Entering the third quarter of 2025, the zero threshold issuance of Meme coins on Solana has intensified. In the first weekend of July, the minting volume of LetsBONK.fun surged to 16,800 coins, accounting for 51% of the market share, surpassing Pump.fun (7,500 coins, 39.9%) for the first time. At the same time, Pump.fun announced the issuance of coins and completed fundraising, and went online for trading in the early morning of July 15. As a coin minting platform that once led the craze, its direction has become a key indicator of the subsequent direction of the Meme market.

Such high frequency of “launching and hyping” has drastically compressed the life cycle of the primary market - most new Meme coins complete the hype-crash cycle within a few days, and only a very few (such as USELESS, whose market value once exceeded US$300 million) survive and continue to be popular in the secondary market.

In this situation of oversupply and extreme differentiation, the spot and contract markets (i.e., secondary markets) of centralized exchanges have become key venues for testing the continued value of Meme coins, taking on liquidity and providing hedging tools. The following article will focus on the three mainstream CEXs, LBank, MEXC, and Bitget, and objectively compare their comprehensive performance in the Meme sector based on the latest 30 -day earnings, liquidity depth, spread cost, and risk control data to help investors make professional and objective judgments:

When the primary market enters the white-hot stage of mass coinage and mass elimination, which exchange can transform short-lived themes into actionable and stable returns in the secondary market?

Increase and income: Which platform’s new currency performs best?

For Meme coin investors, the most important thing is the performance of the new coin after it is launched. Based on the data comparison of the past 30 days, there are significant differences in the performance of the newly launched Meme coins on the three major platforms: LBank, MEXC, and Bitget:

