Original post by: @desh_saurabh

Original translation: TechFlow

Zero-sum attention game

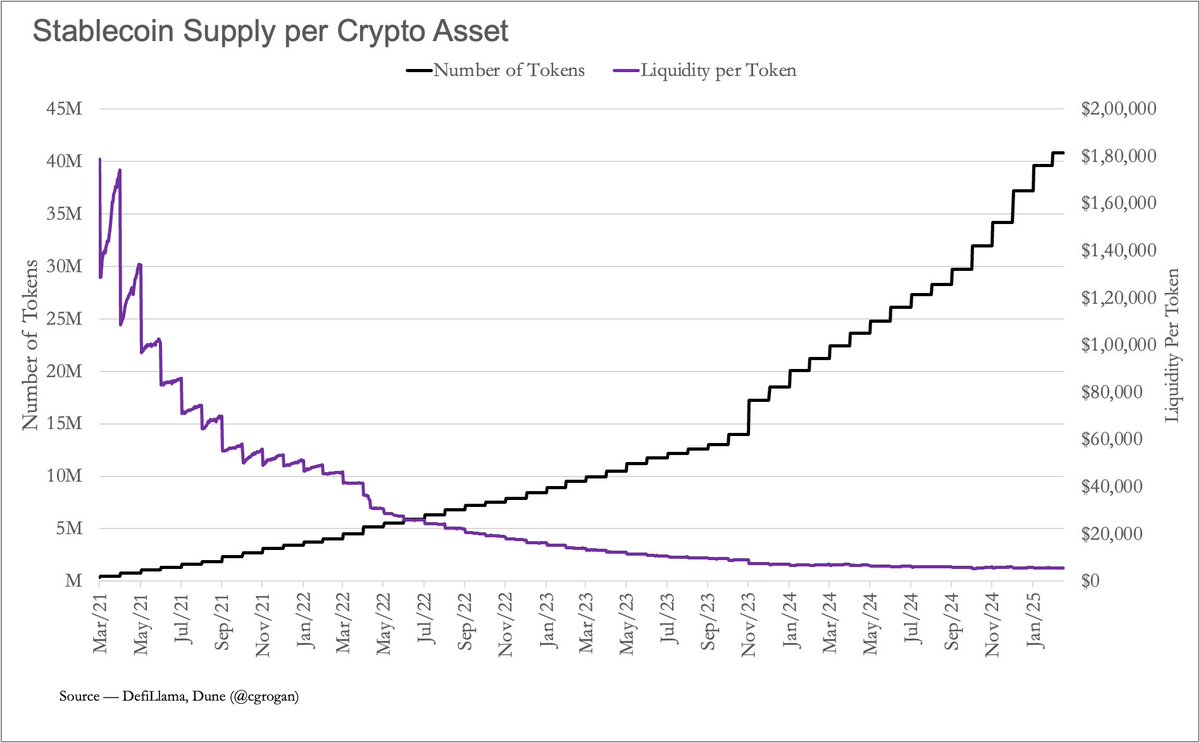

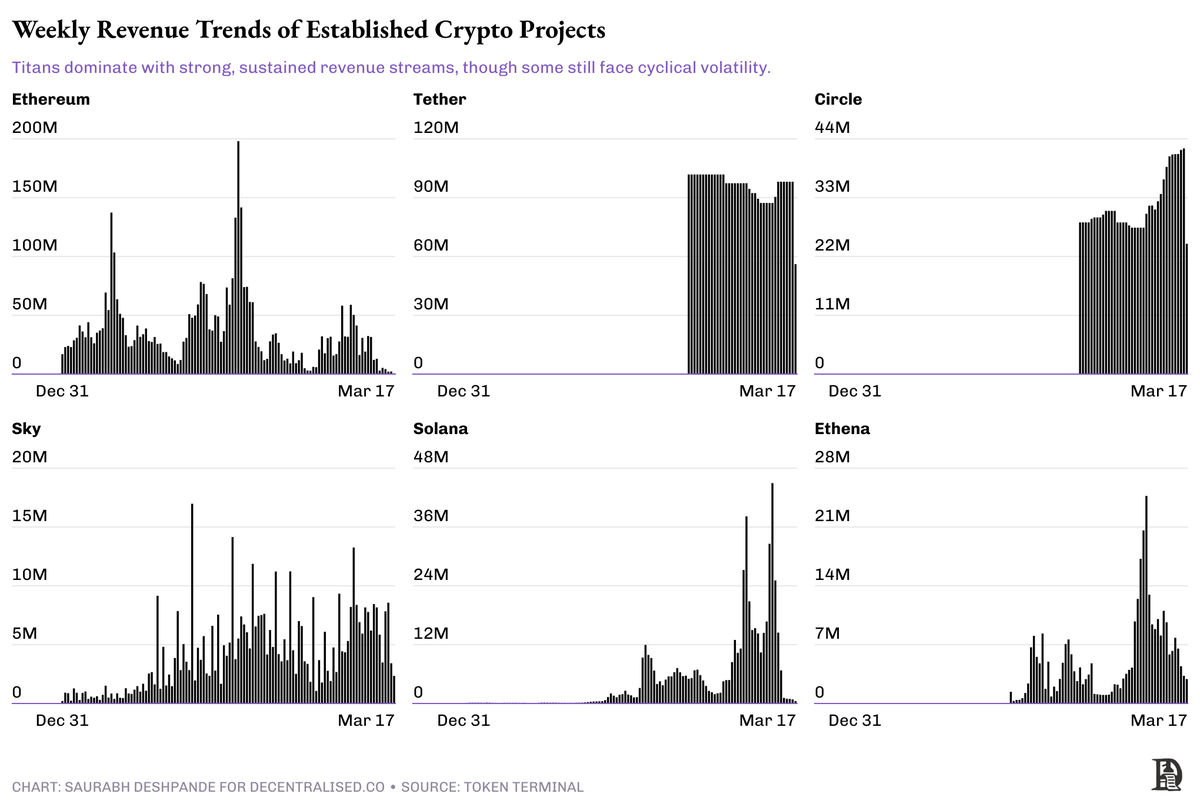

In 2021, each crypto asset had an average of about $1.8 million in stablecoin liquidity. However, by March 2025, this figure had plummeted to just $5,500.

This chart visually illustrates the decline in averages, and also reflects the zero-sum nature of attention in crypto today. While the number of tokens has ballooned to over 40 million assets, stablecoin liquidity (a rough measure of capital) has stagnated. The result is brutal — less capital per project, weaker communities, and rapidly fading user engagement.

In such an environment, short attention spans are no longer a channel for growth, but a liability. Without the cash flow to back it up, that attention can shift quickly and relentlessly.

Income is the anchor of development

Most projects are still building communities the way it’s 2021: create a Discord channel, offer airdrop incentives, and hope that users will yell “GM” (Good Morning) long enough to generate interest. But once the airdrop is over, users quickly leave. This is not surprising, as they have no reason to stay. This is when cash flow comes into play - it is not only a financial metric, but also an important proof of project relevance. Products that can generate revenue mean there is demand. Demand supports valuation, which in turn gives tokens gravity.

While revenue may not be the ultimate goal of every project, without it, most tokens simply won’t survive long enough to become foundational assets.

It is important to note that some projects are positioned very differently from the rest of the industry. Ethereum, for example, does not need additional revenue because it already has a mature and sticky ecosystem. Validators are rewarded with inflation of about 2.8% per year, but this inflation can be offset by the fee burning mechanism of EIP-1559. As long as the burning and income can be balanced, ETH holders can avoid the risk of dilution.

But for new projects, they don’t have such luxury. When only 20% of the tokens are in circulation and you’re still trying to find product-market fit, you’re effectively like a startup. You need to be profitable and prove your ability to be consistently profitable in order to survive.

