Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

During the period of market volatility, the on-chain contract market became increasingly hot, and the Hyperliquid platform trading volume and HYPE token market value both hit record highs: the cumulative trading volume exceeded 1.5 trillion US dollars, and the HYPE token price once exceeded 45 US dollars.

Behind the impressive results, it is inseparable from the long and short contract operations of whales and retail investors, as well as the increased trading holdings by investment institutions.

At the end of June, well-known investment institutions Galaxy and Manifold Trading deposited a total of 30 million US dollars of USDC into HyperLiquid and began to purchase HYPE tokens; previously, the US-listed company Lion Group Holding Ltd. (stock code: LGHL) also allocated 2 million US dollars to purchase HYPE tokens.

The discussion about institutional entry to layout HYPE is getting more and more intense, and some people even shouted the old slogan - HYPE is the next SOL - the last one that was highly anticipated was SUI, and this is the first time that HYPE has been elevated to such a level for discussion.

Odaily Planet Daily will briefly analyze this speculation in this article to explore the rising momentum and future potential behind HYPE.

HYPE’s upward dynamics: platforms, institutions and over-the-counter buying

Unlike the relative stability of SUI prices, the price of HYPE tokens has experienced a series of ups and downs.

In March this year, due to the problem of platform mechanism setting, Hyperliquid platform HLP once lost millions of dollars due to targeted explosion by large investors, and the platform was also in a deep trust crisis due to rollback data. (Odaily Planet Daily Note: For details, please refer to Why did the Hyperliquid whale self-explode to close its position? Who is bearing the millions of dollars in losses? , To make up for the loss of more than 200 million US dollars, Hyperliquids unplugging the network cable forced settlement caused controversy and other articles.) The price of HYPE was also affected, falling from around US$13 to around US$10. Many people even thought that Hyperliquid would lose the contract market under the siege of CEX such as Binance, OKX, and Bybit.

But as time entered April, Trump launched a tariff trade war and then released some favorable policies to ease the situation. The overall market and the contract market gave Hyperliquid a new round of development opportunities. HYPE also started its journey of bottom repair and even setting new highs. On May 23, the price of HYPE broke through US$33, surpassing the US$32.3 on December 22, 2024, setting a new historical high. Until June 16, the price of HYPE hit an all-time high of US$45.59 .

HYPE Price Performance

Looking closely at the driving force behind its rise, I personally believe that it is mainly driven by the following factors:

Rising power 1: platform development and repurchase

In addition to Hyperliquid benefiting from the favorable development of the volatile market, the repurchase mechanism and pledge mechanism of the Hyperliquid platform have provided a strong impetus for the steady increase in the price of HYPE tokens.

