At 12:00 am on May 10, 2025, Eastern Time, the on-chain trading platform MyStonks.org announced that it had completed the platform update and officially launched the on-chain US stock token market with 100% custody support. MyStonks.org stated that crypto users can purchase US stocks through MyStonks, and global asset management giant Fidelity provides US stock custody services to platform users, with the first batch of custody assets reaching US$50 million.

For the first time, MyStonks successfully completed the full cycle process from Fidelitys custody of US stock assets to the generation and destruction of Base chain tokens. Users initiated a request to purchase Stonks 100 US stock tokens through the MyStonks platform, transferring USDC or USDT from their self-custodial cryptocurrency wallets to the platform. MyStonks converted it into USD and purchased the corresponding shares of securities, while minting tokens through the Base chain smart contract.

Taking Apple (AAPL) stock as an example, MyStonks will mint corresponding shares of AAPL.M tokens at a 1:1 ratio and distribute them to the users on-chain wallet address. The minted US stock tokens comply with the ERC 20 standard, and the exchange process uses the ChainLink oracle as the quotation provider .

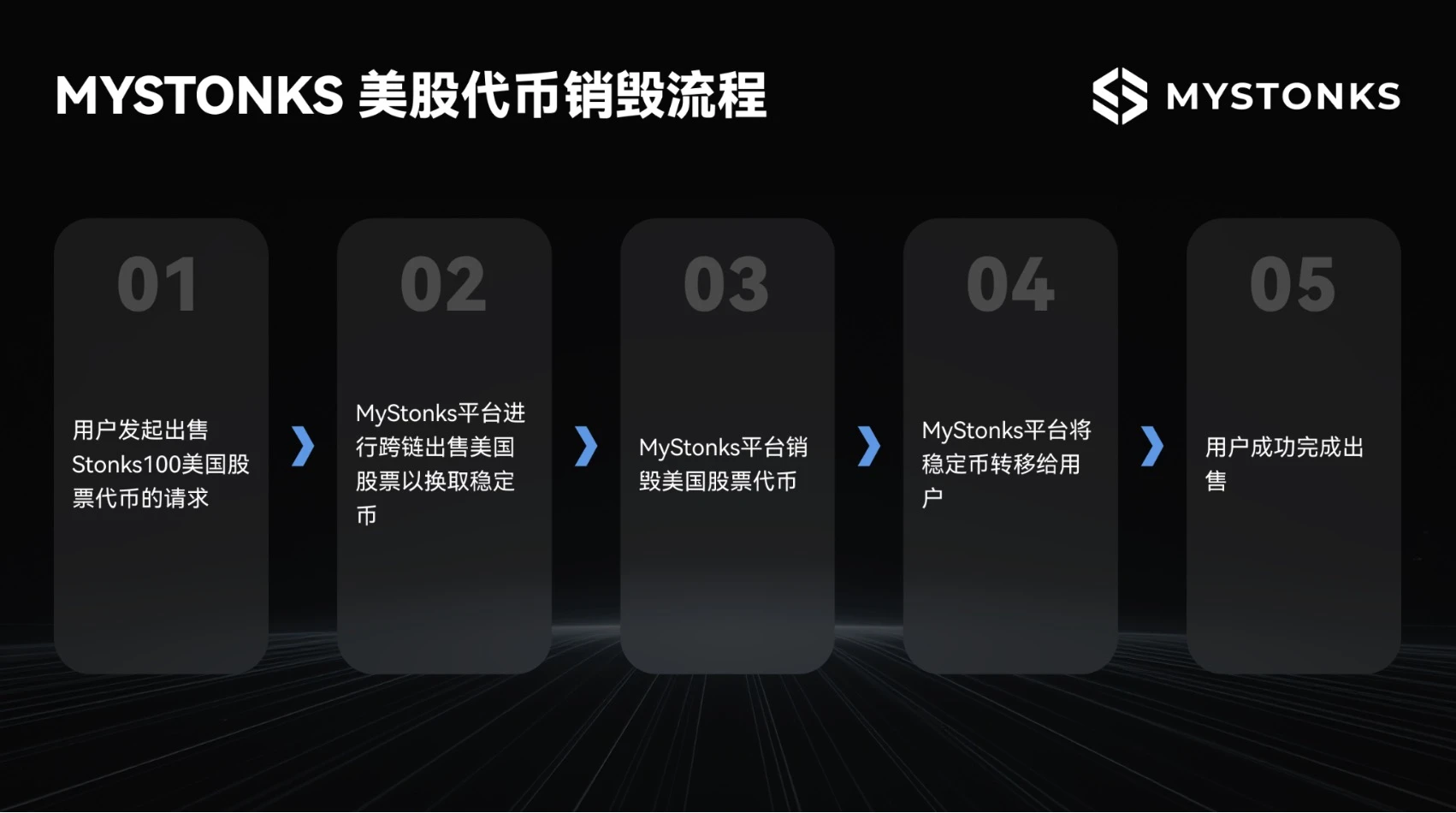

If users want to destroy their minted US stock tokens, taking AAPL.M as an example, they can connect to the self-hosted wallet on MyStonks to initiate a request to sell AAPL.M. The MyStonks platform will perform the reverse operation, convert AAPL.M into stablecoins and transfer them to the users account , and at the same time destroy the corresponding AAPL.M at a 1:1 ratio.

