Originally Posted by Biraajmaan Tamuly

Original translation: TechFlow

Key Takeaways:

Fidelity Digital Assets’ report noted that multiple Ethereum on-chain indicators suggest that ETH is trading below valuation.

The BTC/ETH market cap ratio is back to mid-2020 levels.

The number of active addresses on Ethereum’s second-layer network hit a new high of 13.6 million.

New data from Fidelity Digital Assets hints at cautious optimism for Ethereum, suggesting its poor performance in the first quarter could be an opportunity.According to their latest Signals Report , Ether (ETH) fell 45% in the first quarter, erasing its gains made after the U.S. election, after peaking at $3,579 in January.

Ethereum’s price formed a death cross in March, with the 50-day simple moving average (SMA) falling 21% from the 200-day SMA, reflecting bearish momentum. However, Fidelity noted that short-term pain could turn in Ethereum’s favor.

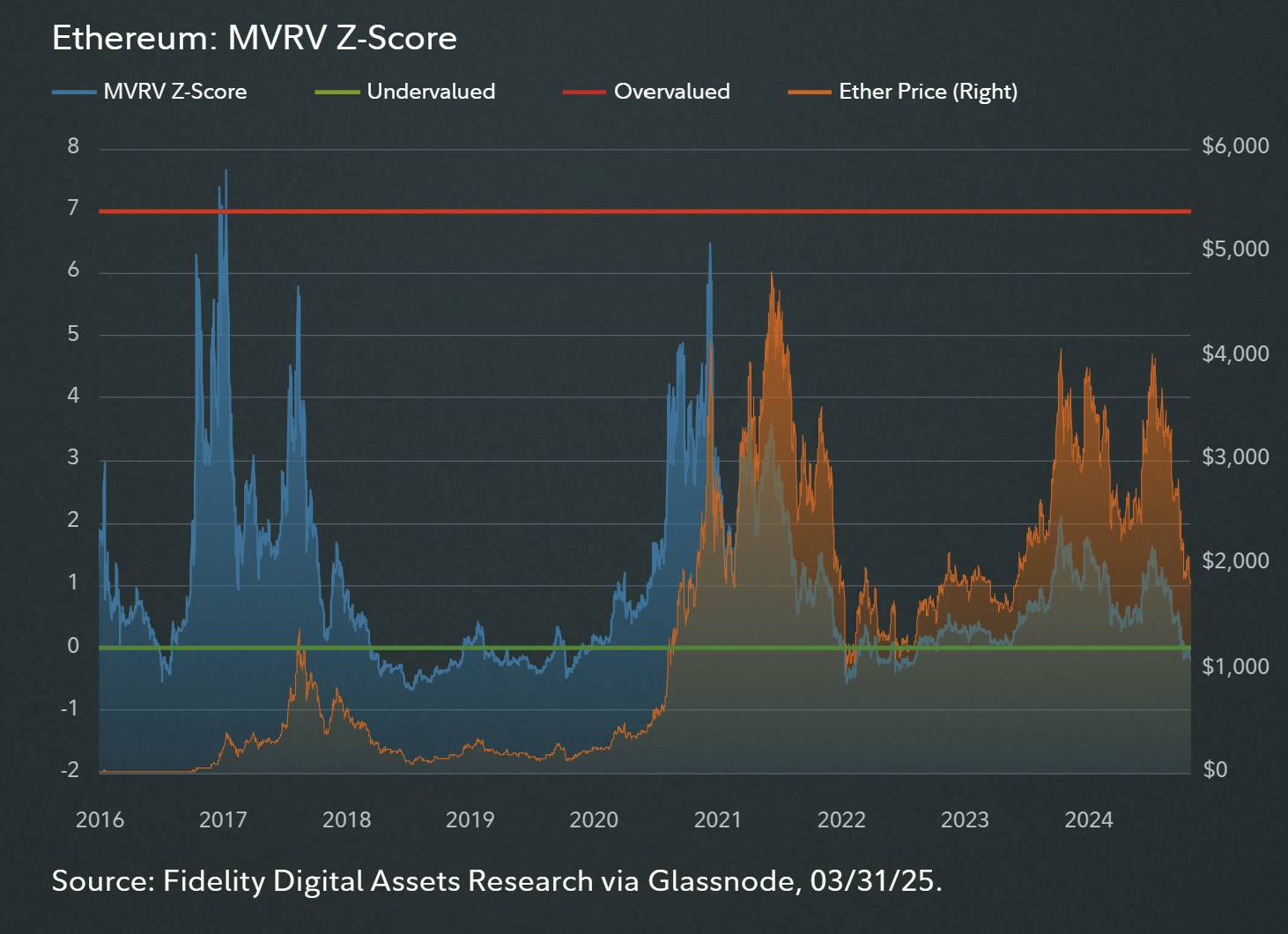

The investment firm noted that the MVRV Z-Score (market value compared to realized value) fell to -0.18 on March 9, entering the undervalued zone. Historically, such levels have often marked market bottoms, indicating that Ether looks cheap compared to its fair value. The net unrealized profit/loss (NUPL) ratio also fell to 0, indicating a capitulation state, where unrealized profits equal losses, suggesting that holders are in a neutral position.

