TL,DR

Macro data show that although there are signs of easing inflation in the United States, it is still higher than the Feds target. The labor market is generally stable, and consumer spending has slowed down due to high interest rates. The Fed has kept interest rates unchanged and is cautious about cutting interest rates. At the same time, geopolitical conflicts in the Middle East have exacerbated market volatility. Although the resumption of economic and trade dialogues between China and the United States has brought a short-term boost, the global economic outlook is under pressure. The future market trend will be affected by the expectation of interest rate cuts and changes in the international situation.

The overall trading volume of the crypto market is active but the momentum is weakening. Affected by geopolitical risks, funds tend to be cautious; the market value fell by 4.03% month-on-month, and the focus of funds has clearly returned to BTC, while ETH and stablecoins have performed steadily. Newly launched tokens are mostly concentrated in the DeFi and Layer 1 tracks, VC-supported projects are still dominant, and hot spots are still driven by emotions.

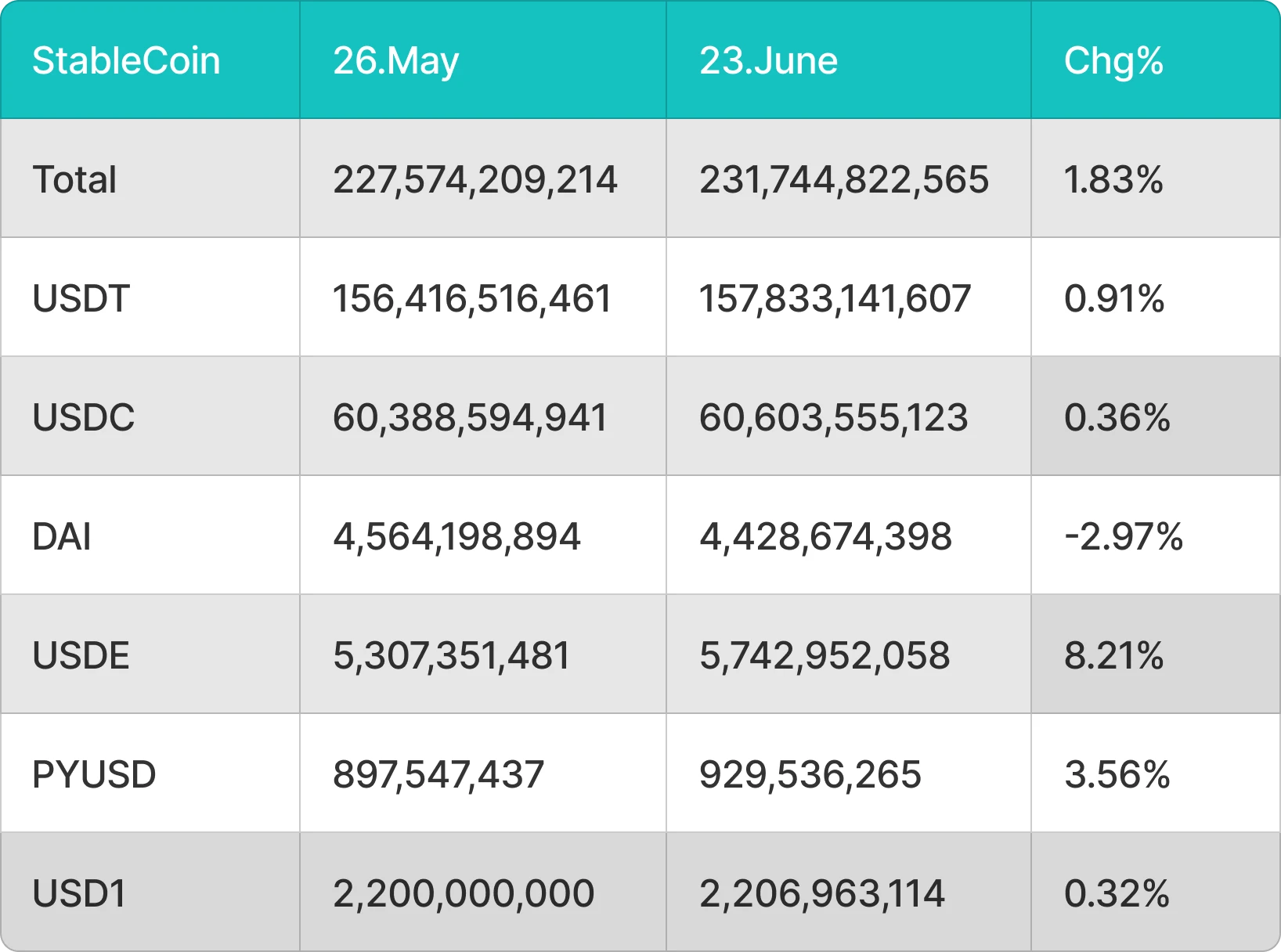

Although geopolitical risks and the hawkish stance of the Federal Reserve put pressure on market sentiment, and the prices of Bitcoin and Ethereum both fell, Bitcoin spot ETFs still had a net inflow of $1.13 billion, while Ethereums spot ETFs had a net outflow of about $80 million due to a larger price drop, reflecting the rise in short-term risk aversion. At the same time, driven by stablecoin legislation and Circles listing, the stablecoin market continued to expand, with the overall circulation increasing by about $4.17 billion in June.

