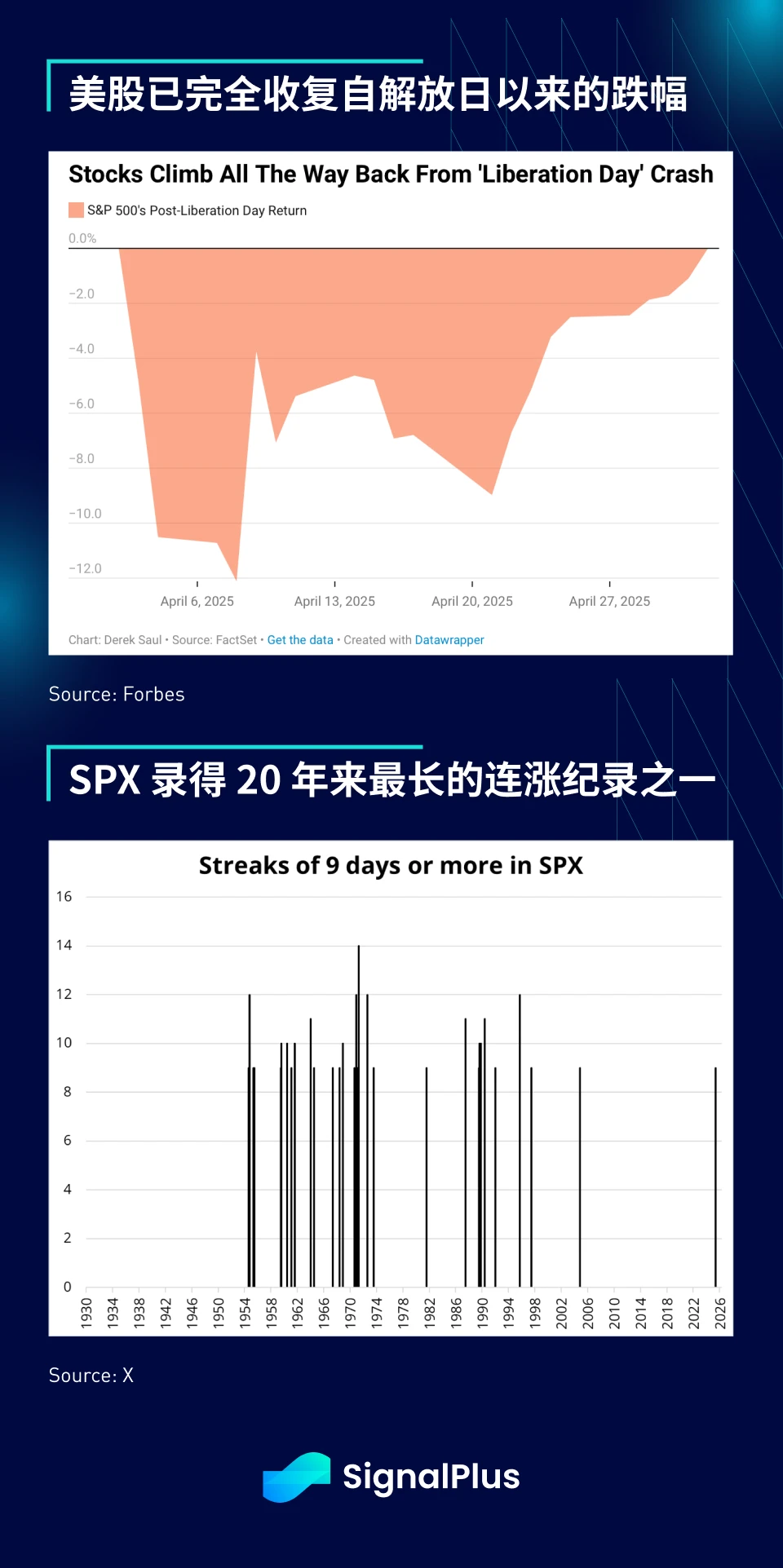

The SPX ended last week with its first nine-day winning streak in more than 20 years and recovered all of its losses since the Liberation Day crash, as the U.S. government softened its rhetoric on its tough trade policies.

