Original author: Green But Red

Original translation: TechFlow

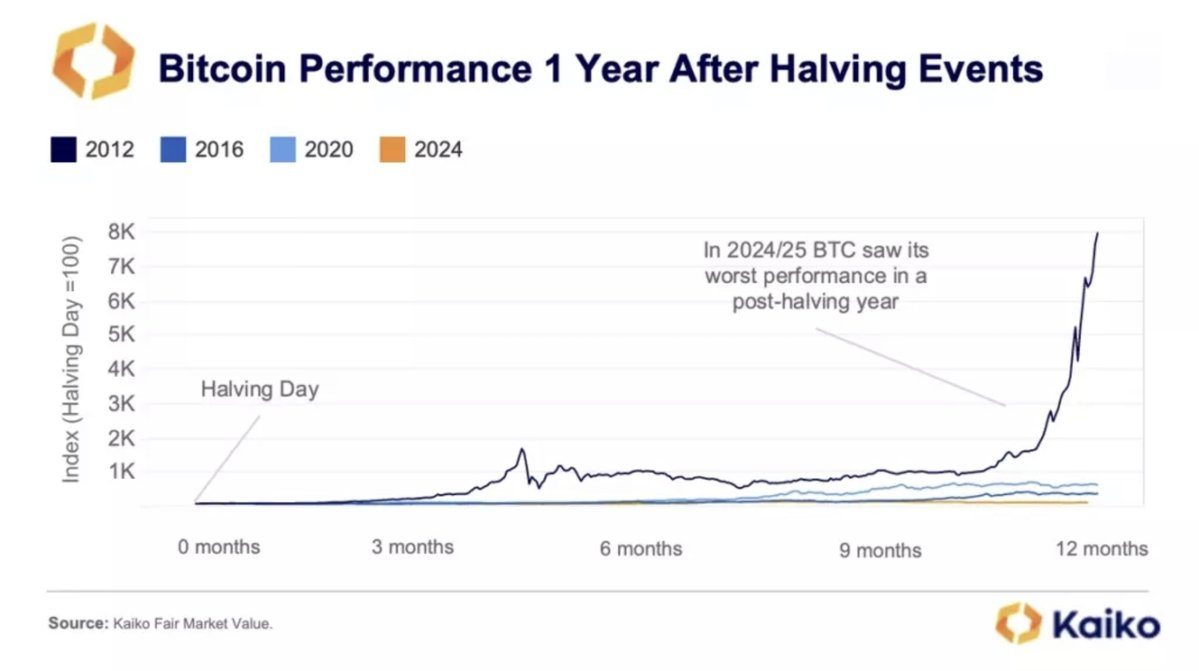

A full year after Bitcoin’s fourth halving, its performance has been surprising: Bitcoin’s price has risen by only 46% and is currently trading about 10% below its all-time high. This is the weakest performance after any halving.

Comparison between historical cycles and the present

Looking back at history, after the halving in 2012, the price of Bitcoin soared by 7,000%; the halvings in 2016 and 2020 brought increases of 291% and 541%, respectively. However, this time, Bitcoin only rose by about 46% after the halving, and the post-halving surge that the market expected did not occur.

Market maturity and the impact of macro factors

One reason for the poor performance this time is the increase in macroeconomic uncertainty. Global tensions and new tariffs have made investors more cautious. The Economic Policy Uncertainty Index (EPU) is much higher than in previous cycles, reflecting a more risk-averse environment in the market.

