Original author: Kazmin

In 2025, yield-based stablecoins have become one of the fastest growing sectors in the crypto market. According to a Cointelegraph report, as of mid-May, the market value of such assets has exceeded $11 billion, accounting for 4.5% of the total market value of stablecoins, a significant increase from only 1% last year. This trend is spreading from on-chain DeFi to CeFi platforms, becoming a new tool for centralized institutions to compete for asset retention.

In this context, Bitget launched BGUSD, a quasi-income stablecoin product that is tradable, interest-bearing, and has no lock-up restrictions. BGUSD uses USDT/USDC for subscription. Its essence is a spontaneous income certificate issued by the platform, representing the users income rights to the income pool. It has both financial income, token functions, and mortgage purposes. The underlying reference assets of the product are a basket of tokenized RWAs (such as U.S. Treasury bonds), which have high security and high liquidity.

This article will disassemble its design structure, functional mechanism and strategic significance, and explore whether it is possible to become the asset form closest to Wealth Management U in the CeFi system.

1. What exactly is BGUSD?

Before we go into the details of BGUSD’s structure, we can first quickly understand the basic characteristics of this product through a set of core parameters:

Product nature: Income certificate within the platform

Supported currencies for subscription: USDT/USDC

Annualized return: 5% in the first 30 days of opening, 4% in the later period

Interest calculation method: Daily interest

Whether to lock position: No

Redemption method: T+ 0 (daily quota for non-VIP users: 10,000 BGUSD)/T+ 3

Usage fee rate: Subscription and redemption are subject to a handling fee, and subscription is free only in the first 30 days

Available scenarios: contract margin, lending, Launchpool, pledge, etc.

Exchange currency and handling fee: can be exchanged with USDC 1: 1, handling fee 0.1%

BGUSD is a kind of income certificate that is only circulated within the Bitget platform. Its core logic is not to anchor the value of assets, but to confirm the users income rights to the platforms income pool, which is equivalent to a structured in-platform financial management certificate.

BGUSD uses Bitgets proprietary funds to allocate traditional low-risk assets such as short-term US bonds and repurchase agreements to build a sustainable income foundation. Users can use USDT/USDC to subscribe (USDC and BGUSD are exchanged at 1:1, and USDT exchange is based on the real-time USDC/USDT spot price) to obtain the right to daily interest settlement. The system calculates the income based on the minimum holding volume of the day and automatically distributes it to the users spot account without any on-chain operations or additional application steps.

The subscription process is similar to the platforms financial products and can be completed directly in the Financial Management > On-chain Selection > BGUSD module of the Bitget App. The operation threshold is low, and CeFi users can earn interest without the participation of a wallet. For example, if a user holds 10,000 BGUSD, based on an annualized rate of 5% in the early stage of development, it is estimated that about 1.37 USDC can be obtained per day, and the cumulative income in 30 days is 41.1 USDC.

The main features of BGUSD include:

Automatic compound interest settlement mechanism: The platform takes snapshots of holdings every hour, takes the lowest value as the profit benchmark, and the profits are credited to the account daily;

High liquidity, no lock-up: supports T+ 0/T+ 3 redemption;

Multi-scenario versatility: It can be used as contract margin, pledge lending, Launchpool, etc. within the platform.

Fundamentally speaking, BGUSD is not an on-chain stablecoin, but a CeFi model asset that combines income rights, circulation capabilities and platform credit structure. It is another attempt at a centralized platform.

2. What kind of “bondization design” does BGUSD demonstrate?

The structure of BGUSD adopts a composite model of platform bonds + token form. Although it is not a traditional bond, its core logic is built around the closed-loop mechanism of income right issuance - capital allocation - income distribution, which combines the stable income characteristics of financial bills with the liquidity function of platform tokens.

The overall operation mechanism can be broken down into five key links:

1. The platform allocates RWA with its own funds: Bitget uses its own funds to invest in short-term U.S. Treasury bonds and other highly liquid, low-risk real-world assets (RWA) to provide sustainable support for returns. Compared with the common algorithmic interest rate model in DeFi, RWA is built based on the deterministic returns of the real financial system (such as the federal funds rate), and the return path is stable and controllable, while protecting user funds from on-chain risks.

