Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Previous records

Follow up of old mines

The market is warming up, and the basic yield is rising

As market sentiment generally warms up, especially as altcoins represented by ETH gradually strengthen, the markets basic yield rate also shows a clear upward trend.

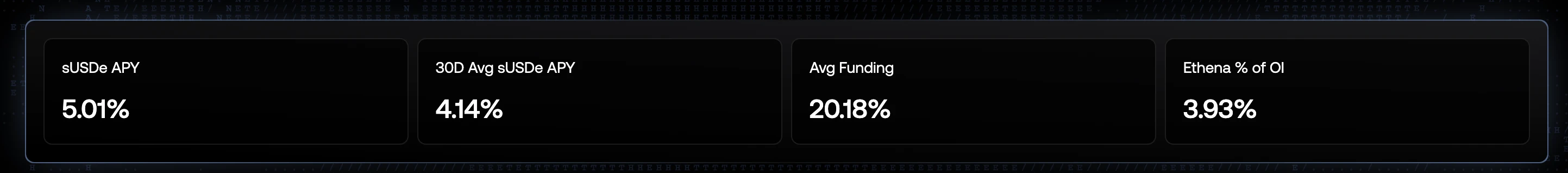

Specifically, the yield of USDT and USDC in OKX has risen to more than 40% in a short period of time many times (short-term peak, not long-term data). In addition, Ethena also disclosed that the average annualized fee rate of BTC and ETH in the current market is about 20%, which means that the next sUSDe yield (currently 5%) may increase significantly when it is updated.

All in all, the rise in the base interest rate is good news for everyone who is keen on stablecoin financial management. I hope this positive sentiment can last longer.

Huma 2.0 opens again

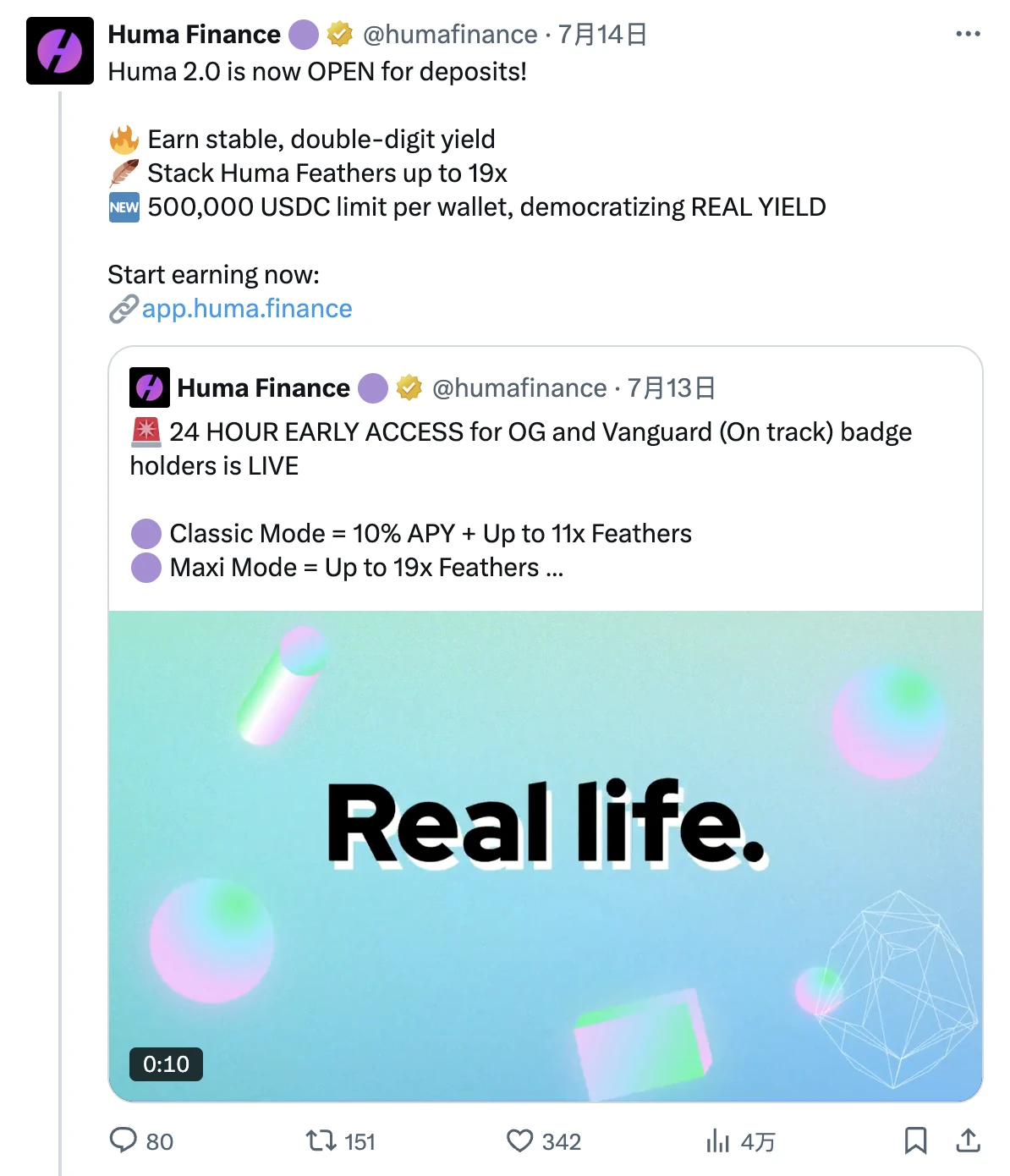

On July 14, PayFis popular project Huma Finance announced that Huma 2.0 deposits are now open again. Users with OG and Vanguard roles can deposit 24 hours in advance. Currently, choosing the Classic mode for deposits can get an average monthly APY of about 10%, and choosing the Maxi mode can get up to 19 times the points (Feathers) rate.