Both China and the United States are continuing to take steps toward restarting trade negotiations and easing relations. Both sides have recently adjusted their trade departments and negotiators. The Chinese side said: The US side has recently proactively conveyed messages to the Chinese side through relevant parties many times, hoping to talk with the Chinese side. In response, the Chinese side said that an assessment is underway.

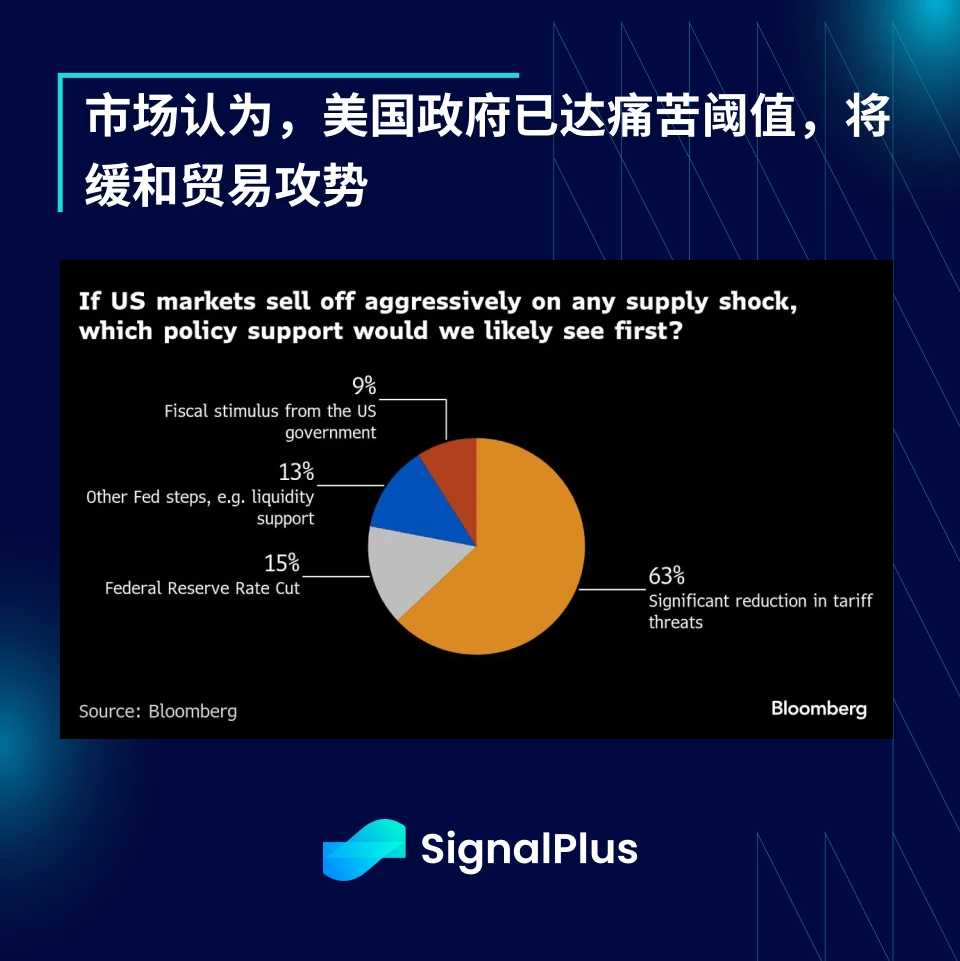

The latest Bloomberg survey shows that the market generally believes that the Trump administration will eventually respond to market changes, despite the previous attempt to blame Bidens legacy. The market believes that the government has reached the pain threshold for being willing to suspend the tariff offensive.