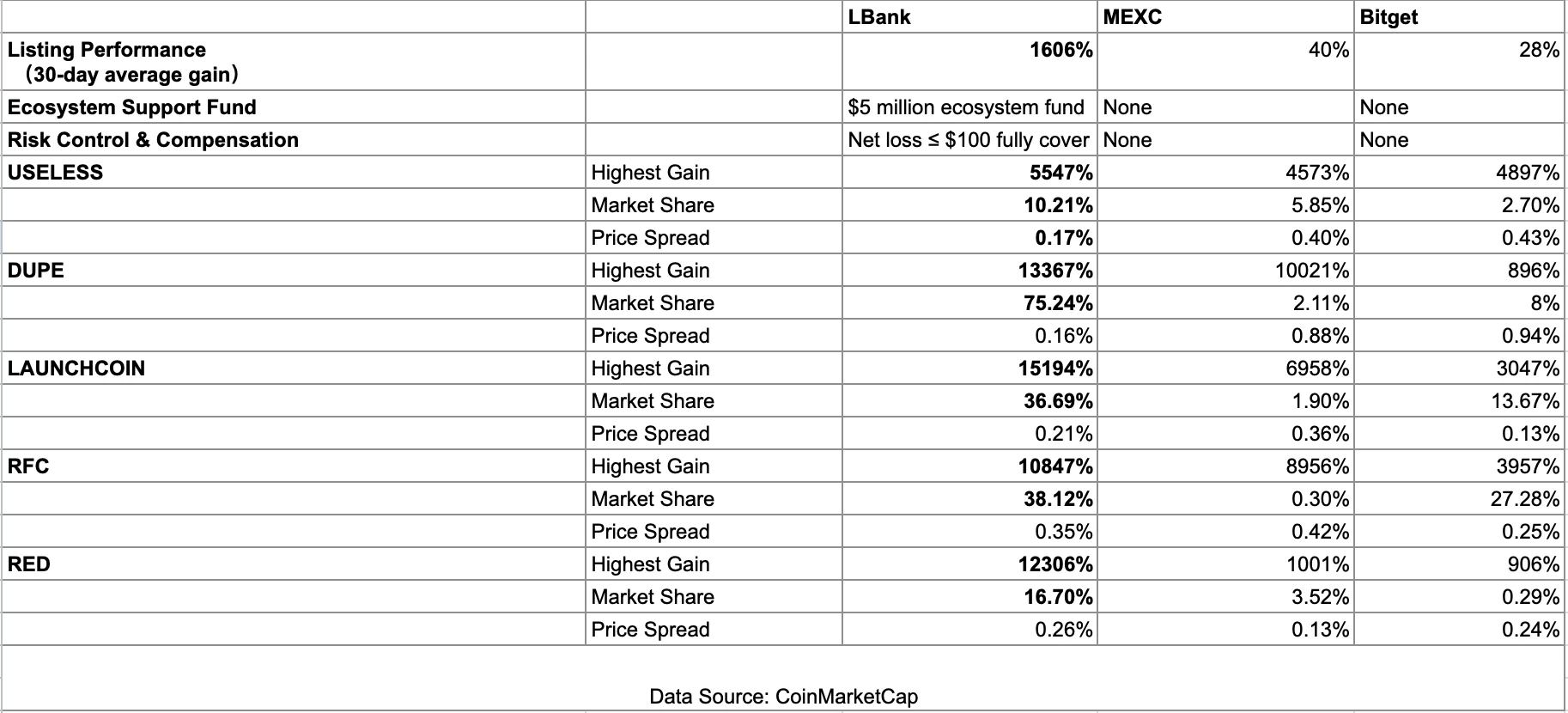

Comparison of Meme sector data of the three major platforms: The above data compares the key performance indicators of LBank, MEXC, and Bitget in the Meme coin spot and contract markets, including average increase, ecological fund support, risk compensation mechanism, and the highest increase, market share and price difference of several typical Meme projects.

First of all, from the perspective of the average increase in the 30 days since the launch of Meme coin, LBank is far ahead. In terms of the 30-day average increase, LBank is still a high-segment player in the current sample - the official disclosed interval average is about 1,606% , which is significantly higher than MEXC 40% and Bitget 28% .

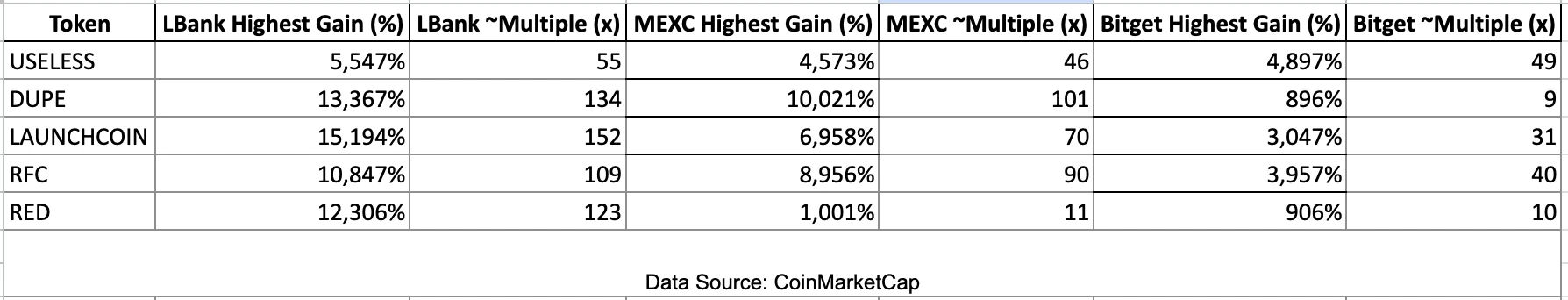

This difference in performance is also reflected in specific cases. Take several recent typical Meme coins as examples:

USELESS: LBank’s highest increase after listing reached about 55 times (≈ 5547%), slightly higher than MEXC’s 47 times and higher than Bitget’s 49 times.

DUPE: LBanks highest increase was an astonishing 134 times (≈ 13367%), significantly ahead of MEXCs 101 times, while Bitgets was only about 9 times, a huge gap.

LAUNCHCOIN: LBank rose nearly 152 times, while MEXC rose about 70 times and Bitget rose about 31 times, showing LBanks advantage in discovering such 100-fold coins.

