Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

On July 1, Sunil, the representative of FTX creditors, issued a statement updating the creditor compensation situation:

On February 18, 2025, the compensation ratio for users with an amount less than US$50,000 will be 120%;

On May 30, 2025, users with a balance of more than $50,000 will receive 72.5% of the compensation, and users with a balance of less than $50,000 will receive 120% of the compensation;

Future compensation payments are expected to be made in October and December 2026, and 2027;

Users with an amount exceeding $50,000 and who have received 72.5% compensation will subsequently receive 27.5% of the par value, which means 100% compensation. (Note: Depending on the compensation situation, the interest rate for FTX creditors after applying for compensation is approximately 40-80%.)

Just when the creditors were planning to wait patiently for their compensation, FTX’s debt claims encountered problems again.

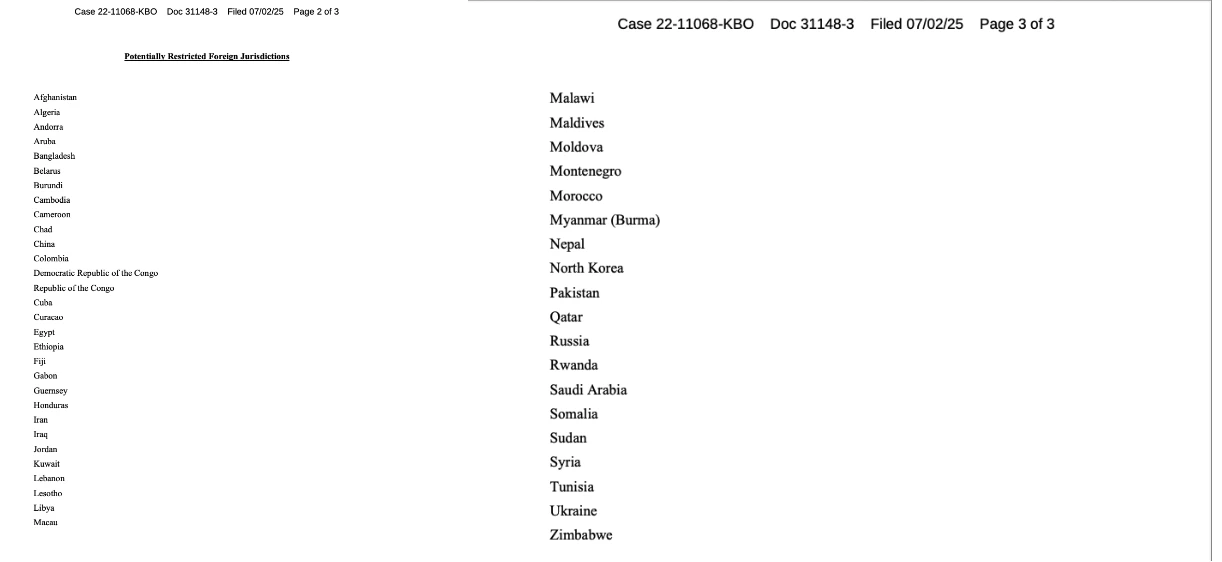

On July 4, Sunil, a representative of FTX creditors, posted on the X platform that creditors in 49 jurisdictions, including China, may lose their right to claim. The claim funds of creditors in these regions account for 5% of the total funds, worth about US$825 million (based on the total compensation assets of US$16.5 billion), of which 82% belong to Chinese creditors, and the claim assets are worth about US$676.5 million.

List of jurisdictions where claims may not be available

At the same time, Sunil said that FTX will seek legal advice to distribute to restricted foreign jurisdictions. However, if it is determined that the user belongs to a restricted foreign jurisdiction, the claim will be disputed and the user will have 45 days to raise an objection, but if the issue is not resolved, the user will completely lose the right to distribute , and his share of the compensation will be confiscated and returned to the FTX liquidation trust for distribution to legitimate creditors in other countries and regions.

