On July 11, according to OKX market data, BTC continued to rise and broke through $118,000 in one fell swoop, setting a new record! So what are BTC holders doing?

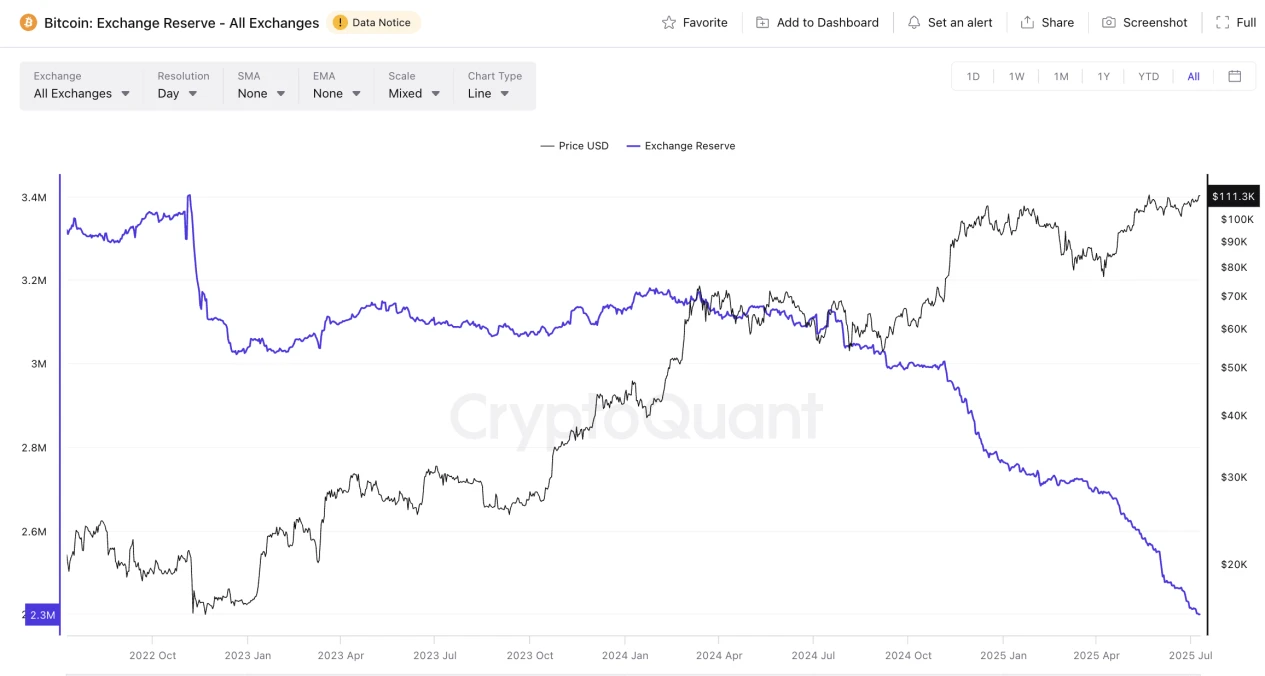

According to CryptoQuant data, as of July 2025, the balance of BTC held by centralized exchanges has dropped to about 2.4 million, accounting for about 12% of the total circulation of Bitcoin, a new low in nearly four years. Since the beginning of 2024, the indicator has continued to decline, and accelerated in the second quarter of 2025, in sharp contrast to the rising trend of BTC prices, showing typical bull market characteristics: the gold outflow of exchanges often indicates the establishment of a medium- and long-term rising structure.

This also shows that a large amount of BTC is flowing into the hands of long-term holders. Driving factors include the continued accumulation of spot ETFs (such as BlackRock and Fidelity), users preferring self-custody assets after the FTX incident, and institutions transferring BTC to private wallets through over-the-counter transactions. At the same time, global interest rate expectations have turned to easing, and funds have flowed back to risky assets, further strengthening the structural supply tightening of Bitcoin. Compared with the past, the market structure behind this round of trends is more mature, and institutions and long-term holders have greater influence. This may mean that the future trend of Bitcoin prices will be more stable, and it is not easy to have the kind of violent crash caused by concentrated selling pressure from exchanges in the past.

But at the same time, we also need to be wary of some historical lessons. For example, when market sentiment is overly optimistic and almost all participants turn to holding on to their coins and are reluctant to sell, the lack of short-term liquidity may amplify price fluctuations, which has also happened in history.