RFC: LBank rose 109 times, slightly higher than MEXC’s 90 times, and Bitget’s about 40 times.

RED: LBank increased by more than 124 times, while MEXC and Bitget increased by only about 11 times and 10 times, respectively.

The LBANK EDGE sector is currently performing quite well, but since its launch on June 12, the sector has still listed less than 20 assets in total. The extreme increase in any single coin will significantly raise the overall average.

In comparison, the number of memes launched on MEXC and Bitget is dozens of times that of LBank, and the sample distribution is closer to the entire market, which naturally includes a large number of mediocre or even falling projects, and the average value is pulled down.

These currencies have often completed the first round of explosion on the chain or in other small exchanges. LBank only released Edge for listing at this time, which means that users may miss the initial 0 → 10 × super early dividends.

LBANK EDGE

Coin listing rhythm: Only 12 assets will be listed, with strict low-frequency screening.

Time of listing: Usually, the market will be launched after the first round of explosive pull-ups on the chain are over and cross-exchange liquidity is stable.

Wealth benefit: The average increase in 30 days is about 1,606%, and the hit rate of 100x coins is high; but users often miss the 100x opening in the earliest hours or days.

Risk/After-sales: Provide full compensation for net loss ≤ 100 USDT and a 5 million USD ecological fund.

MEXC (including DEX+)

Coin listing rhythm: adhere to big in and big out, hundreds of new memes can be listed in a single month, with almost zero threshold.

Time of listing: It will be listed as soon as the popularity of the chain begins. It can also be directly connected to Uniswap, Pancake, etc. through DEX+, which is closest to T 0.

Wealth benefit: high-multiple coins appear frequently (the average peak of the top 10 in a single month is about 8×), but a large number of long-tail projects dilute the average, and the average 30-day increase is only 40%.

Risk/After-sales: No spot compensation or centralized funds; 0 order fees and up to 200 × contracts are provided - high leverage, high self-risk.

Bitget

Coin listing rhythm: Coin listing is more cautious, with small quantities and slow rhythm, and most of them are launched online after the popularity of the project has settled.

Time of launch: often later than LBank, basically missing the initial surge, and focusing on later liquidity.

Wealth benefit: The 30-day average increase is about 28%, and the highest increase is generally lower than LBank and MEXC.

Risk/After-sales: It has a contract insurance fund and forced liquidation protection; it supports Copy Trading, quantitative robots and GetAgent AI, and the strategy is controllable.

The above data show that LBank has the most outstanding overall performance in terms of the increase in Meme coins. On the one hand, it is due to its strict screening of high-quality seeds (projects have more potential to achieve a hundredfold explosion); on the other hand, it also benefits from the platforms own liquidity support and user base. As MEXC almost accepts all coins, although it has caught many projects with high increases, it also includes many mediocre coins, and its average performance is relatively low. However, it should be noted that MEXC launched 160 new projects in April 2025 alone, of which the average peak increase of the top 10 was as high as 832% (8 times), which shows that its users also have the opportunity to capture impressive returns. Bitget tends to launch relatively mature or already popular Meme coins, missing some of the initial outbreak stages, so the overall increase is the smallest. This also reflects Bitgets more cautious style of listing coins: giving priority to stability rather than chasing high volatility. In general, if investors are looking for short-term explosive returns, LBanks EDGE sector undoubtedly offers a higher success rate; MEXC provides a wider pool of opportunities that require investors to identify on their own; Bitget is suitable for those who prefer a stable strategy and intervene after the frenzy subsides.

