1. Introduction

With the rise of Large Language Models (LLM), interacting with blockchains through natural language has become an important development direction of Web3. Orcamind launched the Orcamind AI Agent Wallet based on the Model Context Protocol (MCP). Unlike traditional wallets that passively respond to user instructions, manage isolated addresses and single transactions, AI Agent Wallet breaks through the limitations of private key management and single transaction signatures, and focuses on providing users with secure and automated multi-chain operation capabilities. It provides users with a simple, fast and secure intelligent on-chain interaction solution. This article will explore this innovative technical architecture in depth, and analyze in detail its working principles, core advantages, and how it can bring users a safer and more convenient Web3 experience.

2. Core Concepts

Before diving into the architecture, we first need to understand two key concepts:

2.1 MCP (Model Context Protocol)

MCP (Model Context Protocol) is a standardized communication protocol in the AI field, which aims to solve the integration problem of large models (LLM) with external data sources, tools and services.

The agreement is divided into:

MCP Client: User interaction terminals (such as Claude, Cursor, and Orcamind App) directly receive natural language commands from users, parse user intent through a large language model, match corresponding tools, and extract parameters required by the tools.

MCP Server: executes tool logic and provides feedback to the Client

Developers can expand functionality by registering new tools (such as staking, Dapp interaction) without modifying the core protocol. For the Orcamind App, the MCP service acts as a bridge between the language model and blockchain interaction.

2.2 AI Agent Wallet

AI Agent Wallet is a smart wallet app proposed by Orcamind and powered by a trusted backend agent. Through the MCP service connected to LLM, the users natural language instructions can directly drive the Agent Wallet to automatically perform a series of complex on-chain operations (such as transfers, contract interactions) while ensuring the security of assets, without the need for tedious signature operations or understanding the underlying technical details of the blockchain.

3. Agent Wallet Technical Architecture

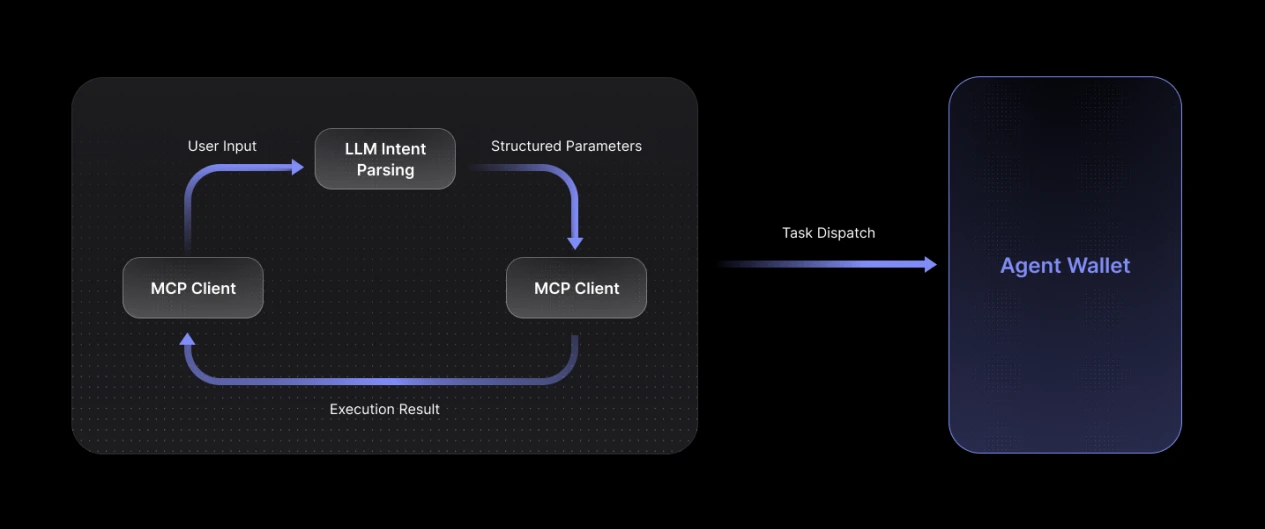

3.1 MCP

In the MCP framework, Agent Wallet runs as an independent MCP Server, providing a dedicated wallet operation tool set. When the users instructions are parsed by the model, the MCP routing layer will call the corresponding tools according to the parameters, initially decompose the instruction tasks (Jobs) into more fine-grained Tasks, and submit them to Agent Wallet to perform the corresponding subsequent operations.

