Key indicators: (June 23, 4pm Hong Kong time -> June 30, 4pm Hong Kong time)

BTC/USD rose 5.1% (102k USD -> 107.6k USD), ETH/USD rose 6.9% (2,320 USD -> 2,480 USD)

For the past few weeks, the price has been trading in a narrow flag channel (except for a brief breakout above $100k due to the Israel-Iran trade). It feels like the market is ready for a move higher and just needs to find enough momentum to break through the strong resistance at $108.5k and then $112.5k. But if we fail to break out, we may slowly return to the bottom of the flag channel, but will encounter trend support at $101k and stronger support at $98k. If these levels are further broken, we may see a sharp drop to $90k.

We remain optimistic and believe there will be a surge to $125-130k to complete the long-term trend.

Market Theme

We had a very quiet week with positive risk sentiment as geopolitical tensions faded. Market focus turned to US developments. Trump announced the upcoming announcement of the new Fed Chair and assured the market that rates will be lowered, and the market quickly priced in a rate cut (20% probability of a rate cut in July, 2-3 rate cuts expected before the end of the year). The US stock market did not encounter much resistance, with the SP 500 and Nasdaq hitting all-time highs. The market is clearly allocating low volatility/risk investments for the summer vacation and does not seem to be worried about the upcoming trade tariff deadline.

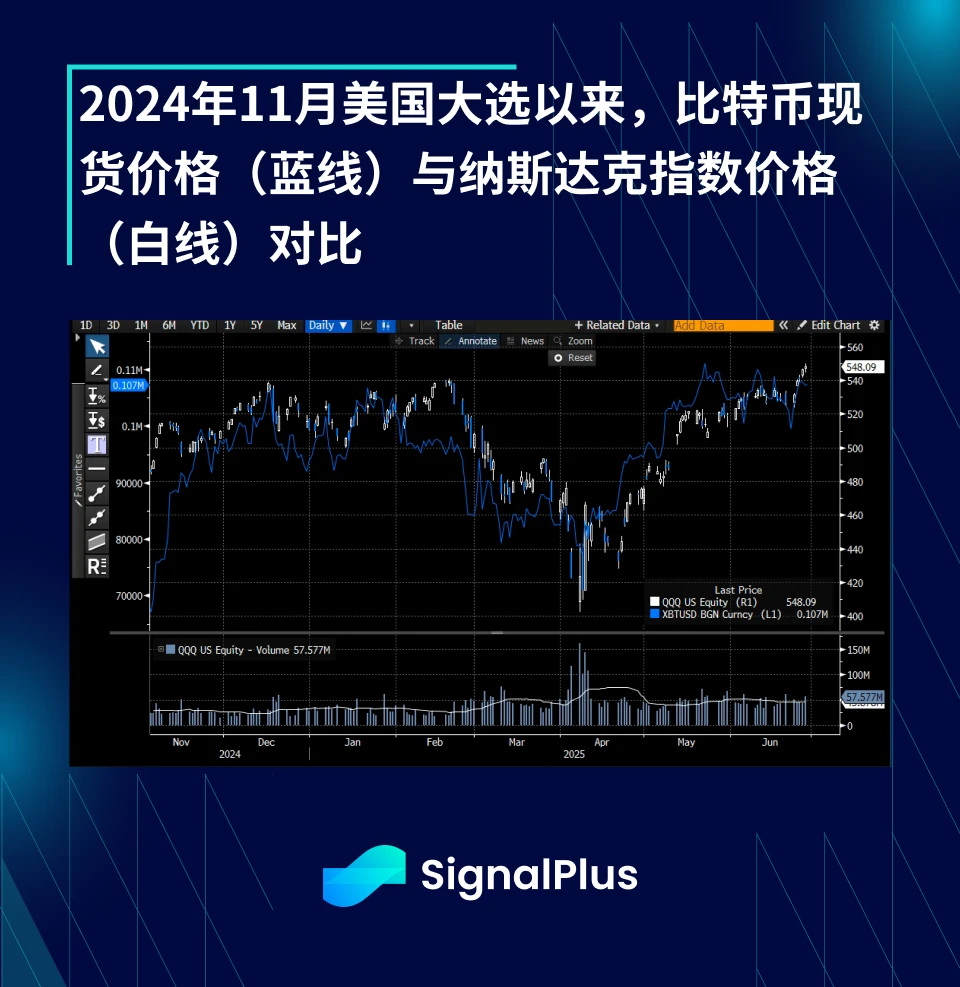

Compared to the overall rising risk sentiment, the performance of the cryptocurrency market is very quiet. Bitcoins recent strong correlation with the Nasdaq has lagged because the market has accumulated too much long gamma and placed a lot of sell orders in front of the local resistance level of $108.5-109k. Small coins have also failed to join this risk rally, and Solana has stagnated before the expected ETF launch on Wednesday this week.

BTC ATM Implied Volatility

Actual volatility weakened rapidly last week. This is mainly because the spot price returned to the comfort zone of 110-112 thousand US dollars, where Bitcoin had stayed for more than 2 months. At the same time, the market obviously took a lot of long Gamma, which also contributed to the price being restricted in the range. Implied volatility was thus greatly depressed. For the first time this year, we saw daily volatility priced below 30, and even the implied volatility for March (expiring in September) was almost below 40 points.

The term structure was quite steep in the one month expiry, with daily volatility set at 27-28 points in the next few days, but was set at 40 points before the end of July. The term structure flattened significantly further out, and the market completely lost track of the actual volatility shifting to a higher range, thus creating very attractive term trading opportunities.

BTC Skewness/Kurtosis

Skewness prices have remained largely sideways over the last week as the lack of momentum in the spot market in either direction has led to a slightly muted trade in skewness. Short-term expiries remain biased to the downside given the more ferocious realized volatility on the downside, while further expiries are biased to the upside due to the lack of appetite for downside Vega.

Kurtosis also moved sideways at first, but eventually turned down. Because more and more longs accumulated in the market, many sellers continued to sell one side to fund their longs. But considering the tendency of realized volatility to move to higher areas and the high volatility of volatility, we think it is worth buying Kurtosis on the dip in this environment (especially considering that realized volatility has been underperforming locally).

Good luck to everyone this week!

You can use the SignalPlus trading vane function for free at t.signalplus.com/news , which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com