Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

ETH is finally getting strong!

With the continuous upward surge of the altcoin leader ETH, the altcoin market has shown signs of recovery. Mainstream projects in the Ethereum ecosystem such as Ethena (ENA), Lido (LDO), Curve (CRV), and Frax (FRAX) have risen even more. Among them, ENA even broke through $0.5 in the short term, and its weekly increase was close to 50% (this is based on the increase after ENA had a round of pull-up after being listed on Upbit more than a week ago). It performed particularly well among many so-called ETH beta.

Regarding the reasons for the strong rise of ENA, after comprehensive analysis from all parties, we believe that it can be attributed to the following four major reasons.

Reason 1: ETH boosted

First of all, most of Ethena’s business is still focused on the Ethereum ecosystem (a small amount of USDe has flowed to ecosystems such as Solana through cross-chain forms), and Ethena is also one of the few star projects that have emerged in the Ethereum ecosystem in the past two years. Therefore, it is no exaggeration to say that it is a direct descendant of Ethereum.

Similar to the currencies mentioned above such as LDO and CRV, the rise of ETH will inevitably boost mainstream projects in this ecosystem, which is an indispensable prerequisite.

However, this cannot explain why ENA has been able to lead the Ethereum concept currency recently. The real reasons are the following three points.

Reason 2: Business model returns to positive flywheel

To understand this reason, you need to first understand Ethenas business model.

In short, Ethena is an interest-bearing stablecoin project focusing on spot-futures arbitrage. Its stablecoin USDe will be collateralized by equal amounts of spot longs and contract shorts. Its income mainly comes from spot long pledge income and contract short funding rate income. The first income does not fluctuate too much, and the second income is the key to the operation of the protocol business.

The funding rate of a contract depends on the two-way game between long and short positions in the market, which itself has great uncertainty. Although in the long run the funding rate will be positive most of the time (that is, overall the short positions of the contract will receive positive rate income), when market sentiment is pessimistic, the rate will continue to decline or even become negative - this will seriously affect Ethenas protocol revenue ability and even result in short-term losses.

Odaily Note: For the basic concepts of Ethena and the impact of fee fluctuations, please refer to A Brief Analysis of Ethena Labs: Valuation of US$300 million, Stablecoin Disruptor in the Eyes of Arthur Hayes and After the Plunge, How Does Ethena (USDe) Perform Under Negative Fees?

For a long time before, due to the lack of optimism in the overall market sentiment, the fees in the contract market remained low, which also led to the long-term less than ideal yields of Ethenas protocol income level and sUSDe (the interest-bearing version of USDe after staking).

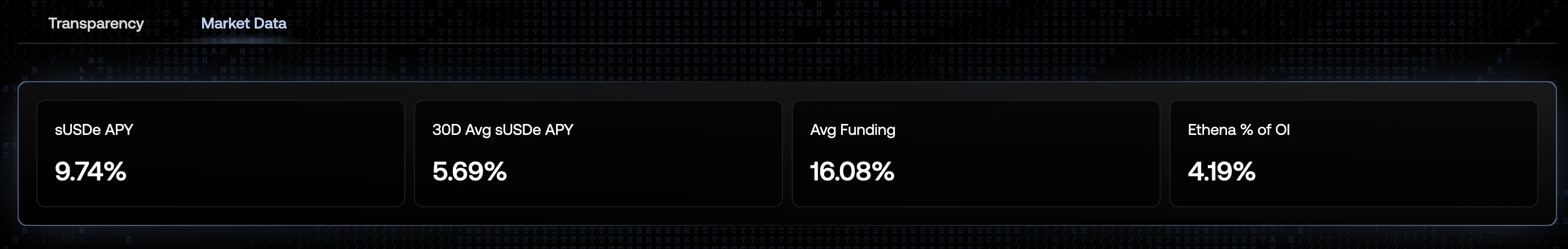

However, with the recent rapid recovery of the market (especially the rise in ETH, because ETH is Ethenas main term arbitrage target), the contract fee level has also been rising - the Ethena page shows that the current average fee of the protocol is about 16% annualized.

