Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA Sector Market Performance

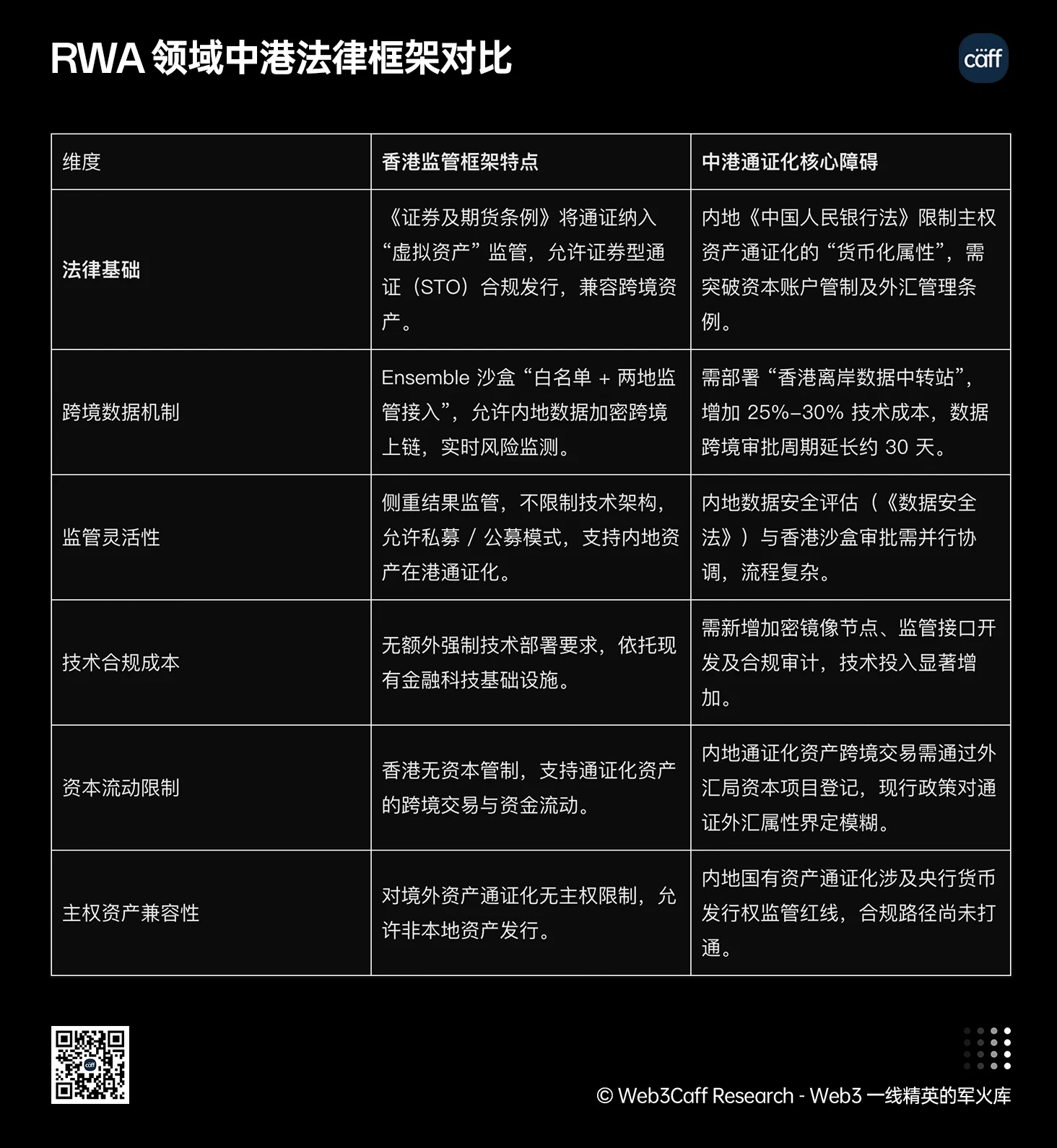

According to the latest data from RWA.xyz, as of June 17, 2025, the total value of RWA on the chain is $23.91 billion, an increase of 3.34% from $23.14 billion on June 10, and the market value is back on track. The number of on-chain asset holders increased from 167,437 to 185,289, an increase of 10.65%, continuing the growth trend of last week. The number of asset issuances remained unchanged at 194. The total value of stablecoins increased from $237.49 billion to $238.03 billion, an increase of 0.23%; the number of stablecoin holders also increased from 166.63 million to 167.45 million, an increase of 0.49%.