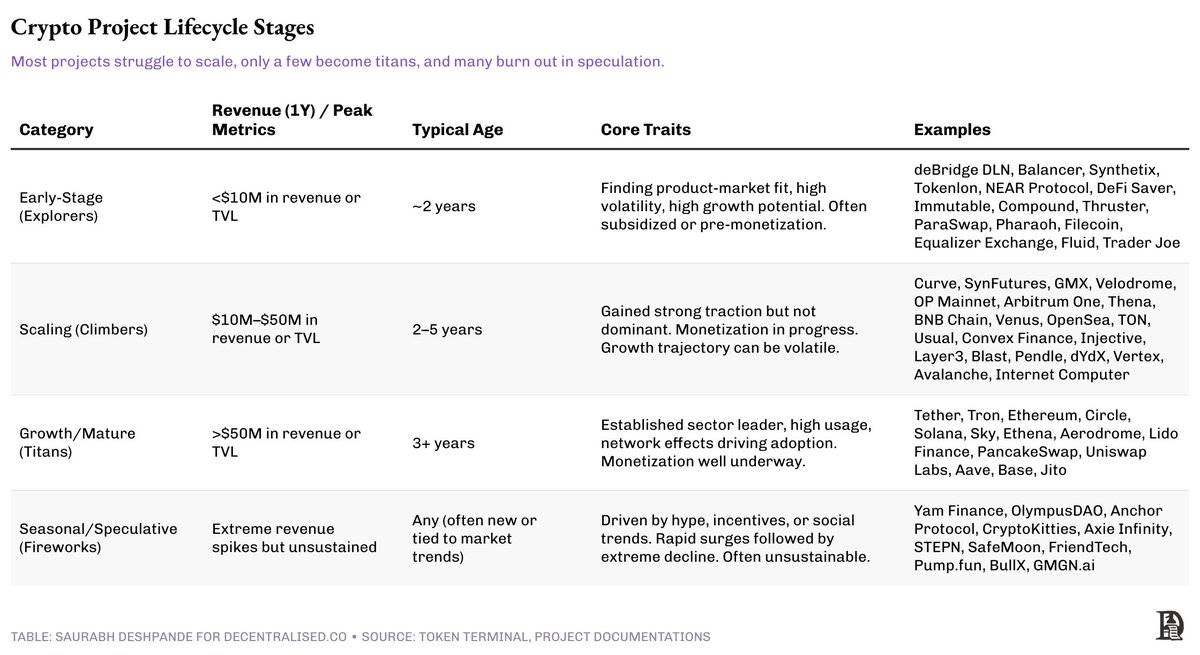

The life cycle of a protocol: from explorer to giant

Similar to traditional companies, crypto projects also go through different stages of maturity. At each stage, the relationship between the project and its revenues — and whether it chooses to reinvest or distribute revenues — changes significantly.