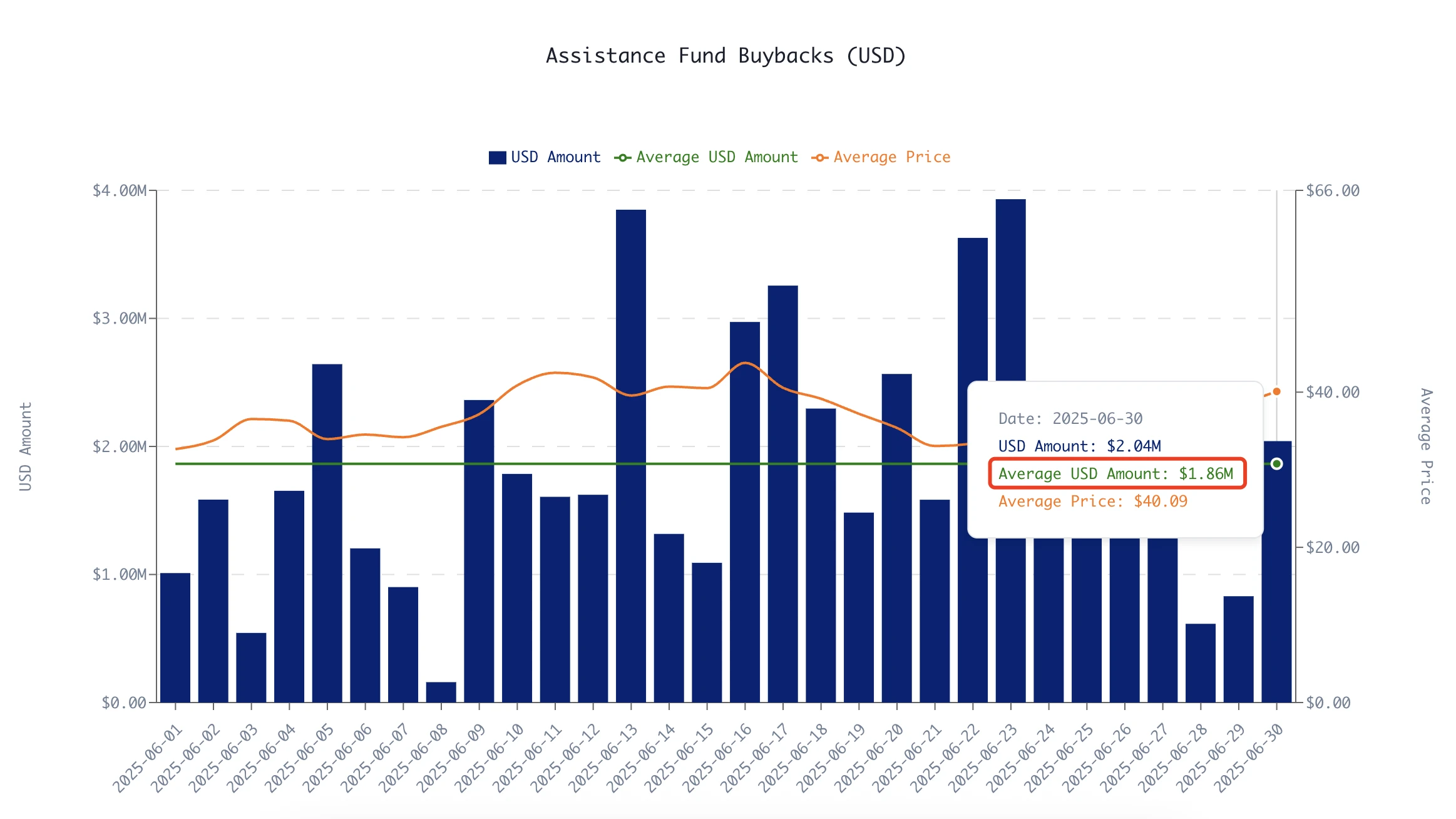

According to data from the ASXN Data website , based on the on-chain data for the past 30 days ending June 30, 2025, the average daily repurchase amount of the Hyperliquid protocols HYPE tokens was $1.86 million. It can be said that this repurchase fund is the biggest driving force for the HYPE tokens, which have a total of 1 billion and a circulation of approximately 330 million.

HYPE token repurchase fund size

According to Hyperliquid community builders Charlie.hl and supermeow.hl, in their article titled How does Hyperliquid, valued at $25.9 billion, occupy both the infrastructure and application layers? , after applying the market value/quarterly repurchase amount multiple indicator of the traditional stock market payment industry, they made a very conservative estimate that the unit price of HYPE is expected to rise to $76.

In addition, the Builder Code program launched by Hyperliquid also provides functional support and user-level convenience for developers to collect fees through the platform, which is expected to attract more on-chain developers and institutions to access the Hyperliquid port and further promote the development of the platform ecosystem.

Rising power 2: Institutional layout

Just like Multicoin Capital and other institutions invested in Solana early on and continued to buy SOL tokens, now some investment institutions have also set their sights on Hyperliquid, which is known as the on-chain contract market leader.