Liquidity and Slippage: Trading Depth and Cost Comparison

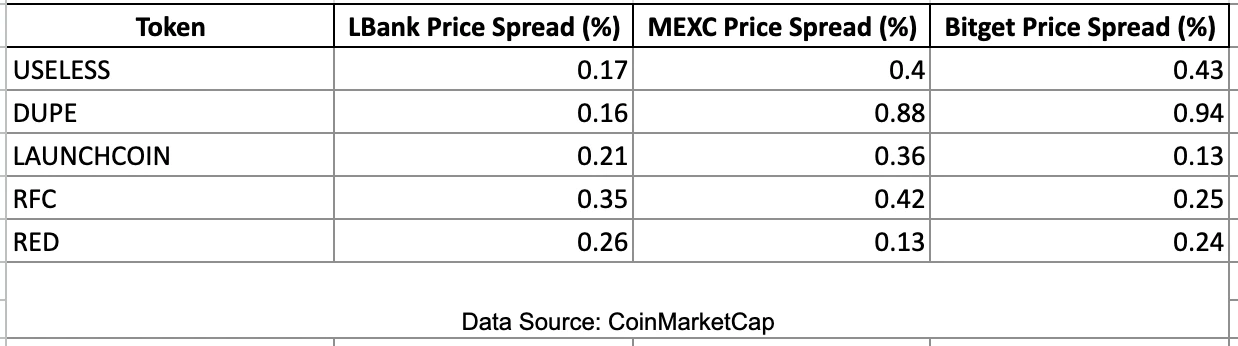

In addition to the increase, trading liquidity and slippage (bid-ask spread) are also core indicators that users care about. A platform with sufficient liquidity can ensure that large-scale transactions have little impact on prices, low slippage, and a better trading experience. Judging from the market share and spread data of multiple Meme coins, the differences in liquidity among the three platforms are also obvious. In this section, we have selected several of the hottest Memes in recent times as the main observation data.

In terms of market transaction share, LBank occupies a major market share in many new Meme coins. For example, more than 75% of the trading volume of DUPE occurs in LBank, which is much higher than MEXCs 2.11% and Bitgets 8%. This means that most DUPE holders and traders choose to buy and sell in LBank, and LBank has almost become the main market for the coin. Similarly, LAUNCHCOIN has about 36.7% of its trading volume in LBank, which is significantly higher than MEXCs 1.9%. Although Bitget has a 13.7% share, it is still less than LBank. For some projects such as RFC, LBank and Bitget share the main market (about 38.1% and 27.3% respectively), while MEXC is almost absent (only 0.3%).

Overall, LBank often takes the majority of the transactions of popular new Meme coins, which shows that its users are more involved in these coins and trade more actively; Bitget has a certain share in some coins, but is mostly in a secondary market position; MEXC has a small share in these examples due to the large number of projects and dispersed liquidity. It should be pointed out that not every coin on MEXC is listed on the exchange - for coins that are not officially listed on the exchange, MEXC users may trade on the chain through its DEX+ aggregator, so the proportion of transactions concentrated in the exchange is relatively low.

In terms of spread (slippage), LBank also shows better trading depth overall. Measured by the bid-ask spread ratio indicator, the bid-ask spread of most Meme coins on LBank is maintained in the range of 0.1% to 0.3%, which is quite tight. For example, the spread of USELESS on LBank is about 0.17%, while it is 0.40% on MEXC and 0.43% on Bitget; DUPE has only a tiny spread of 0.16% on LBank, while MEXC and Bitget are as high as 0.88% and 0.94% respectively, an order of magnitude difference. The smaller the spread, the better the order depth, the more sufficient the bid-ask spread, and the smaller the slippage caused by user market transactions. In general, LBank provides more abundant liquidity support for these currencies and gathers more market makers and traders, making market pricing more efficient. In contrast, some long-tail meme coins on MEXC and Bitget have inactive trading and sparse buy and sell orders, resulting in large price spreads. Investors may face higher hidden costs if they trade rashly.

However, there are exceptions: on LAUNCHCOIN, Bitgets spread is only 0.13%, slightly better than LBanks 0.21%, indicating that when Bitget provides liquidity support for individual currencies, its trading depth can also be close to the leading level. Similarly, RFCs spread on Bitget is about 0.25%, which is also because Bitget owns a considerable proportion of the currency market. But in general, on most new Meme coins, MEXC is limited by scattered resources and a large number of long-tail coins, and the liquidity of a single coin is sometimes not as good as that of a more focused platform; Bitget has sufficient liquidity on mainstream Meme coins, but relatively lacks depth on small-cap coins; LBank provides the deepest trading depth and the lowest slippage, which is suitable for high-frequency trading of large funds.

