positions from any available pool, choose custom ranges, use leverage, customize automation features, and more.

Farmers can take advantage of all that Arcadia has to offer, such as:

Choose an AMM pool from any supported DEX.

Set custom price ranges for liquid positions.

Set up automated features for their positions, such as compounding or automatic rebalancing.

Choose from various rebalancing strategies.

Use leverage to hedge against the risk of impermanent loss (IL) or maximize returns. They can also choose the assets to borrow and the leverage multiple.

Granular control over depositing, withdrawing, borrowing, repaying assets from their accounts.

Summarize

Arcadia has great advantages in providing liquidity management and income strategies for different types of users, especially its automated tools and flexibility. However, since it is more suitable for users with a certain technical background and management ability, beginners or non-technical users may face certain management challenges and risks.

3. Industry data analysis

1. Overall market performance

1.1 Spot BTCETH ETF

1.2. Spot BTC vs ETH price trend

BTC

Analysis

Last week, BTC formed a 4-H W bottom near $74,500 as expected, and the subsequent rebound was slow but relatively stable, so this is a good sign for bulls. However, as the price came above $84,000, the short-term trend faces a first-line resistance of $86,200. Given the current market sentiment is still in a state of relative panic, this weak resistance may also put a lot of pressure on bulls. If the short-term rebound continues to fail to stand above this point, then it is highly likely that it will pull back to around $81,200 to find a first-line strong support.

On the other hand, if the trend can quickly break through and stabilize at $86,200 in the first half of this week, users can look up to $89,000 or even around $92,000.

ETH

Analysis

ETH fell below $1,530 last week and formed a bottom support near $1,380, which is the bottom in March 2023. However, the rebound is still weak so far. The first resistance can be seen at around $1,750. If the rebound is blocked and buying continues to be sluggish, then there is a high probability that it will continue to test the previous low ($1,380). On the contrary, if the fundamentals are good, then there is a certain probability of a continued rebound to around $2,000.