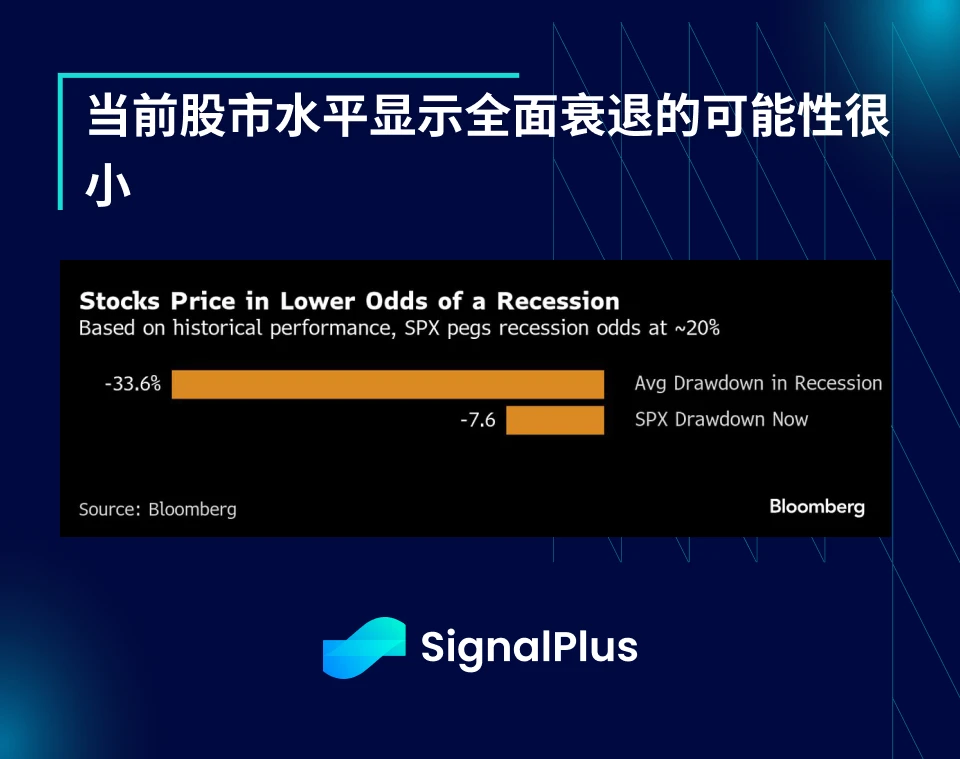

In addition to the positive signals on trade, the unexpectedly strong non-farm payrolls report released last Friday further boosted the markets risk appetite and capped a week of strong economic data, showing that despite negative market sentiment, the fundamentals of the US economy remain solid. 177,000 new jobs were added in April, and the unemployment rate remained at 4.2%, temporarily dispelling concerns that the economy is about to fall into recession. However, the real impact of the tariff policy may not be reflected until the data from May to June.

Moreover, the current stock market rebound implies a recession probability of only about 8%, based on average drawdowns in past slowdowns, far lower than economists’ estimates or the level implied by fixed-income markets.

