In 1606, the Netherlands issued the first stock in human history. From then on, the new form of public fundraising created public value that could be shared by the public. Today, Nvidia, worth $3 trillion, is a profound echo of this 400 years later.

Times have changed. Although the stock market is still the mainstream choice today, most small countries are unable to participate in it. Crypto assets such as Bitcoin are more suitable for small countries to participate in the global mainstream asset pricing system. As far as El Salvador, Bhutan has officially participated in Bitcoin mining.

With the return of Trump, the United States and many countries are trying to establish cryptocurrency reserves in addition to the single currency and mining form of BTC. This is the first time in human history that this has long been the role of precious metals such as gold and silver and the US dollar.

Coincidentally, CZ, who has started anew, also tweeted that Bhutan may include ETH and BNB in Bhutan’s reserves. Following the trend, on January 8, Bhutan’s GMC officially included BNB in its reserves together with BTC and ETH. However, compared with the unique value of digital gold and “ETH is Money”, what does BNB represent?

There is no need to say much about BTC. BTC gives value to cryptocurrencies and is the source of their legitimacy. ETH’s value has been proven by the frequent purchases by retail investors and Trump. However, BNB has long been overshadowed by Binance’s halo, and its unique value in the on-chain ecosystem has long been undiscovered.

Today, we will start with Binance and look back on the long eight years of spring, summer, autumn and winter. The value contained therein will affect the blockchain industry in the next few decades.

Origin: BNB is Binance

In 2008, Satoshi Nakamoto created Bitcoin and opened up the Eden of decentralized value for mankind. Like the founder of a story in ancient civilization, his face is always vague, but his influence is profound. The most important of these is his transaction attribute. A peer-to-peer electronic currency naturally implies value exchange.

Thus, starting from Mentougou, the era of thousands of battles has arrived, and the most important ones are Binance and Coinbase. The former represents the deep cultivation of the on-chain ecology and regards CEX as a stage to free value, while the latter embraces the existing system and moves towards listing.

In 2017, Binance, as a rising star in the exchange system, announced the role of BNB when it launched the exchange. It can be said that Binance has been implementing token economics from the beginning, embracing blockchain, and embracing tokens is the underlying memory of Binance.

