1. Introduction: From Payment Tool to Intelligent Collaboration Hub

At the intersection of Web3 and artificial intelligence (AI), crypto payments are being redefined. In the past, it mainly assumed the underlying function of value transfer, but now it is evolving into the execution center of the AI economy, connecting data, computing power, users and assets in an intelligent collaborative network.

The core logic behind this trend is that AI gives the payment system dynamic decision-making capabilities, while blockchain provides a trusted execution environment. The two merge to form a closed loop of data on-chain - intelligent processing - automatic payment. This not only reshapes the efficiency and structure of the payment system, but also opens up new imagination space for business model innovation, user incentive mechanism reconstruction, and off-chain digital transformation.

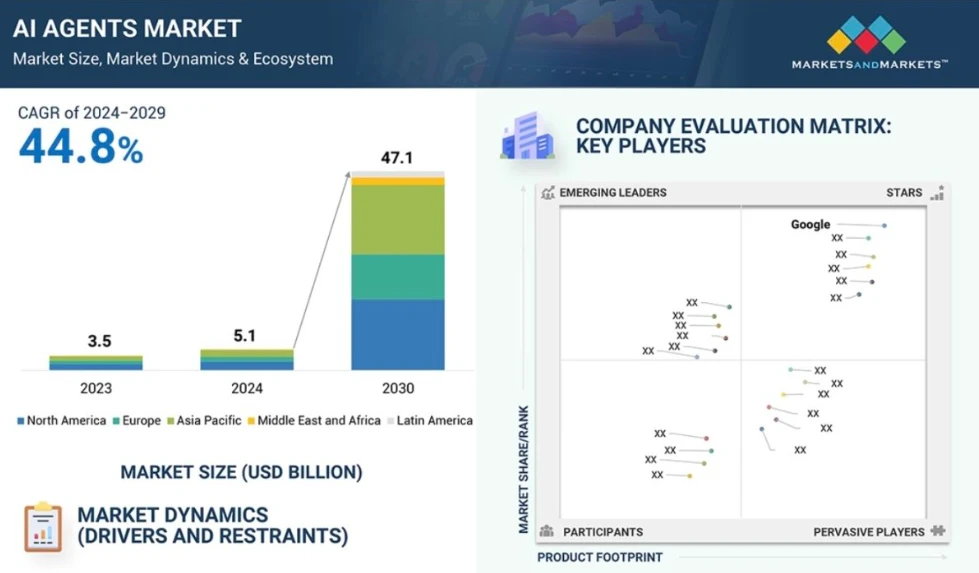

According to MarketsandMarkets, the AI Agent market will reach US$47.1 billion in 2030, and encrypted payments will become the infrastructure and economic lifeblood of this new ecosystem.

2. Integration mechanism: Why is AI+Crypto payment established?

The reason why the deep integration of AI and encrypted payment has become a consensus trend of the new paradigm is not only because the two are at the forefront of the technology cycle, but also because of their high degree of coordination in operation logic, execution mode and value structure. In the traditional financial system, payment is the end link of the centralized clearing system. Its essence is a quasi-administrative behavior centered on account control rights, and there is no room for intelligent agents in the system. In the context of AI, especially the Agent system driven by large models, its operation mode naturally requires a payment interface with openness, automation and minimal dependence - encrypted payment has become the optimal solution for this demand.

From a basic perspective, AI’s key capabilities are logical processing, behavior prediction, and strategy execution based on input. Payment is the direct channel for strategy implementation. If the agent cannot call the payment channel, its autonomy ends at the reasoning stage; if the payment system cannot respond to the agent’s data feedback, it cannot dynamically optimize the execution path. Compared with the multiple permissions, delayed processing, and account restrictions of traditional payment systems, encrypted payments have native programmability and permissionless properties, allowing AI to directly generate and operate wallets, sign transactions, call contracts, set limits, and even cross-chain settlements. The entire process can occur transparently on the chain without relying on human intervention. The coordination of this mechanism layer marks the first time that “machines are users” have truly been established at the payment execution layer.