On June 22, after Trump announced a ceasefire between Israel and Iran, Bitcoin rebounded strongly and broke through $108,000. The continuous net inflow of ETFs reflected the bullish sentiment of institutions. The technical side showed that the bulls regained control of the rhythm and may challenge the historical high of $111,980 in the short term. Ethereum and Solana also rebounded simultaneously. If they break through the key moving average resistance in the future, they are expected to open up further room for growth. On the contrary, if they are blocked and fall, they may return to the shock adjustment pattern.

Circle was successfully listed and benefited from the passage of the GENIUS Act, driving the stablecoin sector to strengthen, but its valuation is highly dependent on interest rate spread income, and its subsequent sustainability remains to be seen. Virtual became popular in the Base ecosystem with its innovative new issuance mechanism, and early users made significant profits, but the popularity subsided after the green lock mechanism restricted liquidity, and the token price fell by more than 30% from its high point.

The auction of Pumpfuns token, which is valued at $4 billion, has been postponed again. Coupled with the platforms trust crisis and ecological doubts, the market is still divided on whether it can bring about a structural breakthrough. Coinbase promotes the integration of Base chain and main applications, and JPMorgan Chase pilots the deposit token JPMD, marking the acceleration of the layout of the on-chain dollar and compliant stablecoin track by traditional institutions and centralized platforms.

1. Macro perspective

1. Inflation trend

The CPI data for June 2025 showed that inflation growth slowed to 3.3%, unchanged from the previous month, and the core CPI increased by 3.4% year-on-year, up 0.2% from the previous month. Although inflationary pressures have eased, the Fed still believes that the current inflation level is high and far from the 2% target. As economic data accumulates further, the Fed remains cautious, emphasizing that more positive data is needed to support the decision to cut interest rates.

2. Labor Market

The US labor market maintained a relatively solid performance, with the unemployment rate slightly raised to 4.5%, slightly higher than the previous expectation of 4.4%. Although the unemployment rate has risen, it is still at a relatively low level, reflecting the stability of the labor market. Retail sales fell by 0.9% month-on-month, the largest drop in four months. In particular, under high interest rates and potential inflationary pressures, consumer spending has been significantly suppressed, especially the consumption of durable goods and high-priced goods.

3. Monetary policy dynamics

The Fed kept the federal funds rate unchanged at 4.25%-4.5% in its June meeting, the fourth time in a row that the rate has remained unchanged. Although the Fed expects two rate cuts before the end of 2025, it remains highly vigilant about inflation risks. The dot plot shows that there is still an expectation of a rate cut in the second quarter of 2025, but the differences on the future monetary policy path are gradually increasing, reflecting different views on the timing of rate cuts within the Fed.

4. Trade policy and global economic outlook

In June, the global market was affected by the escalation of geopolitical risks in the Middle East and the hawkish stance of the Federal Reserve, and the market risk appetite declined significantly. Israels air strikes on Iran caused market panic, and the US stock market was under pressure in the short term. At the same time, the news that the United States and China resumed economic and trade negotiations in London once boosted market risk sentiment, but the escalation of geopolitical conflicts quickly broke the calm of the market. As the global economic outlook came under pressure, investors risk appetite generally declined.

5. Summary

Macroeconomic data in June showed that the US economy is still facing great inflationary pressure. Although some inflation indicators have slowed down, the overall economic growth rate is expected to be lowered, and the Federal Reserve is cautious about cutting interest rates. The geopolitical conflicts in the Middle East have had a great impact on market sentiment, and market volatility has intensified in the short term. However, with the easing of the international situation and the increase in expectations of the Federal Reserves interest rate cuts, market sentiment has warmed up. It is expected that in the next few months, the Federal Reserve may start a cycle of interest rate cuts with the support of data, but it is also necessary to be vigilant against the continued impact of geopolitical uncertainties on the market.