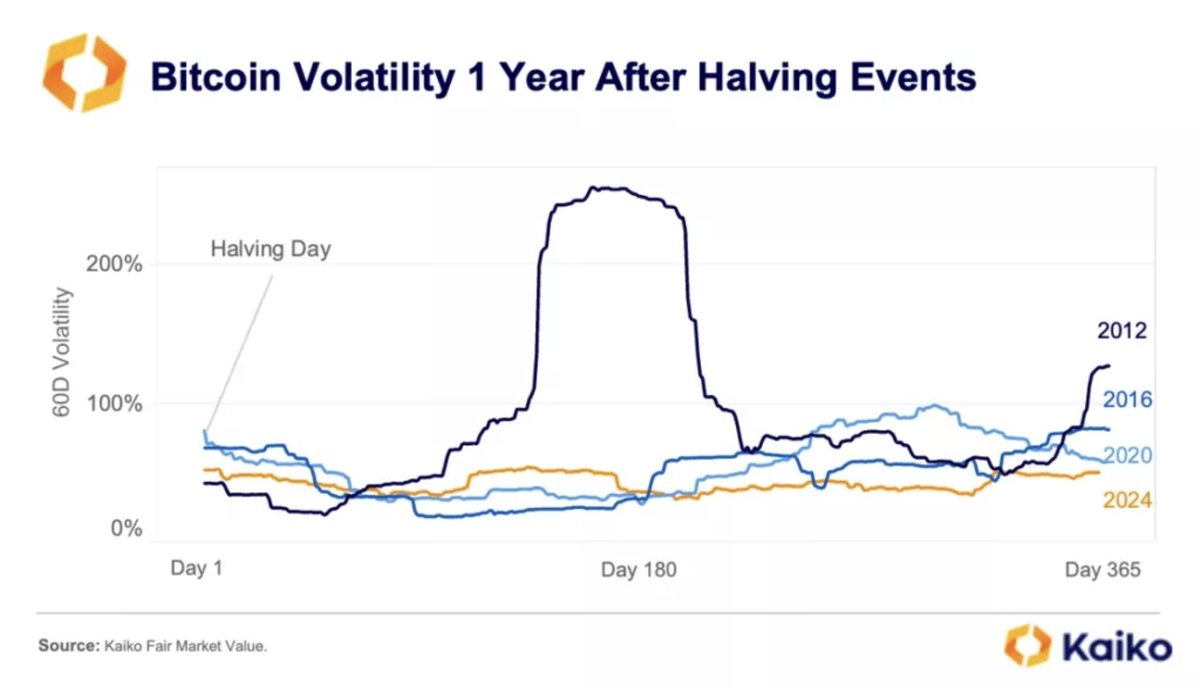

At the same time, the Bitcoin market has matured. Compared to its early days, its volatility has decreased significantly, and the profit potential for long-term holders is no longer as significant. Today, it takes more capital to significantly drive price increases, and the markets price sensitivity has decreased.

Institutionalization and changing market structures

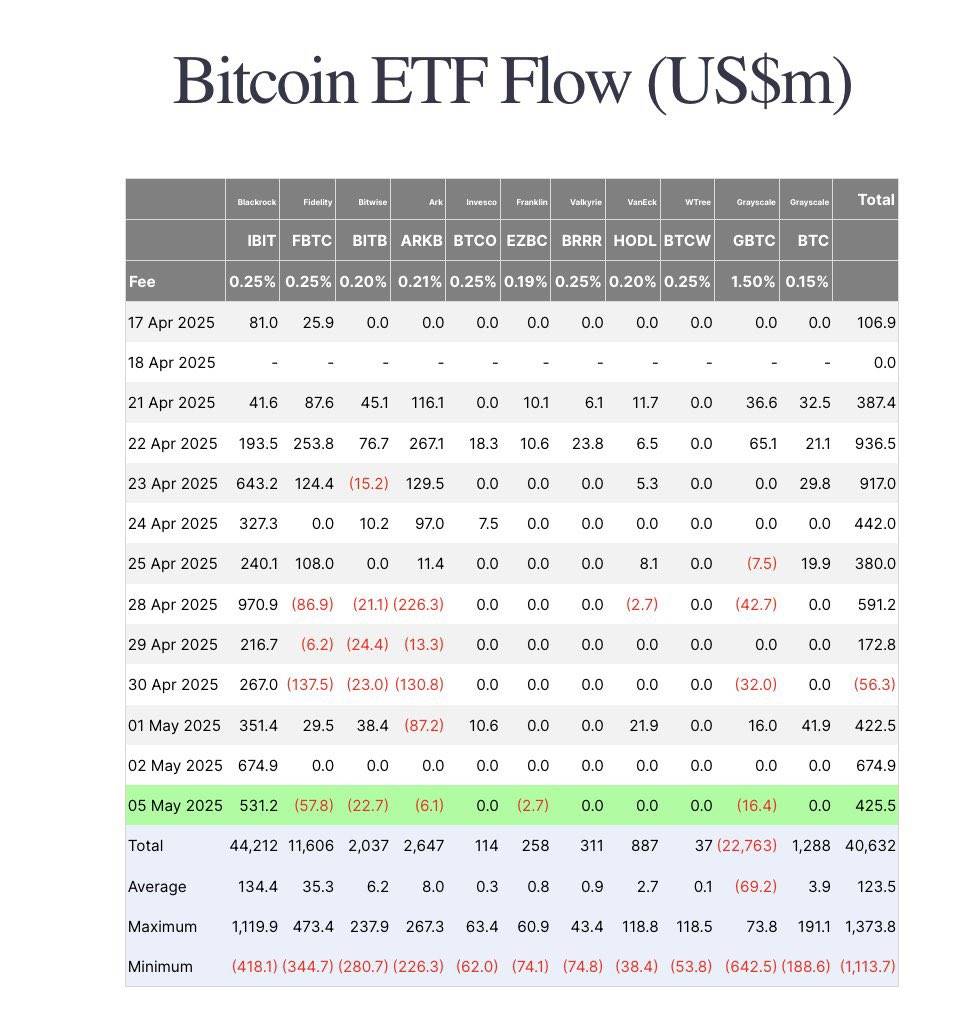

Institutional investors are playing a larger role than ever before. The rise of spot ETFs and corporate investments has made the market more stable, but also more sensitive to macro trends.

Institutional investors buy when prices fall and take profits when they rebound, smoothing out Bitcoin’s price fluctuations. For example, in early May 2025, Bitcoin ETFs attracted $425.5 million in inflows, showing continued institutional interest in Bitcoin.

Mining and production costs

Bitcoin mining remains profitable. The average cost of mining one bitcoin is currently about $49,887. The rate of improvement in hardware efficiency has slowed, allowing miners to use existing equipment longer, reducing the pressure to upgrade equipment frequently.

Outlook and Forecast

Experts are divided on what the future holds. Some predict that Bitcoin could go through a period of sideways trading or correction before resuming a sustainable bull run, which would likely require a breakout above the $100,000 mark. Others are more optimistic, predicting a price between $120,000 and $200,000 by the end of 2025.

Although the explosive gains of past cycles have failed to materialize, Bitcoin is entering a new phase of more stable and sustainable growth, which may be a healthier long-term development path.