Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

“Save ETH!”

“Can ETH be bought at the bottom?”

“All signs indicate that ETH is worth buying, but why do I have no desire to buy it?”

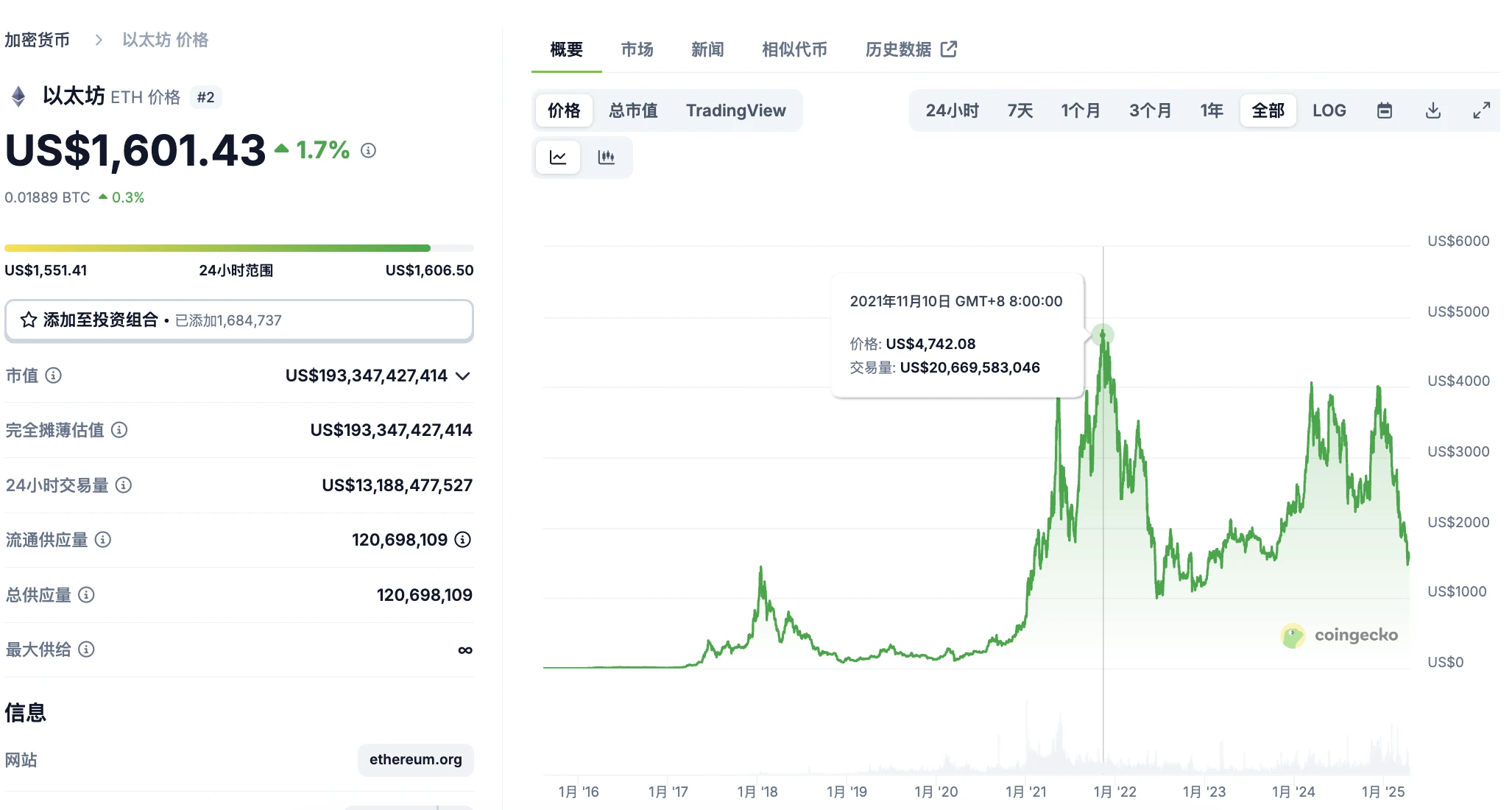

As the market enters a temporary period of oscillation and stabilization, many crypto players have once again voiced the above call, unable to hide their disappointment with the price of ETH and their expectation for the price of ETH to recover. Combined with a K-line comparison chart I saw before and a recent article Amidst the continuous decline, ETH needs a new narrative , perhaps we have reached the market cooling-off period to find a new way out for ETH and the Ethereum ecosystem.