2. Crypto Market Overview

Currency data analysis

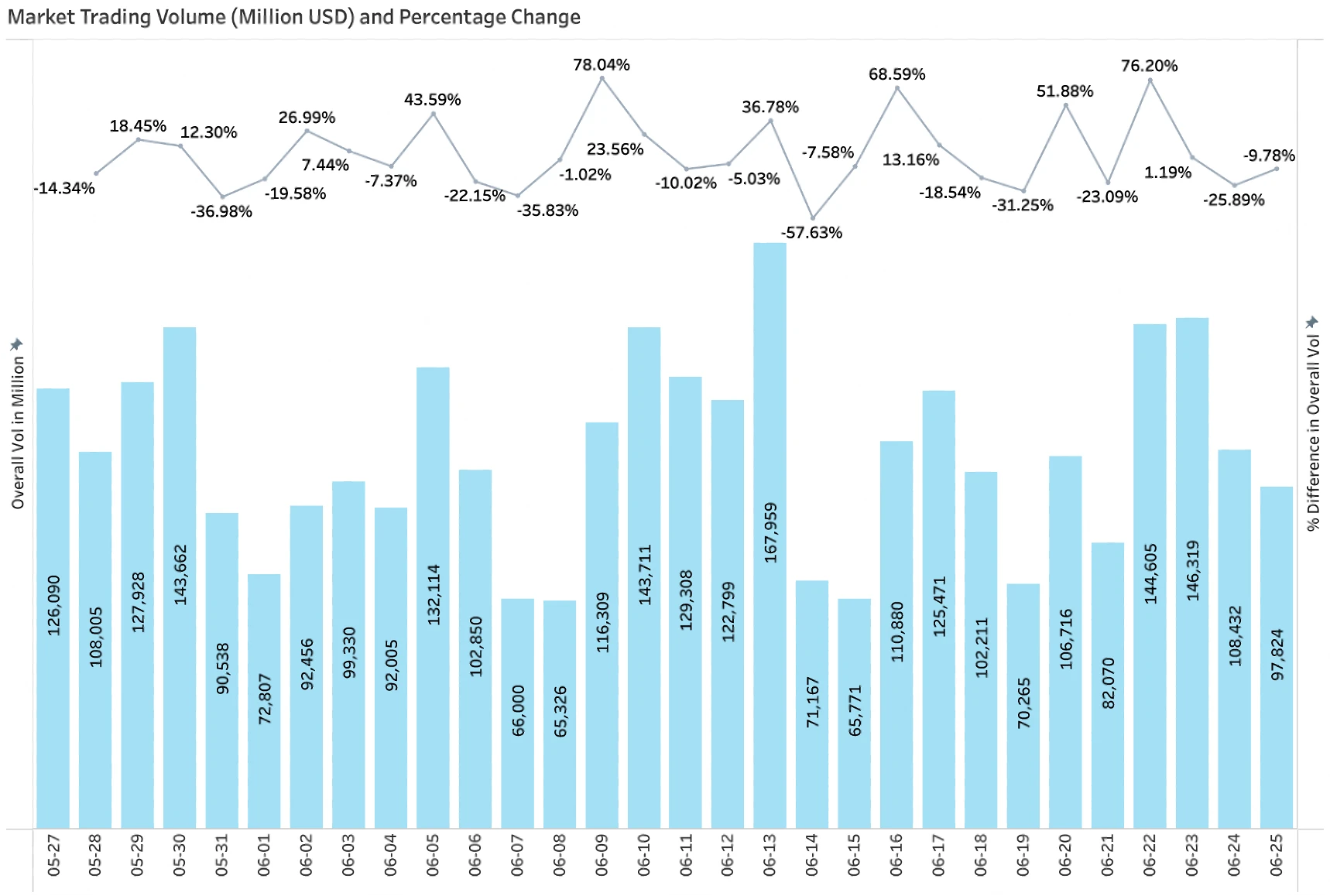

Trading volume daily growth rate

According to CoinGecko data, as of June 25, the average daily trading volume of the crypto market was about $107.7 billion, down 6.6% from the previous cycle. During this period, the trading volume showed a high-fall trend many times, with a single-day increase or decrease of more than 10%. The peak trading volume was recorded on June 13, reaching $167.9 billion, and there were also many sharp corrections. Overall, although the market remains active, the momentum of funds has weakened compared with the previous period. Affected by uncertain factors such as the Middle East geopolitical conflict, market funds tended to be cautious in late June, and risk appetite declined.

