Original author: DeFi Cheetah, Crypto KOL

Original translation: Felix, PANews

As previously predicted, a correction of at least 20% in the US stock market would pull the Bitcoin price back to around $50,000. The first goal was achieved: the US stock market had a 20% correction with the VIX index around 55, as Trump imposed tougher tariffs on many other countries. The Bitcoin price fell to $74,000, which was more resilient than expected based on historical price trends.

Next, it is expected that the Fed will cut interest rates before June, followed by a bottoming out of the US stock market and crypto market. In fact, Trump has just explicitly asked Fed Chairman Powell to cut interest rates. This article will explain in detail why Trump is so paranoid about rate cuts and why he is bullish on the crypto market.

Two pressing issues raised by high interest rates

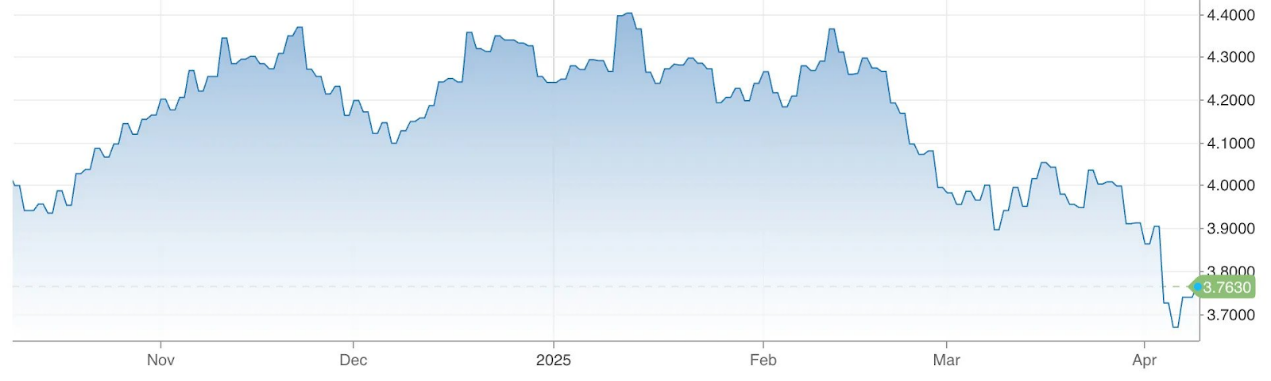

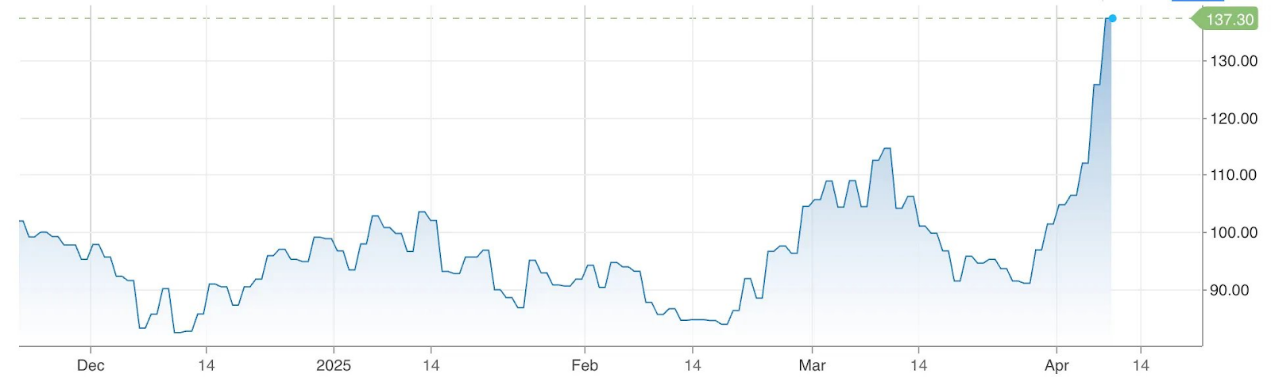

There are two issues that will force the Fed to cut interest rates significantly in the coming months. First, the maturity wall of $9 trillion worth of Treasury bonds this year has forced the Trump administration to do everything it can to seek interest rate cuts to save trillions of dollars in refinancing costs. However, in the Feds view, the current inflation level does not leave room for a rapid rate cut. Therefore, the best explanation for the Trump administrations seemingly unreasonable radical policies and measures (such as tariffs, the establishment of DOGE, etc.) is that they constitute a coordinated mechanism to try to use macro uncertainties to force the Fed to cut interest rates. Otherwise, the US government will have to pay at least 3-4 times the interest after the rollover. In fact, the yield on two-year short-term Treasury bonds has been falling, reflecting the markets risk aversion and the inflow of funds into Treasury bonds.

