In the crypto market of 2025, Meme assets have moved from the margins to the center of the stage. From the birth of DOGE in a joke, to SHIB building the narrative of Dogecoin Killer, to the political symbol TRUMP becoming the focus of the market, the evolution of Meme assets is not only a barometer of market sentiment, but also the ultimate embodiment of the attention economy. Today, with the tightening of liquidity and the proliferation of disposable Memecoin projects, this field is moving from group carnival to a more abstract and emotional new stage. Take the recently popular RFC (Retard Finder Coin) as an example, it reshaped the value logic of Meme assets through ironic community consensus.

The era of grassroots awakening (2013-2024): from jokes to financial experiments

Meme assets originated from the playful challenge of Internet subculture to traditional finance. In 2013, DOGE became popular with Shiba Inu emojis and the Reddit community carnival. Without a white paper or VC, it created a market value of tens of billions of dollars just by cultural resonance, proving for the first time that consensus can be converted into financial value. After 2020, SHIB completed the value transition through destruction + ecology, PEPE evoked the memory of retro memes, and BONK and WIF on Solana used a simple Dogecoin narrative combined with the expectation of listing to detonate liquidity, jointly constructing the underlying logic of Meme assets: cultural resonance is liquidity, and community consensus is the moat.

Meme coins at this stage present two major characteristics: democratization of cultural consensus and community financialization. Users do not need to understand technology, they can participate as long as they have an emotional connection with a meme. From DOGE sponsoring the bobsled team to the SHIB burning competition, Meme has achieved a leap from virtual heat → reality → value. However, during the 2024 election, $TRUMP coins soared to $82 billion FDV due to the heat of the election, and then plummeted 72% in a week due to competing products, exposing the essence of political Meme: whales create FOMO, retail investors take over, and liquidity is quickly withdrawn. After the bubble burst, the track became a speculation field, leaving only exhausted funds and overdrawn trust.

New cycle: abstraction, irony and emotional drive

Entering March 2025, the market is tired of the rampant Animal Coins, and the narrative of Meme assets begins to shift to a deeper cultural identity. Investors are no longer satisfied with simple visual memes, but seek new paradigms with more thoughtfulness and community belonging. Representative projects at this stage, such as RFC (Retard Finder Coin) and PHIL (Binance Mascot), mark the entry of Meme assets into a new cycle of emotional value drive.

