Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

After disrupting the food delivery industry, JD.com is accelerating its pace into the payment field.

On June 17, Liu Qiangdong, chairman of the board of directors of JD.com Group, said , JD.com hopes to apply for stablecoin licenses in all major currency countries in the world, and then use the stablecoin license to realize exchange between global companies, reducing the cost of global cross-border payments by 90% and increasing the efficiency to within 10 seconds. Liu Qiangdong said, Now it takes an average of 2 to 4 days for companies to remit money, and the cost is also quite high. After the B-end payment is completed, we will penetrate into the C-end payment. I hope that one day everyone can use JD.com stablecoin to pay when consuming around the world .

Liu Qiangdongs speech revealed JD.coms ambition to develop stablecoins in cross-border payment business. For most domestic Web2 giants, although they have some layout in Web3-related businesses such as blockchain, most of them are strategic experiments or overseas incubations and belong to marginal businesses. In contrast, JD.com is leading in the exploration of blockchain and stablecoins.

As early as July 2024, JD.coms subsidiary JD CoinChain Technology (Hong Kong) was shortlisted as a participant in the Hong Kong Stablecoin Issuer Sandbox. And it has integrated stablecoins into the groups strategic development blueprint.

Yesterday, a few hours before the June 18 exam, Liu Qiangdong shared with the media in Building 1 of JD.com’s headquarters in Yizhuang , Beijing. We will release several new projects including the stablecoins that have already been issued. JD.com does not plan to come up with a completely new business model, but will deepen and strengthen the existing seven or eight business models centered around the supply chain, as well as internationalize its business. The above is roughly our strategy. This shows how much importance JD.com attaches to the stablecoin business.

Missing the opportunity to become a payment giant - Liu Qiangdongs biggest mistake

Why does Liu Qiangdong attach so much importance to the stablecoin business? In addition to the advantages of stablecoins in cross-border payments such as instant settlement and reduced remittance costs, it may also be because Liu Qiangdong wants to make up for the mistakes he made in the payment field.

In the early years, Liu Qiangdong publicly stated, The biggest mistake I made was not to develop my own payment business after receiving investment. We have always believed that payment is not of much value, but with the popularity of fast payment in recent years, if we want to expand the customer base of financial products, we still need to develop payment first.

Judging from the results, this is indeed a decision that Liu Qiangdong will regret. Data shows that in 2024, the transaction volume of Chinas third-party Internet payment market will be about 33.9 trillion yuan. In terms of market share, UnionPay Business ranks first with 26.63%, followed by Alipay with 20.70%, WeChat Pay ranks third with 18.31%, and JD Pay only accounts for 1-3% of the market share. In the field of C-end mobile payment, Alipay and WeChat Pay have formed a duopoly situation, with a combined market share of more than 90%. It is no longer realistic for JD to grab domestic payment business.

But in the field of cross-border payments, Liu Qiangdong may have a chance to grab market share through stablecoins. At present, cross-border digital RMB and third-party cross-border payment systems are in the development stage, but Chinas cross-border payments are still dominated by the banking system (CIPS). In 2024, CIPS processed a total of 8.2169 million transactions with a total amount of RMB 175.49 trillion; in the same year, although the cross-border digital RMB pilot covered 129 countries and regions, the annual service scale was RMB 7.5 trillion; third-party cross-border payment systems such as Alipay and WeChat Pay Cross-border, the cross-border e-commerce payment and B2B foreign trade payment market size in 2024 totaled RMB 1.534 trillion.

Although the traditional Internet third-party cross-border payment system has obvious advantages over the banking system in terms of fees, speed and user experience, the clearing system behind it still relies on the banking network. There are also problems such as difficulty in applying for licenses, inability to handle large-scale settlements, and insufficient fund security. Therefore, the business is often limited to small and medium-sized e-commerce scenarios and cannot compete with the banking system.