Ethereum’s MVRV Z-score

Source: Fidelity Digital Assets Signal report

The realized price of ETH averaged $2,020, 10% higher than the current value, indicating that holders are facing unrealized losses. While this trend is bearish, the company noted that the realized price has only dropped slightly by 3% compared to the 45% drop, indicating that short-term holders have sold off, while long-term holders have held on firmly, likely stabilizing the underlying price.

However, the company highlights that in 2022, even though the ETH price dropped below the actual price, it continued to fall further before rebounding.

Fidelity also cited Ethereum’s market cap ratio to Bitcoin at 0.13, which is at mid-2020 levels and has been declining for 30 months.

Ethereum/Bitcoin Market Cap Ratio

Source: Fidelity Digital Assets Signals report

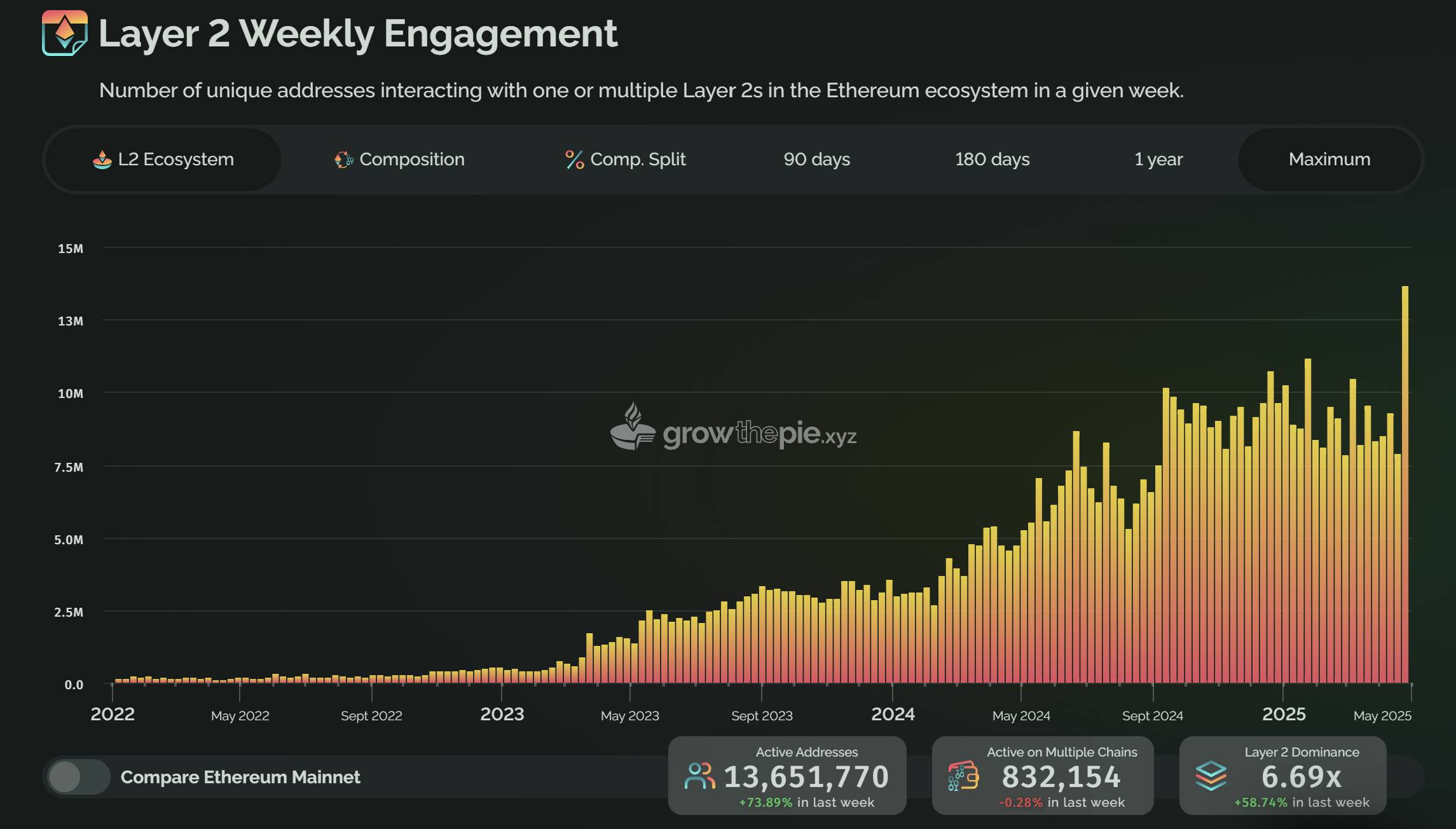

Ethereum ecosystem participation hits new high

Data from growthpie.xyz shows that the number of unique addresses interacting with layer 1 or 2 networks in the Ethereum ecosystem has reached an all-time high of 13.6 million. The percentage of active addresses has risen 74% over the past week, which indicates scalability and growing adoption of the network.