ETH enters the Nokia moment: potential downward momentum in the future

Let’s start with a picture.

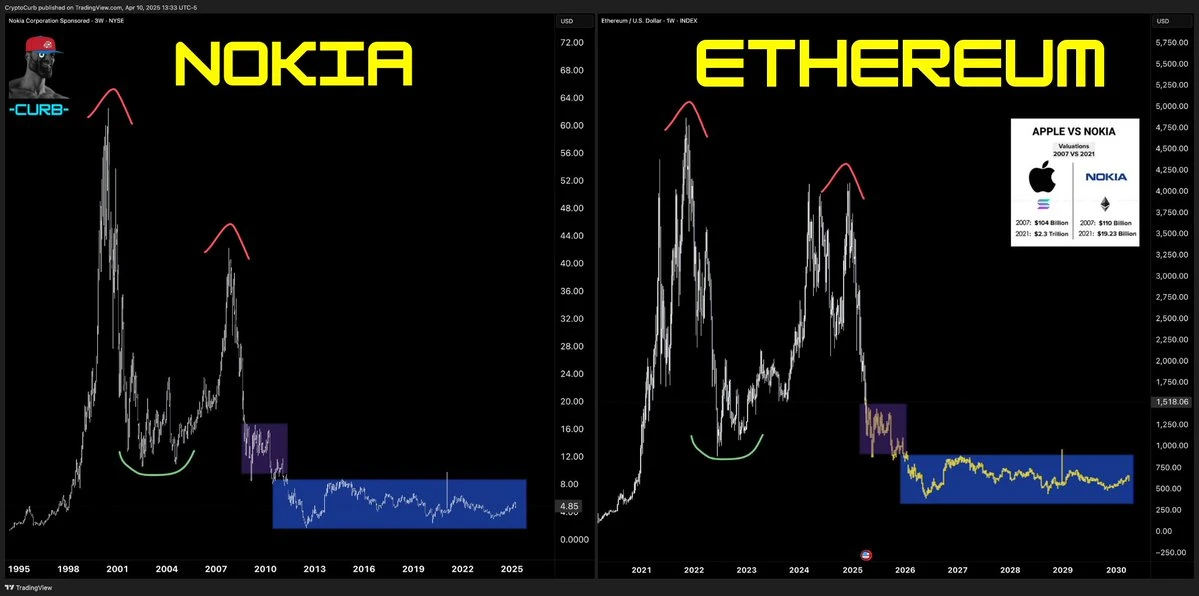

Recently, @CryptoCurb, a die-hard crypto KOL in the Solana ecosystem, posted a tweet comparing the Nokia stock price K-line chart with the ETH K-line chart. Judging from the price trend, the two can be said to be... exactly the same.

Nokia vs ETH

Perhaps this comparison is a bit far-fetched, but if we look at the K-line charts of the two separately, there are still certain similarities:

First of all, from the perspective of cycle nodes , Nokia’s stock price peaked around May 2000, and the second highest point occurred around November 2007; ETH’s price peaked around November 2021, and the second highest point occurred in March 2024 and December 2024 after Trump’s election.

Secondly, from the perspective of the historical rearview mirror , Nokias peak occurred during the Internet bubble, the eve of the Internet explosion; the second highest point occurred on the eve of the 2008 subprime mortgage crisis, the eve of Apples release of the iPhone. In comparison, ETHs peak occurred during the bull market in 2021, when Ethereum experienced ecological booms such as DeFi, GameFi, and NFT, with token consumption far exceeding token supply, and successfully completed the transformation from POW to POS mechanism in September 2022; ETHs second highest point benefited from the policy dividends after the passage of the Bitcoin spot ETF in January 2024 and the bull market accelerated by the Trump effect brought about by Trumps election as US President.

Finally, from the perspective of historical development , Nokia ultimately missed the opportunity to catch up with the hardware device wave due to its backwardness and stubborn adherence to the “feature phone” position, and failed to upgrade to smartphones in time. It was swept into the dustbin of history, while Apple’s iPhone and other product matrices built on the iOS ecosystem eventually allowed Apple to successfully join the trillion-dollar club and became the “world’s largest listed company by market value”. ETH’s current status is similar to Nokia after 2007: it has no new products, no network protocols to lead the development of the next generation of the Internet, and no ecological differentiation of “only one store, no other”. Instead, it is deeply troubled by L2’s bloodsucking and liquidity fragmentation.

