Quick Summary (TL;DR)

BitMEX has been giving money to bulls for a long time - not only SOL, but also mainstream currencies such as AVAX, XRP, DOGE, etc. have maintained high funding rates all year round.

In the first half of 2025, the combination of short BitMEX / long Hyperliquid achieved annualized returns of ≈ 15.6% and 15.7% on SOL and AVAX, respectively, without using any leverage.

Both legs are perpetual contracts. After adding 2-3 times leverage , the apparent return can be easily pushed up to 25-30% +, and it is still Delta neutral.

1. Why is it funding rate arbitrage?

Funding Rate is a payment mechanism designed by crypto perpetual contracts to solve the problem of tracking spot prices: longs pay shorts or vice versa, and the settlement is made every 8 hours (BitMEX) or 1 hour (Hyperliquid). If you also:

Sell (short) the leg with high funding rate

Buy (long) the leg with low funding rate

The spread between the two legs can be collected regularly under the premise of zero price risk (Delta neutrality) - this is the crypto markets interpretation of the classic cash-futures arbitrage.

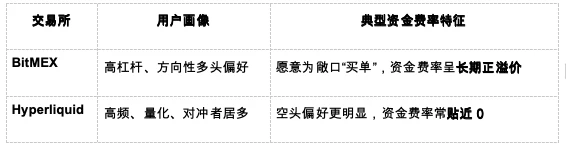

2. BitMEX vs Hyperliquid: The source of the structural spread

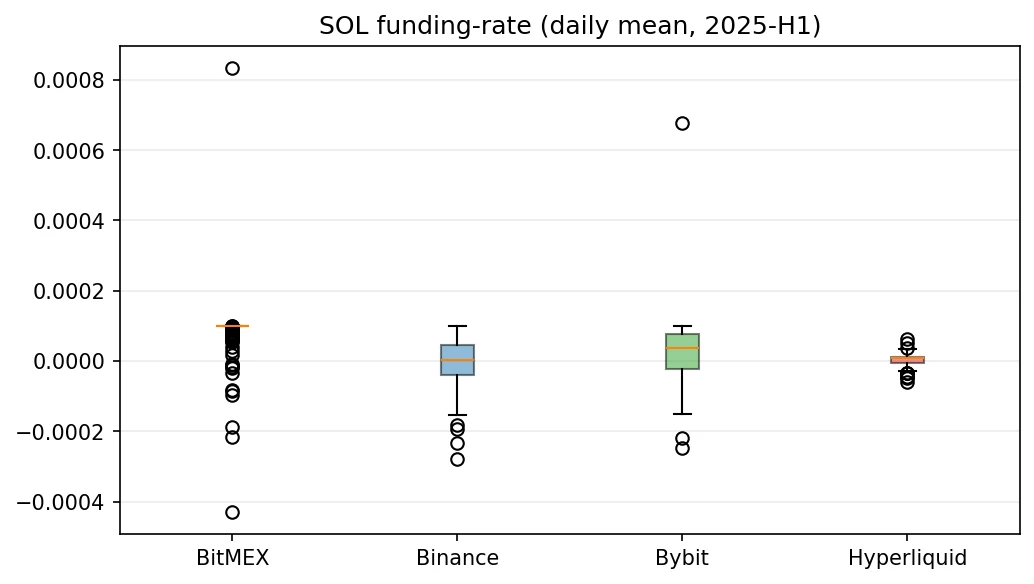

2025 H1 Data at a Glance

* Billed based on 8 hours; annualized = difference × 365 days ÷ (8 hours/day × 3)

Conclusion: BitMEX pays an annual funding fee of around 10% > Hyperliquids basic funding fee is 0 - this is exactly the arbitrage space.

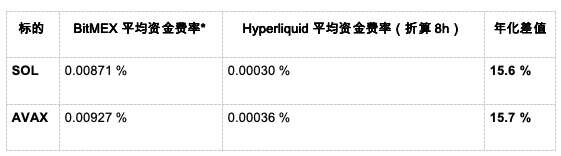

3. Take SOL as an example: the interest rate differential not only exists, but is also long-term and compoundable

Figure 1 → BitMEX SOL perpetual funding rate has almost been leading from the beginning of the year to June, while Hyperliquid has basically been at the bottom.