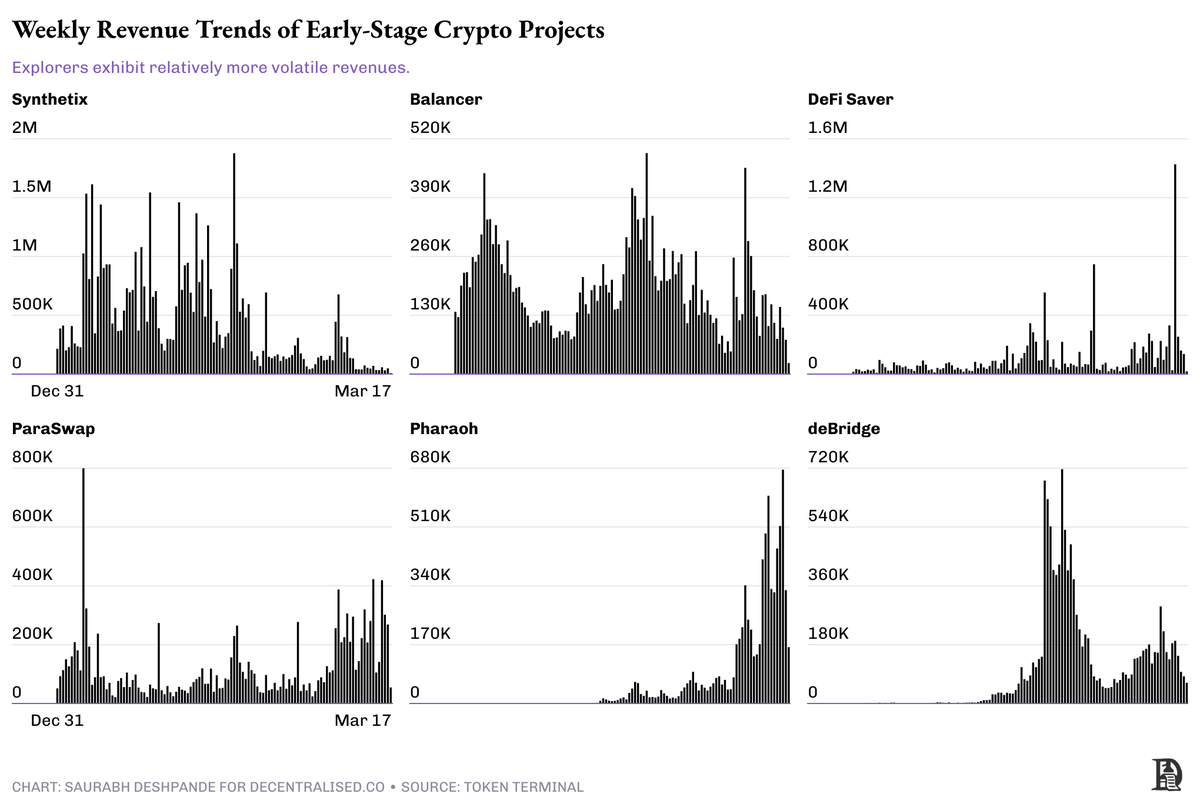

Explorers: Survival First

These are early-stage projects that often have centralized governance, fragile ecosystems, and are more focused on experimentation than profitability. Even when there is revenue, it is often volatile and unsustainable, reflecting market speculation more than user loyalty. Many projects rely on incentives, grants, or venture capital to survive.

For example, projects like Synthetix and Balancer have been around for about 5 years. They have weekly revenues between $100k and $1m, with some unusual spikes during peak activity. Such wild swings and pullbacks are typical of this phase, and are not a sign of failure, but rather a manifestation of volatility. The key is whether these teams can turn their experiments into reliable use cases.

