Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

The cryptocurrency market seems to have entered a stage of accelerated upward momentum. Following a sharp rise overnight, the market ushered in another round of more violent rise last night.

OKX market data shows that BTC once surged to 117548.2 USDT last night, and was temporarily reported at 115408 USDT as of 8:30 this morning, with a 24-hour increase of 3.75%; even more surprising is the altcoin bellwether ETH. Stimulated by multiple favorable factors, ETH once broke through the 3000 mark last night, reaching a high of 3002.99 USDT. As of 8:30 this morning, it was temporarily reported at 2972.21 USDT, with a 24-hour increase of 5.77% ; another altcoin leader SOL was temporarily reported at 162.7 USDT, with a 24-hour increase of 4%.

Affected by the overall upward trend (especially ETH is no longer playing dead), the altcoin market has also ushered in a strong recovery. As of 8:30 this morning, many of the top 100 altcoins have recorded double-digit gains, including SUI temporarily reported at 3.42 USDT, a 24-hour increase of 11.7%; ARB temporarily reported at 0.3915 USDT, a 24-hour increase of 11.1%; PEPE temporarily reported at 0.00001218 USD, a 24-hour increase of 11.2%; PENGU temporarily reported at 0.0194 USDT, a 24-hour increase of 26.18%...

CoinGecko data shows that the total market value of cryptocurrencies has exceeded 3.669 trillion US dollars. In terms of market sentiment, the trading enthusiasm of crypto users has also increased significantly. Todays Fear and Greed Index has reached 71, and the level is temporarily reported as Greed.

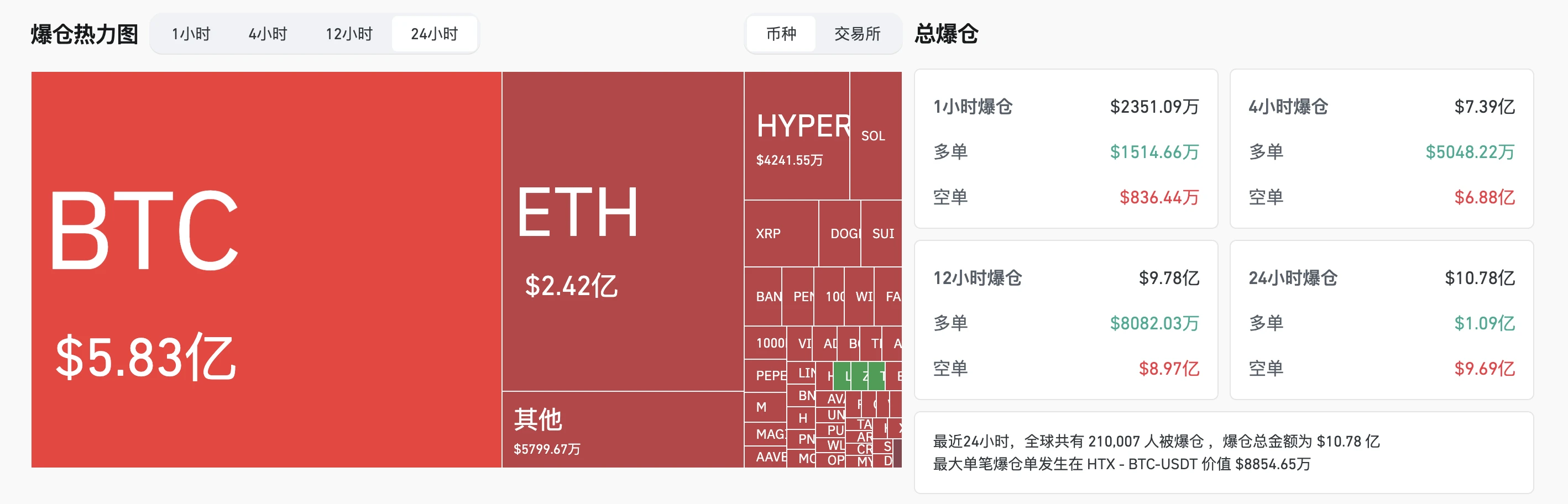

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has been liquidated for $1.078 billion, most of which are short orders, amounting to $969 million . In terms of currencies, BTC liquidated $583 million and ETH liquidated $242 million.

Reasons for the increase: Tariff desensitization, institutions increase investment, and expectations of interest rate cuts

As for the reasons for this round of market upswing, we have already made some analysis in yesterday’s market trend article “ BTC hits a new high of $112,000, ETH leads the rise by 7%, is the dawn of the altcoin season beginning to appear? ”

On the one hand, the market has gradually realized that the collective psychological impact of this round of tariff turmoil has been greatly weakened - just like the story of the boy who cried wolf, when a story is spread many times, its deterrent effect will naturally fade. The panic effect of the tariff war on the crypto market and even the global economy has been greatly reduced.