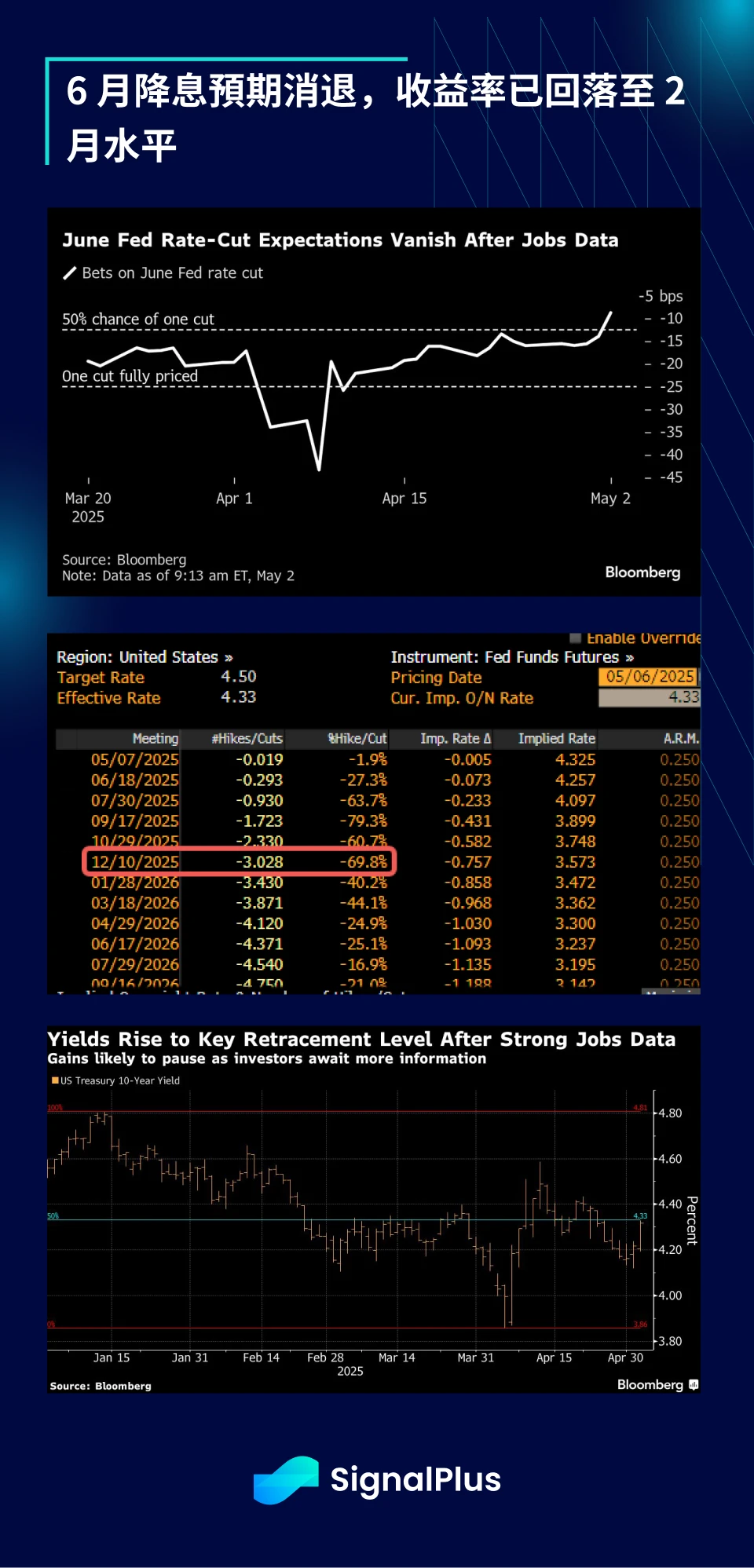

In the fixed income market, the yield curve has flattened and has fallen back to the level of February. The market expects that the probability of a rate cut in June is only about 30%, and only about 3 rate cuts are expected throughout the year.