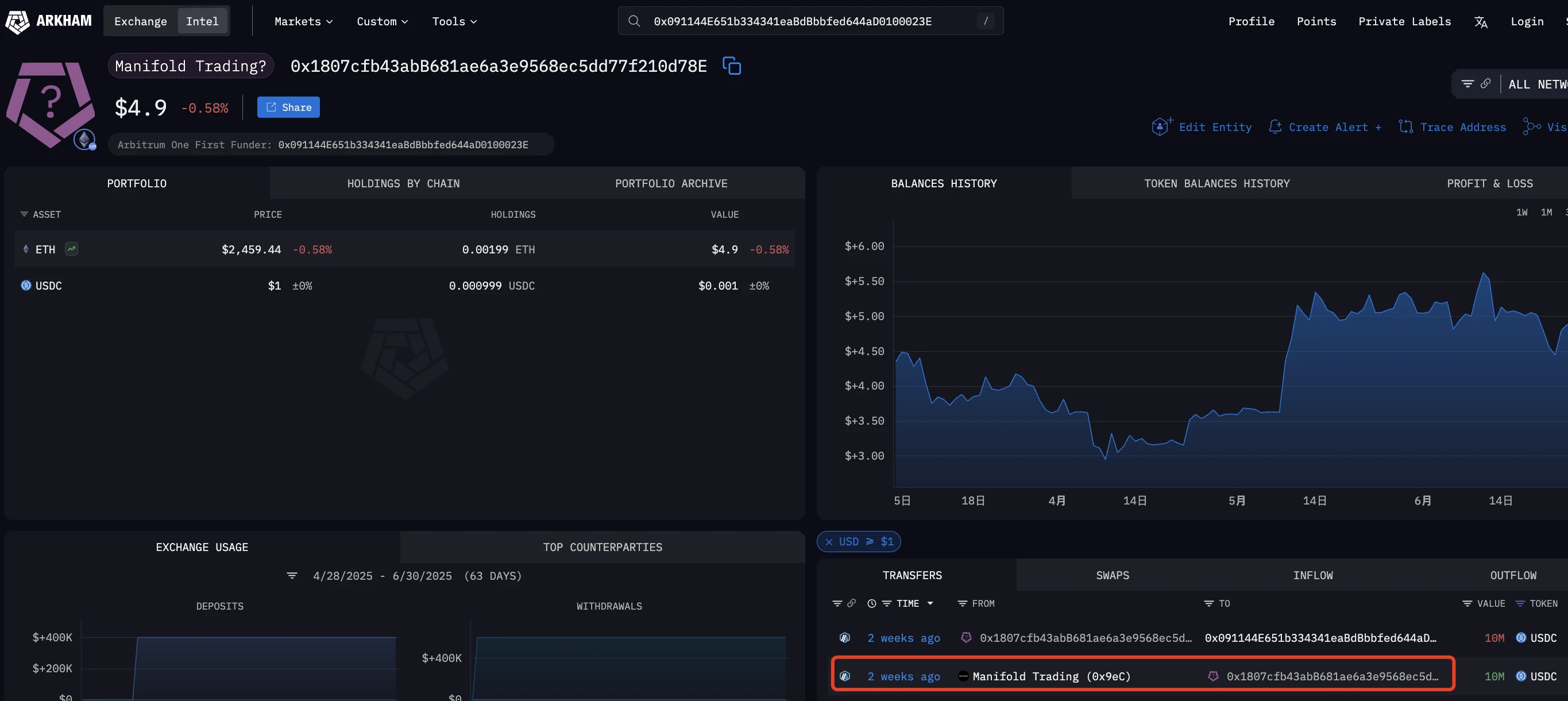

Previously, according to Onchain Lens monitoring , two investment institutions , @galaxyhq and @ManifoldTrading, deposited a total of US$30 million in USDC into HyperLiquid and began to purchase HYPE tokens.

According to the information I found on the Arkham platform, the address 0x091144E651b334341eaBdBbbfed644aD0100023E is indeed the address associated with ManifoldTrading. Previously, the address received $10 million from ManifoldTrading from the address 0x1807cfb43abB681ae6a3e9568ec5dd77f210d78E on June 16. The situation of the suspected galaxy address 0xcaC19662Ec88d23Fa1c81aC0e8570B0cf2FF26b3 is similar.