Risk protection and ecological support: protection of user and project interests

When investing in highly volatile Meme coins, risk control cannot be ignored. The three platforms have adopted different strategies in terms of user protection and project ecosystem support, among which LBanks measures are the most eye-catching.

In terms of user risk protection (compensation mechanism), LBank not only has a 100 million risk protection fund for mainstream coins, but LBANK EDGE has also launched a unique mechanism for novice traders: net loss ≤ 100 USDT full compensation within the specified time of new coins. Simply put, if the users net loss in a single Meme coin transaction does not exceed 100 USDT, the platform will compensate in full. This is equivalent to an insurance for new users who are testing the waters with a small amount, providing a certain safety cushion in the highly volatile Meme market. This measure is still rare in the industry and is regarded as a highlight of LBank to attract newcomers to participate in Meme coin transactions. In contrast, MEXC and Bitget do not have a special spot trading compensation policy (most exchanges have no precedent); users need to bear all market risks themselves. Of course, these two platforms have regular risk reserves and forced liquidation protection mechanisms in contract transactions, but there is no compensation plan for losses from spot speculation of new coins. It can be said that LBank’s compensation mechanism is effective in protecting user confidence and lowering the psychological threshold for new users to try high-risk assets.

In terms of project support and user risk protection, LBanks capital investment far exceeds the initially disclosed $5 million Edge Ecosystem Fund. The fund is mainly used for the subsequent liquidity, marketing and technical docking of the newly launched Meme project to ensure that high-quality projects still have sustainable funds after the first round of popularity. At the same time, LBank announced the establishment of a Futures Risk Protection Fund with a total amount of US$100 million in February 2025: When the top 100 perpetual contracts such as BTC, ETH, and SOL deviate from the reasonable price by more than 2% within 1 minute and rebound quickly, users who suffer losses due to forced liquidation or stop loss will receive 120% USDT compensation, which will be directly charged to the spot account within 48 hours, and an additional 10,000 USDT will be airdropped to all position holders according to their positions, greatly improving the predictability of high-leverage transactions. In addition to conventional protection, LBank continues to invest funds in industry public welfare and community mutual assistance: In March 2024, it took the lead in establishing the Slerf donation pool, and the public on-chain address eventually raised more than 2,600 SOLs to compensate users who failed to receive SLERF private placement shares; in August of the same year, it reached a strategic cooperation with GMGN.AI to build a shared discovery and liquidity network for the Meme super cycle. In February 2025, LBank once again joined MEXC Ventures, HashKey Capital, SevenX Ventures and Mask Network to launch a $15 million donation plan to compensate community users who were damaged by the leak of DEXX private keys, and formed the Meme Prosperity Committee to publicly disclose the progress of the payment. It can be seen that LBank has run the funding system through the three main lines of long-term project operation, extreme market compensation, and industry accident assistance, which not only provides blood transfusions for the Meme ecosystem at the capital level, but also provides users with a quantifiable and traceable safety cushion on the risk side.

On the other hand, MEXC and Bitget have not yet announced an ecological fund plan specifically for Meme coins/new projects. MEXC focuses more on attracting traffic to projects through airdrop incentives and other means. For example, its Airdrop+ event in April 2025 attracted more than 40,000 users to participate and issued new currency rewards worth about 1.5 million US dollars; these marketing activities increased project exposure, but they belonged to user incentives rather than direct investment in the project itself. Bitget does not have a dedicated project support fund for the time being, but its platform has launched online activities such as Launchpad/Launchpool, and its own venture capital department has participated in some project investments, but these are not the same as continuous ecological support. Overall, LBank conveys its long-term confidence in the selected projects to the market through real money ecological funds, and also gives users a reassurance - the project party is more likely to continue to operate with financial support. MEXC and Bitget are conservative in this regard, mainly because the market leads the performance of projects and lacks additional bottoming measures.