Furthermore, on-chain payment is not just the completion of behavior, but also the output of data. Each transaction is written into a verifiable state database, which becomes an important input for the subsequent behavior optimization of the AI model. AI can continuously iterate user portraits based on transaction frequency, time, amount, asset category and other dimensions to make personalized incentives, risk judgments or interaction strategies. For example, in the case of Boba Guys, the AI-driven Crossmint system realizes the automated reconstruction of processes such as loyalty points, discount distribution, and payment recommendations by identifying user behavior paths, making payment no longer a closed result, but a relay point for an open loop. In this model, payment is data, payment is feedback, and payment is intelligent incentive.

What is more noteworthy is that the incentive system has undergone a qualitative change after the combination of AI and encrypted payment. Traditional incentive systems are often based on fixed rules, unified parameters and static judgments, and are difficult to adapt to complex user behavior patterns. The introduction of AI enables the incentive mechanism to have dynamic adjustment capabilities, such as: changing the points redemption ratio according to user activity, automatically determining potential churn based on the length of stay and delivering retention rewards, and even differentiating pricing services based on user contribution. All these incentive behaviors can be automatically executed through smart contracts, combined with the native distributability and composability of cryptocurrencies, greatly reducing operating costs and improving interaction efficiency.

From the perspective of system architecture, the integration of AI and encrypted payment brings unprecedented combinability and interpretability. The traditional payment system is a closed black box structure that is difficult for external intelligent systems to access and their behavior cannot be audited. The verifiability and modular interface of on-chain payment make it an embeddable, callable, and traceable behavior engine for AI Agent systems. New payment protocols represented by AEON even enable AI agents to automatically switch payment paths based on task content, network status, and rate strategies, and autonomously complete cross-chain asset calls and transaction confirmations. Under this mechanism, payment is no longer the result of a single path, but a process node for intelligent collaboration and execution strategy games, providing key support for building a higher level of machine economy.

In general, the integration of AI+Crypto payment is not a technical splicing, but an endogenous unification of operating logic. AI requires an open, real-time, feedback-capable payment system to achieve autonomous decision-making, while the encrypted payment system requires the continuous calling and learning capabilities of the intelligent body to achieve the upgrade path from transaction to growth. The synergy between the two is giving birth to a new intelligent execution economy: payment is no longer a single-point behavior, but a system closed loop with dynamic response, continuous evolution, and collaborative incentives. In the future, any Web3 application, AI platform, retail scenario, and even social network may embed this intelligent payment hub, so that automated behavior has financial logic and value circulation has cognitive dimensions-this is the deep foundation for the establishment of AI+encrypted payment and its core pillar for landing as a new paradigm.

3. Analysis of core project cases: the practical implementation path of AI+encrypted payment

1. Crossmint + Boba Guys: Retail paradigm shift from payment tools to user incentive closed loop

In the tide of Web3 and traditional retail integration, Crossmints payment infrastructure has built a usable and implementable on-chain payment portal for many non-crypto native companies. Its cooperation with the American milk tea brand Boba Guys is particularly typical. The core problem faced by Boba Guys is that traditional payment data cannot effectively activate the loyalty program, lacks personalized recommendations and dynamic incentives, resulting in serious user churn and low repurchase rate. Crossmint built a Solana-based on-chain payment + AI membership system for it. When users place an order, they create a non-custodial wallet. The transaction process is transparently recorded on the chain, and users no longer need to understand Gas or crypto wallets. All consumption data is uploaded in real time, and the AI system then analyzes the users profile and pushes customized discounts and points redemption strategies.

