Original author: Bright, Foresight News

On the morning of May 7, the cryptocurrency market rebounded from the continuous decline at the end of the May Day holiday, and the secondary market followed BTC to rebound. BTC rose from yesterdays low of $93,390 to $97,732, an increase of more than 4.4%, recovering the decline in the past five days. As of press time, Bitcoin is now priced at $96,866.

ETH rebounded from $1751.45 to $1850, a 5.6% increase. SOL rose from $141.41 to $149.54, a 5.74% increase.

The total market value of cryptocurrencies rebounded by more than 2%, rising again to over $3 trillion. Bitcoins market share exceeded 65%, hitting a new high since January 2021. The Fear and Greed Index climbed to 67, representing greed. At the same time, U.S. cryptocurrency stocks rose synchronously after the market, with Coinbase stopping its decline and rebounding to $200 after the market, up 1.58%; MicroStrategy closed at $393.89, up more than 2.15%.

In terms of liquidation data, according to Coinglass, in the last 24 hours, more than 137,600 people were liquidated, with a total liquidation of US$311 million, and both long and short positions were liquidated. In the past hour, US$40.972 million was liquidated, and US$38.002 million was liquidated for short positions. The largest single liquidation on CEX was ETH-USDT, which occurred on Binance and was worth US$8.053 million.

What exactly triggered the sharp rise in the crypto and even global risk asset markets in the early trading session?

On the morning of May 7, the Chinese Ministry of Foreign Affairs announced that Vice Premier He Lifeng will visit Switzerland from May 9 to 12, during which he will hold talks with the US. This news greatly boosted risk appetite, and the RMB once rose by 100 points to break through 7.20. The three major US stock indexes rose sharply, with Nasdaq futures rising by more than 1%. Spot gold fell by more than 1.9%, hitting a daily low of $3,370 per ounce.

The tariff stick is unsustainable

The subtle shift in Sino-US relations has become a key turning point in market sentiment. After the Trump administration imposed a 104% tariff on Chinese goods in April, which caused sharp fluctuations in global risk assets, the Chinese Ministry of Foreign Affairs announced on May 7 that Vice Premier He Lifeng will visit Switzerland from May 9 to 12, during which he will hold formal talks with US Treasury Secretary Benson and Trade Representative Katherine Tai. This is the first time that senior Chinese and US officials have held face-to-face consultations on economic and trade issues since the 2024 G20 summit, which was interpreted by the market as a clear signal from both sides to suspend tariff escalation.

Historical data shows that during the China-US trade negotiation window in January 2024, Bitcoin rose 22% in a single month due to improved expectations for cross-border capital flows. 48 hours before the news came out, the cryptocurrency market had already digested the tariff suppression sentiment in advance - when the US stock market plummeted on May 6, BTC only fell slightly by 0.3%, significantly lower than the Nasdaqs 0.87% drop, showing a desensitization feature to geopolitical risks.

The latest data released by the U.S. Department of Commerce on May 6 showed that the U.S. trade deficit surged to $123.4 billion in March, the highest level since records began in 1992, mainly due to companies stockpiling imported goods before tariffs took effect. This data forced the Trump administration to reassess the actual effect of the tariff pressure strategy.

According to Bloomberg, citing an internal White House memo, if the current tariff rate is maintained, US retailers annual profits will shrink by 15%, and the inflation rate may rebound to 5.5%. The marginal improvement in tariff policy is essentially a process of global capital re-pricing de-dollarized assets. Matt Hougan, chief investment officer of Bitwise, pointed out in a morning conference call that when the credit of the US dollar is damaged by trade conflicts, BTCs digital neutrality becomes the optimal solution for cross-border value storage.

Institutional fixed investment, policy support

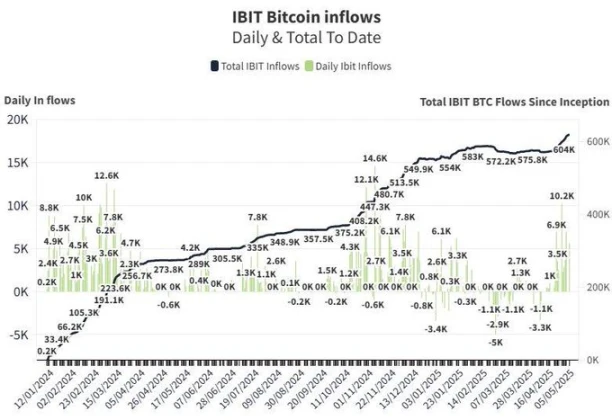

While the market is immersed in the short-term positive outbreak of Sino-US easing, institutions seem to have long reshaped the cryptocurrency valuation system by fixed investment in BTC. According to SoSoValue data, on May 6, the total net inflow of BTC spot ETF was US$425 million, the total net asset value of BTC spot ETF was US$110.685 billion, and the ETF net asset ratio (market value to BTC total market value) reached 5.91%, and the historical cumulative net inflow has reached US$40.662 billion.

According to Lookonchain monitoring, on May 6, BlackRocks BTC spot ETF (iShares Bitcoin Trust ETF) purchased another 5,613 BTC, worth about $529.5 million, and currently holds 620,252 BTC, worth about $58.51 billion. Since April 21, BlackRock has purchased a total of 47,064 BTC, worth about $4.44 billion. Moreover, in the past week, BlackRock ETF has received $500 million in daily directional inflows, causing market speculation that it is adding positions at high levels here.