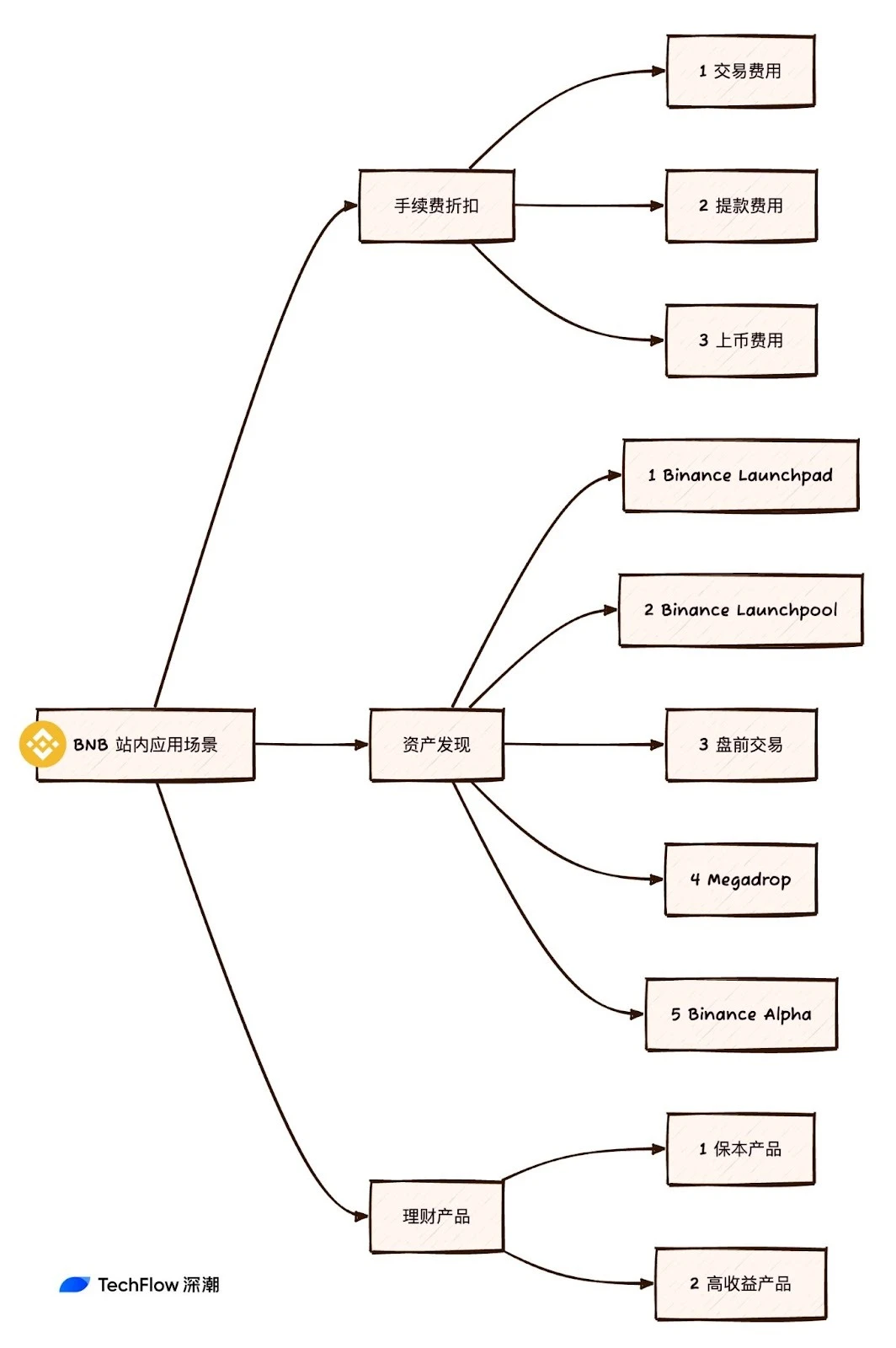

If you look through Binances white paper, in addition to the usual exchange itself, it emphasizes the many roles of BNB, which can be divided into two major roles: transaction fee discounts and participation in platform governance. Among them, transaction fee discounts mainly refer to the fact that platform coin holders can enjoy handling fee discounts within different coin holding ranges, which is equivalent to growing together with the platform and sharing transaction dividends.

Participating in platform governance mainly means that when a project party applies for listing, they need to hold platform coins or pay a certain amount of platform coins as a guarantee, and platform coin holders can vote to select project parties to list coins.

The price of platform coins needs to be strongly controlled by the exchange itself as the minimum source of value for the platform coins. In addition, there are two main specific ways to implement it: the burning mechanism and expanding the usage scenarios.