From the perspective of asset structure, the total value of private credit increased from $13.3 billion last week to $13.8 billion, a significant rebound, once again consolidating its dominant position in on-chain assets. U.S. Treasury bonds also increased to $7.37 billion, a steady increase, indicating that funds continue to have demand for safe assets.

Commodity assets increased slightly to $1.6 billion this week, a small but continuous increase; institutional alternative funds also increased from $529.7 million to $543.1 million, maintaining a steady upward trend. Equity assets rose slightly to $360.9 million, continuing the upward trend over the past two weeks, reflecting the platforms enhanced transparency and display, and also reflecting the markets increasing acceptance of this type of asset.

What is the trend (compared to last week )?

Market value rebounded, and on-chain activity hit a new high: After stabilizing last week, RWA market value rebounded strongly to a record high this week, with a total number of asset holders approaching 190,000, and user growth momentum is still being released; private credit assets returned to the main line of growth, and the market value rebounded to US$13.8 billion: After a slight correction last week, it rebounded again, indicating that market funds are still enthusiastic about high-yield assets, which are the absolute pillar of the current on-chain structure; U.S. debt assets grew slowly and continued to exist as a core and stable configuration: from 7.3 billion to 7.37 billion, indicating that its ballast stone role is still highly recognized and suitable for risk defense needs in the current economic environment; commodities and alternative assets have grown for two consecutive weeks, becoming a stable source of incremental bottom positions. Investors still have a continued willingness to allocate low-volatility assets, which helps to balance the risk exposure in the overall asset structure; stock assets continue to rise, and the on-chain securitization path is gradually being accepted by the market. Although the total amount is still small, it has grown for three consecutive weeks, indicating that its future potential deserves continued attention.

In general, in mid-June 2025, the RWA on-chain asset market showed the characteristics of capital repatriation, stable structure, and steady growth . On the one hand, the total market value and user activity rose simultaneously; on the other hand, the asset distribution pattern remained balanced, without obvious imbalance or unilateral tilt. At the same time, it is recommended that investors continue to use the high yield + low volatility dual-wheel strategy as the basic configuration logic: continue to increase assets such as US bonds, commodities, and alternative funds in a stable configuration, and moderately participate in private credit opportunities according to market risk preferences; for stock assets, a medium- and long-term observation perspective should be maintained to grasp the potential dividends brought by the expansion and structural upgrading of on-chain securities assets.

Review of key events

The U.S. Senate will hold a final vote on the GENIUS Act on June 17, Eastern Time

According to reporters Eleanor Terrett and Senate Cloakroom, the U.S. Senate will hold a final vote on the GENIUS Act (S.1582) at 4:30 a.m. Beijing time on June 18 (4:30 p.m. Eastern time on June 17). The bill has completed the amendment process and will be sent to the House of Representatives for deliberation if passed. This is the last round of voting for the bill in the Senate.