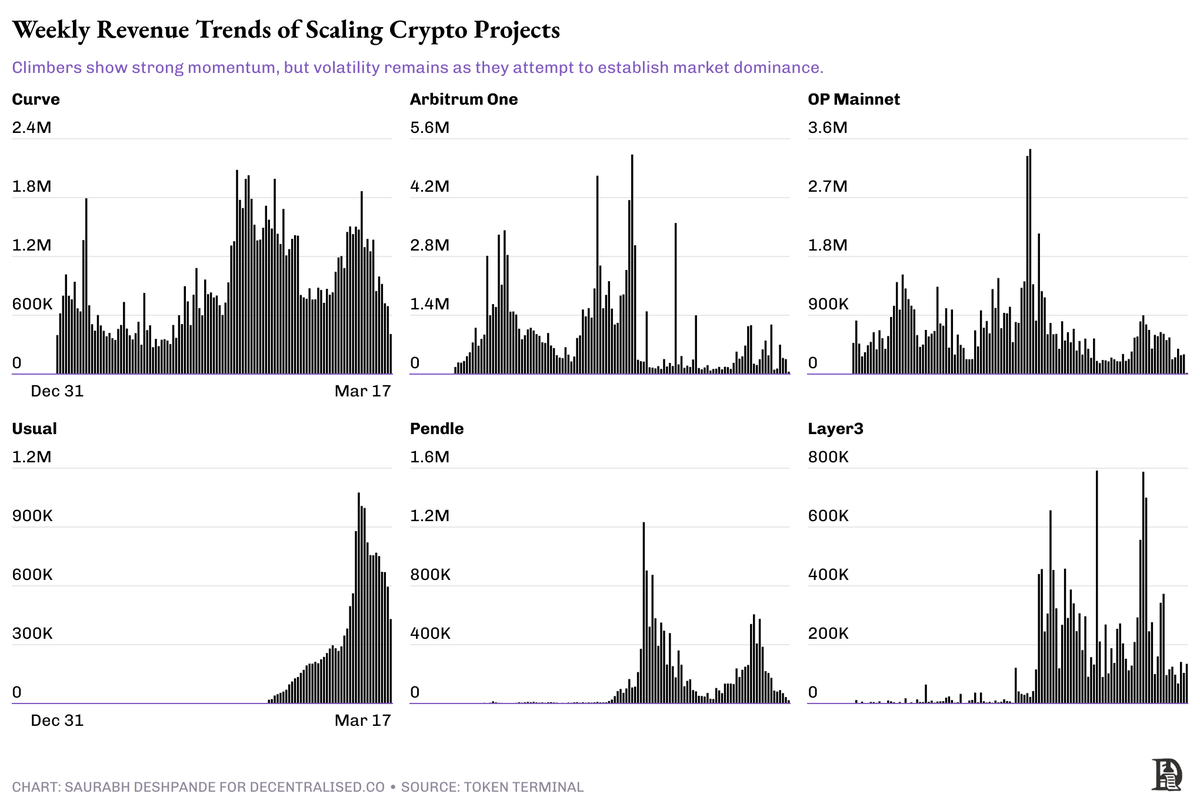

Climbers: Traction but still unstable

Climbers are advanced-stage projects with annual revenues between $10 and $50 million, moving away from a growth model that relied on token issuance. Their governance structures are maturing, and their focus is shifting from pure user acquisition to long-term user retention. Unlike Explorers, Climbers’ revenues have proven demand over different cycles, rather than being driven by one-off hype. At the same time, they are undergoing a structural evolution — transitioning from centralized teams to community-driven governance and diversifying revenue streams.

Climbers are unique in their flexibility. They have built up enough trust to experiment with distributing revenues—some have started revenue-sharing or buyback programs. But at the same time, they run the risk of losing momentum, especially if they overextend or fail to deepen their moats. Unlike Explorers, whose primary task is survival, Climbers must make strategic trade-offs: grow or consolidate? distribute revenue or reinvest? focus on the core business or diversify?

The fragility of this phase lies not in volatility but in the fact that the stakes become real and visible.

These projects face the toughest decision: If they distribute revenue too soon, they risk stunting growth; but if they wait too long, token holders risk losing interest.

Giants: Prepare to distribute

Projects like Aave, Uniswap, and Hyperliquid have already crossed the threshold. They are able to generate stable income, have decentralized governance, and benefit from strong network effects. These projects no longer rely on inflationary token economics and already have a solid user base and market-proven business models.

These giants don’t usually try to “do it all.” Aave focuses on lending markets, Uniswap dominates spot trading, and Hyperliquid is building a DeFi stack with execution at its core. Their strength comes from defensible market positioning and operational discipline.

Most giants are leaders in their respective fields. Their efforts are usually focused on expanding the pie - that is, driving overall market growth rather than simply expanding their own market share.

These are the types of projects that can easily be repurchased and still maintain operations for many years. Although they are not completely immune to volatility, they are resilient enough to cope with market uncertainties.

Seasonal players: lively but lacking foundation

Seasonal players are the most visible yet most vulnerable type. Their revenues may rival or even exceed those of the giants for a short period of time, but these revenues are mainly driven by hype, speculation, or short-lived social trends.

For example, projects like FriendTech and PumpFun were able to generate huge engagement and transaction volume in a short period of time, but rarely converted this into long-term user retention or sustained business growth.

These projects are not inherently bad. Some may pivot and evolve, but most are short-term plays riding on market momentum rather than building lasting infrastructure.