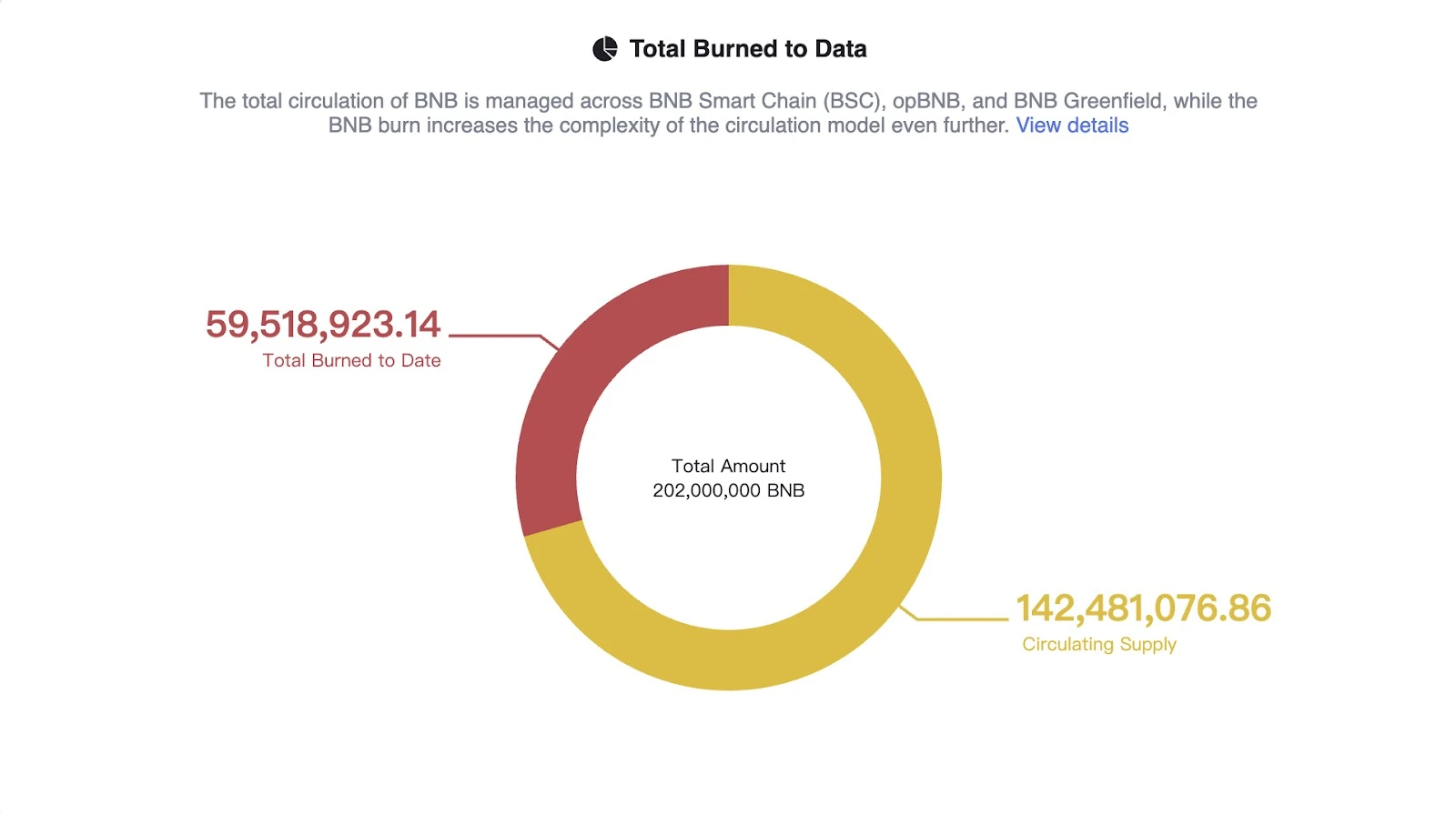

In addition to its most basic functions, the BNB burning mechanism has been operating efficiently. Every quarter, Binance will use its own profits to repurchase BNB and destroy it. The current circulation of BNB is about 145 million. At the current destruction rate, its total amount will drop to 100 million in about four years.

Taking the most recent quarterly destruction as an example, on January 23, the BNB Foundation conducted its 30th quarterly destruction and publicly burned 1,634,200.95 BNBs with a market value of approximately US$1.16 billion.

More importantly, BNB and Binances form of value discovery are closely integrated. From Launchpad, which was transformed from traditional finance, to Megadrop, which refers to industry native, Binance has always led the trend of Crypto asset discovery and issuance.

Upon closer inspection, we can find that Binance currently has Binance Launchpad, which was launched in 2019, creating a new form of cryptocurrency crowdfunding, namely the IEO method we are familiar with, which not only avoids on-chain disorder and fraud, but also provides BNB holders with the privilege of new issuance.

In 2020, Binance followed suit and launched Launchpool, which supports users to stake BNB and obtain new token rewards. When used in conjunction with Launchpad, users can maximize their share of new coin dividends.

In 2024, Binance conducted a total of 21 Launchpool events, with a total locked amount of US$1.53 billion at the end of 2024 and more than 6.1 million participants.