The yield of the fee market will directly affect the yield of sUSDe. In the past two weeks, the average yield of sUSDe has increased from about 5.59% to 9.74%, which has also directly attracted more capital inflows - the chain shows that the issuance scale of USDe has grown to about US$6.1 billion, a record high.

In short, this is a positive flywheel: the market is warming up ➡️ bullish sentiment is rising ➡️ fee income is growing ➡️ stablecoin income is increasing ➡️ capital inflow is increasing ➡️ stablecoin issuance scale is growing ➡️ protocol fundamentals are improving ➡️ coin prices are getting stronger support…

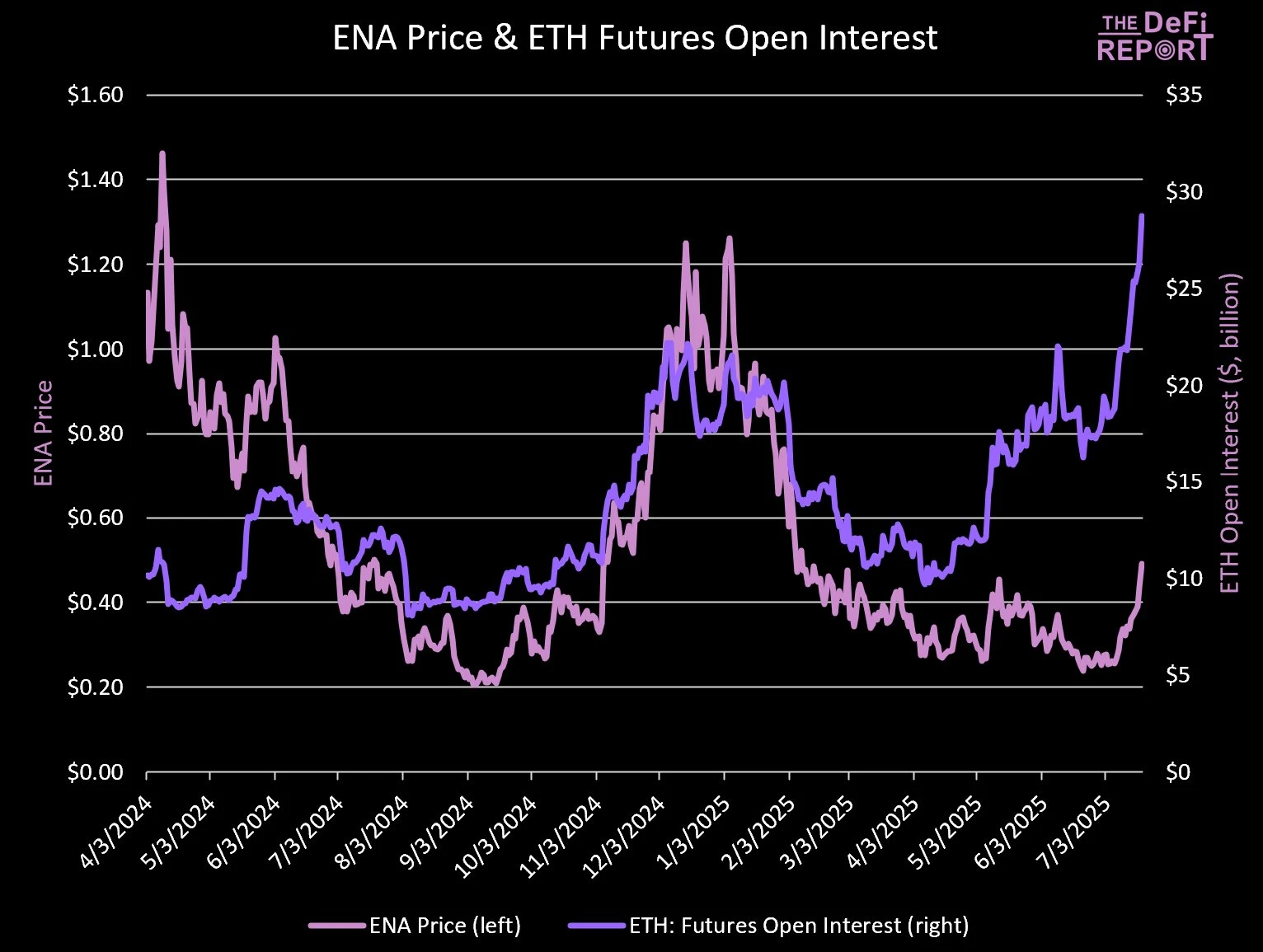

The figure below can present this logic more intuitively. The rise and fall of ENAs price is clearly synchronized with the increase and decrease of ETHs contract size.

Reason 3: The stablecoin bill has been passed, which is good for the sector as a whole

Another major positive news for Ethena recently is the passage of the stablecoin bill.

In the early morning of July 19th, Beijing time, US President Trump officially signed the GENIUS Act in the East Room of the White House, which means that this bill focusing on the development of the stablecoin industry has gone through all legislative procedures and has officially become a law to be implemented.

Odaily Note : See “ Historic Moment: Trump Officially Signs the GENIUS Act” for details.

Although USDes collateral structure may not meet the requirement of the GENIUS Act that stablecoins must be fully backed by U.S. dollars or other highly liquid assets at a 1:1 ratio, Ethena has already made corresponding preparations. At the end of last year, Ethena launched a new stablecoin product USDtb supported by BlackRock BUIDL. The stablecoin will be backed by cash or cash equivalent reserves at a 1:1 ratio. As of the time of writing, the issuance scale of USDtb has also grown to US$1.46 billion.

Simply put, Ethena now walks on two legs, USDe specializes in the crypto-native market, and USDtb specializes in the compliant institutional market.

Reason 4: ENA’s “Fee Switch” Expectation

The potential activation of the fee switch is another reason for ENAs recent rise. The so-called fee switch is a common term in DeFi protocols, which refers to whether the protocol revenue is allocated to the protocols native token (ENA in this case). If the switch can be turned on, it will directly boost ENAs value capture ability.