On the other hand, the buying power of institutions, including ETFs, continues to increase. As of July 10, the spot Bitcoin ETF has maintained positive inflows for 5 consecutive days. After SOL opens the ETF channel, more altcoin ETFs are expected to be approved for listing ; in addition, following the old BTC hoarding companies such as Strategy, more and more listed companies have also shifted their hoarding targets to altcoins such as ETH, SOL and even HYPE.

In addition to the above reasons, the remarks made by several Federal Reserve officials regarding interest rate cuts last night also boosted market sentiment to a certain extent.

San Francisco Fed President Mary Daly said last night: I think there may be two rate cuts , but there is uncertainty about everyones expectations, considering a rate cut in the fall.

Waller, a member of the Federal Reserve Board and a potential candidate for the next chairman, said that even if the June employment data was strong, the Fed should still consider cutting interest rates at the July meeting - I have made my point clear. The current policy interest rate level is too high. We can discuss lowering the benchmark interest rate in July... When inflation is going down, we dont need to maintain such a tight policy stance. This is the decision-making logic that the central bank should have.

ETH rebounded strongly, can it continue in the future?

ETH is undoubtedly the brightest star in this round of market rally. Since the market trough in April this year, no one expected that ETH, which was the most pessimistic at the time, would outperform BTC and SOL, and has now doubled in value.

As for the reasons why ETH has outperformed the market recently, we have made a detailed analysis in the article Five major rising logics are becoming clearer, ETH may usher in a structural reversal . In short, supported by the five major rising logics such as regulatory relaxation, institutional holdings, foundation reform, growth in on-chain activities, and return of market confidence, ETH, which has experienced a long period of consolidation, may usher in a structural reversal and is expected to continue its upward trend in the long run.

Jack Yi, the founder of LD Capital who had previously called for ETH in a high-profile manner (now known as E Boss by the E guards), also posted on X this morning that Ethereums breakthrough of $3,000 marks the start of a bull market in the crypto industry... Ethereum is seriously undervalued. In the past, the bull market was driven by IC0 and DeFi, and this round is driven by stablecoins and RWA.

However, judging from the short-term trend and pending orders, ETH still faces strong selling pressure near $3,000, which means that if it wants to effectively break through this position, ETH may still need to consolidate further below. The analysis model released by CoinDesk this morning also shows that ETH faces strong resistance near $3,000, and the support area below is around $2,750.

In addition, the Ethereum Foundation, which was recently praised for its operational reforms, sold 1,210 ETH again this morning at an average price of $2,889.5. Considering the past record of the Typhoon Foundation in escaping the top, this will also affect market sentiment to a certain extent.

Will the “copycat season” come again?

ETH has always been regarded as a weather vane for altcoins. Previously, affected by the long-term sluggishness of ETH, the altcoin market has been sluggish for a long time. As ETH finally ushered in a strong rebound, the market has rekindled expectations for the legendary altcoin season.

Regarding this discussion, trader degentrading published a different analysis on X last night, arguing that under the market consensus that altcoins are scams, the gradually increasing short position size will eventually become the nutrient for the rise of altcoins due to short squeeze, thereby promoting the arrival of the altcoin season.

The current market is experiencing an unprecedented phenomenon: the open interest (OI) of multiple altcoins exceeds their market value, which means that there are naked shorts that cannot be covered - because short positions must be closed by buying an equivalent amount of spot, and when OI > market value, the market simply does not have enough token supply to take over.

The historic turning point is that when Bitcoin is about to break through its previous high, we observe for the first time: huge amounts of funds continue to flow into ETH; institutions bid for ETH through Treasury companies; the OI of the altcoin derivatives market hits a historical record; a new generation of traders make profits by shorting altcoins (the consensus that altcoins are scams anyway prevails).

The short squeeze storm is coming. The current market OI is about 172 billion US dollars (BTC 83 billion/ETH 40 billion), and altcoins alone account for 50 billion. When these huge short positions established at historical lows begin to be collectively closed - this is the structural source of altcoin demand. The game is about to begin.

However, different voices still exist. Andrei Grachev, executive partner of DWF Labs, believes that most altcoins are expected to continue to underperform Bitcoin in the future.

The approval of the Big and Beautiful Act, seasonal market activity in the fourth quarter, and potential interest rate cuts will push Bitcoin and crypto-related stocks to new highs. The altcoin market may partially follow the rise, but most mid-cap currencies are expected to underperform Bitcoin, and the opportunity has come again.

It has been so long since the last round of copycat season that the term has become a joke, and the market seems to have lost the courage to imagine again.

Will it be different this time?