Lessons from the public markets

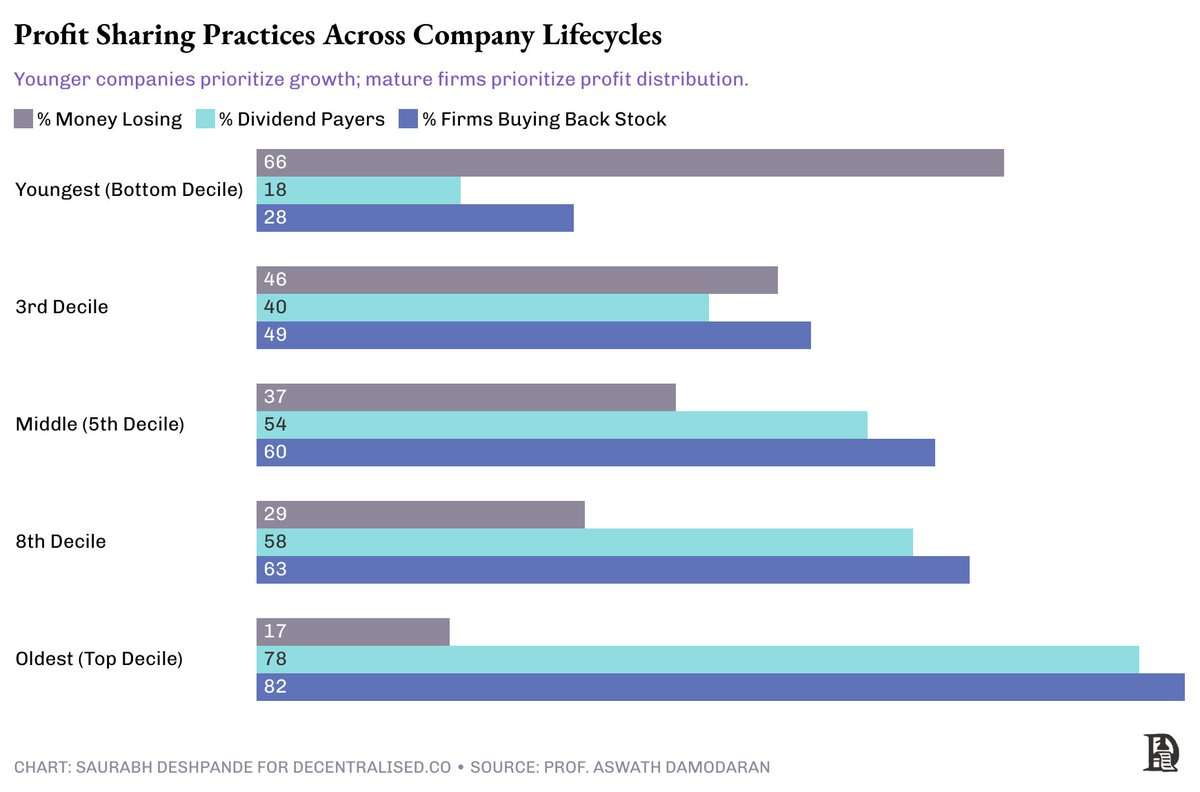

Public stock markets provide a helpful analogy. Young companies typically reinvest free cash flow to achieve scale, while mature companies distribute profits through dividends or stock repurchases.

The chart below shows how companies distribute their profits. As companies grow, the number of companies paying dividends and repurchases increases.

Crypto projects can learn from this. Giants should distribute profits, while explorers should focus on retention and compound growth. But not every project is clear about which stage it belongs to.

