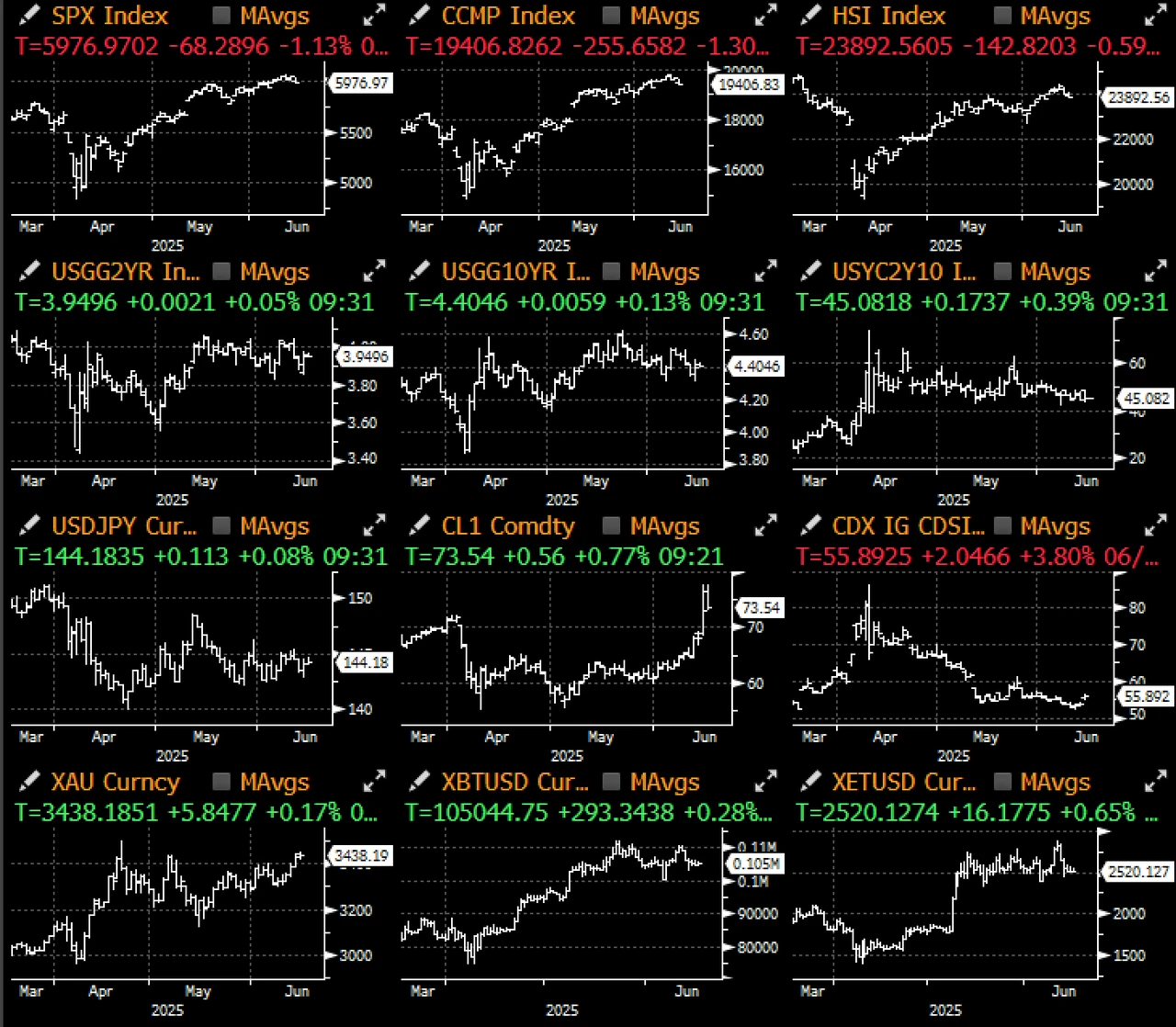

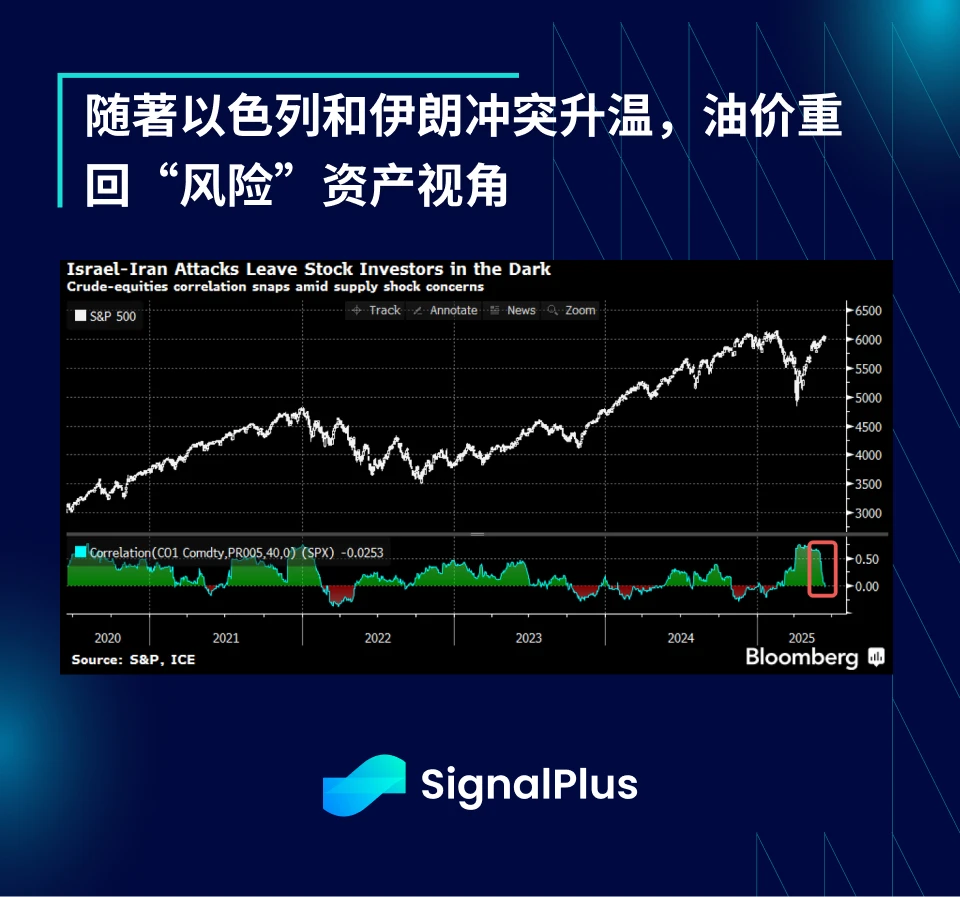

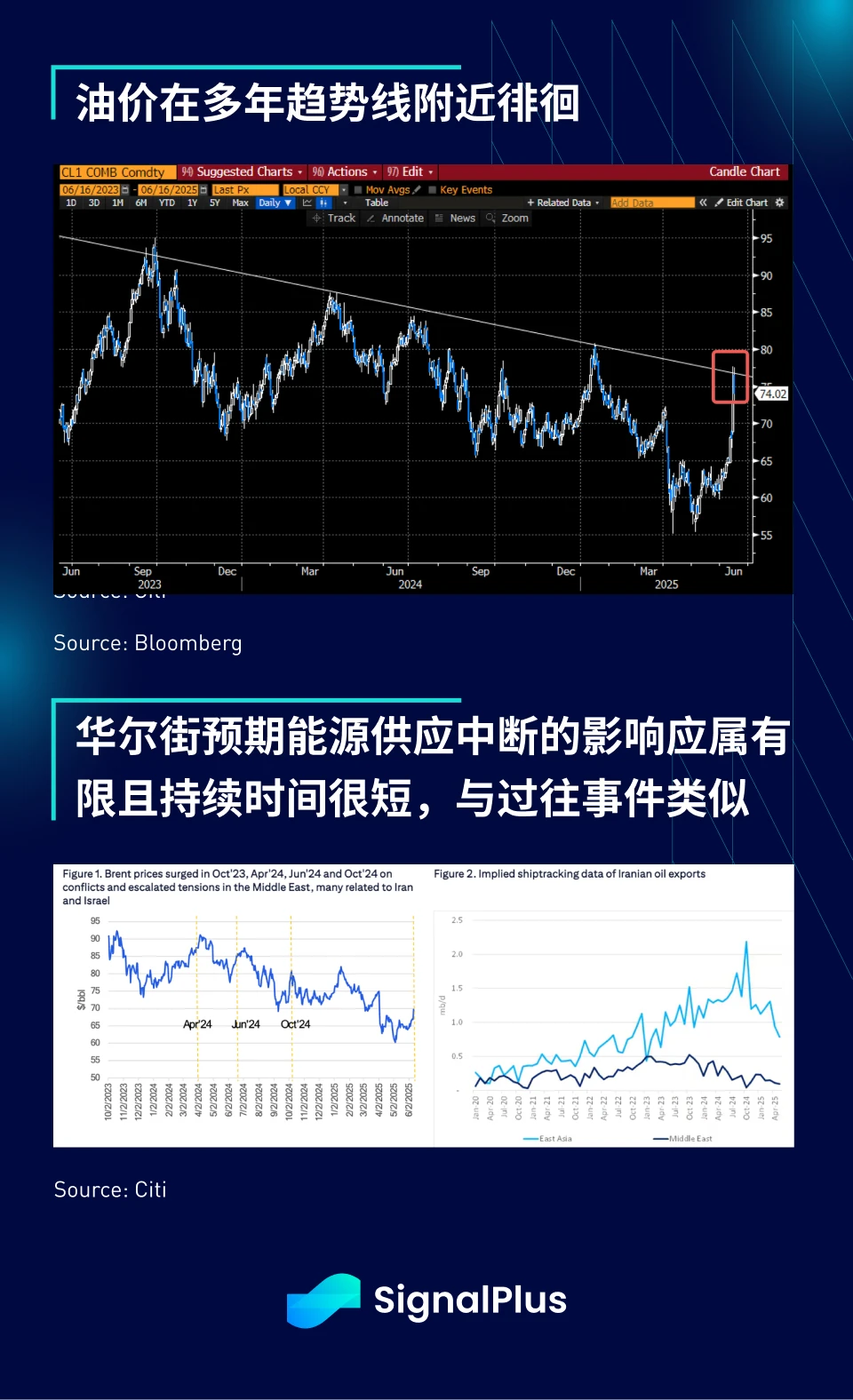

Geopolitics has once again become the focus of the market. Israels attack on Iranian facilities and Irans subsequent retaliation caused oil prices to surge and weakened the markets risk sentiment last Friday. The market is concerned about the risk of escalation, especially Irans possible blockade of the Strait of Hormuz and possible intervention by the United States, which will affect the trend of oil prices during the peak summer driving season in the United States.

Meanwhile, the rise in oil prices has hit a two-year downward trend line, and a more convincing upward breakout could be detrimental to overall risk sentiment in the short term. However, the market generally believes that the impact of energy supply disruptions should be limited, such as supplementary sources such as increased production in Saudi Arabia, but the most sustainable path still depends on a diplomatic solution.