2. Users subscribe and obtain the right to income: Users subscribe to BGUSD with USDT/USDC and obtain the right to daily income distribution, but not the ownership of the underlying assets. The structure is similar to the structured deposit in bank financial management, which puts users at the participating end, and the income comes from the platform income pool distribution.

3. Daily interest settlement and automatic distribution: The system records BGUSD holdings every hour and takes the lowest value of the day as the interest calculation basis to prevent arbitrage. After daily settlement, the income is automatically distributed without user operation, forming a passive income path similar to compound interest, improving the fairness and transparency of distribution.

4. Versatile in multiple scenarios, enhanced flexibility of use: Different from single-purpose financial products, BGUSD is designed as a multi-functional token within the platform, which can be widely used for U-standard contract margin, lending, staking, Launchpool, etc. It has the dual attributes of financial management tools and platform tokens, improving the efficiency of asset reuse.

5. Platform acceptance, dual-channel redemption: Users can exchange BGUSD for USDC at a ratio of 1: 1, supporting flexible redemption of T+ 0/T+ 3, and the platform assumes liquidity and pricing responsibilities. The handling fee is 0.1%, and the process is stable and efficient, ensuring smooth withdrawal of user assets.

Through this closed-loop structure, BGUSD has built a quasi-financial bill system that does not require on-chain contract support, while achieving tokenized benefits and maintaining a high degree of freedom in the allocation and circulation of funds on the platform. It not only retains the controllability of CeFi, but also draws on the flexibility of on-chain assets, becoming a representative design of quasi-bond + stable assets in the CeFi world - of course, its entire operation is still highly dependent on the platforms credit and operational capabilities.

3. Similarities and Differences between BGUSD and Stablecoins

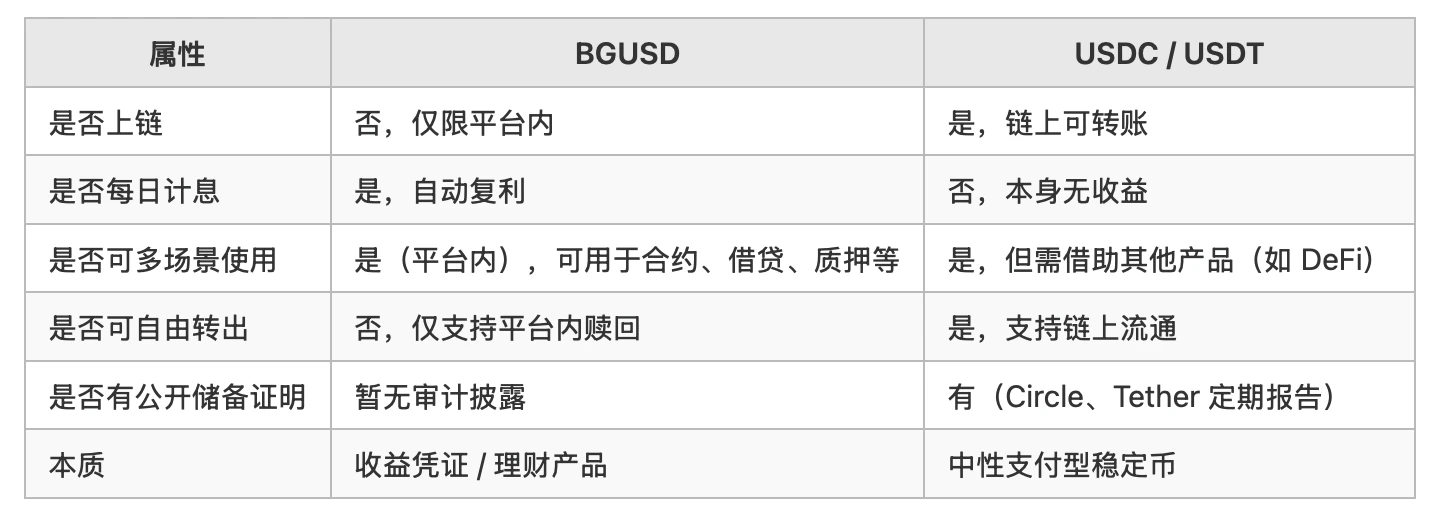

Although the name of BGUSD ends with USD, it is easy to be reminiscent of stablecoins at first glance, but its product structure, income model and circulation method are significantly different from stablecoins. Especially in terms of functional design, it has the dual attributes of stable assets and income certificates, and its positioning is closer to financial assets.

