Original author: ChandlerZ, Foresight News

On March 11, the market was seriously concerned about the rising risk of a US recession. As of the close, the three major US stock indexes collectively plummeted. The Dow Jones Industrial Average fell 2.08%, closing down nearly 900 points; the Nasdaq fell 4%, and the SP 500 fell 2.7%.

Large technology stocks plummeted, with Tesla plunging 15.43%, marking its biggest single-day drop in more than four years. Its market value evaporated by $130 billion overnight, and its stock price was halved from its historical high.

At the same time, Bitcoin continued to fall, officially falling below $80,000. As of press time, Bitcoin was at $79,090, and fell to a low of $76,560, a single-day drop of more than 8%. In addition, Ethereum briefly fell below $1,800, falling to a low of around $1,760. The positions of many ETH whales were liquidated, and the addresses holding leveraged long positions of 1,500 weETH (total debt of approximately 2.27 million DAI) were liquidated. After the price of ETH fell below $1,800, its 643.78 weETH (worth approximately $1.23 million) were confiscated.

Another whale on Maker also faced liquidation, involving 60,810 ETH (US$109 million). Since the Ethereum oracle price on Maker was not updated, the whale eventually reduced its position by 2,882 ETH in exchange for 5.21 million DAI to repay before the Maker oracle price was updated at 10 oclock, slightly reducing the liquidation price to US$1,781. In addition, a wallet suspected to be from the Ethereum Foundation deposited 30,098 ETH (worth US$56.08 million) into Maker 6 hours ago to lower the liquidation price. Currently, the wallet holds 100,394 ETH (worth US$182 million) in Maker, with a liquidation price of US$1,127.06.

According to Coinglass data, the total liquidation amount in the cryptocurrency market in the past 24 hours reached US$937 million, of which US$742 million was liquidated for long orders and US$194 million was liquidated for short orders. A total of 331,076 people were liquidated. The largest single liquidation occurred in the BTCUSD trading pair on the Bybit exchange, with a value of US$5.2611 million.

Since hitting an all-time high on December 16, 2024, the crypto market has lost $1.3 trillion in market value, a 33% drop, equivalent to an average daily loss of $15.5 billion for 84 consecutive days. This marks the largest three-month market value correction in crypto history, and the total value of crypto has now fallen to its lowest level since November 6, 2024.

Is the bull market really over? How long will this round of decline last? In a market where panic is spreading, are there still opportunities to buy on dips? How do institutions and traders view the market outlook? Lets take a look.

Institutional and Trader Perspectives

Arthur Hayes: Dont rush to buy the bottom, Bitcoin may bottom out around $70,000

BitMEX co-founder Arthur Hayes wrote that the plan is as follows: Be patient, dont rush. Bitcoin may bottom out around $70,000, a 36% correction from its all-time high of $110,000, which is very normal in a bull market. Then, we need the U.S. stock market to plummet in free fall, and then the big players in traditional finance will go bankrupt. Then, the Federal Reserve and central banks of various countries will start to release money to save the market, and then it will be all in. Traders will try to buy the bottom. If you are a risk-averse player, you can wait until the major central banks start to release money before increasing your position. You may not be able to buy the bottom exactly, but you dont have to suffer in a long consolidation period and potential floating losses.

It also points out that BTC trading is conducted 24 x 7, and anyone with internet access can trade it around the world. It cannot be printed indefinitely, and the result of failure is bankruptcy or liquidation. No countrys finances are directly tied to BTC price increases. Stocks are traded 8 x 5, and only certain people can trade them. They cannot be printed indefinitely, but if you have political connections, you may get bailed out after failure. US marginal tax revenue is directly tied to the stock market. Therefore, the stock market will eventually be bailed out, it just depends on whether your portfolio can survive when the bailout occurs. BTC is a truly free market, while the stock market is not. Therefore, in a fiat currency liquidity crisis, BTC will take the lead in the decline and rebound of the stock market.

Cathie Wood: The current market is digesting the final stage of the rolling recession

Cathie Wood, founder of ARK Invest, said that the current market is digesting the final stage of a rolling recession, which will give the Trump administration and the Federal Reserve more room for policy adjustments than investors expect, which may push the US economy into a deflationary boom in the second half of this year. Cathie Wood believes that the Federal Reserves monetary policy will be more flexible, and the market may underestimate this potential driving force for economic rebound.

A rolling recession refers to an economic phenomenon in which different industries and sectors take turns experiencing recessions while the overall economy and job market remain relatively stable.

YouHodler: Bitcoins current consolidation period may evolve into a medium-term bear market

Ruslan Lienkha, head of markets at YouHodler, noted that last year, Bitcoins consolidation phase lasted for several months (or even half a year) before the next wave of gains came. However, he believes that the current market environment is more complicated. Pessimism in the US stock market prevails, and concerns about a possible recession in the US are also increasing. Given these factors, the current consolidation period may evolve into a medium-term bear market.

But Lienkha pointed out that although Bitcoin has the potential to evolve into a safe-haven asset in the future, investors currently still view it as a high-risk asset that tends to react more dramatically to changes in market sentiment than traditional financial markets.