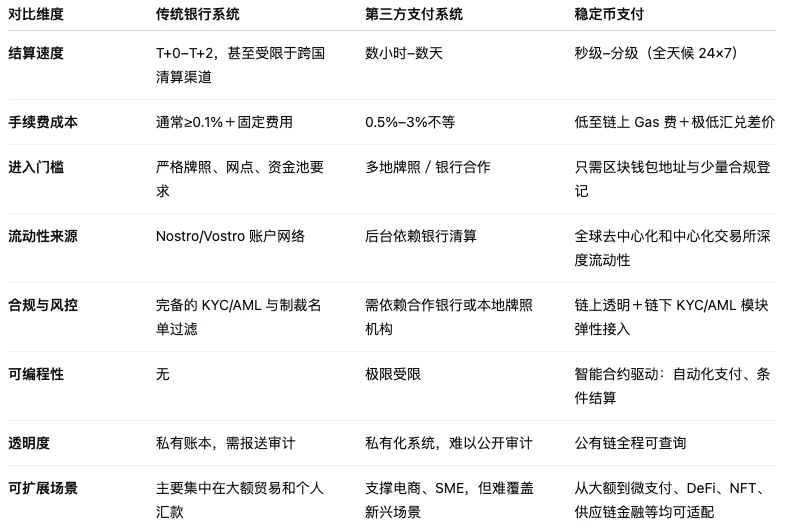

Stablecoins can better avoid the problems faced by third-party cross-border payment systems in cross-border payment scenarios. On the one hand, although stablecoins are anchored to fiat currencies, they do not rely on banking system settlement, but are settled in real time through blockchain networks. On the other hand, in theory, as long as stablecoins obtain local regulatory approval, they can circulate globally, and global supervision currently also has a trend of embracing stablecoins, further reducing the difficulty of compliance.

The advantages of stablecoins over traditional banks and third-party payments in cross-border payments

A true entrepreneur must be good at learning from past mistakes: When third-party Internet payments emerged in 2007-2008, Liu Qiangdong failed to accurately judge the situation and missed the golden period of expanding domestic payment business; now, the US market and regulatory recognition of stablecoins have also accelerated the attention of companies and regulators in various countries to stablecoins. Stablecoins will re-change the cross-border payment landscape, and JD.com finally did not miss it this time.

Stablecoins have become an important part of JD.coms international business

JD.coms exploration of blockchain began as early as 2016, and later launched the alliance chain Zhizhen Chain, the blockchain anti-counterfeiting and traceability platform and the NFT platform Lingxi. However, compared with JD.coms main business, these are all fringe businesses of an exploratory and experimental nature and have not been integrated into the collective strategy.

In July 2024, JD Technology Groups subsidiary JD CoinChain Technology (Hong Kong) appeared on the list of participants in the Hong Kong stablecoin issuer sandbox and announced that it would issue a stablecoin in Hong Kong pegged 1:1 to the Hong Kong dollar. JDs stablecoin journey officially began.

After a year of exploration, in May 2025, Liu Peng, CEO of JD CoinChain Technology , announced the progress of JD Stablecoin . The first phase of JD Stablecoin is tentatively scheduled to issue stablecoins anchored to Hong Kong dollars and US dollars . The test scenarios mainly include cross-border payments, investment transactions, retail payments, etc.

It was not until June 17 that Liu Qiangdong mentioned stablecoins in JD.com’s future strategy that the main line of the stablecoin business and its position in JD.com’s strategy became clear. “ The most important thing in the future is internationalization ,” Liu Qiangdong said when talking about the company’s strategy to reporters. “JD.com’s international business does not follow the cross-border e-commerce model. My international business strategy is local e-commerce, local infrastructure, local employees, local procurement, local delivery, and only selling branded products.”

On June 18, Liu Peng, CEO of JD CoinChain Technology, said , JD Hong Kong and Macau self-operated e-commerce will soon support stablecoin shopping. JD CoinChain plans to obtain a license in early Q4 2025 and launch stablecoins anchored to the Hong Kong dollar and other currencies at the same time.

Perhaps this is also the reason why Liu Qiangdong wants to apply for stablecoin licenses in all major currency countries around the world, and use stablecoins to settle international business. This can not only avoid multiple legal currency exchanges and exchange rate fluctuations in different countries, but also facilitate JD.com to build a unified global settlement network.

Unfortunately, JD.com has not had anything new in the past five years. Honestly, the past five years can be described as the five years of loss and decline for JD.com. I can say this without mercy. These are the five years in my entrepreneurial history in which there has been no growth, no progress, no innovation, the least distinctive features, and the least contribution of value, Liu Qiangdong said with a hint of regret.

Strategic moves such as aggressively entering the food delivery industry, stablecoins, and internationalization may be Liu Qiangdongs reflection on the business in the past five years. What JD.com can deliver in the next five years will not only stir up the landscape of Chinas Internet and finance.

Related Reading

Dollar Hegemony 2.0: How does the GENIUS Act reshape the global landscape of stablecoins?