In fact, when FTX officially began to compensate users with amounts less than US$50,000 on February 18, it meant that five regions, namely China, Russia, Egypt, Nigeria, and Ukraine, were temporarily unable to participate in the claims distribution. Among them, China has the largest number of users, accounting for 8% of the total number of FTX users.

At that time, the victimized users might think that the limitation of claims by judicial regions was only temporary and that FTX would be able to propose a solution in the future. However, the news announced today expanded the areas where claims were restricted, and the wording almost sentenced creditors in restricted areas to death for their right to claim .

The anger of the victimized users can no longer be suppressed for FTXs actions. User @zhetengji said that he has contacted a lawyer in New York and called on more people to take action:

I will definitely take action and raise objections at every stage. I also hope that more people will come forward. We cant just sit and wait - that is absolutely unreasonable. Although mainland China does not support cryptocurrency trading, mainland Chinese residents are allowed to hold cryptocurrencies. The law recognizes the commodity attributes of virtual currencies. The claims process is settled in US dollars. Although foreign exchange controls limit the amount of US dollars that mainland Chinese residents can receive each year, they are allowed to hold US dollars abroad.

How should Chinese creditors collect debts?

The costs and benefits of taking legal action must also be considered. For large creditors who have suffered losses of hundreds of thousands or millions of dollars from FTX, the costs and benefits of taking legal action may be equal; but for users whose amounts are less than $50,000, the claim funds are not worth the money, time and energy spent on taking legal action.

Do we have to watch our money flow into other peoples pockets? Of course not. In fact, there are already many third-party platforms on the market that provide debt sales services for FTX creditors, such as RootData , claims market , ftxcreditor , and Xclaim . In order to understand more in detail how FTX Chinese creditors should collect debts, Odaily asked Loners Liu , head of RootData FTX debt solutions, for relevant information:

RootDatas main business is a financing information platform. It also provides FTX debt sales services for Chinese users. It has successfully handled more than 1,000 cases and assisted in handling debts worth more than $300 million. Loners Liu said: You can think of us as an intermediary like Lianjia. We help Chinese creditors sell their debts at a discount (one-time sale, not in batches), or we can help them manage their debts.

RootData currently charges a 1-2% service fee for this service . It helps Chinese users deal with FTX claims with the following four solutions:

Selling debts;

Transfer of claims to entities owned outside China;

Transfer of claims in the name of a trustee, bank or other entity outside China;

Change of residence;

If you are selling a claim, you first need to log in to claims.ftx.com to confirm that KYC has been passed. Then the buyer and seller need to make an appointment for a video conference, log in to the backend to verify and sign the contract, and finally complete the transfer.

“Before, some people were hesitant about whether to take the initiative to deal with their debt claims, but after the news of restrictions on FTX debt claims for Chinese users came out in the past few days, many people came to consult us.” Loners Liu answered my questions while replying to consultation messages sent by creditors.

However, according to our estimates, among Chinese creditors, there may be only more than 1,000 users with amounts exceeding US$50,000, Loners Liu said, adding that in fact many large customers have already handled their debts through various channels.

From the perspective of the affected users, waiting for years without getting paid is like a bolt from the blue. The 45-day appeal period and cross-border claims rights given by the creditor representatives, coupled with their frustrating efficiency, are another blow. At this moment, if a certain amount of money can be deducted (bond transfer rate + a small amount of handling fee) to achieve partial fund recovery, it is a good solution.

If Chinese creditors insist on legal principles and strictly defend their rights, they will have nowhere to turn to for help in the face of bankruptcy lawyers who earn sky-high lawyer fees and hold the right to speak on the rules. In the ever-changing and ever-changing crypto world, the FTX case seems to be a long time ago, but the scars left to all the parties involved will not heal for a long time. The most unbearable scene is that the cryptocurrency that carried the dream of wealth in the past finally turned into US dollars and entered the pockets of the legal team.