Ethereum, which has the vision of becoming the world computer, is now as rigid and backward as the Windows 98 system.

When ETH is stuck in a narrative deadlock: Where is the next breakthrough?

At present, with the continuous decline in prices and the continuous decline in the ETH/BTC exchange rate, the narrative that ETH has the function of storing value and is a digital silver similar to Bitcoin has been falsified in stages; its narrative positioning as an ultrasonic currency has also reached a dead end due to the scarcity of its own consumption scenarios, the division of liquidity in the L2 network, and the inflation after the POS mechanism.

As a result, the next narrative that ETH and the Ethereum ecosystem are expected to have is mainly in two directions:

The first is the RWA network. Judging from market value, TVL, number of developers, number of users and other indicators, the Ethereum ecosystem is still the backbone of the cryptocurrency ecosystem, so countless crypto users regard Ethereum as the must-pass bridge for RWA assets to bridge to the crypto field.

The second is the PayFi chain. From the perspective of ecological security, ecological scalability, stablecoin circulation, and deposited assets, the Ethereum ecosystem is considered to be the main battlefield of the PayFi chain. Although the main network gas cost was high during the bull market, the emergence of L2 and the decline in ecological activity have greatly reduced payment costs. Many people believe that the Ethereum ecosystem is still a necessary component of the PayFi track.

But at present, the above two narratives cannot serve as the only narrative of ETH and the Ethereum ecosystem.

In other words, the Solana ecosystem can do what the EVM system can do, and even thanks to its lower operating costs and high-performance network, Solana may be able to do better in the RWA and PayFi tracks. This can be seen from the rapid development of Huma.Finance after it expanded to the Solana ecosystem. For more information, see Is Huma, the hottest newcomer in PayFi, a P2P?

Therefore, what can truly open up the situation for ETH and the Ethereum ecosystem is definitely not the asset bridge or payment chain in the conventional sense.

If we want to solve the current poor performance of ETH market price, the fundamental lies in 2 points:

1. Increase consumption and reduce supply.

2. Enhance scalability and reduce segmentation.

The former requires more innovative protocol applications to reduce the amount of market dumping; the latter requires the elimination of L2 ghost chains that have dispersed liquidity and are parasitic on the Ethereum mainnet ecosystem.

How can ETH grow into an IOS ecosystem? Not possible yet, but we can learn from its development ideas

So the next question is: Can the Ethereum ecosystem grow into the Apple IOS ecosystem with a solid moat today?

At present, this path is also difficult to achieve, because the decentralized nature of the blockchain network is naturally contrary to the centralized review mechanism of the AppStore in the IOS ecosystem; but the Ethereum ecosystem may become a decentralized security solution provider.

Looking back, the reason why Apple was able to get out of its previous business quagmire was that the closed and smooth ecosystem of the IOS system provided a foundation for development; the AppStore and the application ecosystem that gradually developed and prospered based on it were the key. For the current ETH and Ethereum ecosystem, promoting the emergence of more applications, thereby incubating and nurturing the birth of more innovative products and protocols, may open up a different development path for the entire ecosystem.

Specifically, the next wave of innovation in the Ethereum ecosystem may appear in the following three aspects:

1. On-chain AI automated trading. With the rapid development of AI, on-chain AI automated trading will be gradually implemented at a much faster speed than expected, and become a reality, achieving the effect of what you see is what you get, what you get is what you trade.

2. Digital asset management application. When all kinds of physical assets can be flexibly numbered and digitized through the blockchain network, the Ethereum network may grow into an on-demand on-chain application for global economic participants to trade. In this regard, IP and content creator economy will be an important part.

3. A distribution center for neutral income products. Institutional investors and professional investors with certain qualifications will look for new neutral income products on the chain, such as stablecoin derivatives interest-bearing products.

Of course, the above is just one person’s opinion. The specific development still needs to be verified by technology and ecology.

Recommended Reading

dacc.eth is born. Is decentralized accelerationism the future?

Ethereum is in a midlife crisis, data dimension analysis of development performance