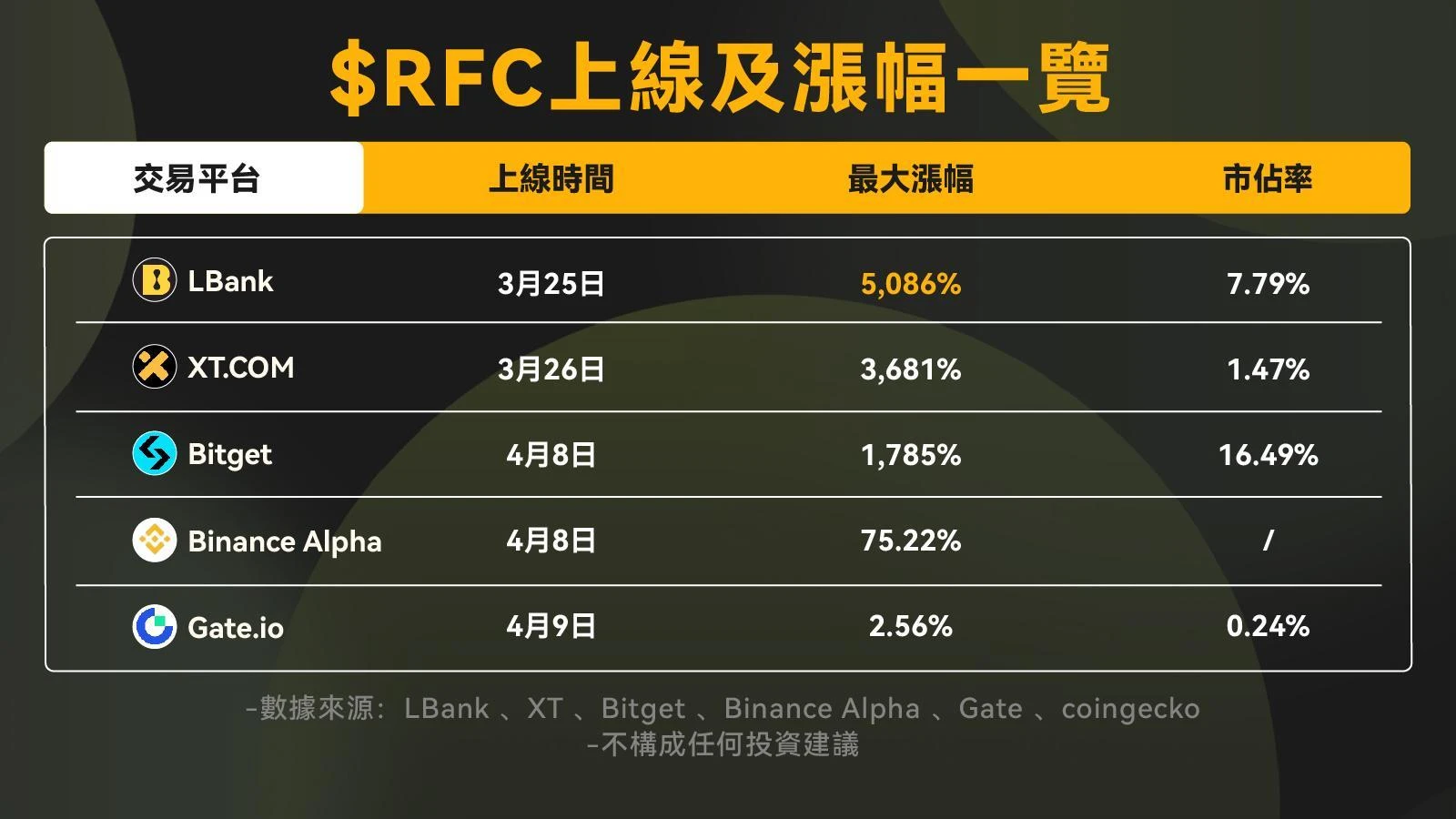

RFC deconstructs the speculative frenzy in the crypto market in a black humorous way. The project claims to be able to sniff out fools in the chaotic market, thereby satirizing the political correctness in the European context and the blindness of crypto speculators. Its fool detection mechanism is not only an accurate capture of degens culture, but also a sharp mockery of the irrationality of the market. The playful RFC landed on LBank and triggered a market frenzy. The price soared 50 times in a short period of time, perfectly interpreting the reversal of Meme coin deconstructing absurdity with absurdity and the real value of the emotional attention economy.

PHIL (Binance Mascot) shows another path of cultural deconstruction. As a community-autonomous version of Binances official mascot PHIL the Bulldog, the PHIL token is essentially a cultural uprising against centralized exchanges. Through the white paper Decentralized Dog Food Manifesto, the community jokingly declared that it would let the mascot truly belong to the people and designed a dog chain governance mechanism - coin holders can vote to decide the evolution of PHILs virtual image. From the regulatory fangs version to the bull market carnival version, each variant is a metaphorical complaint about the current state of the crypto industry.

What is even more ironic is that the PHIL liquidity pool deliberately adopts the BNB/PHIL trading pair to convert Binances native tokens into dog food to feed the mascot. This design has formed a unique cultural phenomenon on BNB Chain: it relies on the CEX ecosystem while deconstructing the authority of CEX.

Traffic competition: Meme assets are becoming one of the core indicators of public chains and CEX

Although the overall crypto market has experienced a deep correction in the past two months, the Meme asset track has shown amazing resilience - the global total market value remains at US$45 billion.

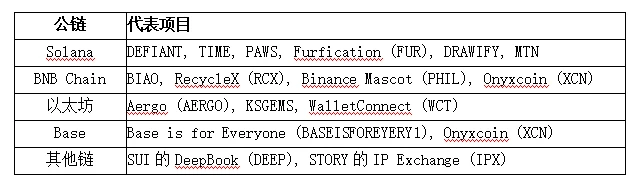

As the value logic of Meme assets evolves, its industry status (in the crypto ecosystem) has also undergone a fundamental change. Meme assets have been upgraded from a pure speculative tool to a core indicator for measuring the attractiveness of the public chain ecosystem. Recently, a large number of popular meme assets have emerged on multiple public chains:

Solana: DEFIANT, TIME, FUR, FIGURE, etc. Solana is still the main battlefield of Meme due to its low cost and high efficiency.

BNB Chain: BIAO, PHIL, RecycleX, etc., relying on the Binance ecosystem to attract traffic.

Base: BASEISFOREYERY 1, Wayfinder, etc., rose with the endorsement of Coinbase.