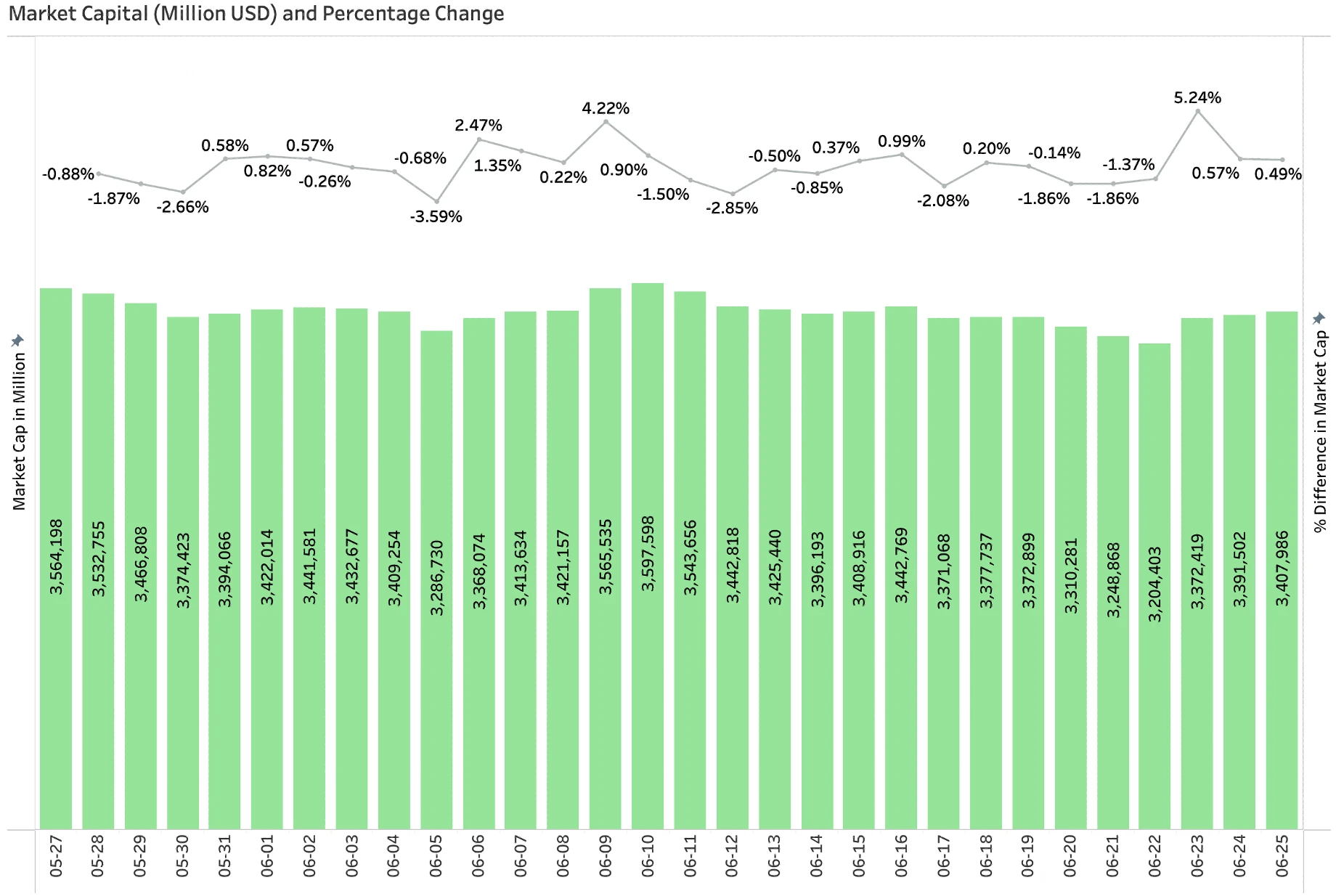

Total market value daily growth

According to CoinGecko data, as of June 25, the total market value of cryptocurrencies fell to $3.40 trillion, down 4.03% from the previous month. Among them, BTCs market share rose to 64.8%, ETHs market share was 9.0%, and the market focus clearly returned to BTC. In terms of overall structure, BTC still holds a dominant position, ETH and stablecoins perform relatively steadily, and short-term hot sectors mostly rely on emotional speculation, lack of sustained support, and it is difficult to form long-term incremental momentum.