Source: CryptoQuant

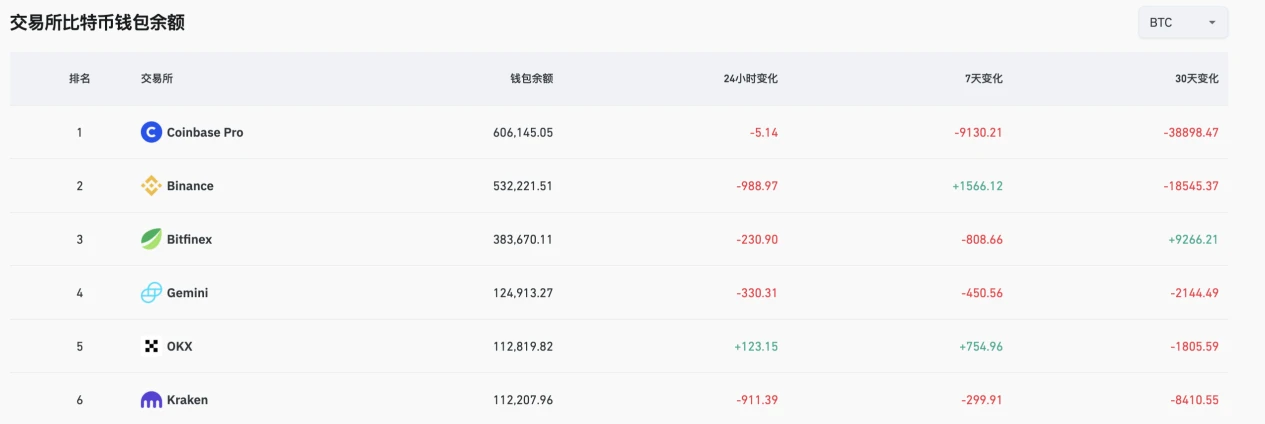

However, according to Arkham Intelligence data, the number of BTC held by OKX exchange wallets has been on an upward trend: it has grown rapidly since April 2019 and remained at a high level from 2023 to 2024; but it has fallen from mid-2024 to 2025, and this change is also confirmed by the trend of BTC balances on other exchanges. As of July 10, the number of BTC held by OKX wallets is more than 110,000.

This divergence suggests that OKX may be more competitive in the current market environment. First, because OKX has long insisted on issuing monthly proof of reserves (PoR) and has maintained a BTC reserve rate of more than 100%, it has significantly enhanced user trust. Secondly, the platform has consolidated its market position as the worlds second largest exchange through product innovation and experience improvement, attracting a large amount of capital inflows. In addition, its active compliance layout in key markets such as Dubai, Singapore, the European Union, and the United States has also driven the asset migration of institutional and retail users. Therefore, although the BTC balance of all exchanges is on a downward trend, the continued influx of new users and institutional funds may drive the platform balance to grow against the trend.