SUI: DeepBook and others are taking advantage of the emerging public chain narrative to get a piece of the pie.

Overall, Solana is still the main battlefield of Meme. New public chains such as Base and SUI have also become the focus of the market due to the Meme craze. Funds and users are dynamically migrating between public chains, and Solana and Base are particularly prominent. The Meme craze not only promotes competition among public chains, but also provides a meeting point for culture and traffic for exchanges.

The evolution of the Meme strategy of exchanges from traffic entry to ecosystem construction

In the crypto ecosystem, exchanges, as key hubs connecting project owners and investors, play a vital role in the development of Meme assets. In the past two years, different exchanges have formed differentiated Meme asset operation strategies based on their own positioning and strategic considerations.

From the Ghibli style, to FIGUREs AI-made characters, to the popularity of the furry FUR, from the individuality of retail investors, to the testing of institutions or crypto pioneers, to official collective attempts, Meme has become the market trend that controls traffic.

Among them, Binance showed typical contradictions. Although CZ once publicly questioned the value of Meme assets, it had to adjust its strategy under the market boom in 2025 and launched Binance Alpha to test the waters. At the same time, it was caught in the public opinion trap due to vote manipulation and internal decision-making in the voting for listing.

By April 2025, the Web3 strategies of mainstream exchanges have shown a clear division. Platforms such as MEXC, Bitget, and Gate have worked hard on aggregated products. MEXC launched DEX+, Bitget launched Onchain, and Gate Web3 wallets, which integrate multi-chain liquidity pools to create super wallet functions. Although this large and comprehensive path improves capital efficiency, it returns the responsibility of project screening and identification to users, and faces the dilemma of internal competition of homogeneous competition.