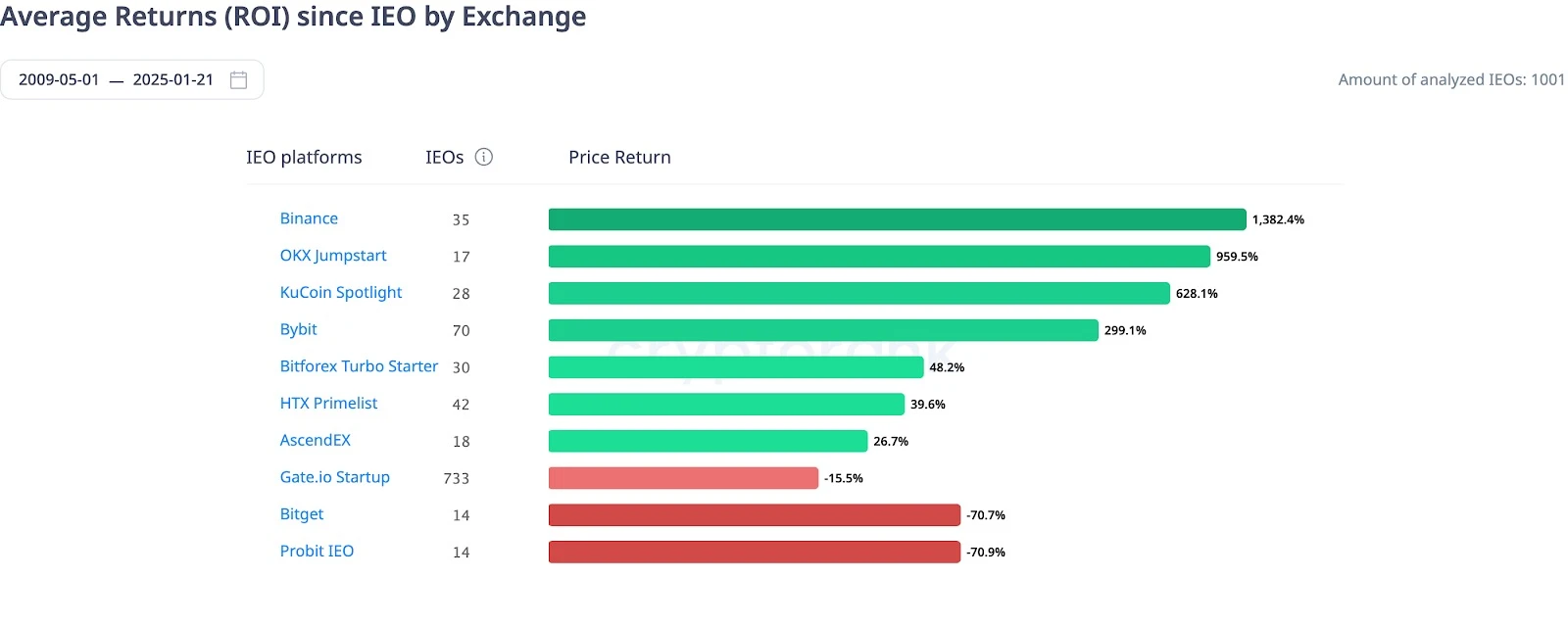

On an historical scale, Binances ROI rate of return on new listings topped the list at 13 times, and BNB holders also reaped great rewards.

But this is not the end. How to better connect the on-chain ecosystem will become Binances next focus. In 2024, Binance launched Megadrop, seamlessly integrating Binance Earn Coins products with Binance Web3 wallet, redefining the airdrop experience.

Binance selects projects and seeks high-quality customers. The key to scoring is the amount and time of locked BNB. The longer the subscription period and the larger the subscription amount, the more points will be obtained.

But this is not proactive enough. Binance needs to be more proactive in reaching out to early-stage projects and discover alpha projects before the coins are issued and before they are launched. Binance Alpha is officially launched and mainly operates within the Binance wallet. If you list Binance Alpha first, there is a certain probability that it will be listed on the Binance main site.