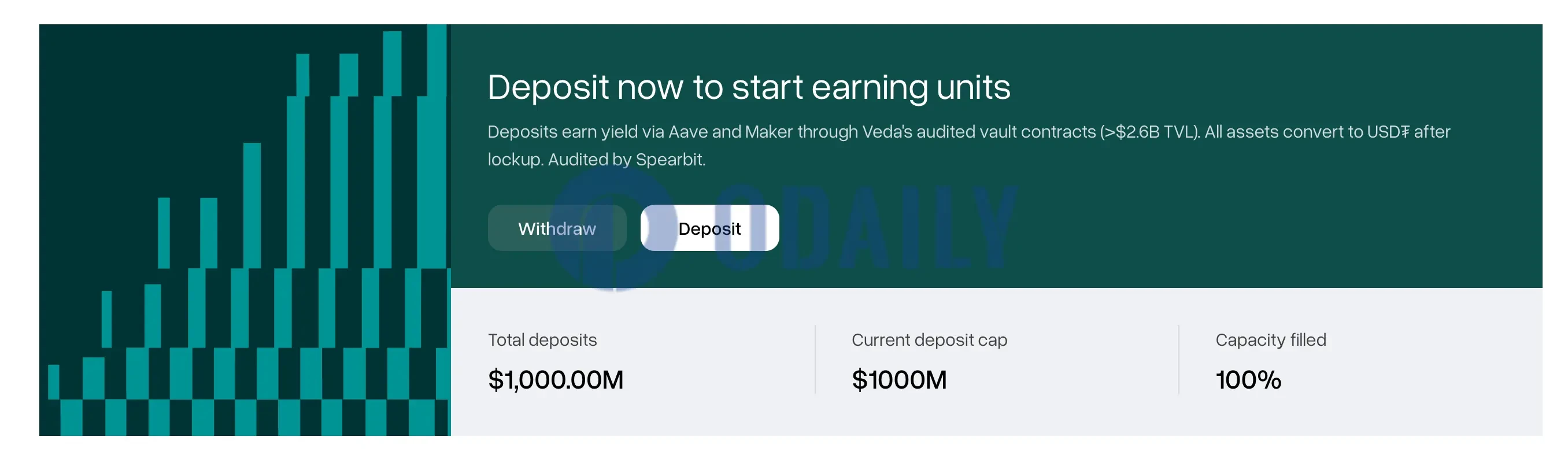

Plasmas $500 million public offering sold out in minutes

Plasma announced on the X platform that the deposit function is now online, and the projects public token sale completed the subscription of $500 million in a few minutes. After that, the official Plasma added another $500 million public deposit quota at 9:00 am on June 12, which took about half an hour to be fully deposited.

Payments giant Stripe acquires crypto wallet provider Privy

Payment giant Stripe has agreed to acquire crypto wallet provider Privy. The specific transaction amount has not been disclosed. It is reported that this is another major layout of Stripe after the acquisition of stablecoin infrastructure company Bridge.

Bank of America CEO: Willing to launch stablecoin with partners

Bank of America CEO Brian Moynihan expressed his willingness to work with partners to launch our own stablecoin, and the trading volume of stablecoins will mainly focus on transactions between cryptocurrencies.

As early as the end of February this year , Bank of America CEO Brian Moynihan said, We have no choice but to enter the stablecoin market. Although it has been conservative about crypto assets in the past, its position has changed significantly in the face of regulatory pressure and competition from peers. Previously, Bank of America had explored cooperating with financial giants such as JPMorgan Chase to issue stablecoins. Although it did not eventually land, it showed its strong interest in blockchain infrastructure.

Ant Group to apply for stablecoin licenses in Hong Kong and Singapore

According to people familiar with the matter, Ant International, the international business unit of Ant Group, plans to apply for a fiat-pegged stablecoin issuer license after the Hong Kong Stablecoin Ordinance takes effect in August this year, and simultaneously prepare for applications for relevant licenses in Singapore and Luxembourg. A spokesperson for Ant International has confirmed the plan for Hong Kong.

The move is aimed at strengthening the role of its blockchain-based Whale platform in cross-border payments and fund management businesses. The Whale platform processed more than $1 trillion in global transactions last year, accounting for one-third of Ant Groups total cross-border processing volume, supports tokenized assets issued by a variety of banking institutions, and uses privacy computing technologies such as homomorphic encryption to achieve multi-party verification.

Ant International has established cooperation with more than 10 global banks including HSBC, BNP Paribas, JPMorgan Chase, and Standard Chartered. Recently, it announced a strategic cooperation with Deutsche Bank, focusing on on-chain fund flow and payment settlement. The sector will generate nearly $3 billion in revenue in 2024, has achieved adjusted profits for two consecutive years, and has laid the foundation for future spin-offs and IPOs, with a valuation range of $8 billion to $24 billion.

Hot Project Dynamics

Bedrock (BR)

One sentence introduction:

Bedrock is a multi-asset liquidity re-staking protocol powered by a non-custodial solution designed in partnership with RockX. Bedrock leverages its universal standards to unlock liquidity and maximize value for PoS tokens such as ETH and IOTX, as well as existing liquid staking tokens called uniETH and uniIOTX.

Latest News:

On June 14, Bedrock announced BR staking rewards on @River4fun The platform is online, offering income opportunities up to 5000% APR, but be aware of the risks.

In addition, Bedrock has previously cooperated with WLFI to launch the USD1/BR liquidity pool on PancakeSwap, providing users with the opportunity to obtain Farming income with stablecoins USD1 and BR.

Usual (USUAL)

One sentence introduction:

Usual is a decentralized stablecoin protocol that aims to create a fair, community-driven financial ecosystem through tokenized real assets (RWA). Its core goal is to transform the centralized profit model of traditional stablecoins (such as USDT) into a user-owned and governed model, redistributing value and control to the community through its stablecoin products USD0 and USD0++ , as well as the governance token USUAL. The project combines the stability of physical assets with the composability of DeFi, and is committed to providing users with secure, transparent and high-yield financial tools.

