Original author: Metaer

With the arrival of 2024, more and more jurisdictions are beginning to explore central bank digital currency (CBDC). Data disclosed by PwC shows that more than 80% of the worlds central banks are considering or have already launched CBDC. For example, the Peoples Bank of China has early Digital RMB began to be explored in 2014, and is currently undergoing large-scale pilots in some cities. It has also become one of the only three payment methods accepted by venues during the 2022 Beijing Winter Olympics. So, the current global CBDC track layout What is the situation? Meta Era will be analyzed in depth in this article.

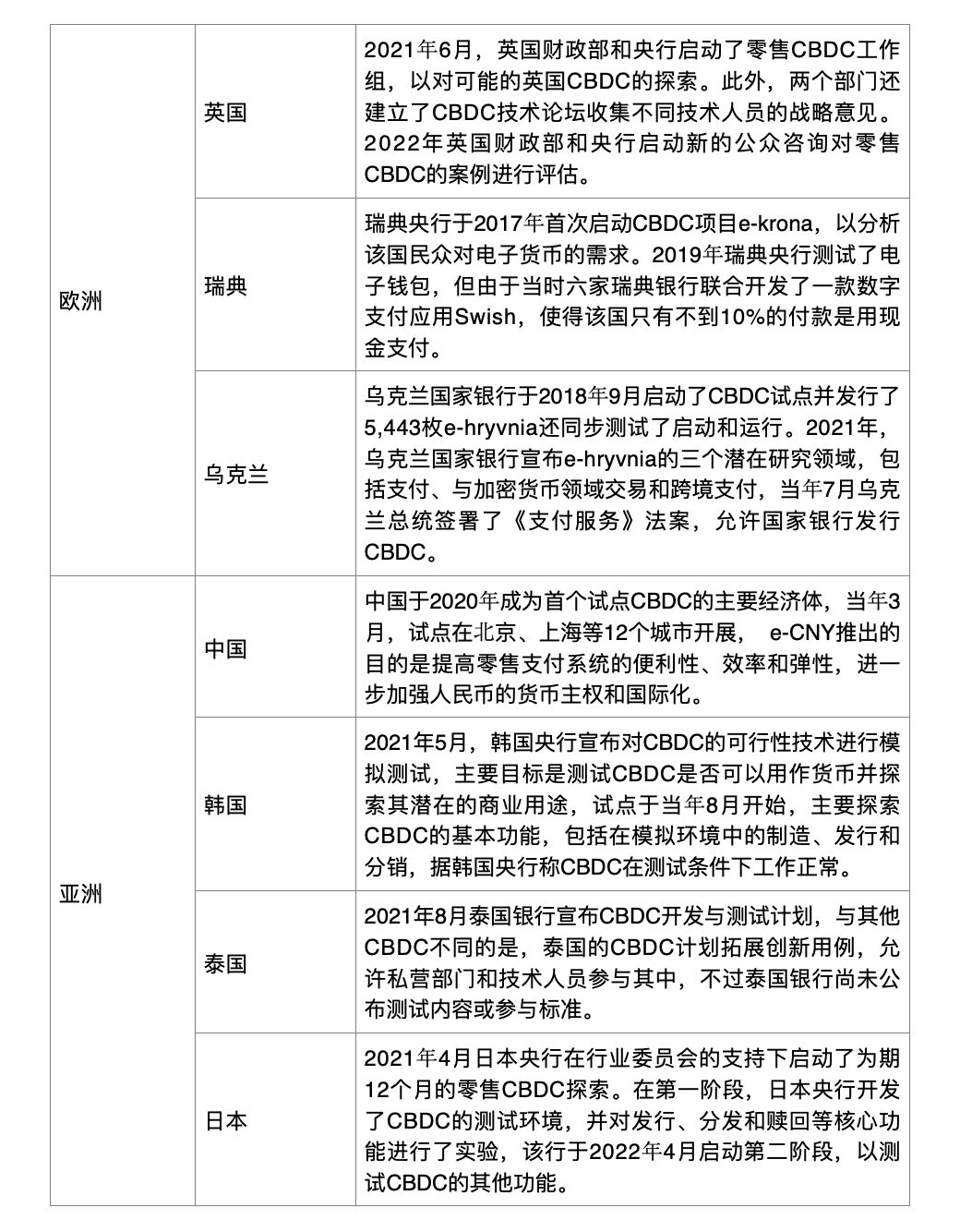

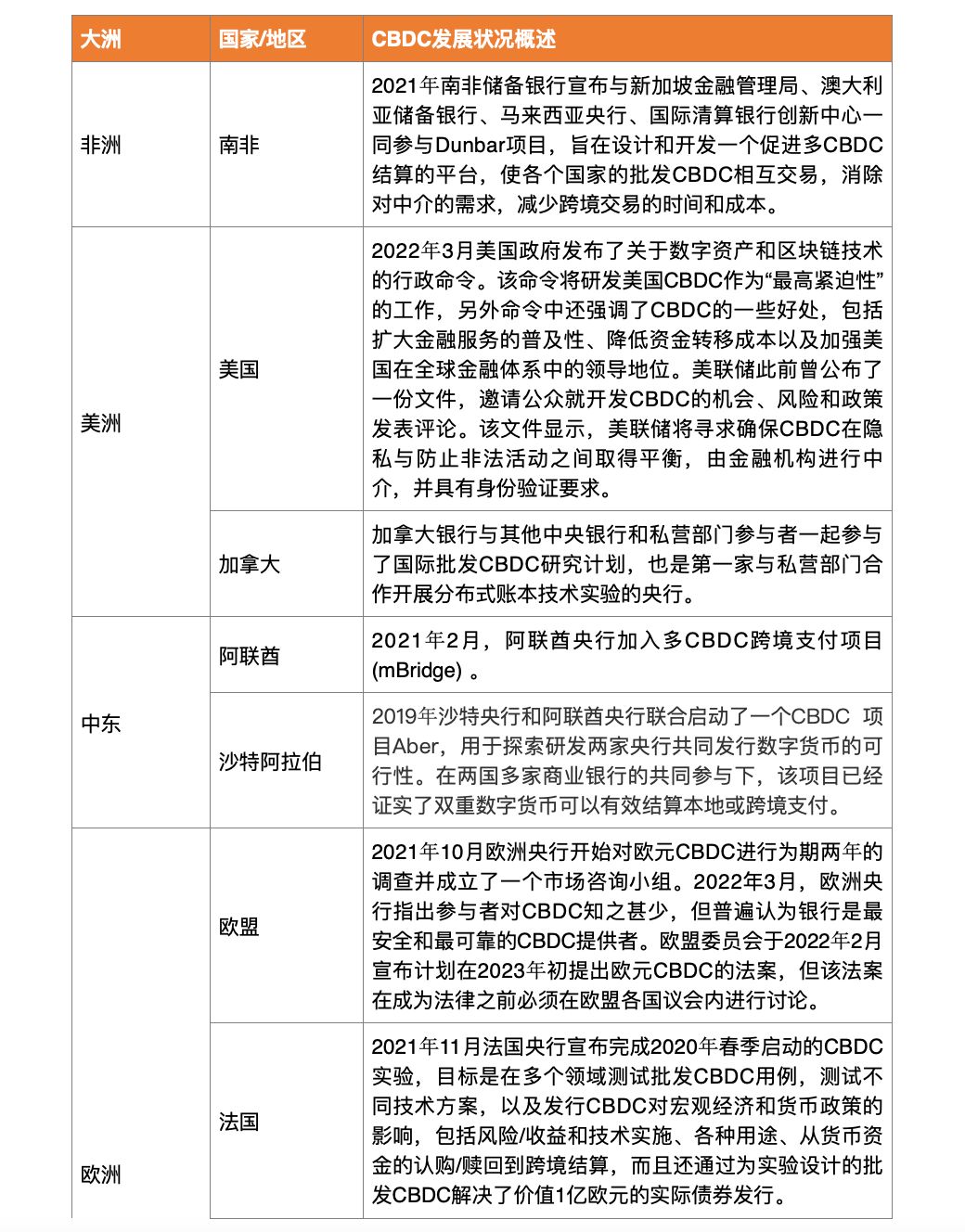

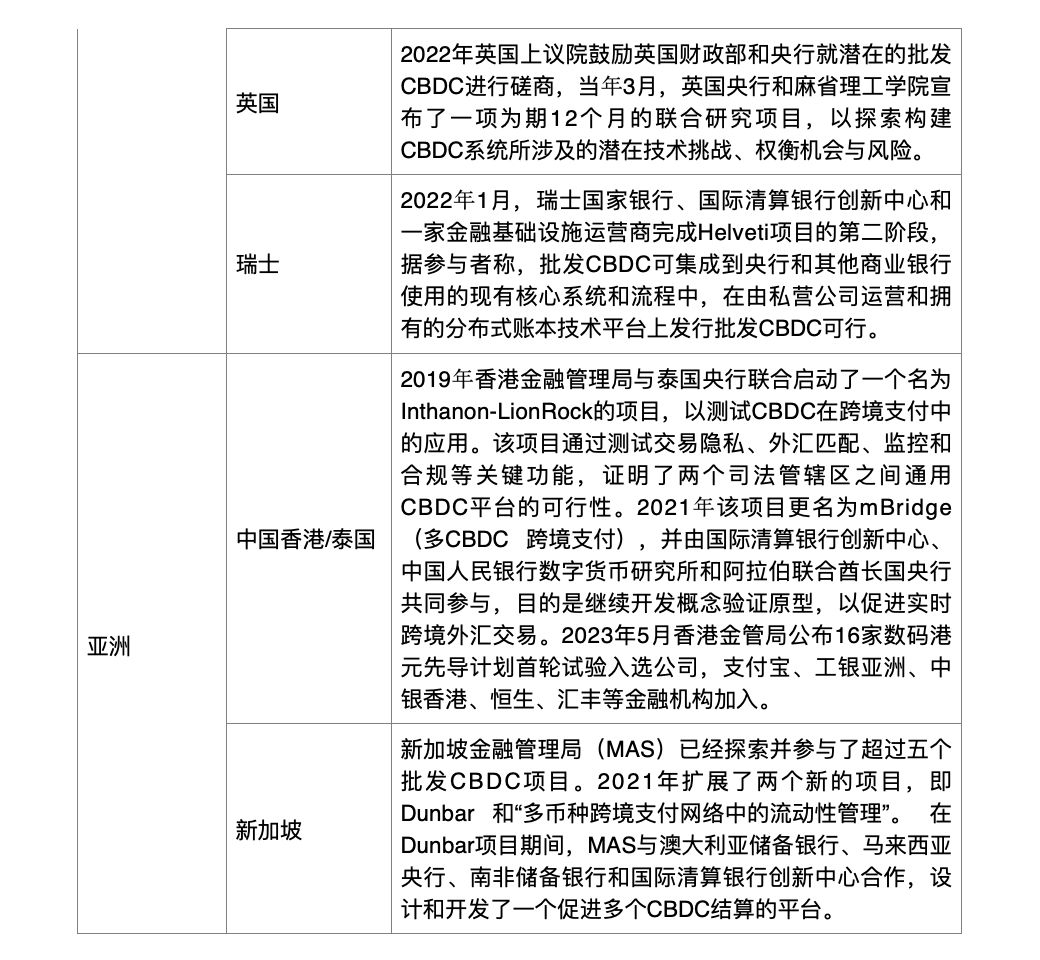

Global CBDC track development status and policy layout

According to the current mainstream framework model, the current CBDC track is mainly divided into two categories: retail and wholesale. Retail CBDC mainly explores digital currencies for use by the general public, while wholesale CBDC is a digital currency used by financial institutions with accounts at the central bank. , Meta Era will also conduct classification exploration from these two framework modes:

Retail CBDC

Wholesale CBDC

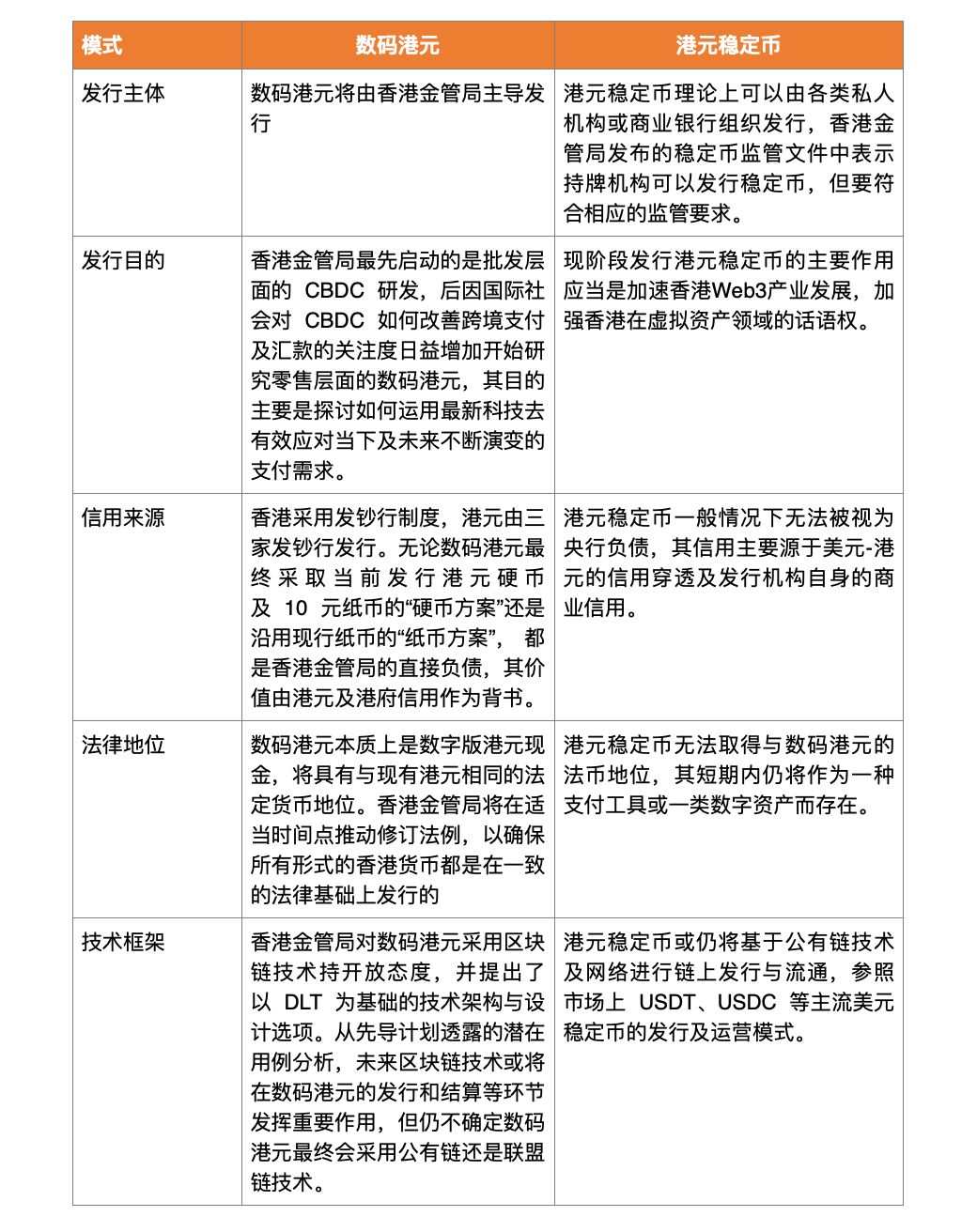

Is the Digital Hong Kong Dollar a Hong Kong dollar stable currency?

We know that at the end of 2023, the Financial Services and the Treasury Bureau (Treasury Bureau) of Hong Kong and the Hong Kong Monetary Authority (HKMA) jointly issued a public consultation document to collect opinions on legislative proposals for the supervision of stablecoin issuers, which formally proposed that The licensing system is implemented through the introduction of new legislation, which requires all eligible issuers of fiat currency stablecoins to obtain a license from the Monetary Authority, and only designated licensed institutions can provide services for purchasing fiat currency stablecoins, and only licensed issuers can provide services for purchasing fiat currency stablecoins. Legal stablecoins issued by investors can be sold to retail investors.

According to the Hong Kong Monetary Authority, Hong Kong promulgated this consultation document on stablecoins to provide clear guidance for the local regulatory framework for stablecoins. It can also improve the transparency and investor confidence of the Hong Kong stablecoin market and provide stablecoin issuers with and service providers, thereby promoting the development of fintech in Hong Kong and attracting more digital asset transactions.