In the previous community vote, Ethena has clearly defined the five conditions for activating the “fee switch”, as follows.

✅ USDe circulation : The requirement is more than 6 billion US dollars, and the current level is 6.1 billion US dollars, which has been met.

✅Cumulative agreement revenue : The requirement is to exceed US$250 million, and the current figure is US$431.31 million, which has been met.

❌Exchange adoption : USDe is required to be listed on 4 of the top 5 exchanges in terms of derivatives trading volume. Currently, there are 3 exchanges, which does not meet the standard.

✅ Reserve Fund : Requires more than 1% of the USDe supply, which has been met.

❌ The spread between sUSDe’s yield and the benchmark interest rate : 5.0-7.5% is required. The current spread with Aave USDC is 3.03%, the spread with US Treasuries is 2.48%, and the spread with sUSDS is 2.05%, which is not up to standard.

As can be seen above, three of the five requirements have been met. Considering the recent trend of rising fees, the yield of sUSDe is also rising synchronously, which will help to achieve the fifth condition, and the third requirement only requires integration with one exchange.

It looks like the activation of the “fee switch” is not too far away, and the market may choose to place an early bet at this time.

Will ENA be ETHs biggest Beta?

In addition to the above reasons, another thing worth noting is that Arthur Hayes, the founder of BitMEX, who had been buying and selling ENA when it was above $1, seems to be quietly replenishing his positions. On-chain analyst Yu Jin monitored last week that Arthur purchased a total of $1.505 million worth of ENA through multiple channels in one day.

You cant trust everything Arthur said, but what he did is still of some reference value...

Odaily Note: Please refer to When Arthur Hayes suddenly praises the coins you bought, you should be careful .

Combining the above reasons, it can be predicted that in the next period of time, ENAs fundamental growth trend and value capture expectations will continue, which may support its continuation of the current price trend. When ETH is in full swing, ENA may be a potential Beta choice.