The urgency of rate cuts in the eyes of the Trump administration can be explained by the following chart:

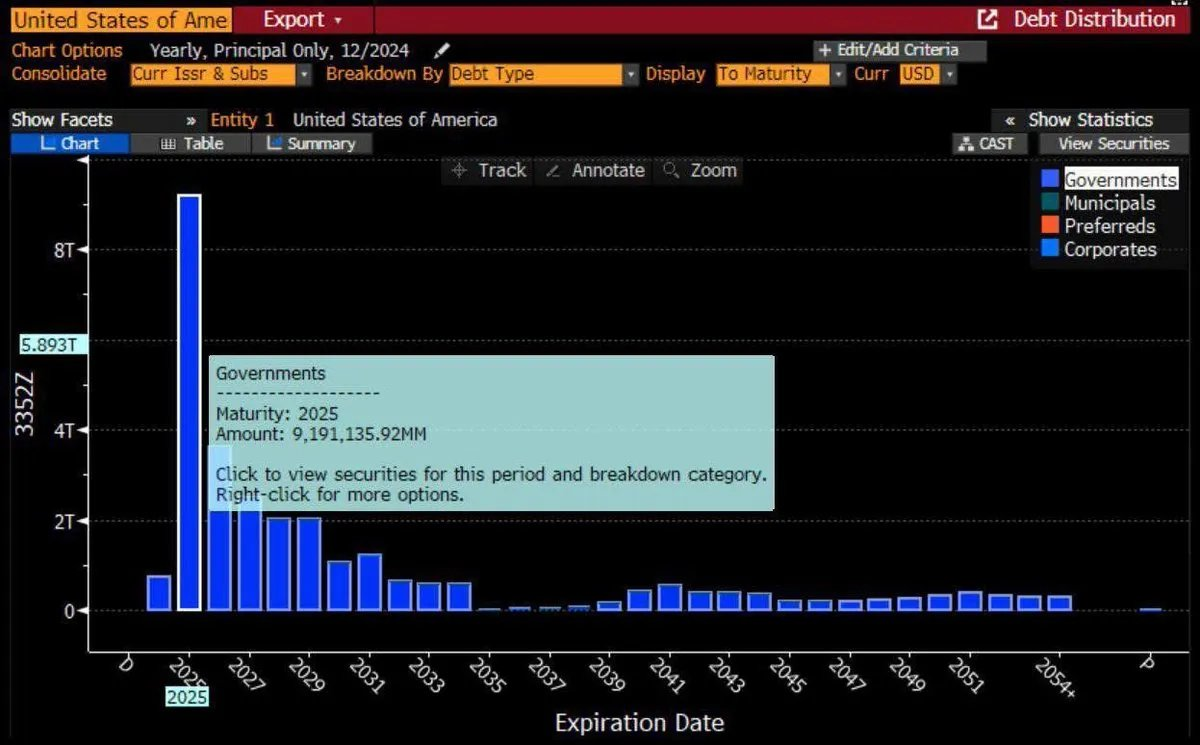

In fact, the surge in the Merrill Lynch Option Volatility Estimates Index (MOVE), which measures interest rate volatility in the U.S. Treasury market, could further support the possibility of a Fed rate cut. The index is seen as a proxy for the U.S. Treasury term premium, or the yield spread between long-term and short-term bonds. As the index rises, anyone engaged in financing transactions in U.S. Treasury or corporate bonds will be forced to sell due to higher margin requirements. If the MOVE index continues to rise, especially above 140, it may indicate extremely unstable markets and may force the Fed to stabilize the Treasury and corporate bond markets by cutting interest rates, as these markets are critical to the normal functioning of the financial system. (Note: The last time the MOVE index surged above 140 was due to the collapse of Silicon Valley Bank, the largest bank failure since 2008.)