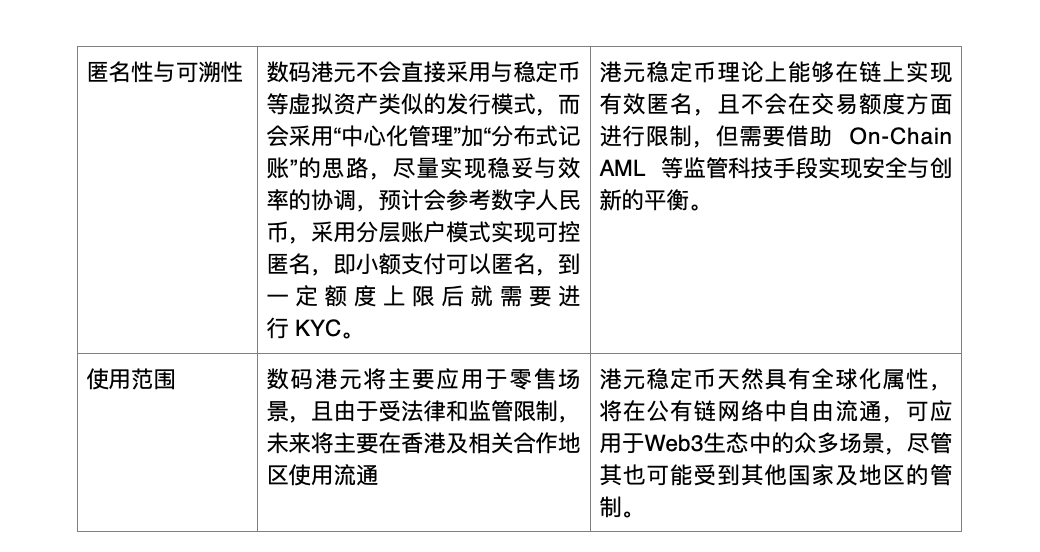

So, what is the difference between a Hong Kong dollar-based stablecoin and a CBDC-based digital Hong Kong dollar?

Frankly speaking, many people easily confuse the two concepts of digital Hong Kong dollar and Hong Kong dollar stable currency. Meta Era will provide a little science from the following seven aspects:

According to the Hong Kong Monetary Authority’s requirements for stablecoin issuer licenses and with reference to international regulatory practices, it is recommended that the company’s equity requirement is 25 million yuan, or 2% of the circulation of legal currency stablecoins, whichever is higher. Institutions and senior managers need to be permanently stationed in Hong Kong , must also comply with anti-money laundering regulations, and must also have disclosure and auditing requirements.

As Yue Weiman, the Secretary of the Hong Kong Monetary Authority, said that stablecoins have the opportunity to become the interface between traditional finance and the virtual asset market. Whether stablecoins truly meet the conditions of stable will become particularly important. According to the relevant content in the consultation document, since only stablecoins issued by licensed issuers can be sold to retail investors, in other words, for stablecoins such as Tether (USDT) currently used in the market to invest in virtual assets, their issuers In the future, if you do not obtain a license from the Hong Kong Monetary Authority, you will not be able to sell it to retail investors. Stablecoins do not yet have an independent regulatory framework. For the time being, like other virtual assets, related purchase services are only available to professional investors.

In particular, it is important to note that issuing and promoting stablecoins without a license in Hong Kong is likely to be a criminal offence. Yes, you read that right. The Hong Kong Monetary Authority’s Stablecoin Consultation Document states that it is a criminal offense to issue stablecoins in Hong Kong without a license and to issue advertisements to promote stablecoins from unlicensed issuers. The document also recommends that the supervisory system should introduce a series of civil and regulatory sanctions. The HKMA may consider imposing appropriate penalties based on the severity and duration of the violation, including temporary or permanent suspension of the license, revocation of the license, and a fine of not more than 1,000. Ten thousand yuan, or a fine equivalent to three times the amount of profit gained or loss avoided due to the violation, whichever is higher.

One thing that is confirmed is that Hong Kong is providing clear guidance on the regulatory framework for CBDC and stablecoins, which not only outlines a series of requirements for stablecoin issuers, exchanges and wallet service providers, but also covers risk management, auditing and Investor protection and other aspects will then promote the development of financial technology in Hong Kong and attract more digital asset transactions.

Summarize

Overall, CBDC will not only facilitate more efficient, lower-cost and 24/7/365 payments in the financial services industry, but will also benefit cross-border transactions and the cross-border economy in all relevant jurisdictions, as the European Central Bank has confirmed CBDC can be better applied in online payments and peer-to-peer transactions. Other application roles may include tax payment, welfare payment income and transaction payments.

At the same time, stablecoins are also becoming complementary to the existing payment ecosystem and provide most of the same utilities as CBDC, such as transmissibility, continuous settlement, traceability, cross-border interoperability, relative to traditional payments Low transaction fees and programmability of the infrastructure, but without limitations.

As can be seen from the analysis of the global CBDC and stablecoin layout in this article, Hong Kong is one of the few jurisdictions in the world that is exploring both CBDC and stablecoins. The digital Hong Kong dollar is also another central bank digital currency launched by a major economy after China’s digital renminbi. currency, indicating that central bank digital currency has entered the substantive application stage from the conceptual stage, and will encourage other countries to accelerate the research and development and piloting of central bank digital currency. As an international financial center, the launch of the Digital Hong Kong Dollar, the central banks digital currency in Hong Kong, will provide a platform for cooperation with other countries and regions in the field of central bank digital currencies and promote the cross-border use and interoperability of central bank digital currencies.

In the next few years, the development of Hong Kongs CBDC and stablecoin markets will depend on factors such as the regulatory environment, market trends, and technological innovation. A series of positive initiatives will also help improve market transparency and investor confidence.