Recent Updates:

On June 12, Usual announced the official launch of ETH 0 (a synthetic asset based on Lidos wstETH 1: 1 support), with the first minting limit of $1 million (500 ETH), providing more than 10% native APY, and USUAL stakers enjoy 105% APY (60% of which is paid in stablecoins), with income coming directly from protocol revenue. Full liquidity, no lock-up period. The first cap was sold out in about 10 minutes.

On June 13, Usual announced that USD0 and USUAL now support BNB Chain and Base through LayerZero’s cross-chain protocol, which can be bridged through transporter . USUAL’s support for Arbitrum is also online on interport , and plans to expand to more chains through Stargate.

Related articles

RWA Weekly Report Last Week: Sorting out the latest industry insights and market data.

As of June 6, the total market value of the global RWA market has soared to US$23.39 billion (excluding stablecoins), a sharp jump of 48.9% from US$15.7 billion at the beginning of the year. However, behind this impressive report card, there are deep-seated problems such as high concentration of asset categories, limited liquidity, questionable transparency, and low correlation with the native crypto ecosystem. RWA still has a long way to go to become a true mainstream track.

《 The most comprehensive interpretation of RWA ecological project 》

This 10,000-word in-depth research report written by DePINOne Labs comprehensively reviews the main categories and representative projects of the RWA ecosystem in 2025.

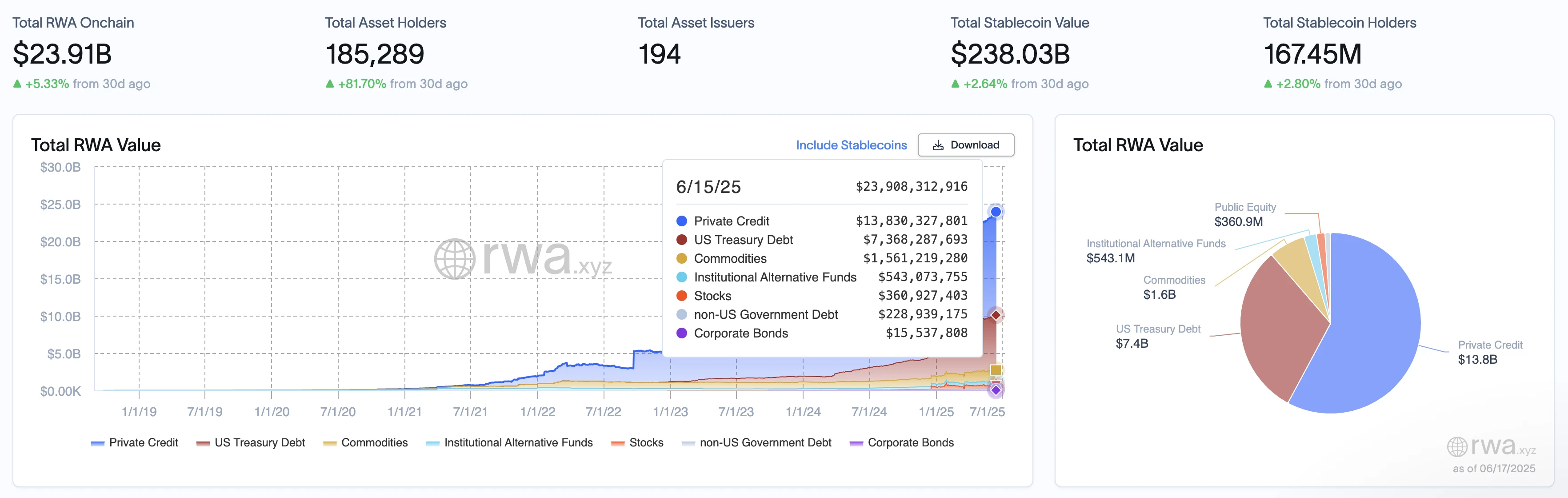

Written by a researcher at Web3 Caff, the full text contains more than 25,000 words. It combines the most cutting-edge regulatory framework to conduct a comprehensive and in-depth analysis. It also focuses on the progress of future key areas such as standardized assets, physical asset RWAs, and infrastructure service providers in the field of technical regulatory collaboration.