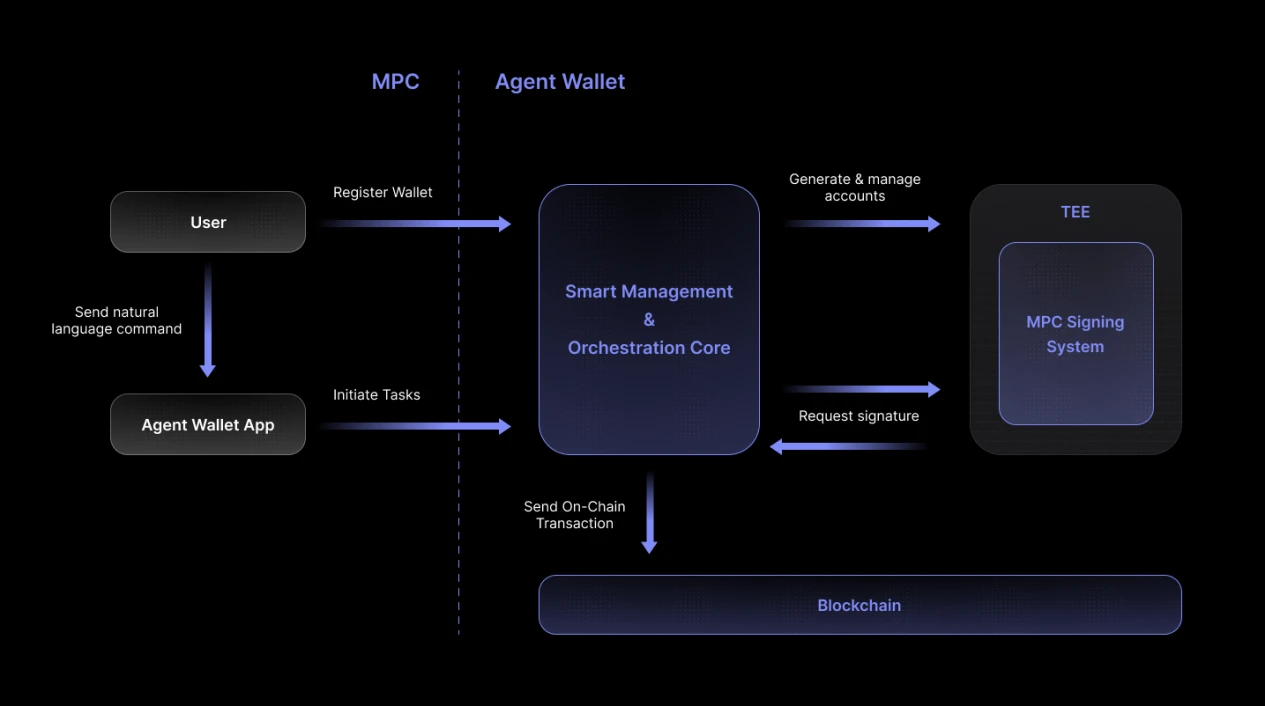

3.2 Agent Wallet

As the core execution engine of blockchain proxy wallet, Agent Wallet adopts modular design to realize the full-link closed loop of account proxy, task scheduling and security signature. Its architecture consists of two core modules, which work together through standardized interfaces:

1. Smart Management Orchestration Core (SMOC)

The intelligent management/scheduling center uniformly manages the global account system and task flow, ensuring that the instructions issued by users through natural language can be accurately and safely converted into on-chain operations. Its core capabilities integrate the two major functions of account management and task scheduling. This module includes the following features:

Unified account management

Based on the OIDC protocol, a strong binding relationship between user identity and multi-chain proxy account is established. SMOC will perform real-time credential verification before each operation to avoid the risk of account hijacking. At the same time, through dynamic account abstraction technology, a single user identity is mapped to the proxy address of different blockchains (such as EVM, Solana), providing a unified entry for multi-chain operations and hiding the complexity of the underlying chain.