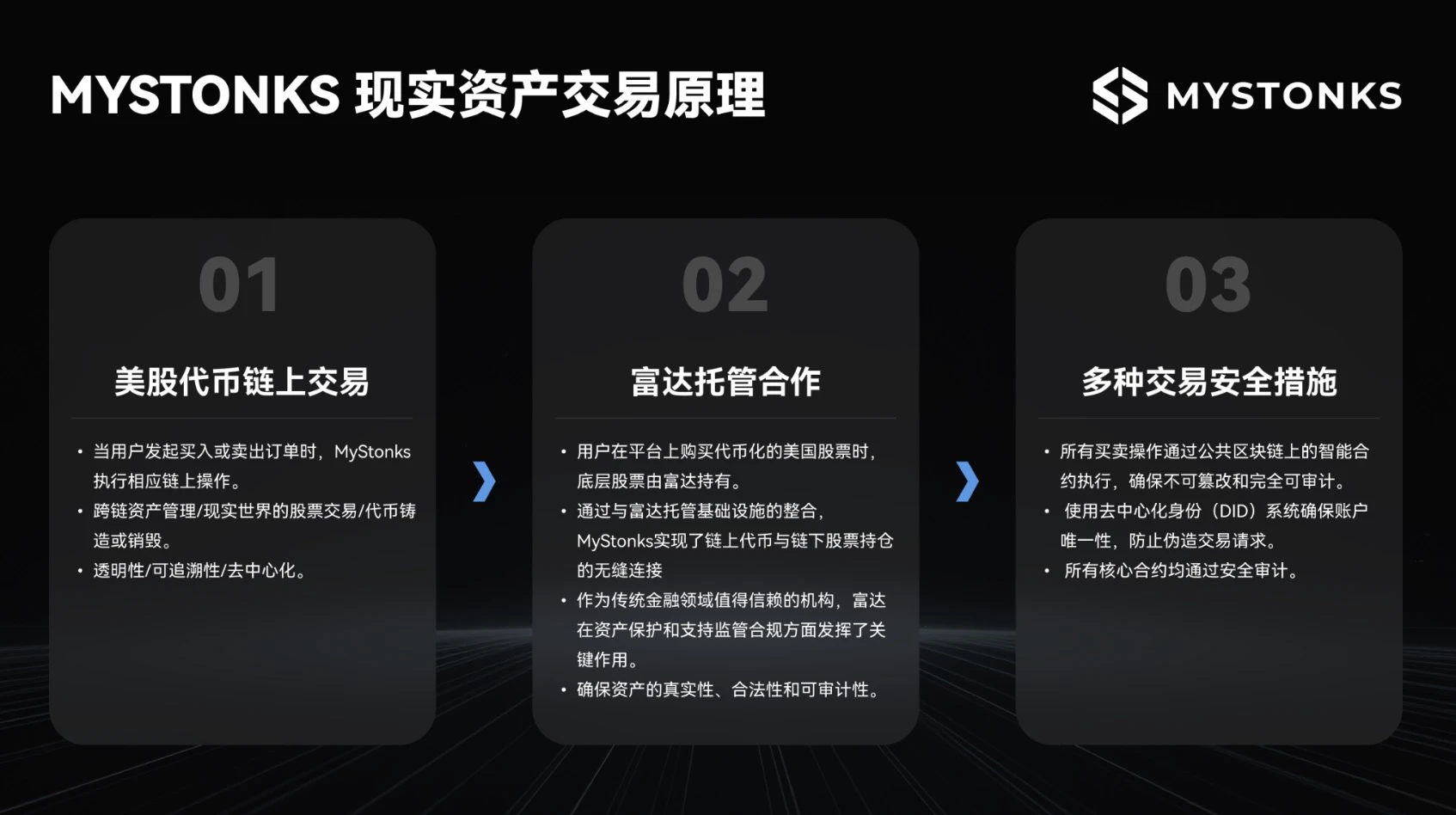

To ensure the security and compliance of user assets, MyStonks has partnered with Fidelity, and Fidelity Custody provides custody services for the U.S. stock assets of platform users.

According to a report issued by Fidelity Custody on April 29, 2025, the value of the first batch of U.S. stocks held by MyStonks Holding Limited exceeded US$50 million ($50,473,199.00). The first batch of securities held by MyStonks included 95 types of AAPL, AMZN, DIS, GOOGL, META, MSFT, NFLX, NVDA, etc., corresponding to 95 1:1 equivalent U.S. stock tokens; and 5 crypto and stock ETFs listed in the United States.

The relevant person in charge of MyStonks.org introduced that when users purchase US stock tokens on the platform, the corresponding stocks are managed by Fidelity, thus ensuring the authenticity, compliance and auditability of the assets. Through the integration with Fidelitys custody infrastructure, MyStonks has achieved a seamless connection between on-chain tokens and off-chain stock assets. As a trusted institution in the traditional financial field, Fidelity plays a key role in ensuring asset security and compliance, and is an important partner of MyStonks in realizing tokenized stock trading .

At the same time, MyStonks has also upgraded on-chain transaction security and user experience.

When a user initiates a buy or sell order, MyStonks will perform corresponding operations on the chain, including cross-chain asset management, real stock trading, token minting or destruction, etc. The entire process is transparent, traceable and decentralized, allowing users to gain exposure to US stocks in a fully digital and tokenized form.

All MyStonks buying and selling operations are executed through smart contracts to ensure that they are tamper-proof and auditable. The decentralized identity system ( DID) ensures account uniqueness and prevents forged transaction requests. All core contracts have passed security audits, and the contract architecture adopts a modular design to facilitate risk isolation.