Weekly interaction between Ethereum and Layer 2 networks

Source: growthepie.xyz

Uniswap’s new layer 2 protocol Unichain leads with over 5.82 million weekly active addresses, surpassing Base and Arbitrum. The collective increase in active addresses has boosted Ethereum’s layer 2 network dominance by 58.74% over the past seven days.

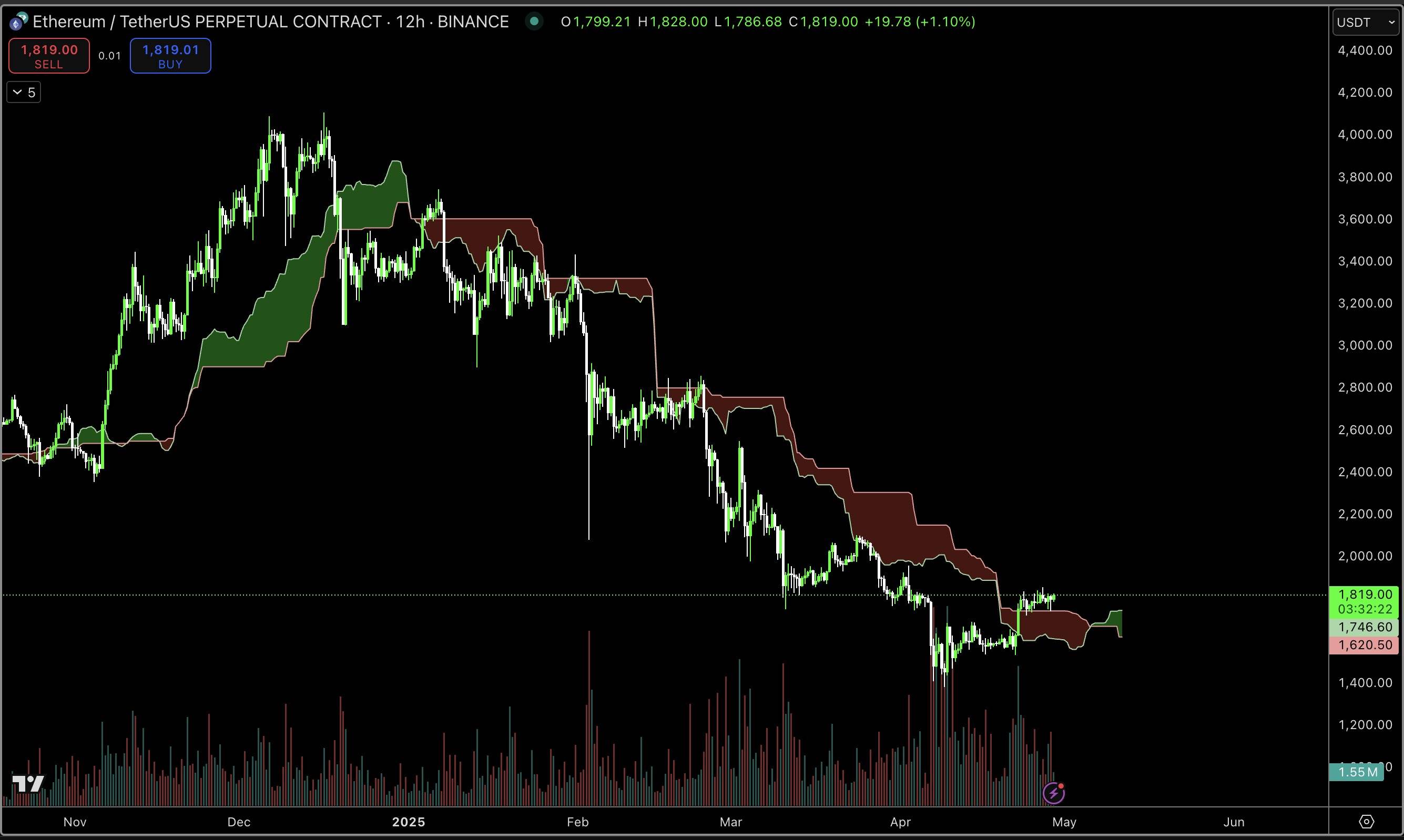

Anonymous crypto trader CRG noted that ETH price has recovered above the 12-hour Ichimoku Cloud indicator for the first time since December 2024. The Ichimoku Cloud shows an uptrend when the price is above the cloud and the cloud turns green, indicating bullish sentiment.

Ethereum 12-hour analysis provided by CRG

Source: X.com

This article does not contain investment advice or recommendations. Every investment and trading action involves risk and readers should conduct their own research when making a decision.