1.3. Fear Greed Index

2. Public chain data

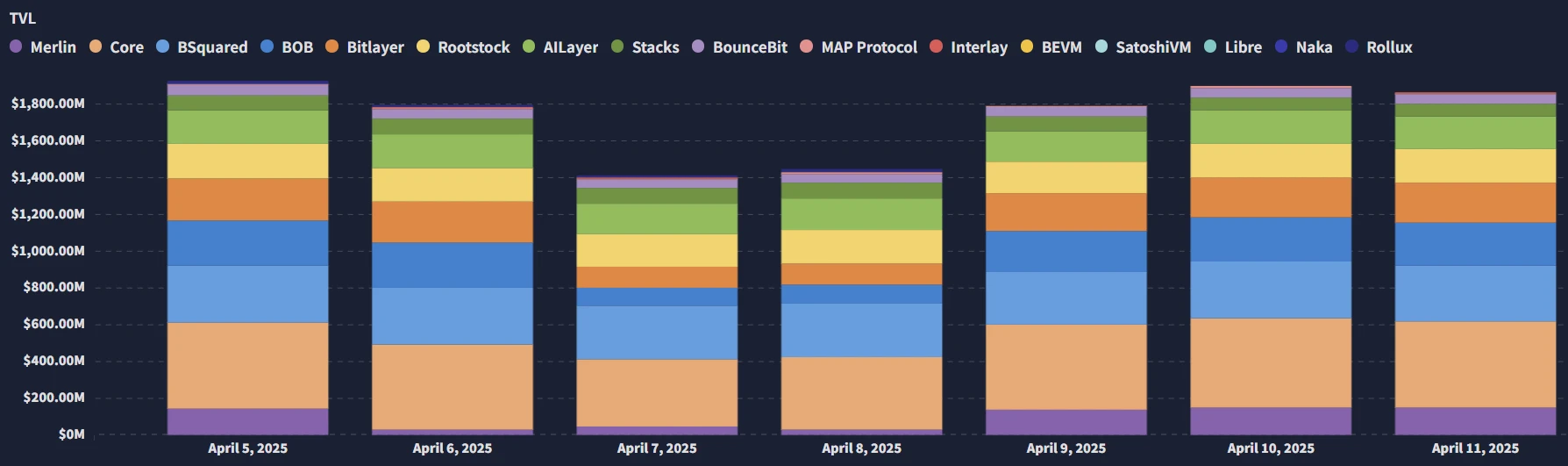

2.1. BTC Layer 2 Summary

Analysis

April 7-11, 2025, marks the continued evolution of Bitcoin Layer 2 solutions. The Nakamoto upgrade of the Stacks ecosystem and the integration of sBTC are key initiatives to improve Bitcoins programmability and scalability. At the same time, the Bitcoin L2 ecosystem is experiencing significant growth, thanks to increased institutional investment and the development of innovative platforms. These developments make Bitcoin Layer 2 solutions a key component of the future development of decentralized finance and blockchain technology.

2.2. EVM non-EVM Layer 1 Summary

Analysis

EVM is compatible with Layer 1 blockchains:

EOS Network:

The EOS Network Foundation is leading the upgrade of its consensus mechanism and plans to integrate the Ethereum Virtual Machine (EVM) system. The EVM mainnet is scheduled to be released on April 14, 2025. The integration aims to improve the scalability and performance of EOS, making it a competitive platform for decentralized applications (dApps).Telos Blockchain:

Telos has launched a fully EVM-compatible Layer 1 blockchain, allowing developers to deploy existing Ethereum dApps without modification. Telos EVM offers significantly higher speed and capacity than Ethereum, providing a more efficient environment for decentralized applications.Polkadot:

Polkadot’s 2025 roadmap includes support for EVM and Solidity, improving its interoperability and scalability. The implementation of a multi-core architecture is intended to increase capacity and address the growing demand for on-chain transactions.

Non-EVM Layer 1 Blockchain:

W Chain:

W-Chain, a hybrid blockchain network based in Singapore, has launched the soft launch of its Layer 1 mainnet. This phase follows a successful testnet period and the launch of the W-Chain bridge to enhance cross-platform compatibility. The full commercial mainnet is scheduled to be released in March 2025.N 1 Blockchain:

N1, an ultra-low latency Layer 1 blockchain, confirms the commitment of its original investors and is ready for mainnet launch. N1 is designed to support high-throughput decentralized applications, providing features such as horizontal scalability and sub-millisecond latency, aiming to simplify the development process of decentralized applications.

2.3. EVM Layer 2 Summary

Analysis

From April 7 to April 11, 2025, several important developments occurred in the EVM Layer 2 ecosystem:

1. Academic Research: On April 7, 2025, a research paper titled “Hollow Victory: How Malicious Proposers Exploit Validator Incentives in Optimistic Rollup Dispute Games” was published. The study analyzed the vulnerabilities in the incentive structure of Optimistic Rollup, revealed possible exploits by malicious proposers, and suggested countermeasures to enhance the security of Layer 2 solutions.

