Original author: Metaer

In the past week, a Bitcoin-based BRC-20 meme coin “ORDI” has attracted widespread attention from the crypto community due to its violent price fluctuations.

The Coingecko data above shows that in the past month, ORDI, which had been hovering at $20, rose to the $40 price range on November 5 after several climbs, almost doubling, but the market did not seem to be satisfied. It broke through $60 a day later and hit a record high of $61 on November 6, with a single-day increase of more than 50%. However, the good times did not last long, and this increase did not last long. On November 7-8, the price of ORDI fell all the way to below $50, a drop of more than 25%.

Two major reasons for ORDI’s “roller coaster” market revealed

1. Potential bull market signals drive ORDI prices up

Frankly speaking, many users in the crypto community mistook ORDI, a Bitcoin-based meme currency, as the native token of the Ordinals protocol. Although this misunderstanding was quickly corrected, the price of ORDI did not rise for a long time. Not much improvement has occurred. If you compare the following two market trend charts, you will find that ORDI has shown a growth attitude since early November, which is very consistent with the time when Bitcoin enters the next bull market cycle and the price rebounds and recovers. ORDI’s price surge has been surprising in recent days as Bitcoin prices surged past $44,000.

2. Bitcoin core developer Luke Dashjr was dissatisfied with the inscription, causing the price of ORDI to fall rapidly.

On December 6, Bitcoin Core developer Luke Dashjr said on social platforms that Inscription is exploiting a vulnerability in the Bitcoin Core client to send spam information to the blockchain. Since 2013, Bitcoin Core has allowed users to set additional data size limits when forwarding or mining transactions. Inscription circumvents this limitation by obscuring its data into program code, and if the vulnerability is fixed then the Ordinals and BRC-20 will cease to exist.

For now, there are still two camps in the Bitcoin ecosystem. One is the core developer team, and the other is the miners. The developers are responsible for maintaining the software level, while the miners are responsible for running the network. For example, in the Ethereum network, Buterin and the Ethereum Foundation represent developers, while miners run the network.

Developers and miners sometimes have differences, but in most cases core developers tend to have greater market dominance. Generally speaking, the increase in ORDI prices is indeed beneficial to Bitcoin miners. After all, in the current Bitcoin ecological use cases In a smaller environment, miners can obtain more fee income through the ORDI bull market. In contrast, developers are often relatively pure. Most of them are technology geeks who want to make the technology more flawless and have a longer-term vision. To give a simple example, at the end of 2022, Buterin and the Ethereum Foundation implemented the Shanghai upgrade of Ethereum 2.0, which caused all Ethereum miners to withdraw from the stage of history. Therefore, once Luke Dashjrs remarks were made, the result can be imagined - — On November 7-8, the price of ORDI fell all the way to below $50, a drop of more than 25%.

Are all the ORDI chips in the hands of the exchange?

On December 7, some media disclosed that the top 30 ORDI holders held a total of 16.78 million ORDI (approximately US$950 million), accounting for 79.94% of the total supply. However, this may not be the actual situation. According to the top ten ORDI Address analysis shows that five of the addresses belong to exchanges such as Binance, OKX, Gate, etc. This means that the current focus of the ORDI market may have changed, starting from minting and gradually shifting to cryptocurrency exchanges, because ORDI Token chips are currently basically concentrated on exchanges.

Another thing that needs attention is that among the top ten ORDI holding addresses above, there are no holders based on Forging. It is reported that among the Forging users with the most holders, they only ranked 19-27, while the ranking in May About half of the top 20 ORDI holding addresses are from casting users, which shows that ORDIs main battlefield has indeed begun to shift.

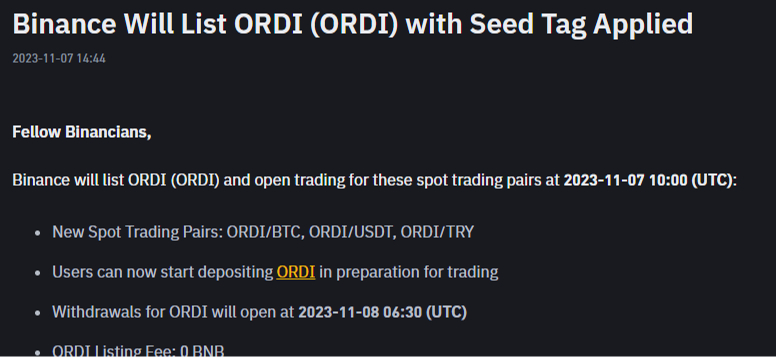

Relatively speaking, exchange giants have actually made preparations for the ORDI market long ago. For example, OKX announced the opening of ORDI recharge as early as May this year, and then Binance announced the launch of ORDI on November 7. At this time, it was not long before ORDI The surge lasted about a month.

According to disclosures, the cryptocurrency exchange Binance has the largest holdings of ORDI tokens at this stage, with at least 38.4% of ORDI, and is currently the largest holding address; followed by OKX, which also holds at least 12.2% of ORDI, and other exchanges include The total holdings of second-tier exchanges such as Gate, Bybit, and MEXC are about 10%. (It should be noted that due to the lack of labels on the Bitcoin network, there may be uncertainty in some addresses)

What impact will the ORDI craze have on the Bitcoin ecosystem?

It is undeniable that ORDI price fluctuations have attracted huge attention from the encryption community, and at the same time, many people have begun to understand the Bitcoin ecosystem. So, what impact will the ORDI craze have on Bitcoin?

First of all, the emergence of ORDI can enhance the value of Bitcoin, making Bitcoin not only a store of value, but also promoting the construction of more possibilities for the Bitcoin ecosystem, bringing new vitality to the Bitcoin ecosystem, and promoting the further development of the Bitcoin ecosystem. develop.

Secondly, ORDI also promotes the development of the inscription track, and may even promote the development of the second-layer network of the Bitcoin blockchain. Users create off-chain transaction channels at the Layer 2 execution layer, and process transactions through off-chain computing methods, thereby improving reliability. Scalability and throughput while reducing transaction costs.

We know that the current Inscription protocol uses the Bitcoin layer 1 network to mint NFTs, allowing users to embed data into the Bitcoin blockchain, and includes Ordinals (Satoshi’s numbering mechanism) and Inscriptions (inscribed Satoshi with arbitrary content), which is essentially Creating Bitcoin-native non-fungible tokens (NFT), although this will increase the transaction volume of the Bitcoin network, may also bring a certain burden to the Bitcoin network. To solve these problems, based on the Bitcoin main blockchain Layer 2 networks may be built as a result.

It is worth mentioning that Binance announced the integration with the Bitcoin Lightning Network as early as July this year, allowing users to directly use the second-layer expansion solution to directly withdraw and deposit Bitcoin. Looking back now, this move seems to be the same. Prepare in advance to support ORDI transactions. The ORDI craze will undoubtedly attract more development teams to move to Bitcoin L2 for base layer development. Coupled with the upcoming Bitcoin block reward halving, the development of Bitcoins second-layer network is bound to attract more attention.

Of course, for any emerging project or protocol, there are uncertainties in sustainability and market recognition. Under the current market background of Initial Bull rising rapidly, market fluctuations are a relatively common phenomenon, and participation also requires Be more cautious. But in any case, the ORDI craze has driven more people to pay attention to the construction of the Bitcoin ecosystem. If more innovative and attractive Layer 2 or other new forms of narrative can be launched, it will undoubtedly be beneficial to the entire encryption industry, let us wait and see!