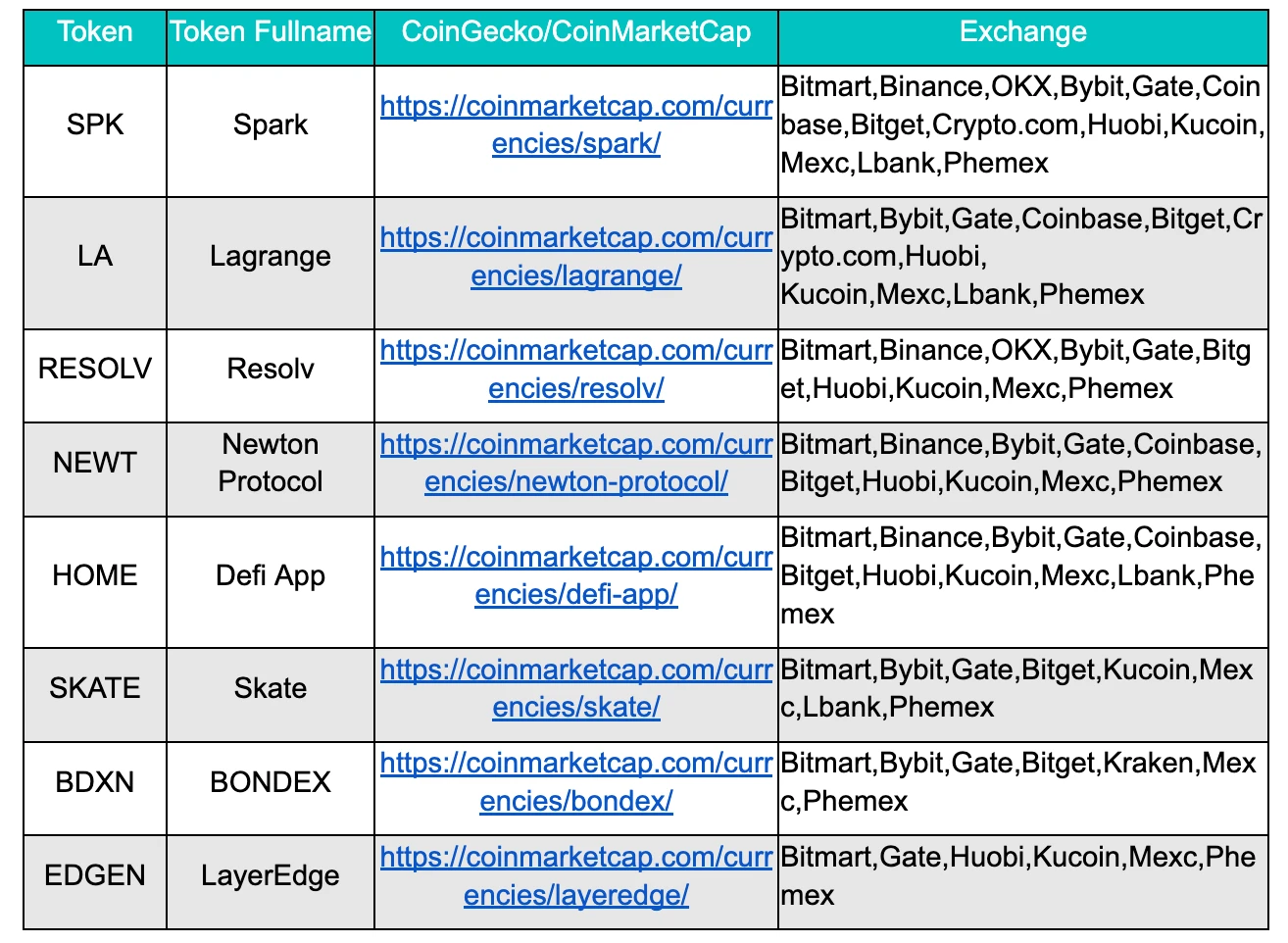

New popular tokens in June

Among the popular tokens newly launched in June, VC-backed projects still dominate based on the Binance Alpha listing route, and popular tracks focus on DeFi and Layer 1. Among them, DeFi projects such as SPK, RESOLV, and HOME have received widespread attention from the market.