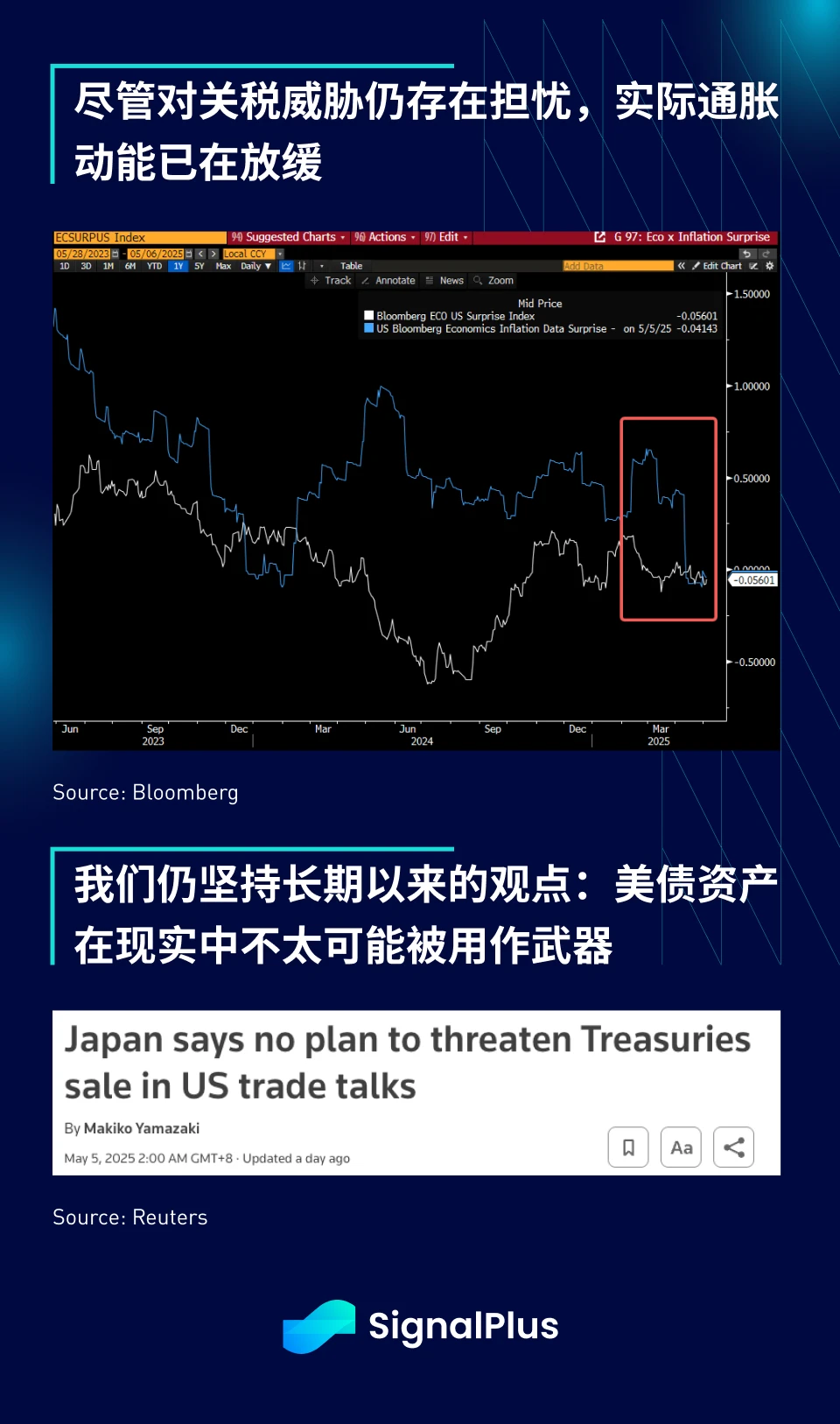

On the other hand, the recent actual inflation data continued to decline, and the positive signals released by central banks of many countries to maintain their U.S. Treasury bond positions have restored the U.S. bond market to normal.