Binances original intention is to do a good job in asset discovery and issuance and lead the trend of industry change. During this period, there is also Binance wealth management products, which has created a Binance wealth management system with BNB as the core. Under the dichotomy of capital preservation and high returns, BNB holders can choose a variety of wealth management products and use BNB as principal to earn higher returns.

In addition to abstract scenarios and architectures, the actual value of BNB is a concrete pragmatism. We will take Solv Protocol as an example to illustrate the seamless flow of BNB in the Binance ecosystem. The correct way to kill two birds with one stone is to deposit BNB into the Binance wallet and then continue to participate in on-chain staking and re-staking activities.

Through the matching of the abstract and the concrete, Binance has maximized the potential of BNB. However, it must be acknowledged that the existence of centralized exchanges is both the only way for humans to achieve freedom and an obstacle that traps people. Different choices do not conflict but are more of a compromise based on time and place.

Humans yearn for freedom and decentralization, and also pursue efficiency and security. However, the development of the real world is always faltering and full of trade-offs. The comparison spectrum before people is never freedom or unfreedom, decentralization or centralization, but the choice of the best among freedom, security, efficiency, and ease of use.

The choice of different path priorities becomes a different odyssey for each participant.

Odyssey: BNB is BNB Chain

During the long season, the lonely traveler can only enter the Western world without framework and rules. In the public chain war that started in 2021, exchanges also joined in, but only three and a half survived, BTC/ETH, BNB Chain, which was called BSC at the time, and half of Solana, which is in a fierce battle with ETH.

Today, the BNB public chain ecosystem, after the name change from BSC, is collectively called oneBNB, which includes BSC, opBNB, and GreenField, which focuses on the storage concept.

BNB Chain is actually a very special product. It is different from the strategic alliance of Solana and FTX, and also different from the self-entertainment of a number of exchanges public chains. BNB Chain really has everything a public chain should have.

The serious side: AI First Chain

BNB is not simply backed by the Binance exchange, nor is BNB Chain. To be more precise, the BNB Chain ecosystem has a huge number of on-chain users and transaction volumes, as well as active developers.

In terms of on-chain transaction volume, BNB Chain and Tron are the only two public chains with real demand. Tron is mainly used for daily use of USDT, while BNB Chain is a new chain that keeps pace with the changes of the times.

BNB Chain currently has 5,607 Dapps, nearly one million active addresses (UAW), and a DeFi TVL of $3.6 billion. Many indicators are even ahead of Ethereum.

For example, after CZ retweeted Magic Eden’s announcement that its platform had added support for BNB Chain, ME broke through $4.4 in the short term, and the wealth effect of BNB Chain remained the same.

BNB Chain is also the most important DeFi market leader outside of ETH. In the BNB ecosystem, meeting urgent needs and thinking about what users want has always been a way of working. It is during the past few years of accumulation that BNB Chain has determined its latest positioning: to be a public chain in the AI era.