Intelligent asset adaptation

Users only need to deposit a single mainstream token (such as USDC or ETH). SMOC will automatically analyze the operation requirements before the task is executed and dynamically exchange the required assets, including the Native Token of the target chain (such as ETH, SOL) and specific tokens required for DApp interaction (such as Uniswaps WETH), ensuring a seamless execution flow and eliminating the tedious operations of users manually exchanging and charging the corresponding tokens.

Intelligent task scheduling

For the parsed task flow, SMOC intelligently decomposes complex operations into atomic subtasks through the DAG scheduler, dynamically manages the dependencies and execution sequences between tasks, and supports automatic rollback and breakpoint continuation. After the task is ready, key preprocessing operations are automatically performed, including dynamic allocation of Nonce sequences, real-time optimization of Gas strategies, and precise construction of cross-chain Calldata to maximize execution efficiency and success rate.

Full-link execution monitoring

SMOC will monitor the full life cycle status (Pending/Confirmed/Failed) from task issuance to on-chain confirmation in real time, and proactively identify congestion or abnormal risks by combining in-depth analysis of the transaction pool with block confirmation prediction. When a transaction fails (such as insufficient Gas, contract execution failure), it will automatically diagnose and ensure the verifiable consistency between user intentions and on-chain operations.

2. MPC Signature System

This module builds the security foundation of the proxy wallet, and achieves end-to-end key protection and signature security by integrating the trusted execution environment (TEE) and the standardized threshold signature protocol. All private key shards are strictly stored in a hardware-level encrypted TEE environment to ensure that the signature calculation is completed in the CPU encrypted memory area, completely isolating the attack threats at the operating system level (such as kernel vulnerabilities and memory capture). Based on the (k, n) threshold signature mechanism, the system divides the complete private key into multiple cryptographically invalid shards. A single shard can neither derive the original private key nor generate a valid signature independently. Only when distributed nodes collaborate in computing can a legal blockchain signature be generated without reconstructing the private key. This architecture meets two core security features at the same time:

1. Zero reconstruction principle of private keys: The complete private key has never and will never appear in any physical device or memory during its life cycle;

2. Dynamic recoverability: When part of the private key shards are accidentally lost (not exceeding the fault tolerance threshold), the system can safely reconstruct new shards and destroy old shards through cryptographic collaboration of the remaining surviving shards, ensuring that asset control is never lost.

This design, which combines hardware-level isolation and distributed cryptography, builds an unalterable security boundary for the operation of proxy wallets, ensuring asset sovereignty even in the face of advanced persistent threats (APTs).

In addition, Orcamind Agent Wallet also supports users to hold and maintain an MPC shard node and jointly participate in the subsequent signing process to provide higher credibility.

3.3 AI Agent Wallet Workflow

Phase 1: Account initialization (first use)

When a user starts and uses the Agent Wallet for the first time, the system will execute a rigorous and automated account initialization process. The core goal of this process is to complete the reliability verification of the users digital identity, the construction of a cross-network agent account system, and the secure custody of keys under high security standards. The entire process revolves around three key links:

1. Identity binding:

The first step of initialization is to establish the association between the user identity and the system. To this end, Agent Wallet strictly uses the industry-standard OIDC (OpenID Connect) protocol as a bridge. Users can complete the operation by simply performing a signature authentication on the page to authorize. After the management center parses and verifies the signature and validity, it will generate an identifier that can uniquely represent the user through a specific encryption algorithm. This globally unique identity identifier is the cornerstone of all subsequent operations. It not only closely binds users to their wallet activities, but also provides an unalterable basis for subsequent account management and audit tracing.

2. Proxy account generation:

After successfully establishing the users identity, the signature system will use the MPC sharding solution to securely generate a set of cross-chain proxy accounts. This process will be completed through a distributed, pre-configured MPC node network. These nodes will jointly participate in sharding calculations in the TEE environment. At the same time, the management center will establish a corresponding association between the users unique identity identifier generated in the previous step and this set of proxy accounts.