The main reason for this sense of inconsistency is that BGUSD imitates the U-standard setting of stablecoins in form, ensuring that it has stable valuation and standardized asset experience within the platform; but in essential logic, it is more like a structured income certificate issued by the platform, representing the users right to income from the platforms income pool, rather than a neutral asset that can be circulated on the chain at any time and used for payment and trading.

The following comparison table sorts out the differences between BGUSD and mainstream stablecoins USDC/USDT in core dimensions, further highlighting its structural nature of more like a financial product than a stablecoin.

Among the current mainstream centralized exchanges, products with designs consistent with BGUSD are not common. Exchanges such as Binance, OKX and Bybit provide some products in the financial management section such as Simple-Earn and OKX-Earn, allowing users to invest stablecoins to earn income, but there is no independent income coin form, and the operation needs to be manually separated, and the threshold for use is relatively high.

Therefore, BGUSD is an attempt to combine stable assets and income mechanisms under the CeFi framework, which not only improves the efficiency of user funds, but also reconstructs the asset model of token + financial management within the platform. This type of product blurs the boundary between stablecoins and financial products, and is a strategic extension of the crypto platform in terms of user experience and asset design.

4. Comparison between BGUSD and other platform products

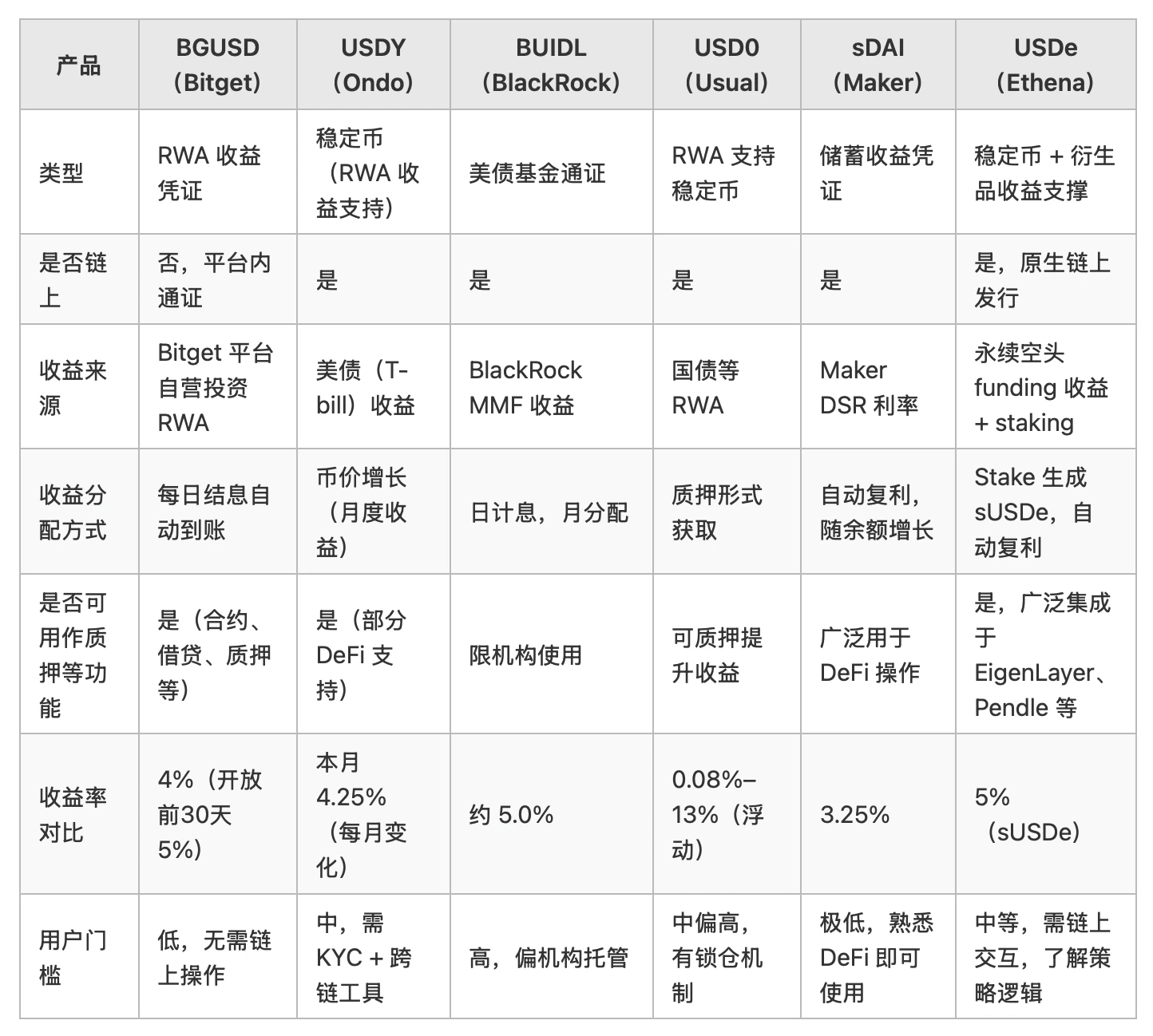

In order to more clearly understand the positioning and design logic of BGUSD in the CeFi world, it is necessary to compare it horizontally with several representative income assets under the current on-chain or institutional compliance framework. Although these products have different mechanisms, most of them use RWA (real world assets) as the underlying support and introduce traditional financial income into the hands of crypto users in different ways.

We selected several products with typical structural characteristics: Ondo Finances USDY, BlackRocks BUIDL, US Treasury-backed stablecoin USD 0, Maker DAOs sDAI, and Ethenas algorithmic stablecoin USDe. They have some similarities and differences with BGUSD in terms of asset structure, income model, openness of use, and user threshold.