In this process, AI is not just a recommendation tool, but an intermediary between marketing and payment: who deserves incentives, what form of incentives, and when to trigger, all are automatically decided by AI after analyzing consumer preferences and historical behaviors. Loyalty programs are no longer just static scoring mechanisms, but have become dynamic self-evolving intelligent systems. Three months after its launch, the program attracted more than 15,000 member registrations, the number of in-store visits by loyal members increased by 244%, and the per capita consumption increased to more than 3.5 times that of non-members. This model verified for the first time the real conversion ability of AI + Crypto Payment in daily consumption scenarios, and also provided a replicable paradigm for high-frequency consumption areas such as convenience stores, gyms, and coffee chains: payment is interaction, behavior is incentive, and on-chain is trust.

2. AEON: Building a native cryptographic payment execution protocol for AI agents

AEON is a more basic encrypted payment protocol for developers and technology platforms. Its uniqueness lies in that it is designed specifically for AI agents, with the goal of enabling intelligent agents to have real and credible value execution capabilities. Unlike Web2s payment system, which relies on central accounts, payment gateways, and authority verification, AEONs design concept is to allow each Agent to independently manage its payment permissions, intelligently call on-chain assets, and freely switch the optimal payment path between multiple chains. Users can issue commands such as book a ticket and take a taxi to AI through natural language instructions. The Agent translates the task semantics into payment intentions, and automatically completes payment generation, asset judgment, inter-chain routing, and transaction broadcasting through AEON. The entire process does not require user intervention.

AEON has built a set of intelligent paths of payment intent recognition + multi-chain payment execution, which enables AI to make autonomous policy decisions based on real-time data and assume the identity of the payment subject. In addition, the Agent-to-Agent collaborative framework it has built allows one AI agent to act as an information producer and another agent to act as a payment executor, realizing a truly decentralized automatic task chain. For example: a recommendation agent searches for hotels and another payment agent completes the settlement. AEON connects the two as a payment channel to complete the first prototype implementation of the machine collaborative economy. At present, AEON has implemented QR code payment scenarios in many places in Vietnam, covering e-commerce, life services, offline transactions and other fields, opening a breakthrough for the penetration of encrypted payments in Southeast Asia. The protocol also supports mainstream networks such as BNB Chain, Solana, TON, TRON, Stellar, etc., showing a strong cross-ecological expansion capability.

The significance of AEON lies not only in the payment execution itself, but also in the fact that it proposes a composable, verifiable, and embeddable intelligent agent payment specification, which transforms payment from human-triggered behavior to an execution logic automatically completed by an intelligent agent. This architecture may become a universal middleware standard for the future AI agent economy, driving Web3 applications towards true autonomous execution.

3. Gaia Network + MoonPay: Promoting seamless integration of fiat currency entry and AI agent network

Gaia Network is a decentralized platform designed for deploying AI agents. Its goal is to allow developers to create sustainable and tradable AI agents, while MoonPay is the worlds leading encrypted payment gateway, providing instant exchange services for fiat and cryptocurrency. The significance of the cooperation between the two parties lies in the fact that for the first time, the complete link of Web2 fiat currency → AI call → Web3 assets has been opened up. In Gaia, users only need to make a request to the agent through voice or text (such as buy $100 worth of ETH), and AI can call the MoonPay API to complete the entire process of pricing, payment, chaining, and transfer. Users do not need to understand wallets, Gas or on-chain operations. The entire process is automatically completed by AI, and transaction records are open and transparent.

MoonPays role is to lower the entry threshold for crypto payments. Through the embedded payment window and low-code modules it provides, Gaia developers can embed on-chain payment functions into their own Agents in minutes. At the same time, MoonPay supports multi-chain asset swaps, allowing Gaia agents to perform high-frequency transactions between chains such as Polygon and Solana, and supports complex scenarios such as small incentives and AI service subscriptions. As Gaia goes online in many countries around the world, MoonPays compliance advantages also make it a trusted value channel-the platform became the first crypto payment company to obtain the EU MiCA compliance license in 2024, and its monthly active users have exceeded 50,000, indicating that the implementation of AI+payment is accelerating towards globalization and compliance.