3. On-chain data analysis

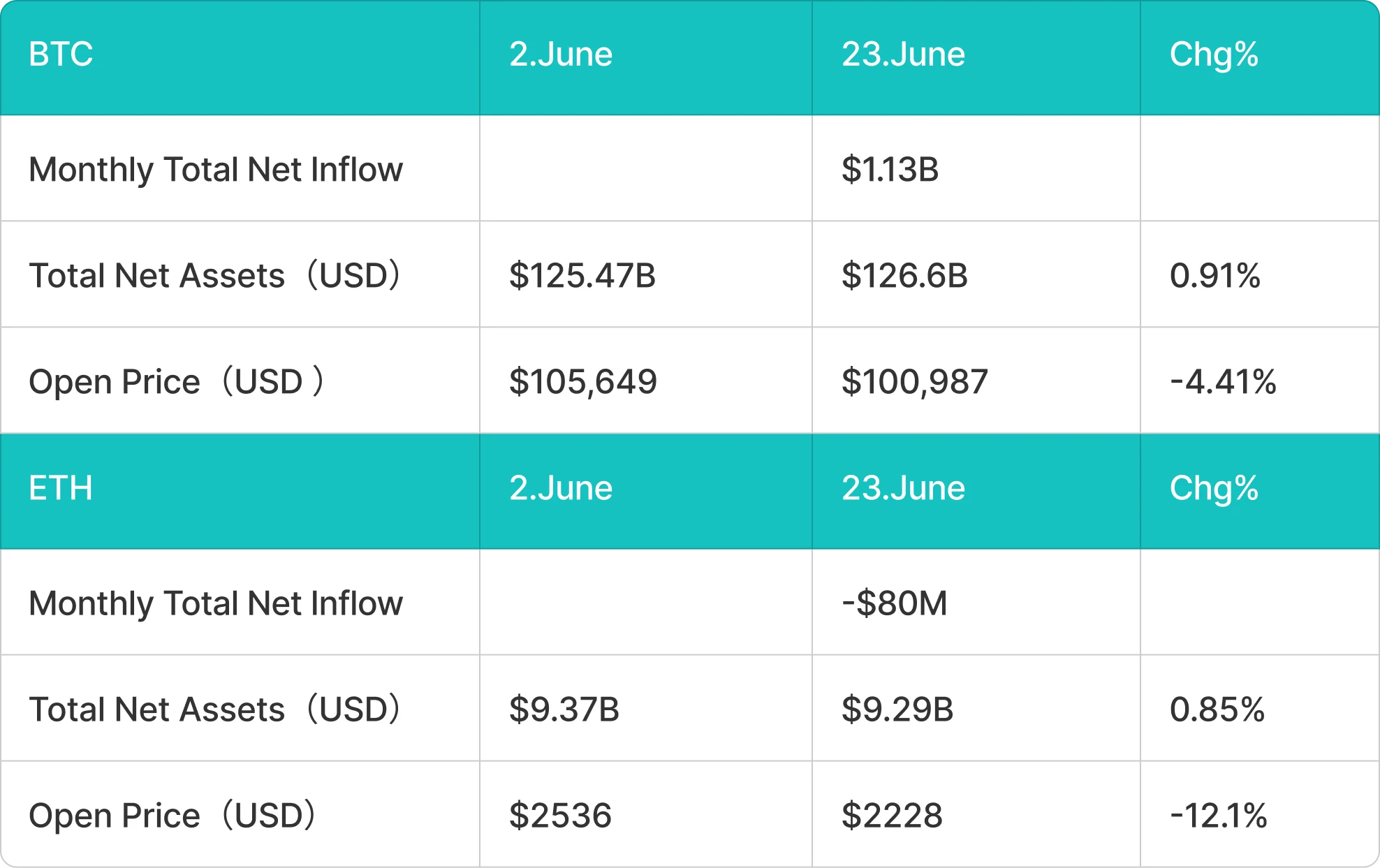

3.1 Analysis of BTC and ETH ETF inflows and outflows

BTC ETFs received $1.13 billion in inflows in June

In June, the escalation of geopolitical risks in the Middle East and the impact of the Federal Reserves hawkish stance led to a decline in market risk appetite, pressure on Bitcoin market sentiment, and a volatile downward trend in prices. The price of Bitcoin fell from $105,649 to $100,987, a drop of about 4.41%. Although the subsequent temporary ceasefire between Iran and Israel led to a price correction, the market is still under the influence of war risks. Bitcoin spot ETF funds still maintain a net inflow trend, reflecting the confidence of traditional investors in long-term value, with a cumulative net inflow of about US$1.13 billion in June.

ETH ETF outflows $80 million in June

As for Ethereum, the price drop was more significant after the war. The price of ETH fell from $2,536 at the beginning of the month to $2,228, a drop of 12.1%. Correspondingly, there was a net outflow of funds from Ethereum spot ETFs, indicating that the risk aversion of short-term funds has increased, with a cumulative net outflow of about $80 million in June.

3.2 Analysis of Stablecoin Inflow and Outflow

Stablecoin inflows in June were around $100 million, mainly from USDT and USDC

In June, with the positive news of the Stablecoin Act and Circles listing on the US stock market, the stablecoin market continued its strong growth momentum. Among them, USDT, USDE, and USDC became the main drivers of growth this month, and the total circulation of stablecoins increased by about US$4.17 billion.

4. Price Analysis of Mainstream Currencies

4.1 Analysis of BTC price changes

Bitcoins rally on June 22 was triggered by the news that US President Donald Trump announced a comprehensive ceasefire between Israel and Iran, and the price quickly broke through $108,000, showing continued strong long buying. Despite the recent increase in geopolitical risks, US spot Bitcoin ETFs have recorded net inflows for 11 consecutive days, indicating that institutional investor sentiment remains positive.