These products represent different design ideas:

USDY and USD 0: Both are supported by Treasury RWA and are stable-income DeFi products. USDY is more compliant, while USD 0 focuses on the staking incentive mechanism. Users need to understand the DeFi operation process.

BUIDL: Launched by BlackRock, the worlds largest asset management institution, it maps the returns of its money market fund (MMF) and is one of the most compliant RWA applications currently available. However, it is limited by its institutional issuance mechanism and is mainly aimed at users of custody platforms.

sDAI: The native passive income certificate launched by Maker DAO. The income behind it comes from DSR (Dai Savings Rate). It is characterized by flexibility, transparency, and no lock-up, but lacks the RWA component supported by real finance. The yield is more sensitive to Makers monetary policy.

USDe: Based on derivative hedging strategy, it does not rely on RWA. Users pledge USDe to obtain sUSDe, and the current annualized rate is about 5%. The mechanism is novel, but it needs to deal with the risk of fluctuations in funding rates.

Although BGUSD does not have on-chain attributes, it configures RWA through the platforms own funds, providing users with a similar experience within the exchange: low volatility, high certainty of returns, automatic distribution, and circulation functions such as contract mortgage and pledge participation that the platform token has.

It can be said that BGUSD is a usability translation version of CeFis DeFi income asset logic. It is similar to USDY and BUIDL in investment logic, but its operation path is more like sDAI - users do not need to understand the on-chain structure, do not need wallets and cross-chain tools, and do not need to bear on-chain gas fees, and can earn interest with one click.

This design lowers the threshold for use and builds a user experience similar to traditional financial products through platform credit endorsement, packaging the complex underlying financial infrastructure into an intuitive and easy-to-use digital token form. This is not only an optimization of product design, but also an integration of the DeFi/TradFi model.