The strategic significance of this combination is that, on the one hand, it strengthens the user-friendliness of the entrance and solves the wallet threshold problem; on the other hand, it provides a payment platform and settlement mechanism for the commercialization of AI agents, allowing Web3 agents to leap from information tools to transaction executors. It not only breaks the boundaries between Web2 and Web3, legal currency and encryption, AI and payment, but also provides a realistic template and path for the global popularization of the intelligent agent economy.

IV. Challenges and Trends: Roadmap to the “Smart Payment Economy”

Although AI + encrypted payment presents a strong system synergy potential and commercial landing path, it still faces a series of key challenges in the actual promotion process, including technical complexity and interoperability problems, as well as compliance, security, user cognition and other multi-dimensional obstacles. Only by identifying and facing these structural constraints can we lay a solid foundation for truly entering the smart payment economy in the future.

First of all, technical complexity is the biggest barrier. AI and blockchain represent the two most complex technical systems at present. Fusion of them is not just superposition but deep coupling. This requires the payment protocol to adapt to the high-frequency and low-latency requirements of AI in terms of performance, while also being able to support the transparency and security of on-chain asset calls. On the one hand, the demand for multi-chain compatibility is becoming a standard, and the payment system must be dynamically routed according to dimensions such as transaction speed, Gas cost, and contract stability, but the security and real-time performance of inter-chain bridges are not yet ideal. On the other hand, AI agents must also have sufficient autonomous authority and control interfaces to initiate payment execution in a safe and verifiable manner, and how to build this trusted AI authorization model is still in the early experimental stage.

Secondly, compliance pressure constitutes the core limitation of global layout. Against the background of the gradual expansion of autonomous payment behavior of AI agents, regulators have continuously strengthened their attention to compliance elements such as payment initiation rights, user funds control and anti-money laundering review. Europes MiCA, the United States SEC and FinCEN, and Chinas multi-layered regulatory framework for cross-border data flows and anti-money laundering may all become stumbling blocks to platform expansion. Especially when AI is given the power to allocate and pay funds, how to define its legal responsibility subject, whether it constitutes shadow banking or illegal payment agency, these issues urgently need legislative follow-up. Although platforms such as MoonPay have obtained compliance licenses in some regions, their business advancement is still subject to obvious regional constraints. Many developers find it difficult to make a unified technical architecture deployment when facing different markets.

Furthermore, the high cost of user awareness and education has become an important bottleneck for large-scale implementation. Although AI agent + encrypted payment can achieve seamless interaction technically, the thresholds such as on-chain wallets, gas fee concepts, and authorization mechanisms still exist. Especially among non-crypto native user groups, there is a general lack of basic understanding of mechanisms such as wallet as account and smart contract automatic expenditure. Once an error occurs (such as AI erroneous payment, asset loss), the mechanisms such as responsibility attribution, asset recovery, and user compensation are not yet mature, which can easily undermine user trust. This problem is particularly prominent in retail, e-commerce, and financial scenarios. If the platform wants to truly penetrate the mainstream market, it must achieve user-imperceptible experience translation in the underlying design.

Despite numerous challenges, the smart payment economy represented by AI + Crypto payments is gradually showing a clear development trajectory and change trend.

First, the trend will accelerate towards lightweight and scenario-based. The main battlefield of AI+Crypto payment in the future may not be large-scale asset liquidation, but focus on small-amount, high-frequency segmented scenarios: such as in-game prop purchases, retail membership discounts, content rewards, AI service subscriptions and other micro-transaction economies. In these scenarios, AI can exert stronger strategic adaptation and user understanding capabilities, and the borderless nature of encrypted payments can also break through the limitations of the fragmentation of the original payment system. The rapid verification of the Boba Guys model means that spaces such as convenience stores, gyms, and the sharing economy may become technology test fields, pushing encrypted payments from on the chain to street corners.