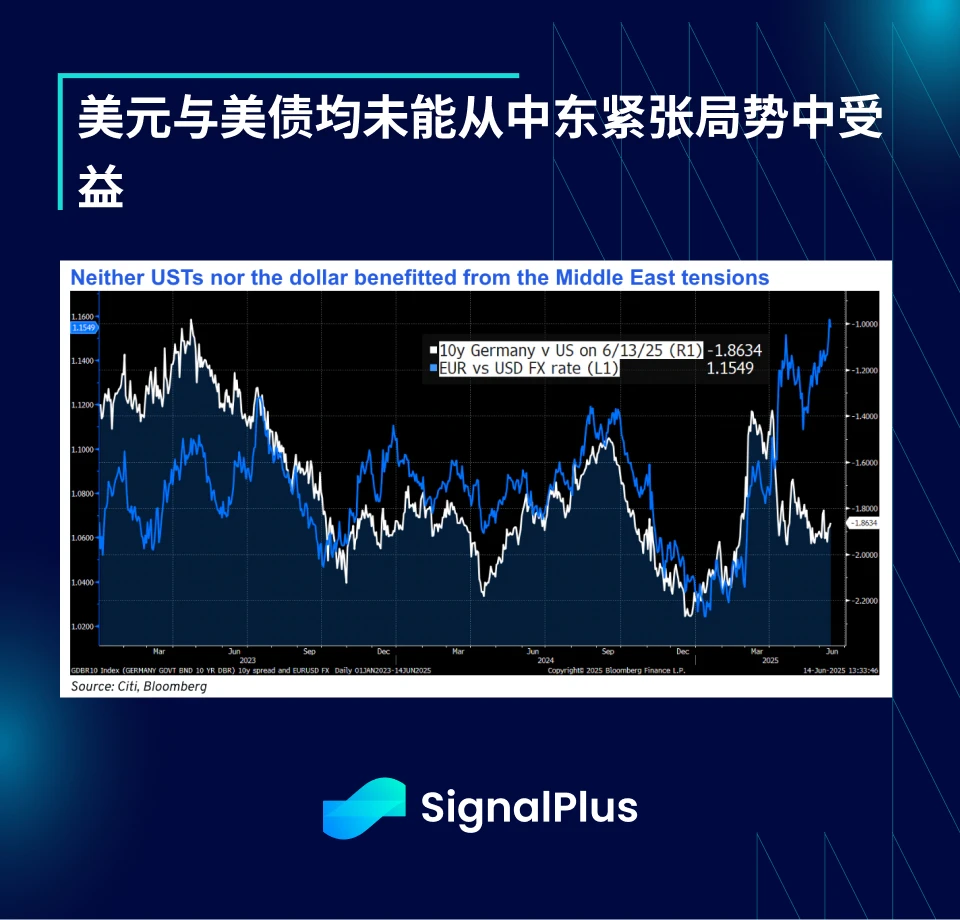

What is more noteworthy is that during this wave of conflict, there has been no obvious flight-to-quality buying of the US dollar and US bonds, indicating that global investors concerns about US capital flows are still higher than their attention to the situation in the Middle East, which obviously cannot be ignored.

Interest rate volatility has also fallen back to near multi-year lows, showing that the macro market is more inclined to shift the focus back to tariffs and economic fundamentals.

