Key Indicators (April 28, 4pm - May 5, 4pm Hong Kong Time)

BTC/USD price unchanged ($94,700 -> $94,700), ETH/USD up 1.4% ($1,800 -> $1,825)

As the market stabilized this week, the price of the coin fluctuated in a small range and failed to hit the key resistance level of $99-100k overhead. Support at $89-91k can currently maintain the price in the current range, but if it breaks, the price of the coin may adjust sharply downward to $85k. With the end of several holidays last week, we expect to see the price of the coin being moved unilaterally - perhaps trying to test $100k - but if it fails to break, it may lead to an extended period of low volatility.

We remain bullish on Bitcoin and expect it to reach $115k-125k in the next few months or quarters.

Market Theme

Global markets had another quiet week as last week was dominated by holidays. Stocks continued to rise. As Trump and Bessant continue to push for a deal with China, and deals with other countries or regions are also soon to be announced (but the market has already expected this), the SP index has recovered the gap since Trump Liberation Day in early April. Non-farm payrolls were the main data of the week, and unexpectedly strong data calmed concerns about the economic slowdown and supported the rise of US stocks, while several leading companies earnings data were also quite strong.

Last week was a very quiet week for cryptocurrencies. Bitcoin was basically unchanged for 7 days, although it briefly rose to $97.8k on Friday night but quickly fell back. MSTR continued to buy Bitcoin ($180m last week) and announced another round of equity to continue buying Bitcoin (as the first round of 2.1b equity was bought), but overall the buying has been fully absorbed by the market. The current $92-96k range looks like the equilibrium price range for Bitcoin. We had been stable here for a long time in February and hovered here before the tariff news. Therefore, we expect to continue to consolidate in the current range for a long time unless there are major external factors.