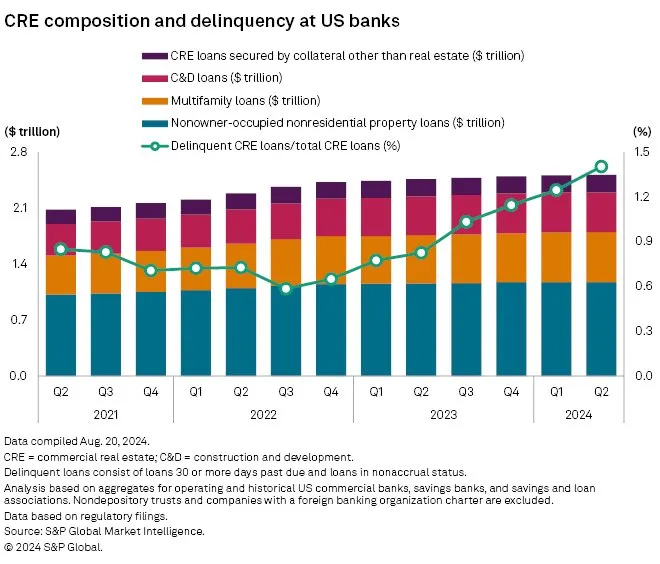

The second reason for the big rate cuts in the coming months is also due to the “maturity wall”, but this time it refers to the more than $500 billion in U.S. commercial real estate (CRE) loans that mature this year. Many CRE loans were previously underwritten at lower rates during the pandemic, and face refinancing challenges in an environment of continued high interest rates, which may lead to higher default rates, especially for overleveraged properties. In particular, the growing popularity of working from home has triggered structural changes that have led to high housing vacancy rates after the pandemic. In fact, potential large-scale defaults on CRE loans could cause the MOVE Index to soar.

The CRE loan delinquency rate is 1.57% in the fourth quarter of 2024, up from 1.17% in the fourth quarter of 2023. Historical data shows that rates above 1.5% are worrisome, especially in a tight monetary environment. At the same time, office values are down 31% from their peak, due to vacancy rates as high as 20%, rising cap rates (around 7-8%), and a large number of loan maturities, and default risk is rising.

The logic here is: high vacancy rates reduce net operating income (NOI), debt service coverage ratio (DSCR) and debt yield, but increase capitalization rates. High interest rates will exacerbate this situation, especially for loans due in 2025, refinancing at higher rates may be unsustainable. Therefore, if commercial real estate loans cannot be refinanced at reasonably low rates similar to those during the epidemic, banks will inevitably have more bad debts, which in turn may trigger a domino effect and more banks will fail (recall the severity of the failure of banks such as Silicon Valley Bank due to the surge in interest rates in 2023).

Given these two pressing issues caused by the current high interest rates, the Trump administration must take radical measures to cut interest rates as soon as possible. Otherwise, these debts must be rolled over, the US government will face higher refinancing costs, and many commercial real estate loans may not be rolled over, resulting in a large amount of bad debts.