3. Secure key storage:

The private key shards will be completely stored in the TEE environment to ensure that they cannot be illegally accessed or stolen, thereby minimizing the risk of asset loss due to private key leakage or single point failure.

Phase 2: Instruction Execution

When a user issues the instruction Use addresses A1 and A2 to pledge 0.5 ETH to the contract 0x Stake, the system implements secure and automated execution through the following closed-loop process:

1. Semantic analysis and intent encapsulation

The LLM engine parses the users natural language instructions, identifies the operation type (agent_wallet_staking) and completes the context parameters (address list, number of tokens, contract address), and generates a structured operation framework for transmission to SMOC.

2. Unified scheduling and task decomposition

Account authentication: Verify proxy account ownership through identifiers and perform OIDC real-time credential verification to ensure the legitimacy of operations.

Dynamic asset adaptation: Check the balance of the Fund address and automatically redeem it if ETH is insufficient

Intelligent task breakdown:

→ Subtask 1: Transfer 0.5 ETH from Fund address to A 1

→ Subtask 2: Transfer 0.5 ETH from Fund address to A 2

→ Subtask 3: A 1 calls the deposit() method of the 0x Stake contract → Subtask 4: A 2 calls the deposit() method of the 0x Stake contract (dependency between tasks: staking can only be done after the transfer is completed)

3. Automated transaction construction and signing

Real-time parameter generation: dynamically allocate Nonce based on on-chain status, optimize Gas strategy, and construct Calldata (such as ABI encoding of staking contracts).

Distributed secure signature: The signature system initiates a collaborative signature request to the MPC node cluster in the TEE environment through an encrypted channel. Each node uses private key sharding to calculate partial signatures in a hardware-isolated environment, and finally aggregates valid transaction signatures under the premise of zero private key reconstruction.

4. Transaction execution and status monitoring

Broadcast signed transactions to the network and monitor transaction pool depth and block confirmation status in real time.

The entire chain tracks the life cycle (e.g. A 1 transfer pending → pledge confirmed). If a subtask fails (e.g. insufficient gas), a rollback is automatically triggered and an alarm is issued.

Generate an operation log, including the full chain of evidence from LLM parsing to on-chain confirmation.

3.4 Agent Wallet Scalability

Agent Wallet also provides a powerful function integration portal for third-party developers through standardized and highly scalable architecture design. Developers can implement customized Agent Wallet tool logic according to business scenario requirements (such as cross-chain asset routing, customized DeFi strategies, on-chain governance automation, etc.). The tool only needs to follow the following simple integration path:

1. Interface compliance implementation: Developers implement the core logic of the tool according to the preset protocol specifications, such as parsing specific instruction parameters and generating atomic operation steps;

2. Capability registration declaration: register tool metadata (function description, input and output formats, dependent resources) to the global scheduling directory of SMOC (Smart Management Orchestration Core);

3. Dynamic process injection: Define task decomposition rules in the DAG scheduling framework of SMOC and map complex business flows into atomic nodes that can call the tool.

After the connection is completed, developers can enable users to directly drive custom processes through natural language. This decoupled design enables third-party tools to reuse the security foundation (TEE+MPC) and intelligent scheduling capabilities of Agent Wallet, greatly reducing the development threshold for complex on-chain operations.

4. Conclusion

By combining a large language model, Orcamind AI Agent Wallet can convert user instructions into safe and automated operations. Its Smart Management and Scheduling Core (SMOC) dynamically disassembles tasks, optimizes Gas/Nonce parameters, and monitors the status of the entire chain in real time, while relying on TEE hardware isolation and MPC threshold signatures to achieve account security. At the same time, developers can expand the MCP Server tool through standardized interfaces, reuse its security base and scheduling engine to build customized processes, and ultimately allow users to drive complex on-chain interactions (such as multi-address staking, cross-chain asset routing) with natural language, completely bid farewell to the operational burden of manually managing Gas, Nonce, and multi-chain assets, and become a truly autonomous on-chain execution agent.