MyStonks.org introduced that off-chain deposit and withdrawal operations require multi-signature wallet authorization to avoid single point failure and internal abuse. Cross-chain asset transfers are completed through audited cross-chain protocols. A transaction delay confirmation mechanism (Time-Lock) is implemented to prevent lightning attacks. The front-end uses HTTPS and HSTS to enforce encrypted access. This upgrade also optimizes the user experience of MyStonks, including supporting on-chain price limit order transactions, enhancing wallet connection experience, refining the user account center, and optimizing UI layout.

Stonks 100 U.S. stock tokens are not only the latest successful attempt of MyStonks, but also mean that we can continue to deliver on our promise of innovation-driven growth and will continue to expand the tokenization of U.S. stock assets and related businesses in the future. Safe, professional, stable and real and transparent transactions are the value we hope to create for the industry. I believe that as MyStonks develops, MyStonks users and Stonks global community partners will also benefit together. We are moving forward steadily. said a relevant person in charge of MyStonks.org.

About MyStonks.org:

MyStonks.org is a decentralized crypto asset trading platform created by Stonks community CTO (Community Take Over), providing users with 100% US stock asset custody support, 1:1 on-chain RWA issuance and trading. MyStonks vision is to become a decentralized Nasdaq in the cryptocurrency field , provide support and platforms for emerging token projects, innovate the decentralized financial ecosystem, and promote the healthy development of the cryptocurrency industry.

About the Stonks Community:

The Stonks community inherited the GameStop $GME and the rebellious spirit of cryptocurrency. The communitys slogan is: FIGHT! HODL! Check out the Stonks white paper: https://main.mystonks.org/pc/whitepaper.html

View Fidelity Custody Report: https://main.mystonks.org/static/pdfjs/web/viewer.html?file=/static/Proof.pdf