Stablecoins are the catalyst for the next bull market

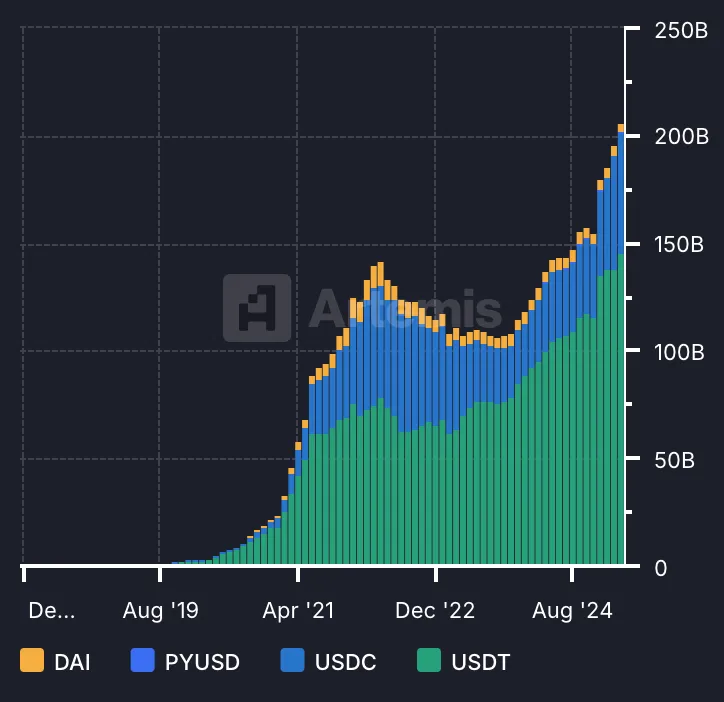

The biggest influence on the crypto market is market liquidity. But the factors that have the greatest impact on liquidity are (i) monetary policy and (ii) the popularity of stablecoins. Driven by dovish (moderate) monetary policy, the popularity of stablecoins can further catalyze capital inflows in a bull market. The upside of the bull market depends on the increase in the total supply of stablecoins. In the last bull market (2019-2022), the total supply of stablecoins increased 10 times from trough to peak, while it only increased by about 100% from 2023 to early 2025, as shown in the figure below.

Below we focus on events that indicate rapid growth in stablecoin adoption over the next year:

Progress of US Stablecoin Legislation: In the first quarter of 2025, the Senate Banking Committee approved the GENIUS Act in March, which outlines the regulation and reserve rules for stablecoin issuers. The bill aims to incorporate stablecoins into the mainstream financial system, reflecting the growing recognition of their role in the crypto market. In addition, the U.S. House of Representatives Financial Services Committee passed a stablecoin framework bill, the STABLE Act, which stipulates that any non-bank institution can issue stablecoins as long as it obtains approval from federal regulators. Regulatory transparency has always been considered the most important factor affecting the adoption of stablecoins, thereby affecting the flow of capital into the crypto industry through stablecoins.

Accelerating institutional adoption: Fidelity Investments began testing a dollar-pegged stablecoin in late March, marking a major step for the traditional financial giant to enter the crypto space. Meanwhile, Wyoming announced plans to launch a state-backed stablecoin by July, aiming to be the first fiat-backed, fully-reserved token issued by a U.S. entity.

World Liberty Financial Stablecoin: Trump-linked World Liberty Financial announced plans to launch a stablecoin pegged to the U.S. dollar, USD 1, on March 25, after raising $500 million in a separate token sale. The move is in line with the Trump administration’s policy of supporting stablecoins as key infrastructure for cryptocurrency transactions.

USDC expands to Japan: On March 26, Circle partnered with SBI Holdings to launch USDC in Japan, making it the first stablecoin officially approved for use under the Japanese regulatory framework. This move reflects Japans positive attitude in incorporating stablecoins into its financial system, and may serve as a model for other countries.

PayPal and Gemini advance stablecoin development: Throughout the first quarter, PayPal and Gemini consolidated their positions in the stablecoin market. PayPals PYUSD and Geminis GUSD saw increased adoption, with PayPal leveraging its payment network and Gemini focusing on institutional clients. This intensified competition in the U.S. stablecoin issuer market.

More use cases for payroll platform Rise: On March 24, payroll platform Rise expanded its service scope to provide stablecoin payments for international contractors in more than 190 countries. Employers can pay wages in stablecoins, and employees can withdraw in local currency.

Circles IPO: Circle has submitted an IPO application. If approved, Circle will become the first stablecoin issuer to be listed on the New York Stock Exchange. This will mark the official status of the stablecoin business in the United States and encourage more companies to explore this field, especially large institutions, because the stablecoin business relies more on institutional resources, distribution channels and business development.

Why is the Trump administration so actively supporting the development of stablecoins? This is consistent with the view in the first part: the collateral for stablecoins in circulation is mainly short-term U.S. Treasury bonds. Therefore, as the U.S. government rolls over trillions of dollars of maturing Treasury bonds this year, the more popular stablecoins become, the higher the demand for short-term Treasury bonds.

The market direction is clear: in the short term, we may experience market turbulence, high volatility, and even further declines from current levels. But in the medium term, we expect that against the backdrop of dovish monetary policy, significant interest rate cuts, coupled with the popularity of stablecoins, could trigger another strong bull run, comparable in size to the previous cycle.

We are approaching the ideal time to earn good returns by investing in the crypto market.