Second, the underlying infrastructure will tend to be modular and standardized. Currently, various AI payment projects are still mostly independent systems and customized API architectures, with high development barriers and low reuse efficiency, which hinders the expansion of the ecosystem. In the next few years, projects such as MoonPay, Crossmint, and AEON are expected to promote the development of unified SDKs, payment standard interfaces, and identity/wallet abstract protocols, allowing developers to access smart payment capabilities like calling Stripe or Firebase. This trend will greatly enhance cross-platform interoperability and promote the formation of a common technology stack of payment-agent-data-identity in the ecosystem.

Third, AI will be upgraded from a payment executor to an active builder of compliance guardrails. Under the simultaneous evolution of regulatory pressure and technical capabilities, AI itself will also be given the role of compliance intelligence, such as: automatic identification of illegal instructions, detection of money laundering paths, blacklist identification, intelligent tax generation, etc. This means that the payment process in the future will not only be a value transfer, but will also have compliance, risk control, identity verification and other functions, becoming a component of a multi-level trusted payment infrastructure. This is also expected to ease regulators concerns about the risk of AI agents out of control and promote the gradual inclusion of smart payments under the compliance framework.

Ultimately, the roadmap towards the smart payment economy is not a linear path, but more like a multi-dimensional network that unfolds layer by layer: starting from small scenarios, aggregating to ecological standards, and then gradually incorporating into the regulatory system, driven by user experience, supported by developer tools, and centered on technical collaboration. Only in this way can the integration of AI and encrypted payment no longer be an imagination in the laboratory, but a key engine to promote the implementation of the value Internet in the real world.

V. Conclusion: Reconstructing Payment Sovereignty in the Era of Intelligent Agents

AI is rapidly becoming the most powerful collaborative interface between people and systems, and crypto payments play the role of value transmission and responsibility execution in this collaborative relationship. When the two are coupled, an unprecedented digital economic paradigm is taking shape - payment is no longer a static action, but a dynamic intelligent behavior, no longer initiated directly by people, but automatically completed by trusted agents after understanding the context and intention. From AI generating payment intentions, calling on-chain assets, selecting the optimal execution path, achieving cross-chain settlement, and then feedback on behavioral results, the completion of this closed loop marks a fundamental migration of the payment paradigm: from manual user operation to machine trusted agents; from platform monopoly of execution rights to user sovereign agency systems.

In this trend, the traditional payment system is built on centralized identity, account system and settlement network. The users payment rights are essentially rights of use granted by the platform, not sovereignty. You can use an account, but you cannot define account rules; you can initiate transactions, but payment routing, priority, and fee structure are all controlled by banks or platforms. The rise of AI+Crypto payment systems is breaking this limitation: users can host agents, authorize them to manage assets and initiate transactions on their behalf, and make each call verifiable, traceable and revocable through blockchain, truly taking back payment sovereignty from the platform to the user.

This reconstruction of payment sovereignty is not achieved overnight. It requires the support of a series of infrastructure and cognitive systems: such as account abstraction, compliance programmability, AI permission system, automated wallet, micropayment network and cross-chain settlement protocol. From Crossmint to AEON, from Gaia to MoonPay, from Boba Guys loyalty AI to the language agent that automatically executes ticket payments, these practices are not isolated innovation cases, but organic nodes that form the embryo of a new financial system. Together, they point to a longer-term possibility: in the near future, payment will no longer be an act, but a right; no longer a platform function, but a protocol consensus.

Just as data sovereignty was once a sign of awakening for Web2 users, payment sovereignty may become the starting point for Web3 to truly enter the social fabric and economic daily life. In this new order, users have agents, agents have logic, logic follows code, code is written on the chain, and the chain returns value. Payment is no longer just paying the bill, but a core interface that connects user intentions, intelligent reactions and economic incentives.

This is a profound structural paradigm shift. It will not only liberate users right to use, but also redefine the boundaries of the platform, the flow logic of assets, and the distribution of trust in business relationships. AI makes payments thinking, and Crypto makes payments free. The combination of the two is a reshaping of contemporary financial technology and a return of payment sovereignty.

In this era of intelligent agents, whoever has the right to define payment holds the key to the next generation of digital economy.