Source: Arkham Intelligence

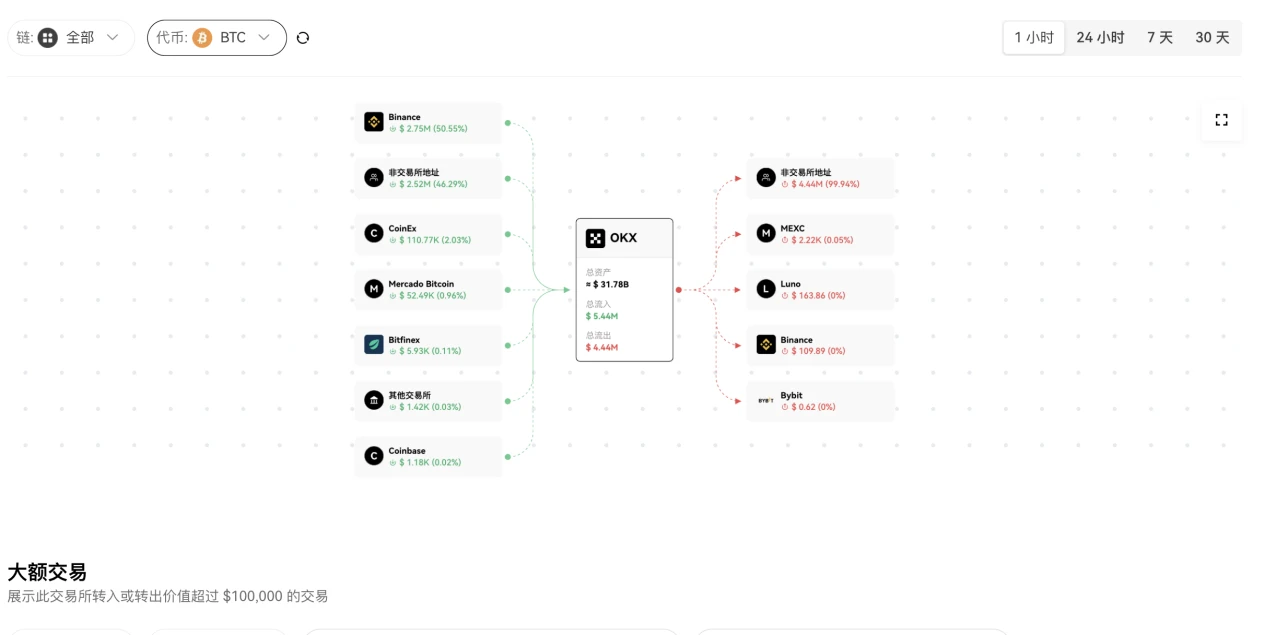

In addition, according to Coinglass data, as of July 10, OKX has seen a net inflow of BTC in the past 24 hours, indicating that BTC users are accelerating their concentration on its platform. This change may be related to the recent launch of the BTC Hoarding Interest-bearing Treasure product, which has attracted more high-net-worth users to deposit BTC into OKX.

More on-chain data also confirms this judgment. Since July 9, the BTC holdings of OKX exchange wallets have increased to a certain extent. Arkham Intelligence shows that the timing of the inflow of on-chain funds coincides with the launch of OKXs low-risk principal-guaranteed financial product BTC Coin Hoarding Interest-Bearing Treasure. The product was snapped up for two consecutive days after its launch, showing users strong demand for low-risk BTC value-added tools.

So, is this the coin-based optimal solution that high-net-worth users are looking for? According to the official introduction, this product is the first BTC financial product in the industry, with a historical average annualized return of about 2.57%. Platform VIP 1-8 users can apply for purchase and redemption at any time, and there is no handling fee. Compared with traditional financial management methods, its flexibility and low-risk principal preservation attributes are popular among BTC holders.

Source: Coinglass

It is worth noting that according to OKLink data, part of the capital inflow is not from new purchases, but from asset migration of users of other exchanges such as Coinbase and Bitfinex, indicating that OKXs BTC Coin Hoarding and Interest-bearing Treasure has stronger user stickiness and capital absorption capabilities in the current market. This phenomenon reflects the markets continued exploration of innovative financial management tools and also highlights users urgent need for safe and flexible solutions.

The reason is that in the current market environment, BTC holders are not only facing the pain point of idle assets that cannot be effectively appreciated. It is also about how to achieve steady appreciation while ensuring the safety of the principal. Although there are many CeFi financial products on the market, many still have limitations such as long lock-up periods, large fluctuations in returns, and poor flexibility. When the market is extremely volatile or the platform mechanism is opaque, it is difficult for users to quickly redeem or clearly guarantee the safety of their principal.

DeFi products are limited by natural barriers such as smart contract security, high volatility of returns, and high complexity of on-chain operations. They are not friendly to most BTC holders who want low thresholds, security, and peace of mind. At the same time, frequent negative industry events such as running away, liquidation, and technical failures have made users more sensitive to capital preservation. In particular, high-net-worth individuals, miners, and long-term position holders are more inclined to choose capital-preserving products under large platforms and transparent mechanisms to avoid non-market risks.