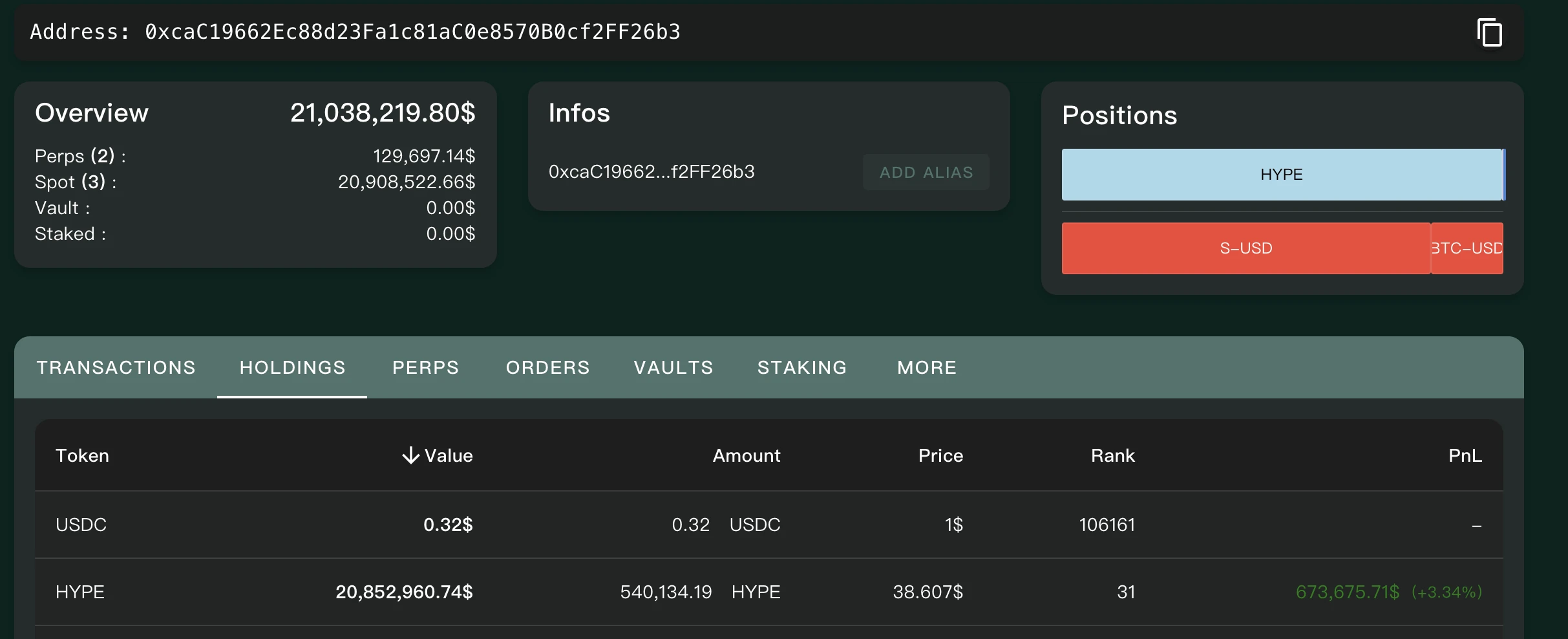

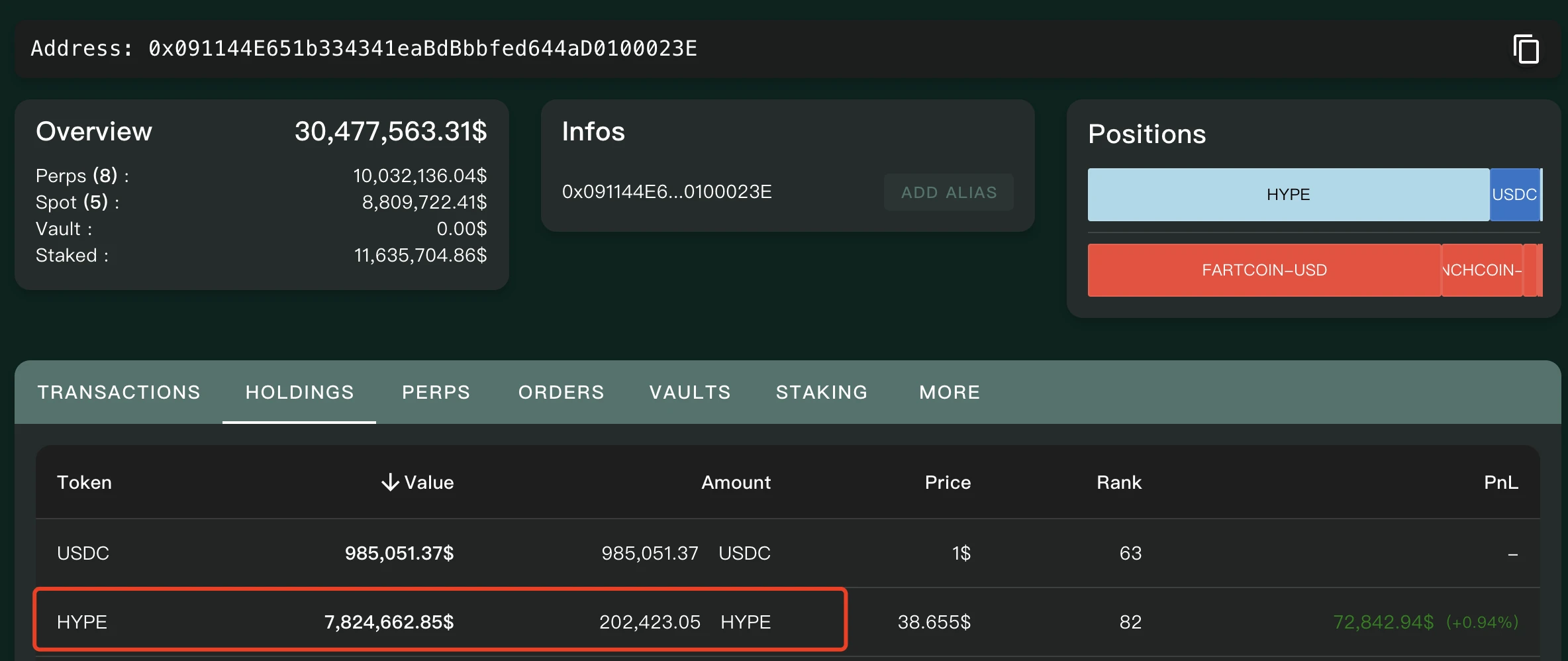

At present, the galaxy-related address holds more than 540,000 HYPE, worth about 20.85 million US dollars, ranking 31st; the ManifoldTrading-related address holds about 202,000 HYPE, worth about 7.82 million US dollars, ranking 82nd. The two addresses have opened multiple orders in Hyperliquid and still hold short orders for BTC, S, FARTCOIN, ENS and other tokens, with profits and losses.

It can be seen that institutions not only bought HYPE for layout, but also got involved and opened positions on the Hyperliquid platform to make profits.

Galaxy address holding information

ManifoldTrading address holding information

Rising power 3: OTC US listed companies buying

In addition to the above internal and external factors, just as Strategy hoards BTC to boost the price of BTC and its own stock price, some US-listed companies have also used the same strategy on HYPE.

On June 23, according to an official announcement , Eyenovia, Inc. (NASDAQ: EYEN) announced the completion of a $50 million private placement financing and the purchase of 1,040,584.5 HYPE tokens, becoming the first company listed on the Nasdaq in the United States to hold HYPE tokens. After the news was released, EYENs stock price rose 77% intraday and 181% in the past 5 days.

At the end of June, LGHL (Lion Group Holding Ltd.), a US-listed company, announced that it had completed its first strategic purchase of Hyperliquid (HYPE) tokens for $2 million, at an average price of approximately $37.30 per token. The acquisition was also the company’s first token purchase under its $600 million convertible bond financing.

Since then, HYPE has become one of the cryptocurrencies with buying support from over-the-counter U.S.-listed companies, and to a certain extent even has the market position of old cryptocurrencies such as BTC, ETH, and SOL.