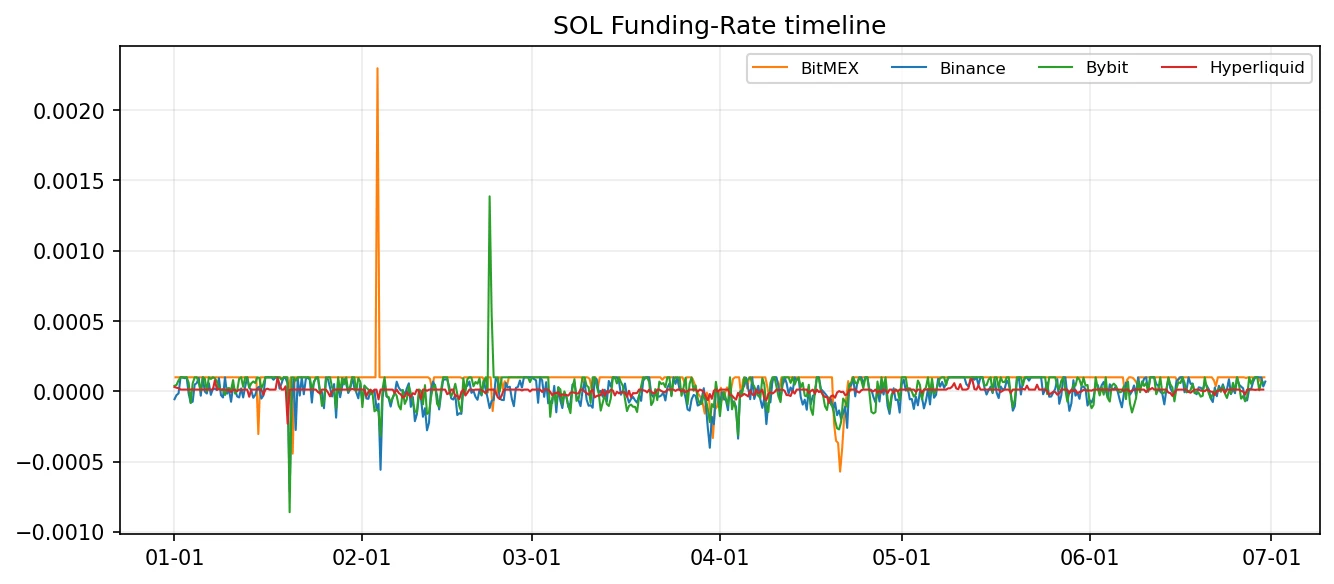

Figure 2 → BitMEX’s funding rate distribution is obviously skewed to the right; other platforms mostly fluctuate around 0.