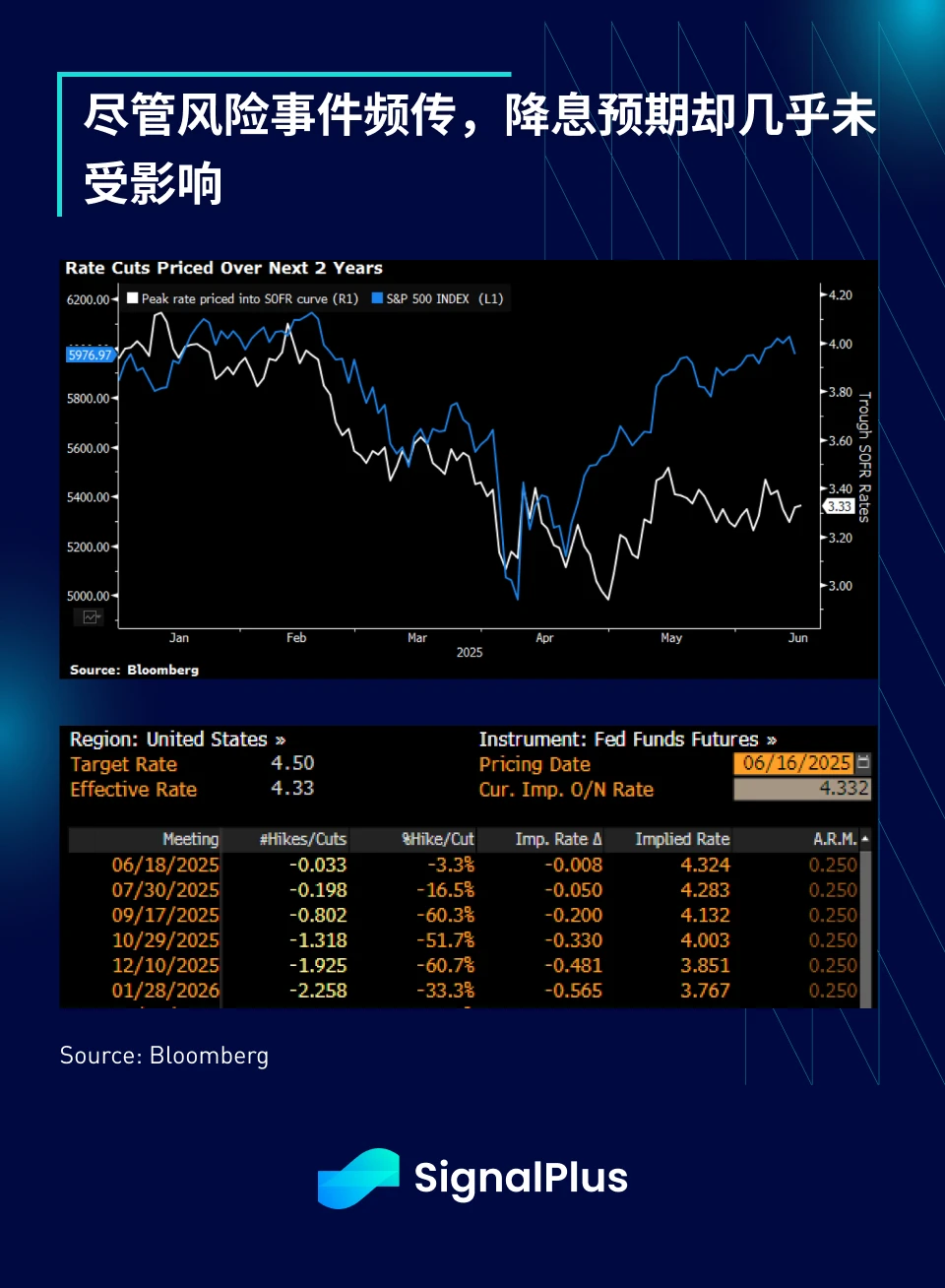

In fact, this wave of conflict has hardly affected market expectations for rate cuts in 2025. The market currently still expects only two rate cuts before the end of the year, even though inflation data has repeatedly fallen short of market expectations.