Yuga Vice President: If this is the beginning of a bear market, ETH may fall to $200-400

0x Quit, vice president of blockchain business at Yuga Labs, said that seeing some people predict that the bottom of ETH is around $1,500, this seems reasonable given the market we are experiencing, but you need to ask yourself an important question-are we at the beginning or end of the bear market?

If this is the end of the bear market, great. BTC has barely taken a big price hit and is holding steady at levels that were still all-time highs just a few months ago, which is very bullish for BTC.

However, if this is the beginning of a bear market, then be prepared to see ETH prices well below $1,500. It is quite ridiculous to think that an asset that is down 30% this week and over 50% in the past 3 months has a long-term final bottom only 20% away from here. If the bear market has just begun, ETHs target price may be $200-400, which means another 80% drop from the current price, a total drop of 90%, which is consistent with past bear markets.

0x Quit finally said: I personally tend to be bullish at this position, but my position layout can also accept the market continuing to fall. If you cant accept the worst expectations, please consider selling some.

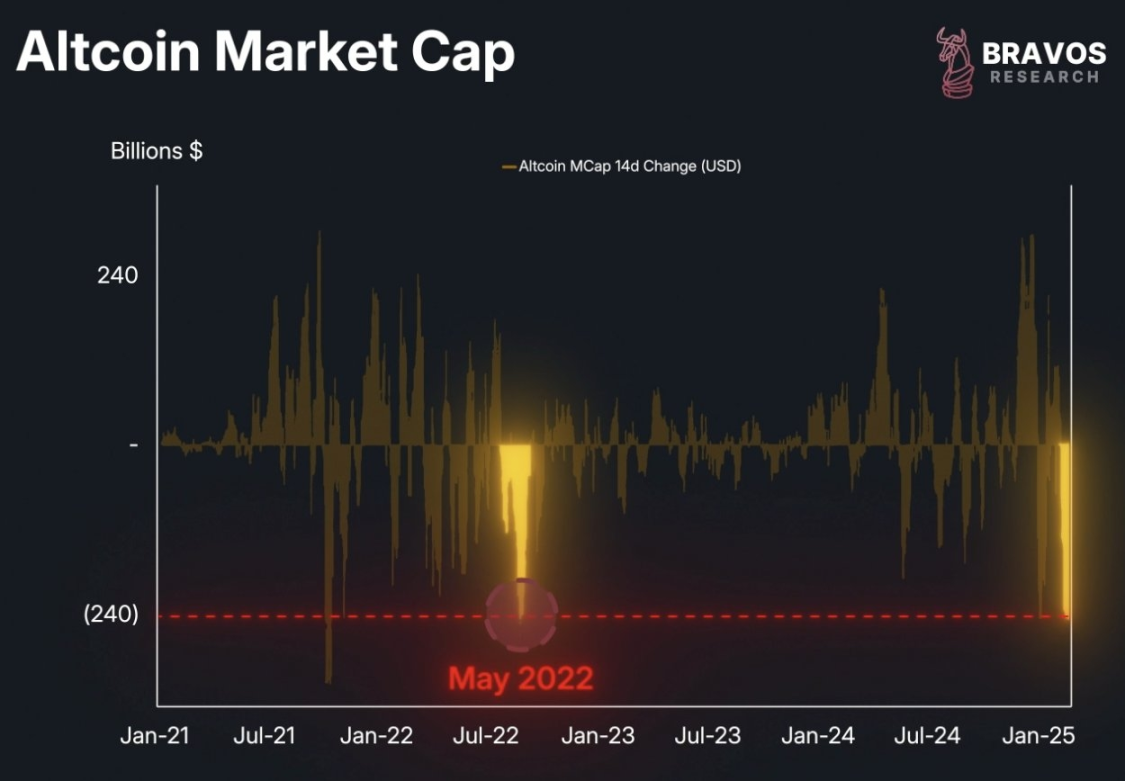

Bravos Research: Crypto Markets Are Experiencing the Largest Altcoin Liquidation Since the LUNA Crash

According to Bravos Research, the current cryptocurrency market is experiencing the largest altcoin liquidation since the LUNA crash in May 2022. The market has seen about $10 billion in liquidations, far exceeding the situation after the FTX crash. Data shows that Bitcoins dominance continues to rise, indicating that there is no obvious altcoin season signal in the short term.

Anthony Pompliano (Pomp): Trump deliberately crashed the market to force the Fed to cut interest rates

Crypto analyst Anthony Pompliano (Pomp) has a bold theory: The Trump administration may be intentionally creating chaos in the stock market in order to force the Federal Reserve to cut interest rates to avoid the United States refinancing about $7 trillion in debt. Pomp pointed out that the 10-year U.S. Treasury yield has fallen from 4.8% in January to 4.21% now, indicating that the strategy is moving in the right direction.

Trump once said on Fox News that no one can get rich when interest rates are high because people cant borrow money. The market expects the Fed to maintain the current interest rate at its March meeting, but the possibility of a rate cut in May is close to 50%.

Eugene: The small limit order for long SOL at $113 has been triggered

Eugene Ng Ah Sio posted on his personal channel that a small SOL limit order was triggered at $113 - lets see if this marks some form of short-term bottom.