Source: OKLink

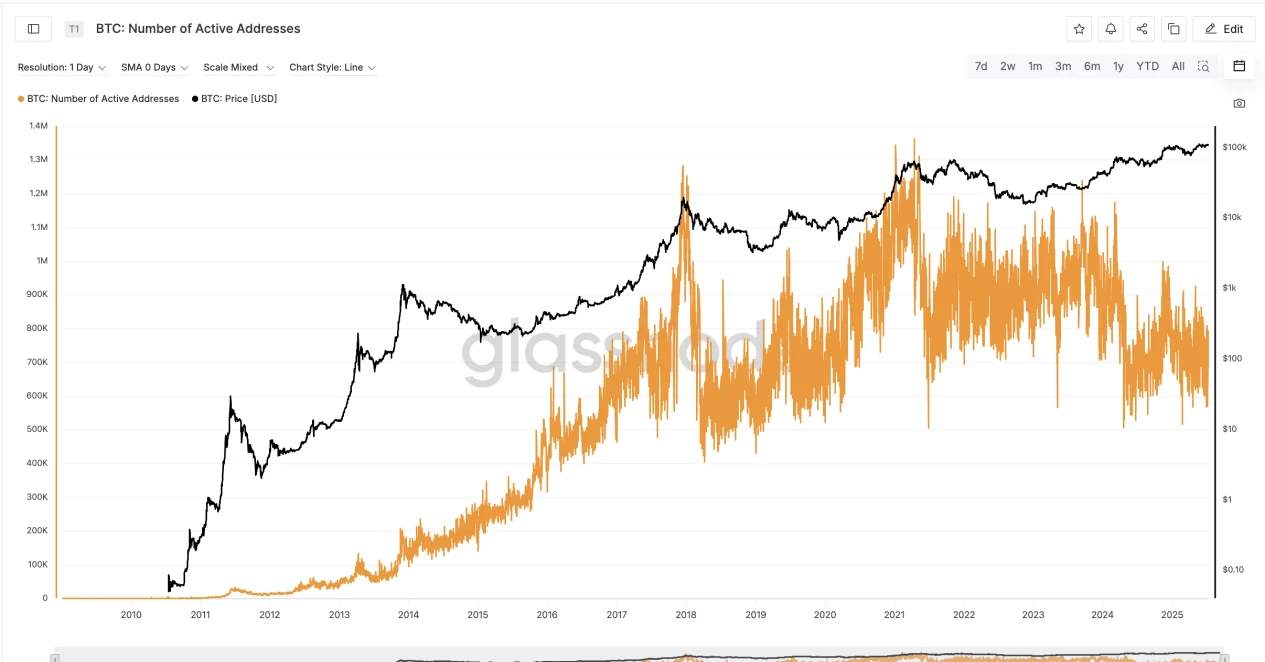

An interesting phenomenon has emerged in this round of bull market: although the price of Bitcoin has hit new highs, the number of active addresses on the chain has not surged synchronously. Glassnode data shows that on July 9, the current number of daily active addresses on the Bitcoin network is about 775,000 , which is comparable to the levels in 2019 and 2020. This means that although the price of BTC has risen several times, the influx of new users and new funds is relatively limited, and the market is more driven by existing funds. This deviation of rising prices and not rising active addresses reflects that the main driving force of this round of market is not the widespread participation of retail investors, but the behavior of institutional funds and long-term holders.

Many large transactions are completed through over-the-counter or block trades, and do not generate a large number of new address activities on the chain. Therefore, the indicator of active addresses suggests that the current market rise is more driven by changes in the capital structure (such as institutional hoarding, ETF subscription, etc.) rather than the enthusiastic entry of ordinary investors. This also explains why the market has not seen the previous phenomenon of network congestion and soaring fees while setting new highs - because a large number of transactions occur off-chain or between large accounts, and the on-chain activity is relatively mild.

This type of large Bitcoin holders have extremely high security requirements, not only because of the scale of their BTC holdings, which often start at millions of US dollars, but also because once assets are stolen or platform risk control errors occur, the losses will be huge and difficult to recover. At the same time, large holders often bear more stringent compliance reviews and reputation maintenance pressures. They prefer to choose established exchanges with third-party audits, multiple security protections, and licenses, so as to minimize technology and risks while pursuing profits.

Source: Glassnode

Bitcoin is often regarded as digital gold, and its anti-inflation attribute has become a consensus. Especially at the moment when the credit of legal currency is constantly diluted and global liquidity fluctuates frequently, its long-term value is more prominent. However, the Bitcoin market is no longer an isolated niche field, but a global asset that is deeply linked to the macro economy and the traditional financial system. Inflation data, interest rate policies, fluctuations in US stocks and even geopolitical events may affect the price performance of Bitcoin through channels such as risk preference and capital flow. Therefore, to understand the market of Bitcoin, we cannot just focus on the K-line on the chain, but also need to have a cross-market and multi-dimensional analysis perspective to grasp the interactive logic between macro variables and the encryption ecology.

At the same time, the market structure of Bitcoin itself is also changing. The reserves of BTC in exchanges continue to decline, more and more assets are flowing into large accounts, and market liquidity is being absorbed on a large scale, resulting in a gradual decrease in the availability of Bitcoin and a continuous increase in marginal costs. Under this supply tightening trend, coin holders need to think more about how to realize asset appreciation while holding. The BTC Hoarding and Interest-earning Treasure launched by OKX allows users to enjoy low-risk and principal-guaranteed currency-based returns without selling BTC, achieving the dual goals of hoarding coins and earning interest, and providing a more stable way to deal with inflation and interest rate uncertainty.

There is no doubt that BTC’s stable value-added methods and products are becoming the consensus choice of major investors.