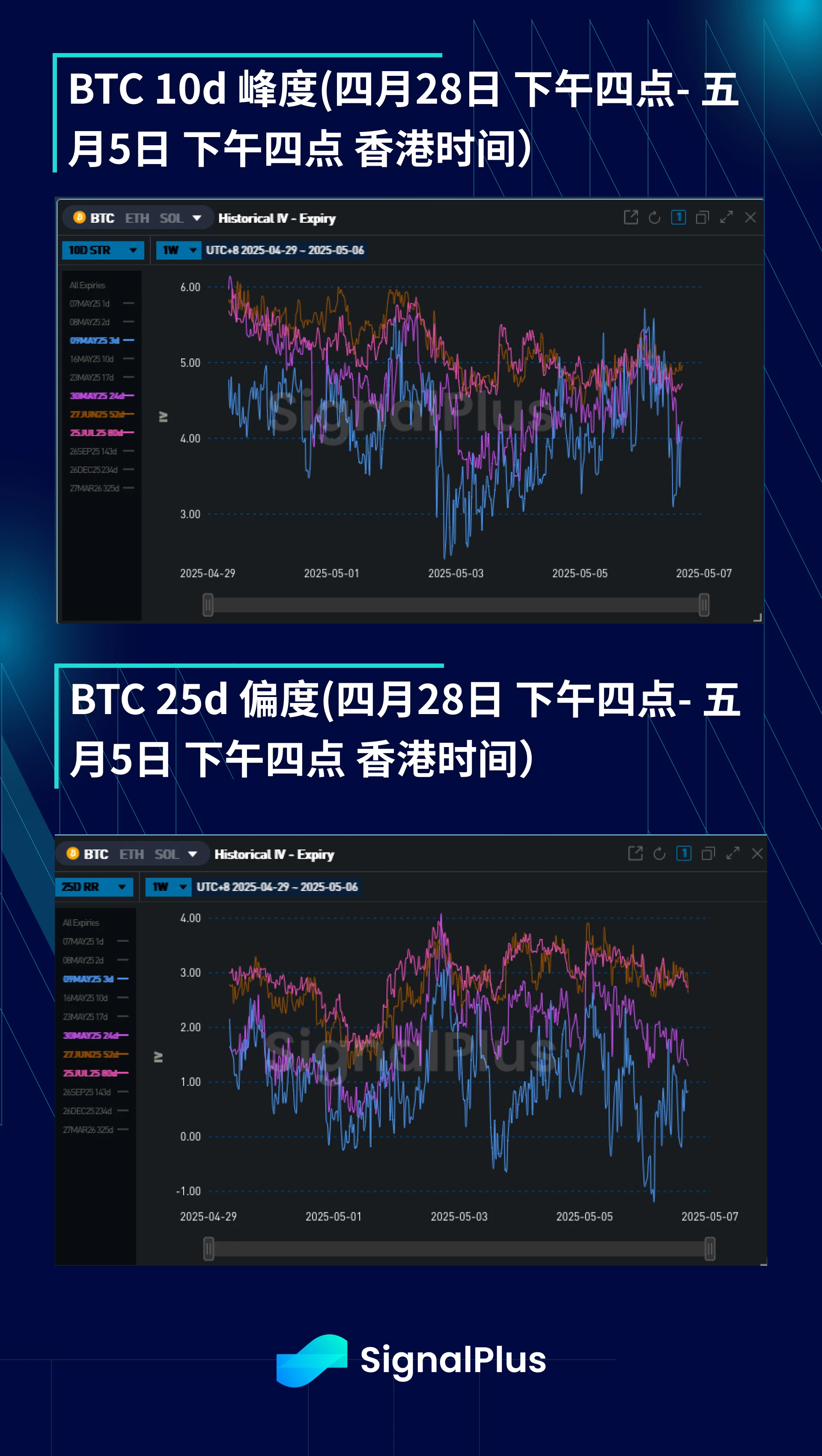

BTC ATM Implied Volatility

Implied volatility briefly rose last Monday as the price of the currency climbed, and then gradually decreased. High-frequency realized volatility is locked in the early 30s, and the term structure is very steep (the market currently prices a return to the 50s in late May to June), which means that any long position at the far end of the term is currently difficult to make money. We suspect that the market holds long positions due to the selling pressure in the past few weeks and it is difficult to hold, so the volatility of short-term expiration dates is pushed down to this level.

In the very short term, the market is not pricing in much of this week’s Fed meeting (only 40 bps of price change) and we expect to see buyers emerge soon.

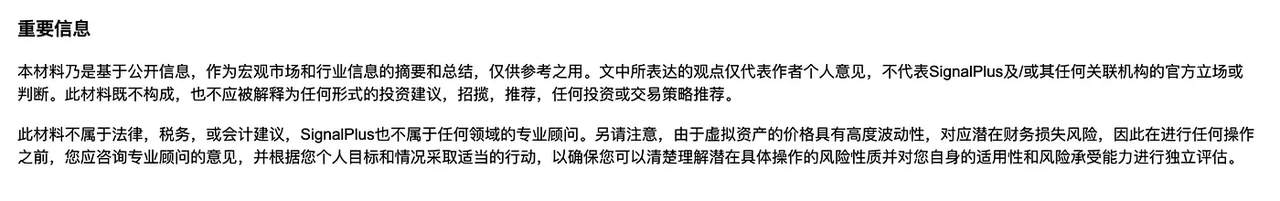

BTC Skewness/Kurtosis

The skewness moved strongly upwards as the exchange rate briefly broke through $97k and there were signs of a move to $99k-100k. However, the price eventually stalled and fell below $94k at the beginning of this week, pushing the skewness back to lower levels as the market realized that the price could go either way at this point.

Due to the low realized volatility this week and the fact that the price of the currency remains in the comfort zone, the selling pressure on both sides has increased, which has lowered the kurtosis today. However, considering that we have such low volatility at present, we believe that breaking through the current large range of volatility of 89-99 thousand US dollars will accelerate the rise. At the same time, it will also be accompanied by a large skewness to the corresponding side (that is, breaking through 99 thousand US dollars will tend to rise, and breaking below 89 thousand US dollars will tend to fall)

Good luck to everyone this week!

You can use the SignalPlus trading vane function for free at t.signalplus.com/news , which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com