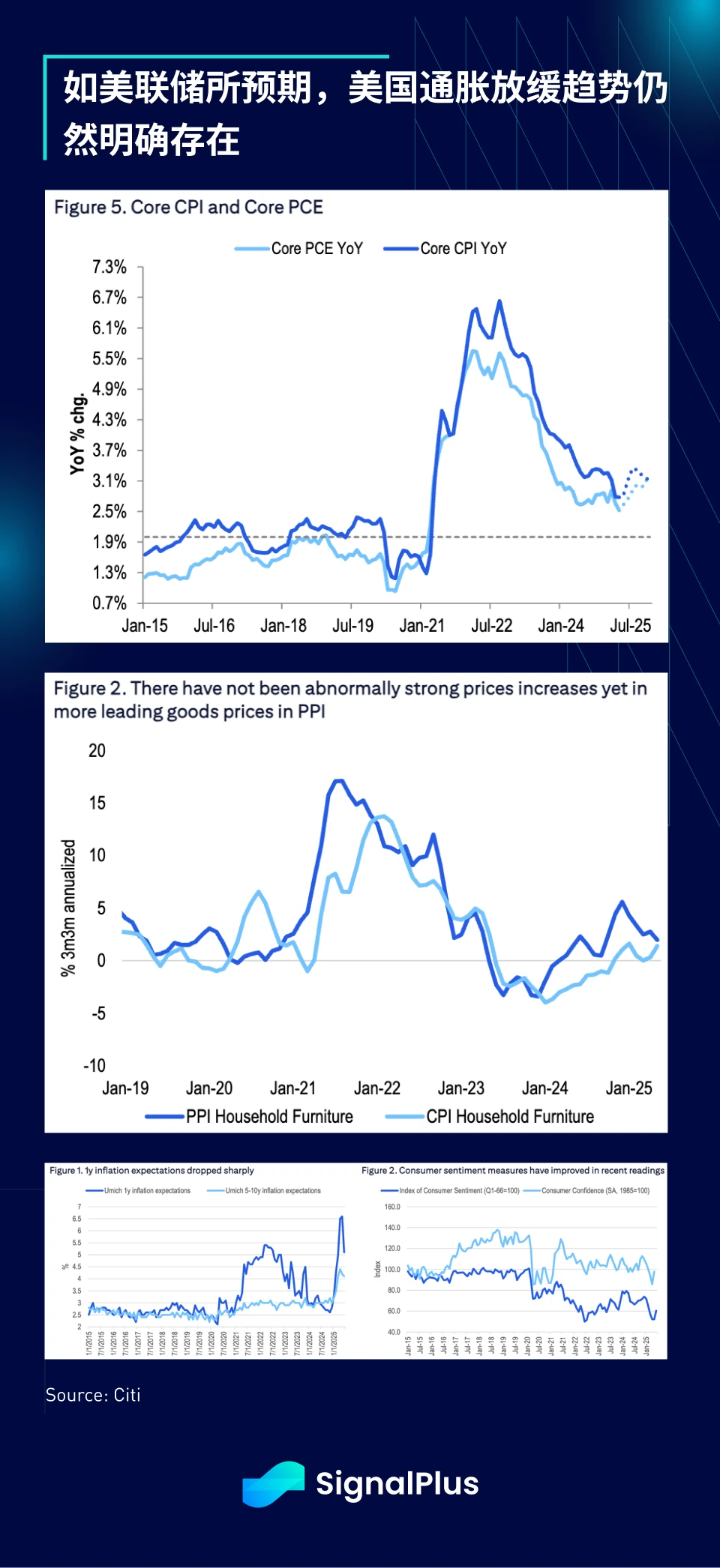

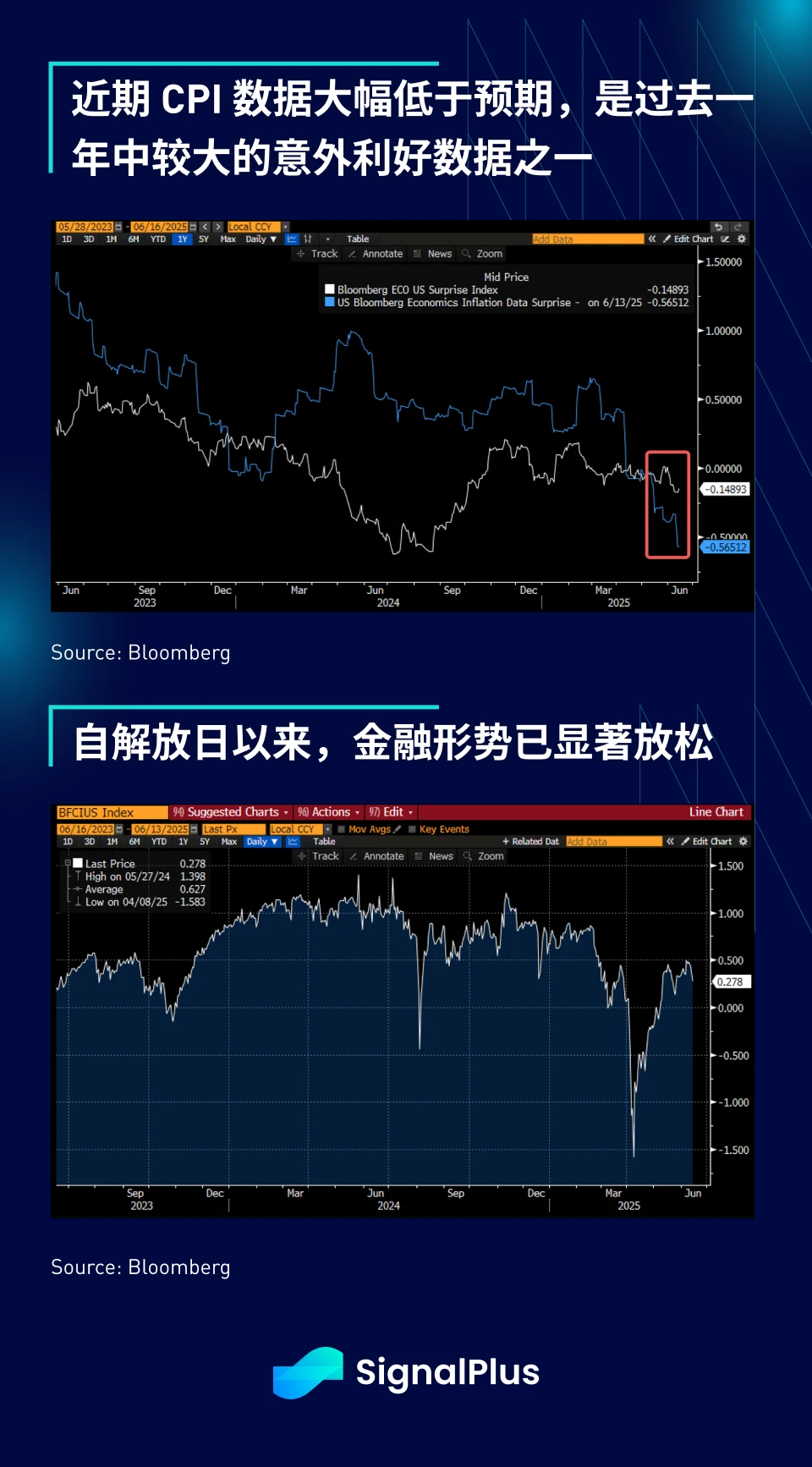

Prior to Fridays move, markets were celebrating lower inflation data across multiple developed markets (excluding Japan), with U.S. CPI, PPI, New York Fed inflation forecasts and University of Michigan inflation forecasts all coming in below expectations.