Bitcoin is currently expected to challenge its all-time high of $111,980. However, in the absence of new catalysts, the price may continue to consolidate in the range.

On June 22, Bitcoin rebounded strongly from $100,000 and broke through all major moving averages, indicating strong buying power at low levels. The 20-day exponential moving average (EMA) has now started to rise, and the RSI indicator has also entered the positive zone, both suggesting that bulls are back in control of the market rhythm.

In the short term, the bears are likely to defend the downtrend line at $111,980. If the price finds resistance here but finds support near the 20-day EMA, it will suggest that the bulls are buying on dips ahead of another breakout attempt. Otherwise, if the price breaks below the moving average support, the BTC/USDT pair is likely to continue trading between $98,200 and $111,980.

4.2 Analysis of ETH price changes

Ethereum rebounded from $2,111 on June 22 and hit the 20-day EMA ($2,473) on June 24. Currently, the 20-day EMA is flattening and the RSI is also close to the mid-axis position, indicating that the markets long and short forces are temporarily in balance.

If the ETH price breaks through the moving averages, it may open up room for growth, with the target looking at the two resistance levels of $2,738 and $2,879. On the contrary, if the price is blocked near the 20-day EMA and falls below $2,323, it means that the bears continue to exert pressure during the rebound, and the ETH/USDT pair may once again test the key support of $2,111.

4.3 Analysis of SOL price changes

Solana rebounded from $126 on June 22 and broke above the critical decline level of $140 on June 24. The current up move was blocked near the 20-day EMA ($147), but the positive sign is that the bulls have managed to defend the $140 mark.

If the correction is limited, the market is expected to try to break through the 20-day EMA. Once it holds, the SOL/USDT pair may further test the 50-day simple moving average (SMA) level of $160.

If the bears succeed in sinking the price back below $140, it could trigger a correction with support towards $123 or even $110.

5. Hot events of this month

1. Circles listing triggered a wave of stablecoin concepts

Circle Internet Group, the parent company of stablecoin issuer Circle, was successfully listed on the New York Stock Exchange on June 5. Its stock price rose from the opening price of $31 to the highest point of $298, a surge of 861%, with a market value of about $76 billion. Subsequently, because Cathie Woods ARK Fund quickly sold about 1.5 million shares after the IPO and cashed out more than $330 million, its price fell to $198 as of June 26, with a market value of about $50.6 billion.

At its peak, Circles market value exceeded the actual circulating market value of USDC. Its revenue mainly comes from USDC reserve interest. By the end of 2024, it has generated a total revenue of US$1.6 billion, of which Coinbase received more than half, becoming Circles largest source of distribution costs. Although the cooperation between the two parties is crucial to expanding the ecological coverage of USDC, the current income structure also exposes the risk of Circles over-reliance on interest rate spread income. If interest rates fall in the future, profitability will be squeezed. However, this IPO coincided with the passage of the GENIUS Act by the U.S. Senate, which strengthened policy support for compliant stablecoins and became a catalyst for market speculation on the theme of digital dollar. Overall, Circles listing has become an important node for the compliance of the stablecoin industry. The market has given it a premium for being the leader in digital dollars, but whether its long-term valuation can stand firm still depends on its ability to break through its dependence on reserve income and build a sustainable multi-income model.

2. The GENIUS Act was passed and is awaiting the president’s signature

In June 2025, the U.S. Senate passed the GENIUS Stablecoin Act with an overwhelming majority (68:30), marking a historic step forward in the field of cryptocurrency regulation in the United States. The bill imposes strict compliance requirements on stablecoin issuers: including 1:1 U.S. dollar or short-term U.S. Treasury bond reserves, monthly audits, prohibition of interest-bearing stablecoins, and only allowing bank subsidiaries, federal or specific state-level authorized entities to issue. The bill clearly includes stablecoins in the regulatory scope of the Bank Secrecy Act, establishes the legal status of digital currency for them, and is regarded as an important milestone in promoting the mainstreaming of digital assets. Local platforms such as Circle and Coinbase have become direct beneficiaries. Circles market value soared 35% after the bill was passed, while Tether faces multiple compliance challenges such as audit qualifications and reserve structure.

Although the bill has yet to be voted on by the House of Representatives and signed by the President, Trump has publicly endorsed it on social media, calling it the foundational project for the digital dollar. Overall, the passage of the GENIUS Act is not only a strategic move by the United States to compete for the dominance of digital currency, but it may also become a weathervane for the global stablecoin regulatory paradigm. The stablecoin market is expected to usher in explosive growth, and the U.S. financial system is also accelerating towards a new era of greater digitalization and globalization.