Vertical product and strategy support: trading tools and investor profile adaptation

In the competition for Meme coin secondary market users, various platforms not only compete on currency types and returns, but also launch distinctive vertical product modules and strategy support tools to meet the needs of different investors.

LBANK EDGE: Positioning as the 10 0x Meme Zone - LBANK EDGE focuses on discovering coins with 100x potential. EDGE integrates features such as AI screening, fast launch mechanism and user protection. Nearly 60% of the new projects listed by LBank are Meme assets. Through EDGE, LBank strictly controls and empowers early projects: the speed of listing coins is fast but the number is carefully selected (currently a total of 12 EDGE projects have been launched), while using funds and operating resources to promote project growth, and providing measures such as the aforementioned loss compensation for newcomers to reduce user risks. It can be said that LBANK EDGE is more like a boutique Meme trading zone, helping users to screen out projects with explosive potential and enjoy the protection provided by the platform. It is suitable for investors with medium to high risks but who hope that the platform will be endorsed - these users pursue high returns, but also value the certain guarantees and project quality screening provided by the platform, and are unwilling to find a needle in a haystack to identify thousands of miscellaneous coins by themselves. Through EDGE, such users can deploy high-quality Meme projects earlier, enjoy high returns, and at the same time transfer part of the black swan risks to the platform within a certain period of time.

MEXC DEX+: An aggregator for on-chain transactions – Compared to LBank’s selective thinking, MEXC takes a “big and comprehensive” route and further expands its boundaries through the DEX+ module. MEXC itself is known for its rich list of currencies, providing up to 2950+ spot trading pairs and 1000+ contract trading pairs (including a large number of small-cap Meme coins). In 2025, MEXC will launch the “DEX+” decentralized trading aggregation platform, allowing users to directly access the liquidity of decentralized exchanges through MEXC. Simply put, even if a new Meme coin has not yet been officially listed on MEXC, users can use DEX+ to link to Uniswap, Pancake and other on-chain markets for trading with one click, and MEXC serves as a convenient aggregation entrance. This strategy ensures that “MEXC users do not miss any market hotspots” and truly realizes the “all-inclusive” Meme trading experience. In addition, the MEXC platform itself offers up to 200 times leveraged contract transactions and zero order fees to attract high-frequency traders. Overall, MEXC DEX+ is more suitable for experienced Degen players and traders with high risk preferences - they want to get involved in every popular Meme coin at the first time, whether in the centralized or decentralized market; they have a clear understanding of the risks and are good at screening projects by themselves, and do not rely on the platform to screen and endorse, but pay more attention to the platforms complete tools (such as high leverage, low handling fees, and a large number of currencies) to implement their trading strategies. For such users, MEXC and its DEX+ module provide a great degree of freedom and choice, but the price is that users need to bear the responsibility of distinguishing good and bad projects and controlling risks.

Bitget: Advantages of derivatives and copy trading – In the meme coin wave, Bitget did not launch a special Meme Zone product, but with its accumulation in the fields of contract trading and social trading, it still attracts a unique user group. Bitget has always been well-known in the industry for copy trading (Copy Trading), providing copy trading functions covering spot and contracts, so that novices can automatically copy the operations of senior traders. For users who want to participate in meme coin trading but lack experience, active star traders and strategy providers on Bitget can help them develop strategies and even directly copy orders to make profits. In addition, Bitget supports a variety of quantitative trading tools and trading robots (such as grid trading, etc.), and in July, Bitget launched GetAgent, which can use AI to analyze real-time market conditions, market sentiment and technical indicators to provide accurate suggestions. Investors can use these tools to implement automated strategies (such as shorting on highs and adding positions on lows) in the highly volatile meme market to improve trading efficiency. Bitget allows up to 125 times leveraged trading in contracts, and provides perpetual contracts for hundreds of mainstream and popular currencies (although the number is not as large as MEXC, it covers Meme currencies with larger market capitalizations such as DOGE, SHIB, PEPE, etc.). Its contract liquidity and trading depth are among the best in the industry, suitable for professional traders who like leveraged hedging and short selling. In general, the Bitget platform is more inclined to derivatives. After the spot market was launched last year, Meme was more cautious in listing coins, which is suitable for strategic and stable investors: on the one hand, those who want to use professional trading tools and expert experience to participate in Meme coins (such as copy trading and quantitative strategies to reduce human judgment errors); on the other hand, investors with low risk appetite but still want to benefit from hot spots, they may not charge in the earliest stage of the project, but prefer to wait for the currency to be slightly larger and then obtain profits through two-way transactions (long or short) in Bitgets contract market. For this type of users, Bitget provides a more mature and stable trading environment and a complete risk control experience, exchanging a slightly inferior currency variety for more controllable trading risks.