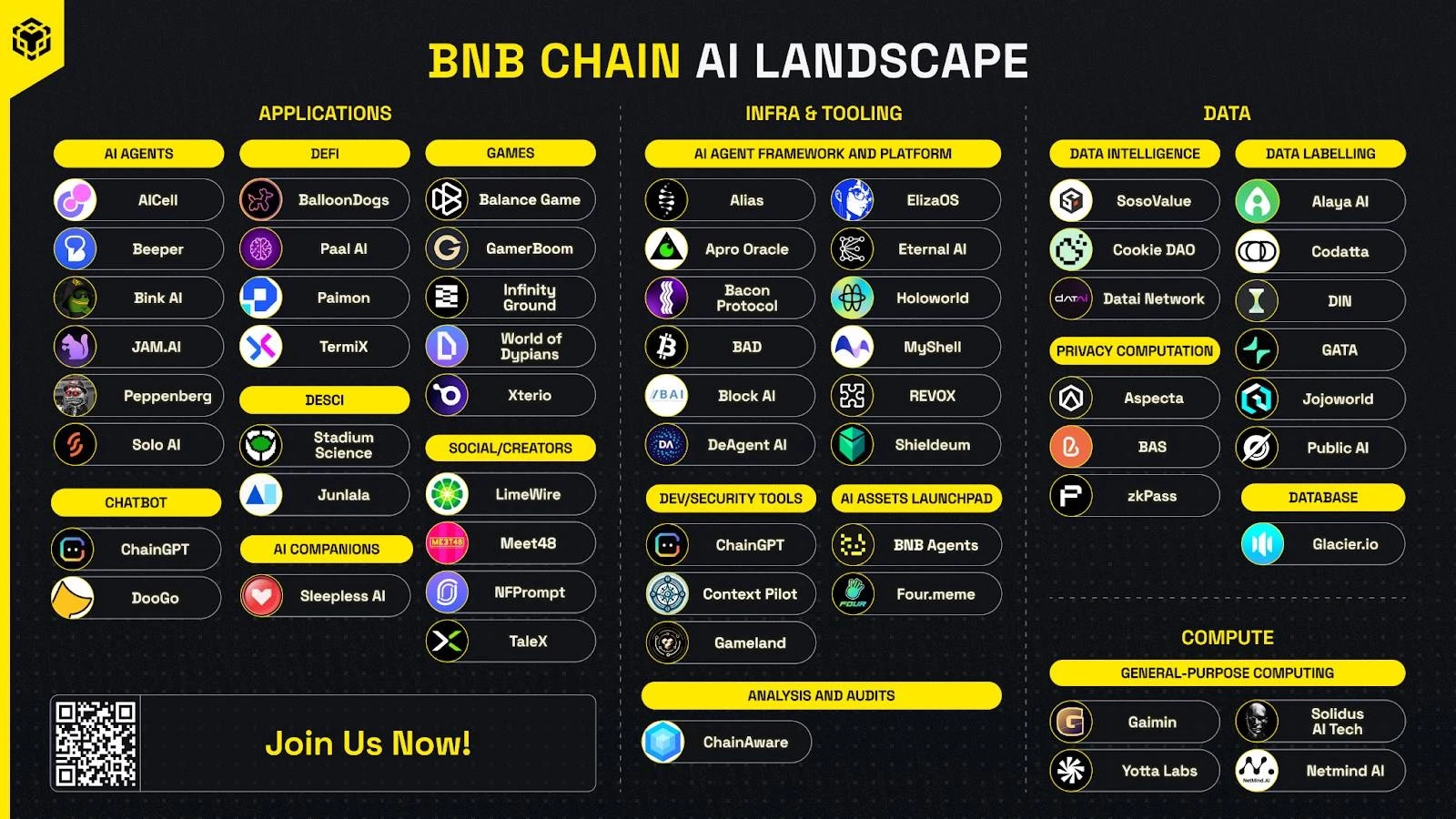

From DeFi, NFT to todays Meme and AI, BNB Chain has always been a trendsetter of the times. Under the guidance of the AI First idea, BNB Chain has laid out the three basic projects of computing power, data and models required by AI, and launched new projects and new tokens on this basis to complete its own business closed loop.

The most typical of these is MyShell. As an old AI Agent project, Myshell has attracted a large number of users with its strong technical strength and was successfully selected into the 2023 BNBChain and Binance Labs MVB Season 6 incubation program.

Although the meme becomes strange, AI is very suitable to be completed on the chain, such as using cheap labor for data labeling and completing salary payments in cryptocurrency, and BNB Chains Greenfield can be used for storage, and everything can be done within the BNB Chain.

For example, DIN, the leading data annotation project in the BNB chain field, is benchmarked against ScaleAI, a giant in Web2. The project has currently received investment from Binance Labs.

In 2025, BNB Chain will implement the established idea of AI priority, empower the existing infrastructure from all processes of AI flow, and create the most active on-chain AI ecosystem.

Ecological prosperity is not a disorderly false fire, but a unique value support for its own advantages. According to on-chain data, BNB DEX trading volume has reached a high point in the past three years, with weekly trading volume exceeding US$17.74 billion.