From the data dimension, how far is HYPE from SOL?

On May 26, according to Coingecko data, the price of HYPE was temporarily reported at US$38.03, and its market value was temporarily reported at US$12.64 billion, surpassing SUI and ranking 13th in the total market value of cryptocurrencies (including USDT, stETH, WBTC, etc.).

On June 16, as the price reached its all-time high, HYPEs market value once exceeded $15 billion, reaching $15,017,966,172, a record high. As of the time of writing, HYPEs price is temporarily reported at around $39, with a circulating market value of approximately $13 billion and a FDV of approximately $39 billion.

In contrast, as of the time of writing, the SOL price is temporarily reported at $149, with a circulating supply of 534 million and a total supply of 600 million; its circulating market value is approximately $80 billion and its FDV is approximately $90 billion.

Although the ecological positioning of the two is not completely consistent, at a time when the Meme coin craze has subsided and on-chain contracts have become the mainstream sector of the crypto market, there are certain signs that SOL is declining and HYPE is rising.

If calculated based on the conservative estimated price of US$76 mentioned above, HYPEs market capitalization is expected to rise to around US$25 billion; its FDV will rise to around US$76 billion, which is approximately 84% of SOLs current FDV.

Conclusion: HYPEs next explosion point is ecological-level applications

In summary, combined with the on-chain contract platform, HyperEVM ecology, Hyperliquid NFT and other assets and ecological development, Hyperliquid has great potential for future development. If a killer application like Pump.fun for Solana ecology can emerge, HYPE may also be able to compete with SOL.