3.Virtual: pumpfun+Bn Alpha new issuance mechanism ignites market enthusiasm

This month, Virtual is undoubtedly one of the most popular projects in the market. With its innovative new issuance mechanism, it quickly attracted a large amount of funds and user participation, becoming the core representative of the current Base ecosystem new issuance narrative. The price of VIRTUAL has risen from $0.5 in mid-April to a high of $2.5 in early June, an increase of 400%. The core advantages of Virtuals new issuance are:

Extremely low financing price: Each new project raises funds at a market value of 42,425 virtuals (US$224,000), so users can participate in financing at an extremely low price, and the potential profit margin after the project is launched is huge.

Token linear unlocking: Unlike MEME on PumpFun, Virtuals new projects are not fully unlocked after the opening, but are unlocked in batches with a transparent token economic model like VC coins. In addition, in order to prevent the project party from dumping the market, the raised funds are not directly handed over to the project party, but are all injected into the initial liquidity pool.

Low risk of new projects: If the user participates in a new project and fails to raise funds successfully, the full amount will be returned to the user. In addition, Virtual only releases a few new projects a day, so the quality is generally higher than MEME, and the risk of user participation is very low.

Reduce the probability of project parties Rug: Virtual sets a 1% handling fee, of which 70% is returned to the project party. This incentive model motivates the project party to increase trading activity rather than short-term cashing out, forming a virtuous ecological closed loop.

However, as the popularity of the platform increased, early users frequently obtained short-term high returns through the strategy of selling new projects as soon as they were launched, causing huge selling pressure on new projects and undermining the stability of the overall ecosystem. To this end, Virtual launched the Green Lock Mechanism in mid-June, setting a mandatory lock-up period for new users, during which they were not allowed to sell the tokens they received. If they violated the rules, their points accumulation would be suspended. Although this mechanism helps to curb early selling and extend the life cycle of the project, it also significantly changes the original speculative logic. Users profit cycle is forced to lengthen, capital efficiency decreases, and market enthusiasm has experienced a phased ebb. Virtuals price entered a downward channel in mid-June, falling from its high to $1.69, a drop of more than 37%.

6. Outlook for next month

1. Pumpfun: Token auction with a valuation of $4 billion postponed again

The Pumpfun token auction, originally scheduled for the end of June, has been postponed again and is now expected to be held in mid-July. This is the first time the token issuance has been postponed since it was first proposed at the end of last year. It is reported that Pumpfun plans to raise $1 billion at a valuation of $4 billion (FDV) and plans to airdrop 10% of the tokens for community incentives.

Since its launch, Pumpfun has achieved a revenue of about $700 million by relying on low fees and the bonding curve mechanism, becoming one of the most profitable projects on the Solana chain. However, its ecosystem is facing multiple trust challenges such as the proliferation of robot transactions, stagnant product innovation, and unclear use of funds. In mid-June, the platform and the founders social account were banned on the X platform, which triggered the spread of false news such as regulatory intervention and founders arrest, further amplifying market concerns. Whether this round of high-valuation financing can bring a structural breakthrough to the Solana ecosystem or become another capital harvest, there is still controversy in the market.

2. Coinbase promotes Base chain integration, JPMorgan Chase pilots deposit tokens

Coinbase is currently promoting the deep integration of the Base chain into its main application. It has launched the Coinbase Verified Pools feature. KYC users can directly use the Coinbase account balance to interact with the DApp on Base without the cumbersome wallet switching and on-chain transfer process. It has announced Uniswap and Aerodrome as its DEX platform for on-chain transactions. Although this function is still in its early stages, this direction is highly consistent with the current trend of many centralized trading platforms to promote the integration of on-chain and off-chain. For example, Binance enables exchange users to directly purchase on-chain tokens through the Alpha system; Bybit launched Byreal to provide its exchange users with the DeFi function of trading popular on-chain tokens and Solana assets. At present, the one-stop trading experience of centralized exchanges and on-chain transactions has become an important direction for platform evolution.

At the same time, JPMorgan Chase launched a pilot deposit token JPMD on the Base chain. As a compliant digital dollar tool for institutions, it is supported by bank deposits and is limited to use by permission. From an industry perspective, the combination of Coinbase and Base strengthens its compliant chain positioning and entry-level advantages. If the application-level integration is achieved in the future, it may significantly expand the active user group on the chain; and JPMorgan Chases pilot reflects the positive impact of the passage of the GENIUS Stablecoin Act. Traditional institutions have begun to vigorously deploy the on-chain dollar track, which may inject new variables into the competitive landscape of compliant stablecoins under the current trend of gradually loosening policies. Both can be regarded as important signals under the trend of centralized institutions and on-chain ecology, and it is worth paying attention to the subsequent large-scale landing rhythm and policy interaction effects.