Other major exchanges in the industry are also launching similar vertical products to compete for users. For example, Gate.io upgraded the original MemeBox to Gate Alpha, launched hundreds of new projects in May 2025, and launched a points system, issuing a total of $1 million+ trading rewards to nearly 100,000 users; Binance also launched the Alpha plan, introducing MEV protection and points incentives to increase user participation, and eventually became a Shura field for brushing points, and the liquidity mechanism caused the price of BR to plummet. All this shows that major platforms are aware of the huge potential of the Meme coin market and have joined the battlefield with differentiated strategies. However, no matter how the strategy is refurbished, users will eventually choose the most suitable platform according to their own situation.

Which platform is suitable for whom? Investor profile at a glance

In summary, LBank, MEXC, and Bitget have different focuses in the Meme coin secondary market. There is no absolute good or bad, only suitability. Investors should choose a platform based on their own risk appetite, trading style, and ability:

LBank – High Return + Security: Suitable for users who dare to pursue 100x coin returns but hope that the platform will provide certain risk control protection. Especially for newcomers in the Meme market or those with medium to high risks, LBank’s strict project screening, compensation mechanism and ecological support can give them confidence and get an extra safety cushion while enjoying high returns.

MEXC – Wide coverage + high flexibility: Suitable for experienced players who prefer to gamble on long-tail opportunities. Such users are good at discovering hot spots on their own, have the ability to identify the pros and cons of projects, and pursue a full range of currencies and trading freedom. MEXCs large number of new coins and DEX+ aggregated transactions allow them to hardly miss any opportunities, but also require investors to have self-risk control and screening capabilities. Low fees and high leverage tools are also conducive to high-frequency traders to implement their strategies.

Bitget – Strategy Tools + Robust: Suitable for professional/semi-professional investors who focus on trading strategies and risk control. Bitget provides an ideal platform for users who want to participate in the Meme market with the help of copy trading and quantitative tools. At the same time, those who prefer contract hedging and look for opportunities after the frenzy will also favor Bitgets robust trading environment and rich derivatives product line. This platform is more suitable for investors who think rationally and attach great importance to risk management.

As various launch platforms are competing fiercely, Pump.fun has finally ushered in the much-anticipated TGE moment. Nowadays, under the extreme rhythm of coin issuance in a few seconds, hype in a few minutes, and return to zero in a few hours, the entire Meme track is rapidly sliding from everyone can issue to everyone is confused. The coin-making carnival in the primary market is certainly lively, but where to take over the heat next, how to manage volatility, and what tools to use to hedge against drawdowns have become common questions for most retail investors and project parties.

LBank, MEXC, and Bitget provide three completely different secondary paths with very different screening logics, liquidity structures, and risk support plans. The former exchanges winning rate and confidence with selection and compensation, the middle one relies on extreme coverage and direct connection on the chain to leave enough first-launch windows for high-risk preference, and the latter uses derivatives and strategic tools to provide a hedge haven for stable funds. When the primary market continues to roll in frequently and it is difficult to distinguish between good and bad, what really determines the investment experience may no longer be whether you can grab the next new coin, but which exchange to choose to eliminate uncertainty. In the future Meme cycle, who can transform this heat into sustainable liquidity, measurable risks and repeatable returns will ultimately require every user to cast a vote of confidence with their own trading behavior.