For on-chain protocols and Dapps based on BNB, they will have stronger value support. In the mutual promotion of currency price and value, BNB will become a long-term value target.

Lively side: Happy-SciDesci

The competition in the on-chain ecosystem is both a competition of technology and a competition of traffic. However, beyond technical terms such as AI and public chain, BNB Chain is still exploring more possibilities.

For example, the Happy-Sci campaign initiated by Binance Labs researcher @cyodyssey has sponsored 500 doctoral students and made small payments to them through Trustwallet to make the boring scientific research life more colorful.

During the operation of the project, rewards are distributed through BNB Chain. BNB Chain has also received a lot of praise from PhD for its efficiency, not only because BNB Chain sponsored the project, but also because of BNBs support for various assets, especially stablecoins. PhD lives in different regions and uses various financial systems, and stablecoins can maintain the fairness of US dollar pricing. With the help of BNB Chains high speed and low fees, PhD can receive it directly in Binance or Binance wallet. Whether it is consumed through Binance Pay or exchanged for fiat currency, it will save huge time costs.

In addition to happy scientific research, the slightly more serious DeSci (decentralized scientific research) also has a deep connection with CZ and BNB Chain. CZ not only showed a keen interest in the research and application of Desci, but also supported the development of the project on many occasions.

Whether serious or joking, the development of BNB Chain is solid and powerful. It not only focuses on the underlying technology, but also continues to expand the wealth effect. PancakeSwap has developed from DeFi Summer to the present, and has never fallen into the route of opening high and closing low. The popularity of Meme platforms such as Four also shows that BNB Chain is always at the forefront of the times.

With both traffic and expertise, the future of BNB Chain is a great revolution, guiding more people towards freedom. In addition to trading and finance, BNB is also a valuable crypto asset. BNB is by no means limited to trading and Binance. The vast human world is a great space for BNB to leave its footprints.