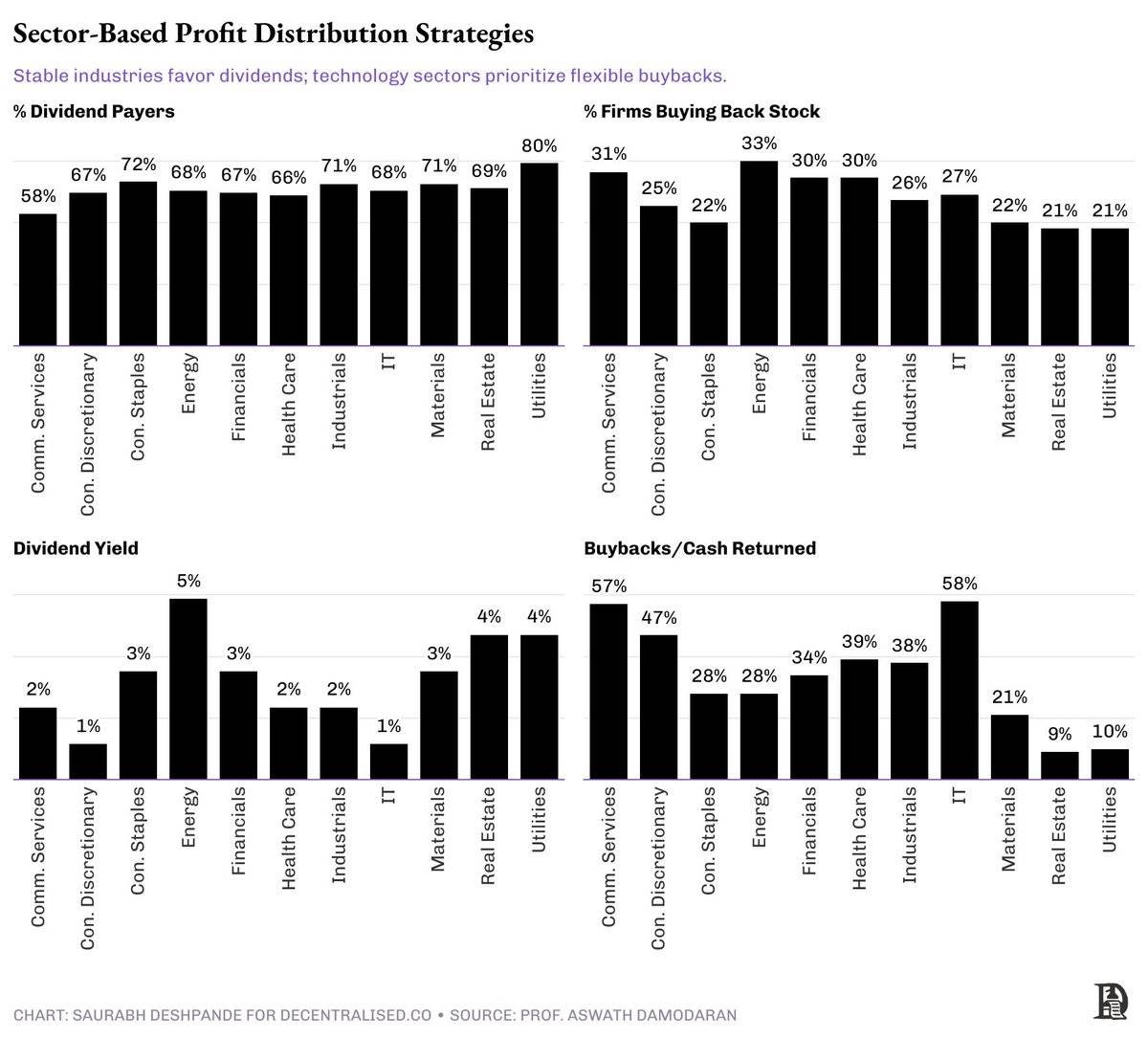

Industry characteristics are equally important. Utility-like projects (such as stablecoins) are more like consumer staples: stable and suitable for dividends. This is because these companies have been around for a long time and demand patterns are largely predictable. Companies tend not to deviate from forward guidance or trends. Predictability allows them to share profits with shareholders on a consistent basis.

High-growth DeFi projects are more like the tech industry — the best way to distribute value is with a flexible buyback plan. Tech companies typically have higher seasonal fluctuations. Most of the time, their demand is not as predictable as some more traditional industries. This makes buybacks the preferred way to share value.

What if you have a great quarter or year? Pass on the value by buying back shares.