In fact, the recent core CPI was significantly lower than expected, which helped boost risk sentiment and gave the Federal Reserve more room to maintain a loose financial situation.

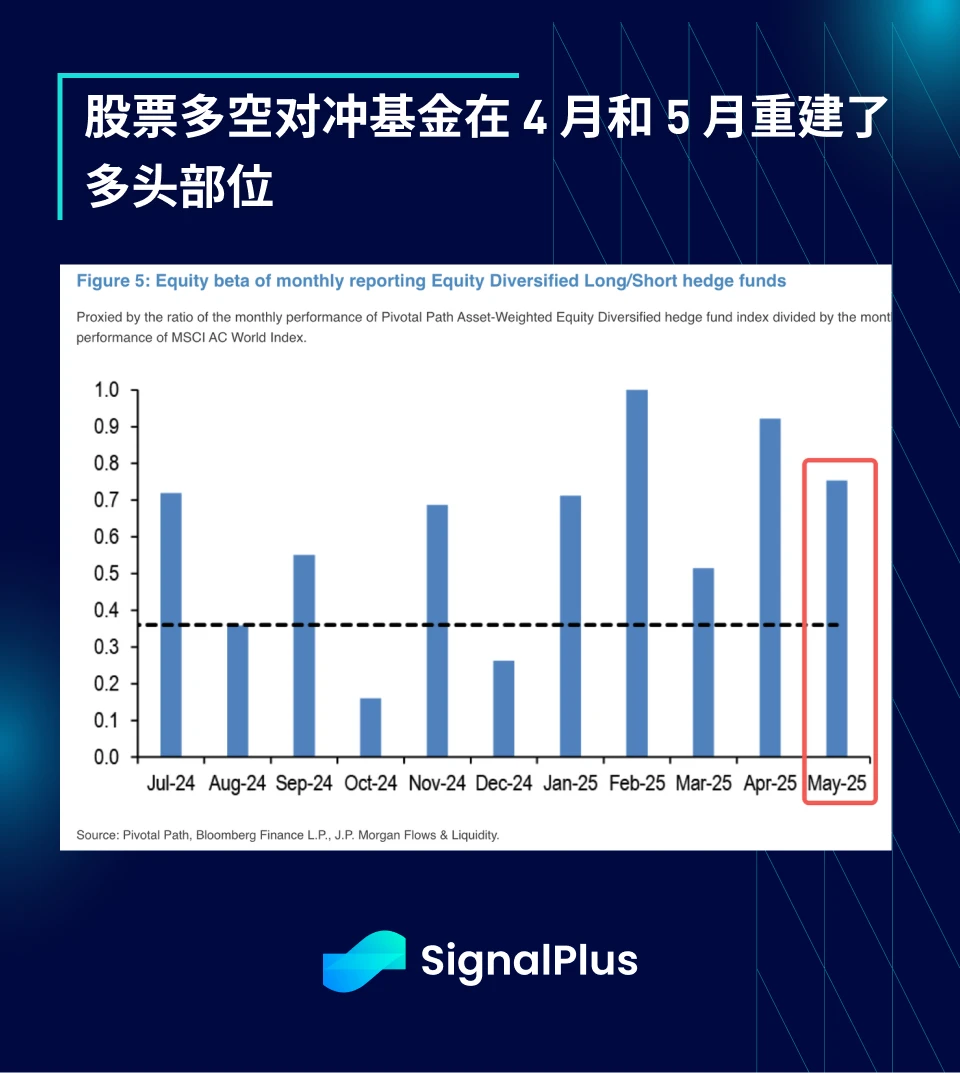

Equity long-short hedge funds have re-increased their long equity positions, with net exposure rising to a one-year high, and the path of least resistance for the market in the short term remains to the upside.