Big Revolution: BNB is the Future

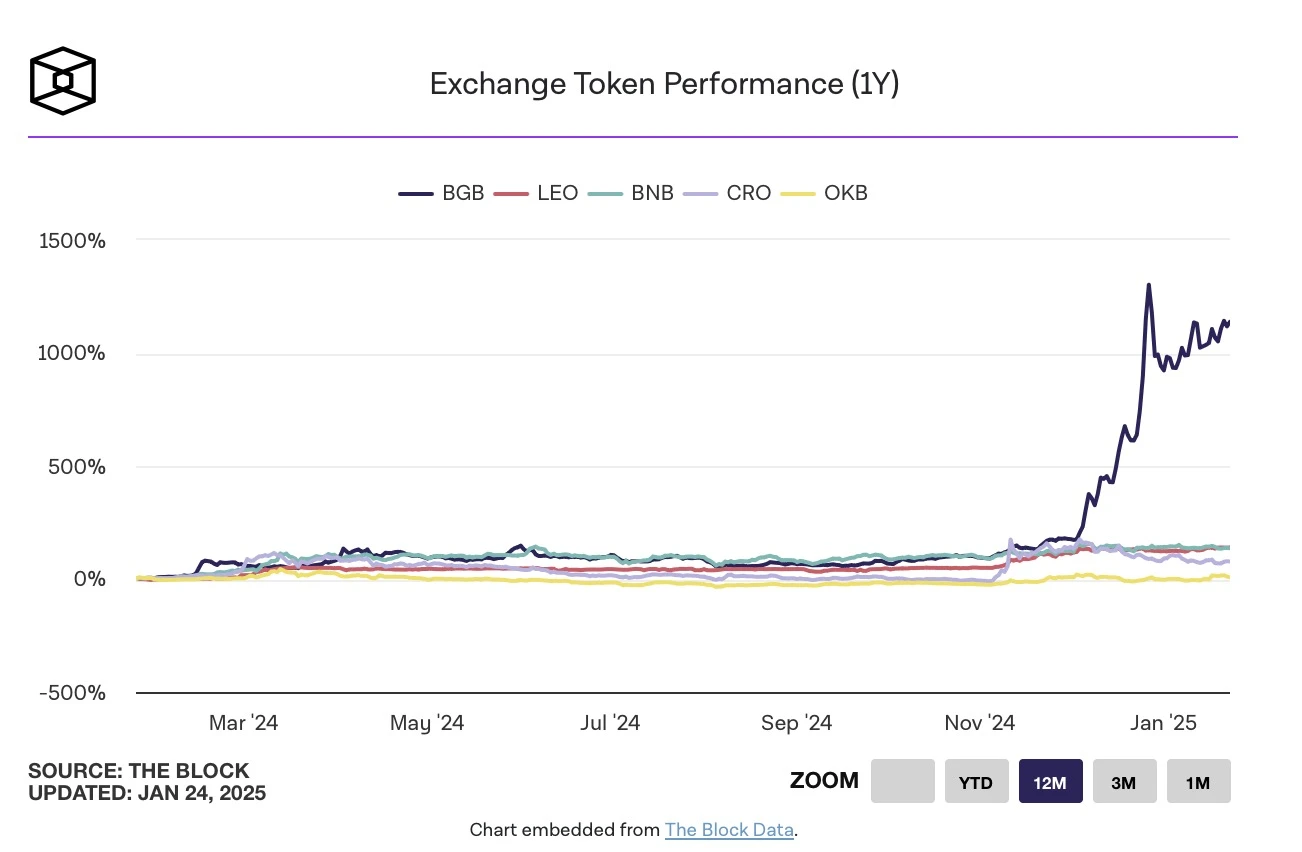

Throughout 2024, the price of BNB rose by 1.2 times, not only outperforming ETH by 46%, but even slightly ahead of BTC by 1.19 times. Among the top ten mainstream currencies, the increase was the most obvious.

Although BTC and ETH are still the worlds conceptual understanding of Web3, Binance is indispensable in the process of pushing the crypto world towards the mainstream. Binance can be considered a portal and a novice village. Only after trials can we enter the dark forest on the chain.

On the road to the mainstream, BNB must not be absent. It can be understood like the viewfinder of a camera. From a micro perspective, a closer look shows the composable banking of the on-chain world. From a meso perspective, the mid-term view is the strength of existing CEXs. Finally, from a macro perspective, the long-term view is the governments trend of cryptocurrency reserves.

The three together create the many aspects of BNB.

At present, Binance has obtained compliance licenses in 20 jurisdictions. In addition to compliance, it also has the trust of users. Binance currently has US$20 billion in user deposits and insists on publishing its own reserve status (PoR). All this trust makes Binance the first CEX to exceed US$100 trillion in total trading volume in 2024.

In addition to trading, BNB Chain is also actively expanding its possibilities.

BNB is not only a cryptocurrency, but also an important tool to connect global users, promote financial inclusion and technological innovation.

With the in-depth layout of BNB, off-chain consumption scenarios, especially stablecoin-based payments, will become the industry development trend in 2025. The average transaction fee of opBNB is US$0.001, and the average transaction fee of BSC is US$0.03, which is particularly suitable for stablecoin consumption. The fee rate is significantly lower than that of various existing card organizations.

For example, Singapore digital payment provider dtcpay has partnered with BNB Chain to accelerate the practical application of stablecoins. Enterprises using dtcpay can accept payments in stablecoins such as USDT and USDC through the BNB chain network.

Looking back over the past 8 years, BNB’s journey has just begun. It is no longer a new cryptocurrency, but is at a critical stage of cryptocurrency “adolescence”.

In 2017, Binance started as an exchange. In 2021, it began to delve into the on-chain ecosystem, and DeFi/NFT became actual tools. In 2024, it was AI, Meme, and DeSci.

The highest good is like water, BNB is invisible.

In the past 8 years, BNB has witnessed the evolution of the crypto industry from the Wild West to a mainstream issue, from a plaything for a niche group to a new technology paradigm known to the public. However, there is enough reason to believe that today is still the early stage of BNB. The journey of crypto gaining mainstream recognition is not easy, and the medal will be awarded to all those who stick to it. In the next 8 years,