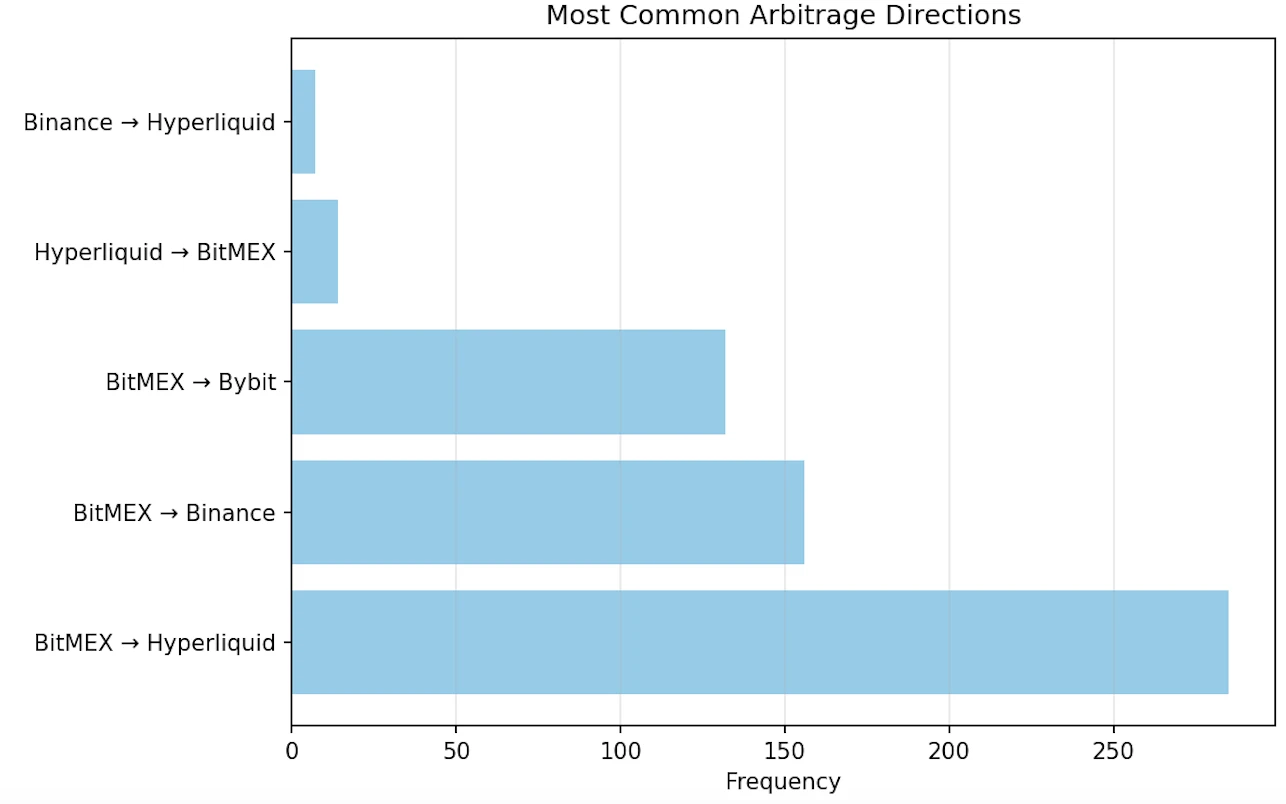

Figure 3 → Statistically, the combination with the highest frequency and the most stable returns is short BitMEX / long Hyperliquid.

Result: The PnL curve is almost linearly upward in 2025 H1 - you only need to collect interest and dont need to bet on the direction.

4. Practical Guide: Locking the Spread in Three Steps

1. Short BitMEX SOLUSDT Perpetual

Lock the side with high funding rate and let the counterparty pay interest to you.

2. Long Hyperliquid SOLUSD Perpetual

Hyperliquids funding rate is ≈ 0 all year round, and you almost dont have to pay.

3. Track real-time rates

BitMEX settles every 8 hours, and Hyperliquid settles every 1 hour; remember to observe the rate updates on both sides at the same time to avoid missing the spread or reverse payment.

(Want a refresher on inter-exchange arbitrage? Read the “Multi-Venue Basis” section of the BitMEX blog.)

5. Earnings Potential

Exact returns cannot be locked in in advance because funding rates fluctuate with market sentiment.

However, data from 2025 shows that BitMEXs average funding rate is significantly higher than other trading platforms, while Hyperliquid remains almost zero. If this gap continues, you can earn a stable funding rate in each funding settlement cycle while completely avoiding price direction risks.

If both parties add a moderate leverage of 2×, you can also compound the basis income, and the annualized return is expected to exceed 20%.

6. Risks and precautions

Conclusion

With the structural difference between BitMEXs long-term positive premium and Hyperliquids near-zero fees , SOL and AVAX perpetuals offer sweet basis to arbitrageurs in H1 2025. If you are looking for:

Stable: No need to bet on market direction

Replicability: The funding rate mechanism is open and transparent

Efficient: 20-30%+ annualized after leverage

Adding short BitMEX / long Hyperliquid to your arbitrage toolbox may be one of the most cost-effective low-risk return strategies this year.