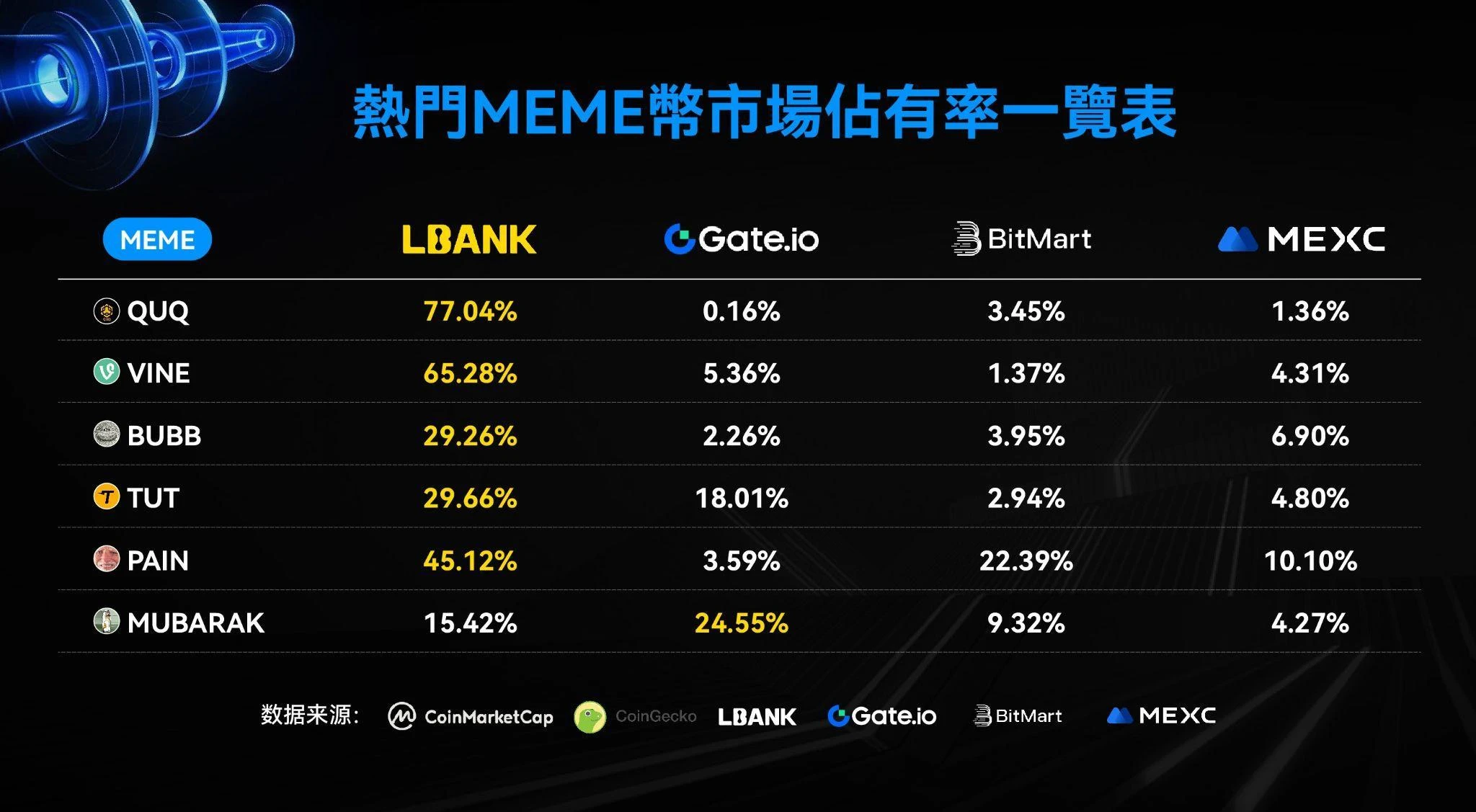

Among them, LBank has achieved the trading achievement of fast listing and the first in depth with its forward-looking strategic vision. Its success stems from three key decisions: first, it took the lead in the industrys wait-and-see period in 2024, launched potential projects such as GOAT and MOODENG, and seized the market opportunity; second, it innovatively launched the pre-market trading + compensation mechanism. In the projects such as PAIN, IP, and KAITO in Q1 2015, users received high returns for their early participation; LBank explored the super cycle of Memecoin through in-depth cooperation with on-chain analysis tools such as GMGN.ai, and built a complete closed loop from cultural value discovery to transaction realization. This all-round ecological empowerment model makes LBank the preferred listing platform for Meme project parties.

Over the past month, LBanks differentiated strategy of spot is king has become increasingly obvious. Potential Memecoin was listed first, 2 to 3 days faster than its competitors. Accurately discover potential Meme, and a considerable proportion of the projects launched in April saw a first-week increase of more than 200%, forming a penetration effect similar to Moonshot in DEX. Pre-market trading compensation activities relieve users concerns about early investment. This light sniper model is reshaping the value positioning of exchanges. When most platforms are obsessed with infrastructure arms race, LBank proves that in the MemeCoin ecosystem, speed and accuracy are more lethal than functional completeness.

Judging from the market data of the past week, the new Meme assets launched by LBank have set off a new round of wealth effect. Projects such as MemeCOIN 1 (+ 231%), FUR (+ 261%), TIME (+ 285%), and DEFIANT (+ 221%) have more than doubled in the first week, and Action Figure (FIGURE) on the Solana chain has even surpassed the rest with an astonishing increase of 2,422%.

The Ultimate Paradox of Meme Assets: Finding Eternity in Dissolution and Reconstruction

Today, Meme assets have completed an amazing self-deconstruction and reconstruction. This cultural experiment, which began as a jokey emoji and went through a speculative frenzy, finally showed its most profound contradiction in 2025 - it is both a complete dissolution of the traditional financial system and unexpectedly became the most tenacious value carrier in the crypto world.

The evolution of Meme assets reveals a cruel and poetic truth of the market: the most meaningless creations can often carry the richest emotions of the times. DOGE deconstructs the seriousness of finance with Shiba Inu emojis, SHIB reconstructs the logic of value storage with a burning mechanism, and RFC sublimates Meme into a consensus ritual of digital tribes through the reflective expression of meta-narratives. This spiral from deconstruction to reconstruction just confirms Nietzsches philosophical prophecy - you must destroy before you can create.

What we are seeing is not only a capital game, but also a living history of digital cultural evolution. When political memes are short-lived and animal coins are collectively receding, the projects that truly survive are those that have deeply embedded their cultural genes in the token mechanism - they use jokes to fight hypocrisy, use consensus to dissolve authority, and ultimately build a new temple of value on the ruins of the bubble.

At the same time, the evolution of the market structure shows that the role of exchanges in the Meme ecosystem is undergoing a fundamental change: from a simple transaction matchmaker to a value discoverer and ecosystem co-builder. The success of LBank proves that only by integrating cultural insights, risk control and technological innovation can users truly seize the historic opportunity of Meme assets.

When the market finally finds the balance between speculative impulse and cultural sedimentation, these digital symbols born as jokes may become the most lasting fossils of civilization in the blockchain world.