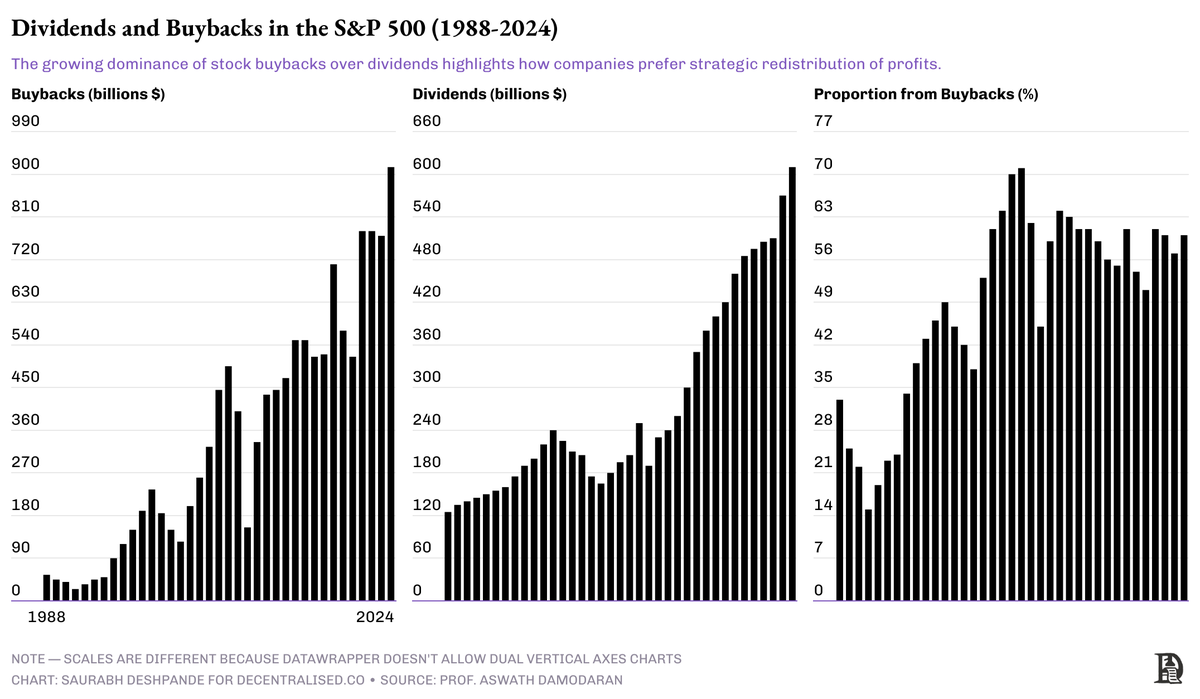

Dividends vs. Buybacks

Dividends are sticky. Once a dividend is promised, the market expects it to remain consistent. Buybacks, by contrast, are more flexible, allowing teams to adjust the timing of value distribution based on market cycles or when the token is undervalued. From ~20% of profit distribution in the 1990s to ~60% in 2024, buybacks have grown rapidly over the past few decades. In terms of dollar amount, buybacks have exceeded dividends since 1999.

However, there are some drawbacks to buybacks. If not communicated properly or priced appropriately, buybacks can transfer value from long-term holders to short-term traders. In addition, governance mechanisms need to be very tight because management often has key performance indicators (KPIs) such as improving earnings per share (EPS). When a company uses profits to buy back shares in circulation (i.e., outstanding shares), it reduces the denominator, thereby artificially inflating the EPS figure.

Dividends and buybacks each have their place. However, without good governance, buybacks can quietly benefit insiders at the expense of the community.

Three elements of a good buyback:

Strong asset reserves

Well-thought-out valuation logic

Transparent reporting mechanism

If a project lacks these conditions, it may still need to be in the reinvestment phase rather than making buybacks or dividends.

Current revenue distribution practices of leading projects

@JupiterExchange made it clear at the token launch: no direct revenue sharing. After growing 10x in users and having enough reserves to sustain operations for many years, they launched the Litterbox Trust - a non-custodial buyback mechanism that currently holds ~$9.7M in JUP tokens.

@aave , with over $95M in reserves, is allocating $1M per week for buybacks through a structured program called Buy and Distribute. This program comes after months of community dialogue.

@HyperliquidX goes a step further, using 54% of its revenue for buybacks and 46% for incentivizing liquidity providers (LPs). To date, over $250M in HYPE tokens have been bought back, fully backed by non-VC funding.

What do these programs have in common? They all started their buyback programs after ensuring that their financial footing was solid.

The missing link: Investor relations (IR)

The crypto industry loves to talk about transparency, but most projects only disclose data when it helps their own narrative.

Investor relations (IR) should become core infrastructure. Projects need to share not only revenue, but also expenditure, capital reserves (runway), asset reserve strategy, and repurchase execution. Only in this way can confidence in long-term development be established.

The goal here is not to claim that a certain way of allocating value is the only correct one, but to acknowledge that the way of allocation should match the maturity of the project. In the crypto space, truly mature projects are still rare.

Most projects are still finding their footing. But those that get it right — those with revenue, strategy, and trust — have the opportunity to become the cathedrals that the industry so desperately needs.

Strong investor relationships are a moat that builds trust, mitigates panic during market downturns, and keeps institutional capital engaged.

Ideal IR practices might include:

Quarterly Income and Expense Reports

Real-time asset reserve dashboard

Public record of executed buybacks

Clear token distribution and unlocking plan

On-chain verification of grants, salaries, and operating expenses

If we want tokens to be seen as real assets, they need to start communicating like real businesses.