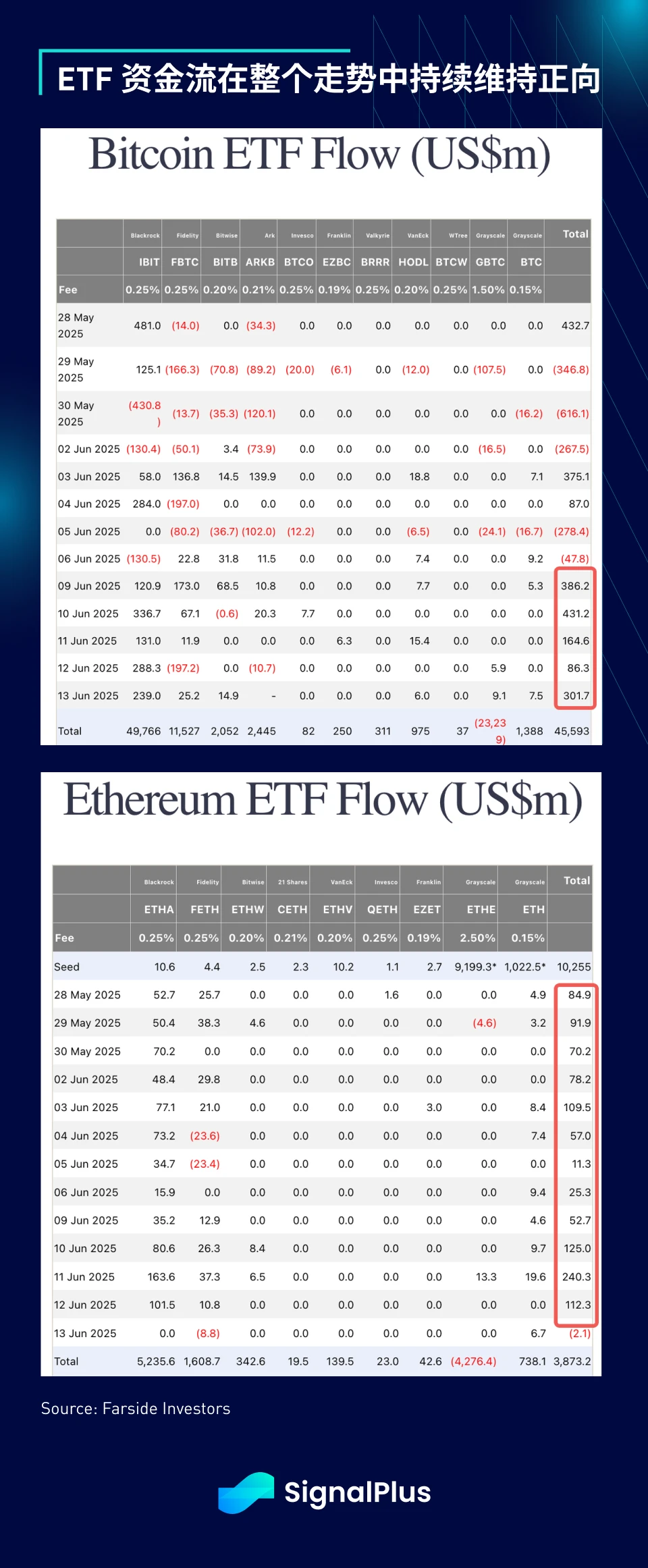

Cryptocurrency once again verified its positioning as a high-risk asset, and the prices of various tokens fell across the board last week. Last Friday, cryptocurrency prices fell along with the stock market, and more than $1.2 billion in futures positions were liquidated. Fridays decline mainly came from altcoins, while BTC returned to around $105k with the support of stable ETF fund flows and listed companies holding coins.

BTC ETFs saw net inflows of $1.4 billion, while ETH ETFs just broke a record of more than two weeks of net buying, showing that TradFi participation remains healthy. We expect prices to continue to follow stock market sentiment and move slowly upward as we head into the summer.

This week will see several central bank meetings (including the Fed, Bank of Japan, Bank of England, Norges Bank and Swiss National Bank), but we believe the actual impact will be limited. The Fed may send slightly dovish signals, and the market will be watching whether it will use the recent series of lower-than-expected inflation data and weak unemployment claims data as the basis for a further dovish turn. We do not expect major policy moves, and the market focus in the near term will still be on the development of the situation in Israel and Iran, especially any substantial military escalation or dangerous political moves, while the United States is still stuck in a deadlock in tariffs and budget negotiations. I wish you all a good trading week!

You can use the SignalPlus trading vane function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com