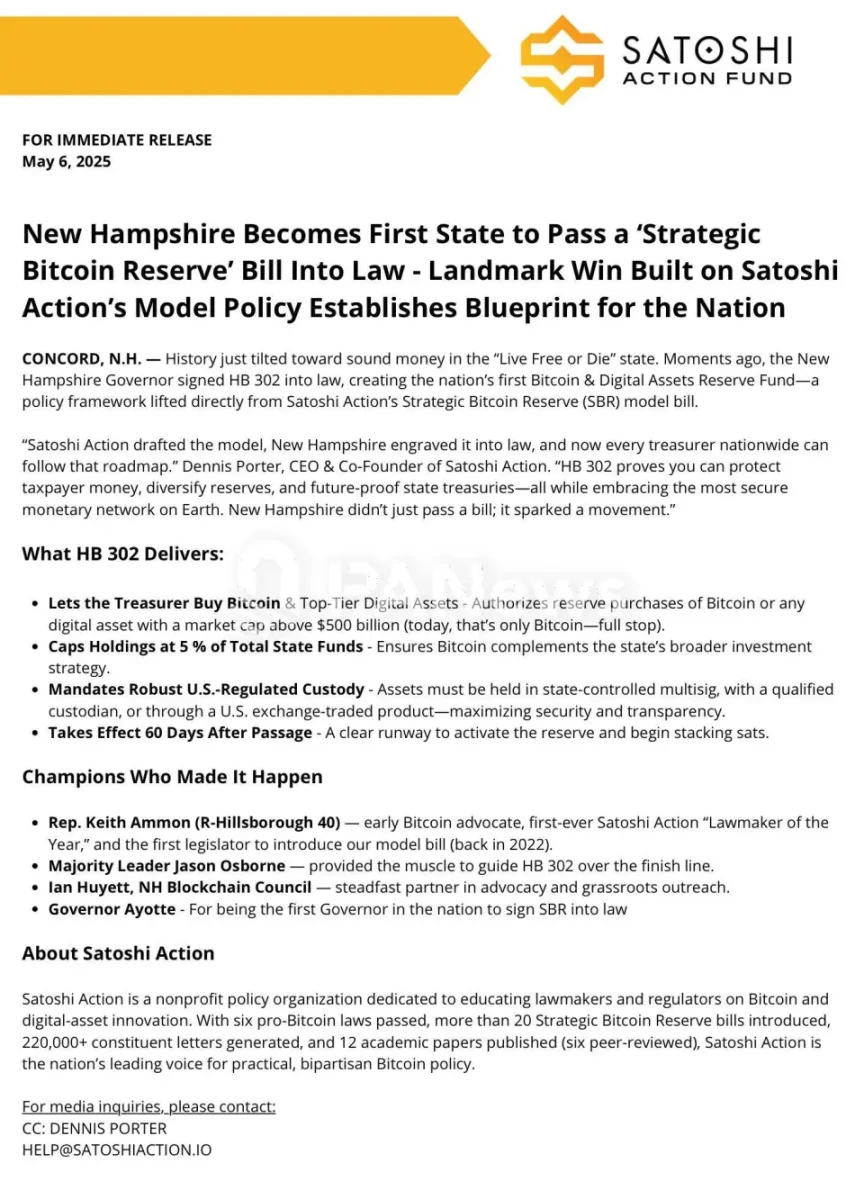

In terms of policy, the strategic reserve of cryptocurrency at the state level in the United States has received good news. New Hampshire Governor Ayotte signed the HB3 02 bill, which is the first state bill in the United States to use cryptocurrency as a strategic reserve. This also means that the Secretary of the Treasury of Hampshire will invest up to 5% of state government funds in precious metals and cryptocurrencies with a market value of at least $500 billion. Based on Hampshires total budget of $15.4 billion, 5% is about $770 million, and based on the general fund of $5.6 billion, 5% is about $280 million. Therefore, the states potential cryptocurrency investment amount is between $280 million and $770 million, setting a flag for subsequent state legislation to establish a strategic reserve of cryptocurrencies.

The Fed meeting still has a fuse buried deep

Despite the short-term recovery in sentiment, the Feds May interest rate decision is still like a Sword of Damocles hanging high. CME interest rate futures show that the current market believes that the probability of a 25 basis point rate cut in May is only 3.1%. The probability of a 25 basis point rate cut in June is only 65% (down 10 percentage points from the April peak). The 10-year US Treasury yield has accelerated its decline to 3.75%, reflecting investors concerns about the policy lag effect - non-farm employment increased by 177,000 in April, and the core PCE price index rose by 4.7% year-on-year, showing that the US economy is still resilient and may delay the timing of rate cuts.

The cryptocurrency market faces a delicate balance. If the Fed keeps interest rates unchanged, high funding costs may suppress the valuation of risky assets (historical data shows that for every 1 percentage point increase in interest rates, Bitcoins implied volatility will increase by 12%); if a dovish signal is released, the logic of BTC as an anti-inflation asset will be rapidly strengthened.

The current point of disagreement in the market is the Feds rhythm of interest rate cuts. In the latest Summary of Economic Forecasts released by the Federal Reserve, 12 officials supported a rate cut of only 50 basis points in 2025, and 7 supported a rate cut of 100 basis points, forming a rare hawk-dove confrontation. When the traditional financial system falls into a stagflation spiral (stubborn inflation + slowing growth), Bitcoins network effect (12 million daily active addresses) and market value (over $1.9 trillion) make it a necessity for institutions to hedge policy risks. It is worth noting that the scale of the Feds overnight reverse repurchase has fallen to $1.2 trillion for three consecutive days, indicating that the problem of excess liquidity in the banking system has eased, which may indirectly affect the scale of leveraged funds in cryptocurrencies.

However, although BTC has rebounded above the $97,000 mark, its dominance has exceeded 65%, indicating that funds are highly risk-averse. Combined with BTCs recent extremely low volatility, there may be significant price fluctuations after the Fed meeting. Whether Powell will be hawkish or dovish this time will be crucial.