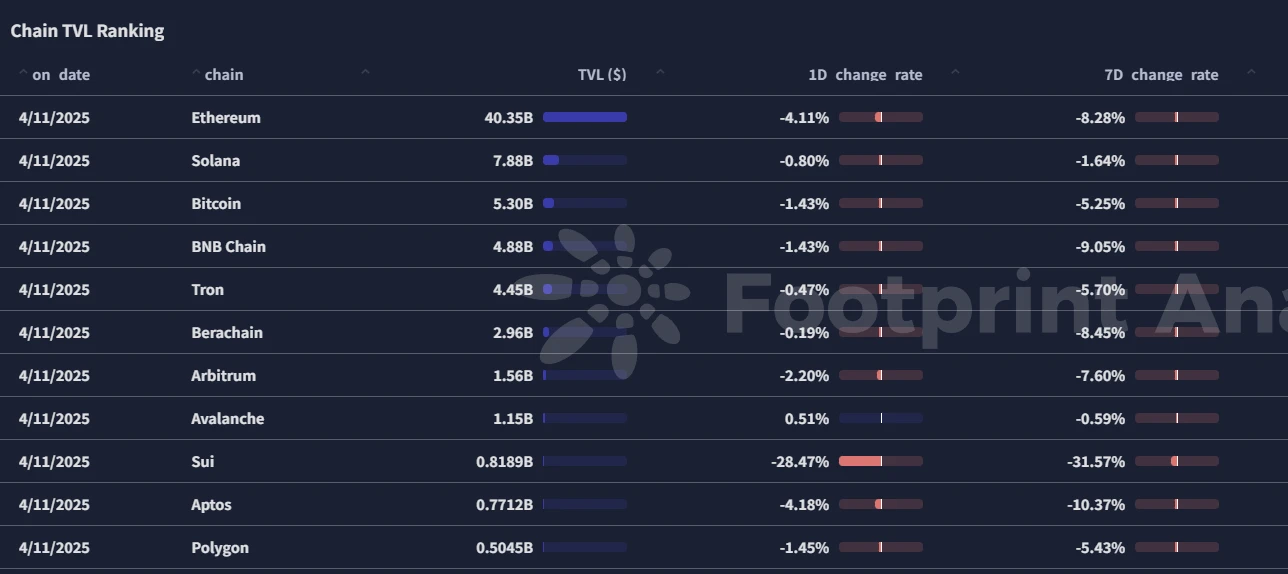

2. Market performance: As of April 12, 2025, the total locked value (TVL) of the Ethereum Layer 2 platform has exceeded US$51 billion, an increase of 205% from November 2023. Leading platforms such as Arbitrum and Base have played an important role in this growth, reflecting the strong interest of investors and the expansion of the application of Layer 2 solutions.

3. Technical Progress: The Telos Foundation has announced its zero-knowledge EVM (ZK-EVM) development roadmap. Plans include deploying hardware-accelerated zkEVM to the testnet in Q4 2024, mainnet integration in Q1 2025, and full SNARKtor integration in Q4 2025. These advances are designed to improve the scalability and efficiency of the Telos network.

4. Industry Collaboration: Interlay has launched the minimum viable product (MVP) of its “Build on Bitcoin” (BOB) solution, a Bitcoin Layer 2 network fully compatible with the Ethereum Virtual Machine (EVM). The development aims to bridge the gap between the Bitcoin and Ethereum ecosystems, enabling developers to create decentralized applications on Bitcoin that use Ethereum smart contract capabilities.

4. Macroeconomic data review and key data release nodes next week

The annual rate of the US unadjusted CPI in March fell to 2.4% year-on-year, a six-month low, lower than the market expectation of 2.6% and lower than the previous value of 2.8%. After the data was released, the market increased its bets on the Feds interest rate cut. CME interest rate futures show that the probability of a rate cut in June has risen to 68% (52% before the data was released), and the expectation of a rate cut in 2025 has expanded to 75~100 basis points.

The data confirmed the trend of falling inflation, but the stubbornness of core inflation may prompt the Federal Reserve to maintain its gradual interest rate cut statement in subsequent interest rate meetings.

Important macro data nodes this week (April 14-April 18) include:

April 16: U.S. retail sales monthly rate in March

April 17: U.S. initial jobless claims for the week ending April 12

V. Regulatory policies

USA

Trump administration strengthens cryptocurrency policy support: US President Donald Trump signed an executive order to make cryptocurrency a national priority and set up a Presidential Digital Asset Market Task Force to create a regulatory framework and evaluate national digital asset reserves. The order protects fair banking access for self-custody and crypto businesses and explicitly prohibits the launch of a US central bank digital currency (CBDC).

Europe

EU Crypto-Assets Markets Act (MiCA) Advances: The European Commission continues to advance the formulation of the MiCA Act, which aims to provide a unified regulatory framework for crypto assets and enhance market transparency and investor protection.

Japan

The Japanese government is cautious about Bitcoin as a strategic reserve: Japanese Prime Minister Shigeru Ishiba said the government currently lacks sufficient information to consider Bitcoin as a strategic reserve.