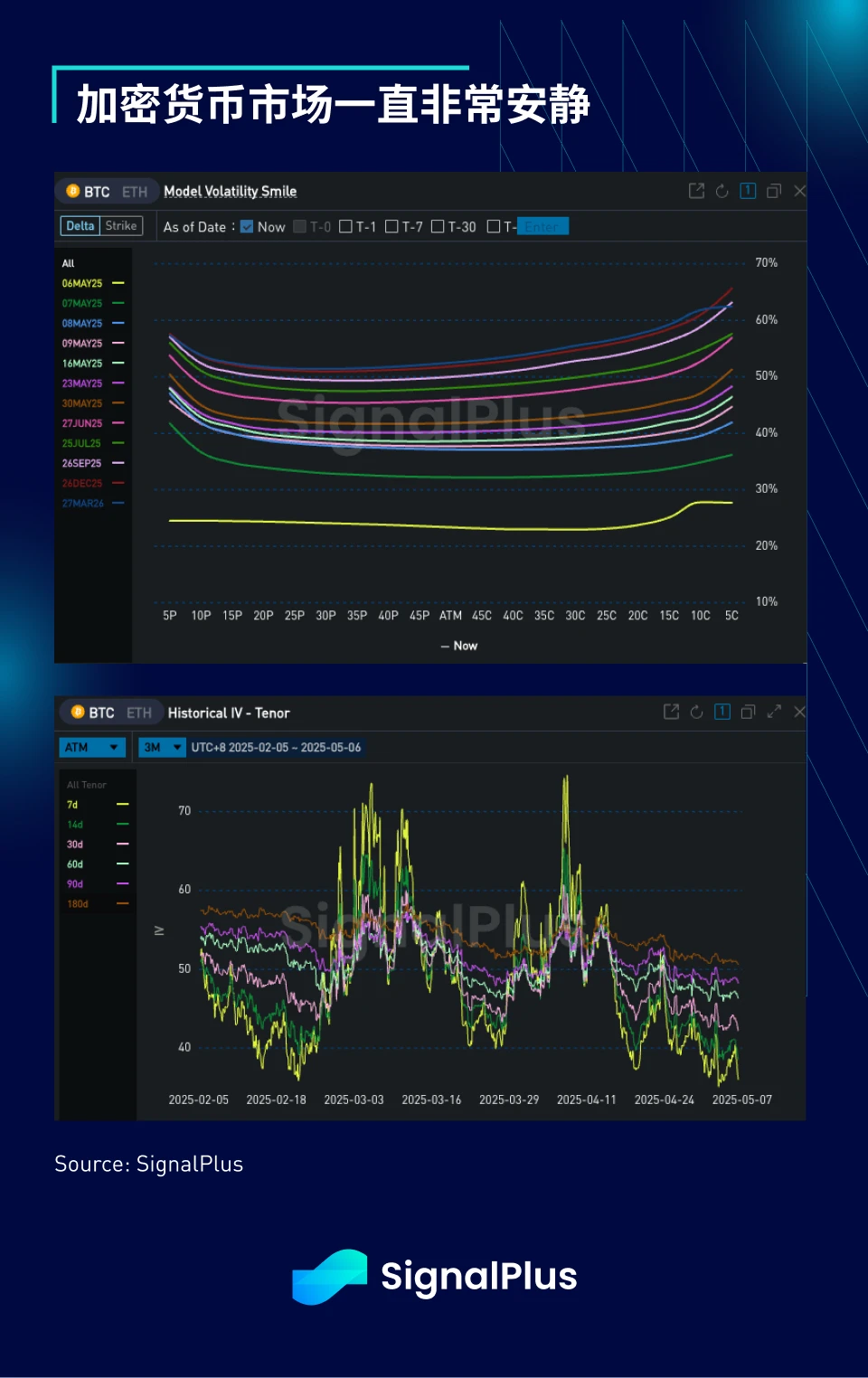

In terms of cryptocurrencies, the past week has been relatively volatile, with prices remaining flat, although BTC once regained the 96k level, but then encountered short-term profit-taking pressure. The volatility curve has flattened, indicating that the market lacks a clear direction for the future, and the realized volatility has fallen back to the low point of the year.

If there are no major changes in macro assets, we expect cryptocurrency prices to continue to consolidate in the short term and may maintain a bullish trend in the medium term.