5. Who is BGUSD suitable for? What is its user value?

The core advantage of BGUSD is that it integrates income generation, token circulation, and platform function access into a unified asset unit. This makes it naturally suitable for users who want to improve capital efficiency but do not want to face the complexity of on-chain operations. The following are several typical user portraits:

1. Users who prefer centralization: They are used to managing assets on exchanges and are unfamiliar with on-chain wallets and cross-chain operations. BGUSD’s “automatic interest settlement + no lock-up” feature meets their needs for income and flexibility.

2. Long-term capital deposit users: They hold stablecoins as reserve funds but do not configure any income strategy. Through BGUSD, these idle assets can automatically generate interest every day and can be used at any time.

3. Highly active users who seek to reuse funds: frequently participate in contracts, lending and other scenarios, and hope that funds can be used for multiple purposes. BGUSD has both income attributes and platform token functions to meet the needs of flexible deployment.

4. Stablecoin holders who do not participate in financial management: due to trouble or risk concerns, they do not configure a profit strategy. BGUSD stablecoin asset form provides a low-threshold automatic profit solution.

5. Conservative users who focus on deterministic returns: They are unwilling to engage in high-risk strategies on the chain and prefer a simple and stable income experience. BGUSDs one-click subscription and daily compounding mechanism just meet this preference.

In general, BGUSD is an attempt at “financial tokenization”: it encapsulates the right to income into a token form and can be flexibly used in a variety of scenarios within the platform, which not only improves the user experience but also prolongs the active cycle of funds within the ecosystem.

VI. Risk structure behind returns

Although BGUSD has built a complete closed-loop profit model, as a CeFi product, its operation still relies on the platforms credit and capital operation capabilities, which also constitutes its core trust foundation.

Unlike the open compliance path of the on-chain RWA project, BGUSD is more like a financial token with a closed structure within the platform, and its institutional transparency and regulatory interface still need to be improved. This design gives it a lower threshold for use and stronger product integration, which is in line with Bitgets strategic positioning of developing Web2 users.

In general, BGUSD is not a replica of traditional stablecoins or on-chain strategy products, but a structured attempt to integrate returns, liquidity and user-friendly experience. Its innovation space comes from this not yet fully defined platform model.

Before using the platform, users should still make rational judgments based on their own risk preferences, cash flow needs and trust in the platform.

Conclusion: BGUSD is CeFi’s attempt to structure stable income assets

The launch of BGUSD is a strategic extension of Bitget in the direction of income-generating assets, and also an active exploration of the logic of RWA income integration. While the on-chain world emphasizes the design philosophy of transparency, combination, and automation, BGUSD attempts to reconstruct a simple, interest-bearing, and schedulable asset model from the perspective of user experience in the form of platform tokens.

It does not rely on complex wallet operations, nor does it require users to master the on-chain protocol logic; there is no need for cross-chain or collateral, and stablecoin assets can be converted into compoundable, participatory, and redeemable income certificates through just one subscription action. In this process, users do not need to understand U.S. bonds, repurchase agreements, RWAs, or DeFi interest rate models, but can intuitively feel the increase in asset value through daily income. This experience reconstruction is a key trend in the popularization of crypto finance.

In the field of on-chain finance, products such as sDAI, USDY, and USDe emphasize on-chain transparency and income composability; while products such as BUIDL and USD 0 represent the mapping of traditional financial assets (RWA) on the chain and experimental compliance paths. In contrast, in the context of CeFi, BGUSD provides a feasible solution with lower learning costs and higher circulation efficiency within the platform. It is not a simple copy of the on-chain logic, but a structured innovation that combines user usage habits with the platforms capital operation model.

It is not equal to stablecoin, but it may be a prototype of the multifunctional evolution of stablecoin;

It is not a financial product, but it provides a financial product-level experience;

It cannot be put on the chain, but it has become an internal token with the most currency function within the platform.

For exchanges, BGUSD is a rearrangement of the platforms financial system: it turns the right to income into a programmable digital asset, turning income from an operational behavior into an asset form; for users, BGUSD is an entry point to digital financial management without changing their identity, a relatively credible interest-bearing token in a centralized financial environment.

Whether BGUSD will become the future industry paradigm remains to be tested by the market. But it is certain that it has opened up a new direction for innovation in CeFi financial products - a direction that is worth observing, experimenting with, and possibly being emulated by more platforms.