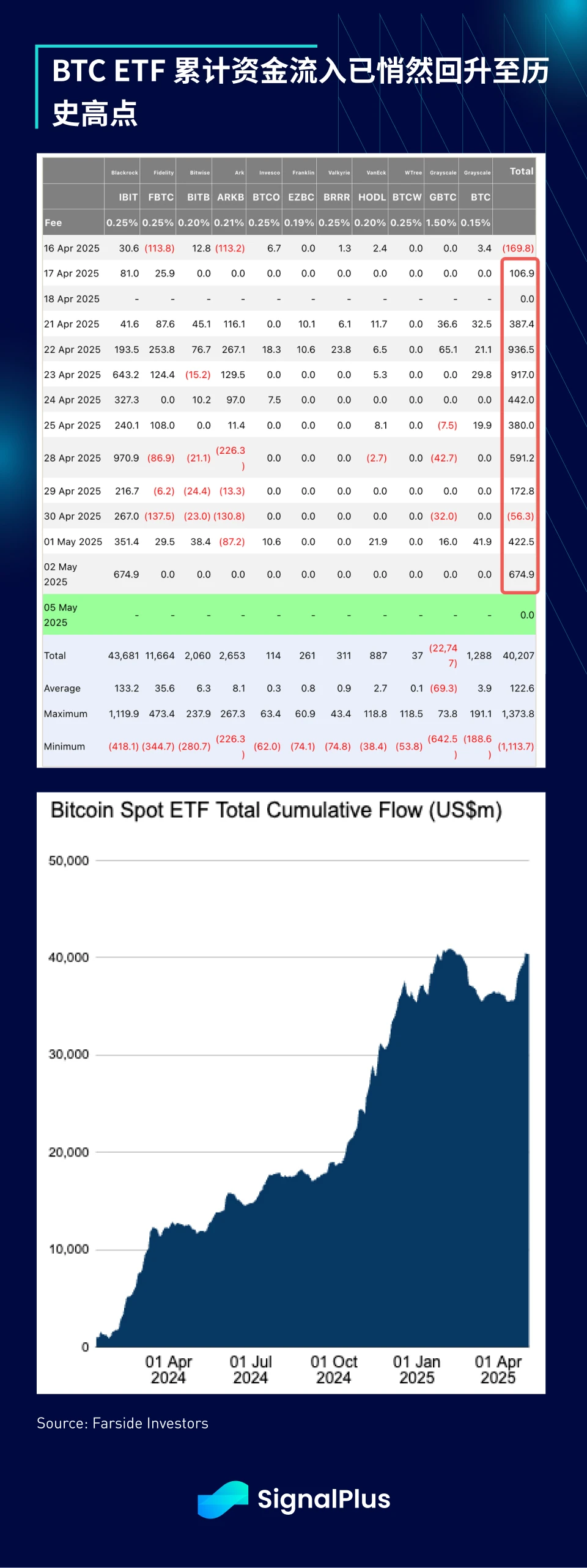

ETF inflows have continued to be positive, albeit modest, over the past two weeks, with cumulative net inflows nearly exceeding the highs seen earlier in the first quarter.

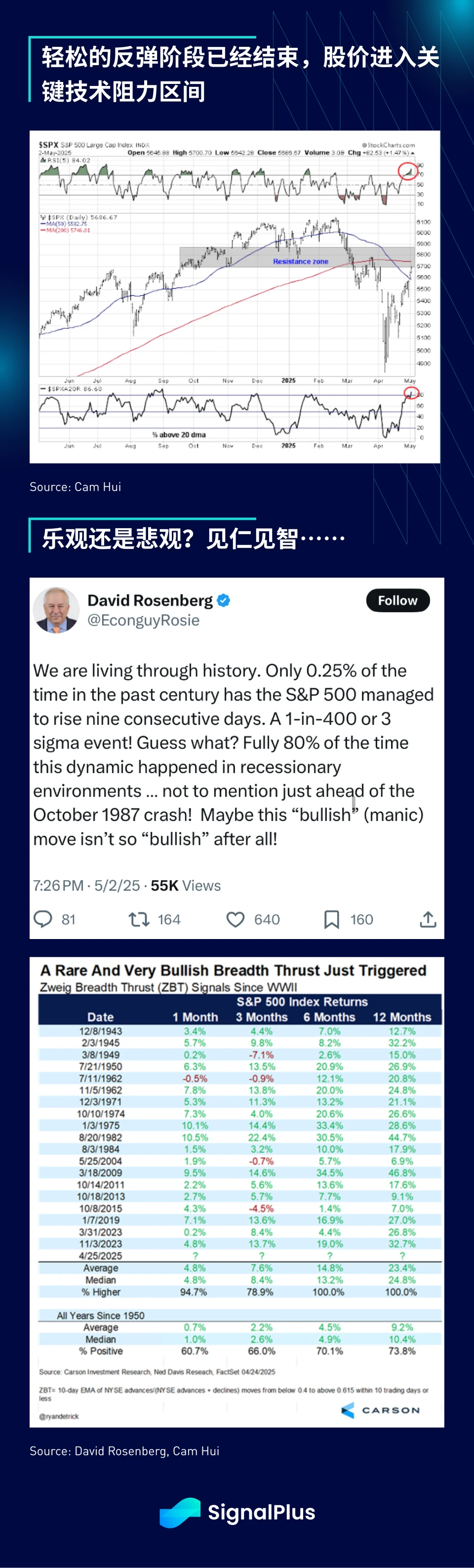

Looking ahead, the easy part of the rebound has been achieved as the SPX has successfully recovered its post-Liberation Day losses, and price has reentered a technical resistance area. Historically, bear market rallies (if this one counts) have been the most volatile and irrational to observers, however, this rapid rebound has also triggered some positive divergences that could push prices back to the January highs.

We do not expect this weeks FOMC meeting to have a significant impact on the market. There is no clear direction at present, and price movements may be as unpredictable as flipping a coin. Ultimately, it will come down to corporate profit growth, which will further depend on economic realities and the subsequent impact of tariffs.

So far, so good, with first-quarter earnings growth expected to be close to 13% year-over-year, almost double expectations at the start of earnings season and the second straight quarter of double-digit growth.

If we have to make a choice, we believe that the markets pain trade is still further upward price action. After all, most observers are still obsessed with the argument that the die is cast and there is no way back on tariffs. However, we should be aware that dead cat bounces in bear market rallies should not be taken lightly!

You can use the SignalPlus trading vane function for free at t.signalplus.com/news , which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com