In the article on May 27 , we mentioned that Huma officials have determined that they will take a snapshot of the second quarter airdrop three months after TGE, distributing 2.1% of the total supply (5% in the first quarter). The airdrop snapshot is expected to be completed by the end of August , so it is not too late to make up for the current work.

In the article on May 27 , we mentioned that Huma officials have determined that they will take a snapshot of the second quarter airdrop three months after TGE, distributing 2.1% of the total supply (5% in the first quarter). The airdrop snapshot is expected to be completed by the end of August , so it is not too late to make up for the current work.

In terms of strategy, in addition to direct deposits within the Huma protocol, the RateX double-eat strategy we mentioned earlier is still effective.

Huma Portal: https://app.huma.finance

RateX Portal: https://app.rate-x.io

New opportunities

Katana Blind Digging Launch

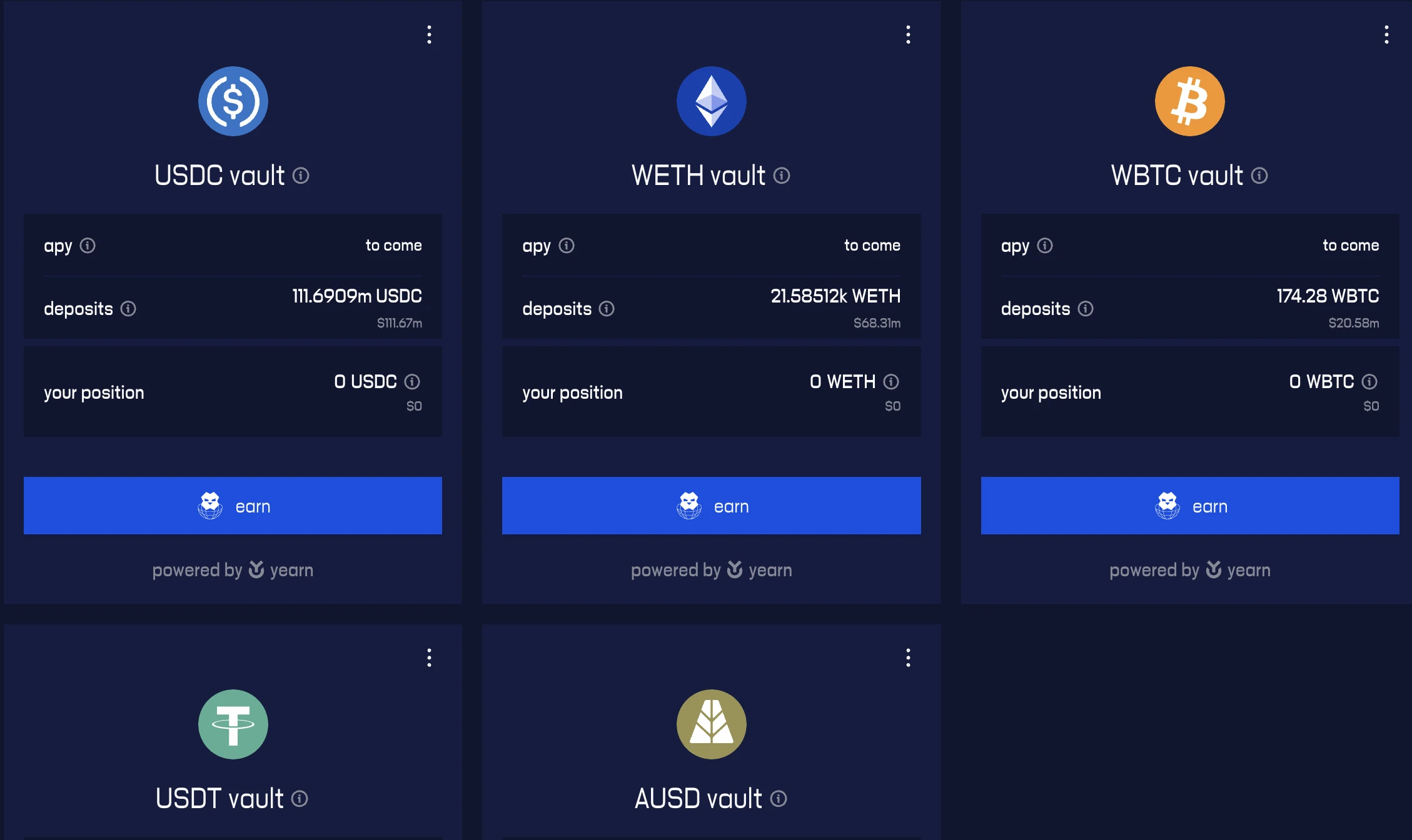

Katana is a mine that has been discussed a lot in the community recently. Katana is a DeFi-specific blockchain jointly launched by Polygon Labs and crypto trading company GSR. The mainnet was launched earlier this month.

Katana now supports users to deposit USDC, USDT, AUSD, ETH, WBTC and other assets, and the project has announced that it will provide 1 billion native tokens KAT as liquidity incentives. KAT is not yet online, so it is impossible to calculate the exact rate of return based on the price, but considering the solid endorsement of the chain and the current low total deposit scale, the rate of return of blind mining should be good.

A special mention should be made of AUSD here. Its issuer Agora has just completed a $50 million financing led by Paradigm. I personally recommend using this token for deposits as there are certain opportunities for dual mining.

Resolv Partners with Binance Wallet

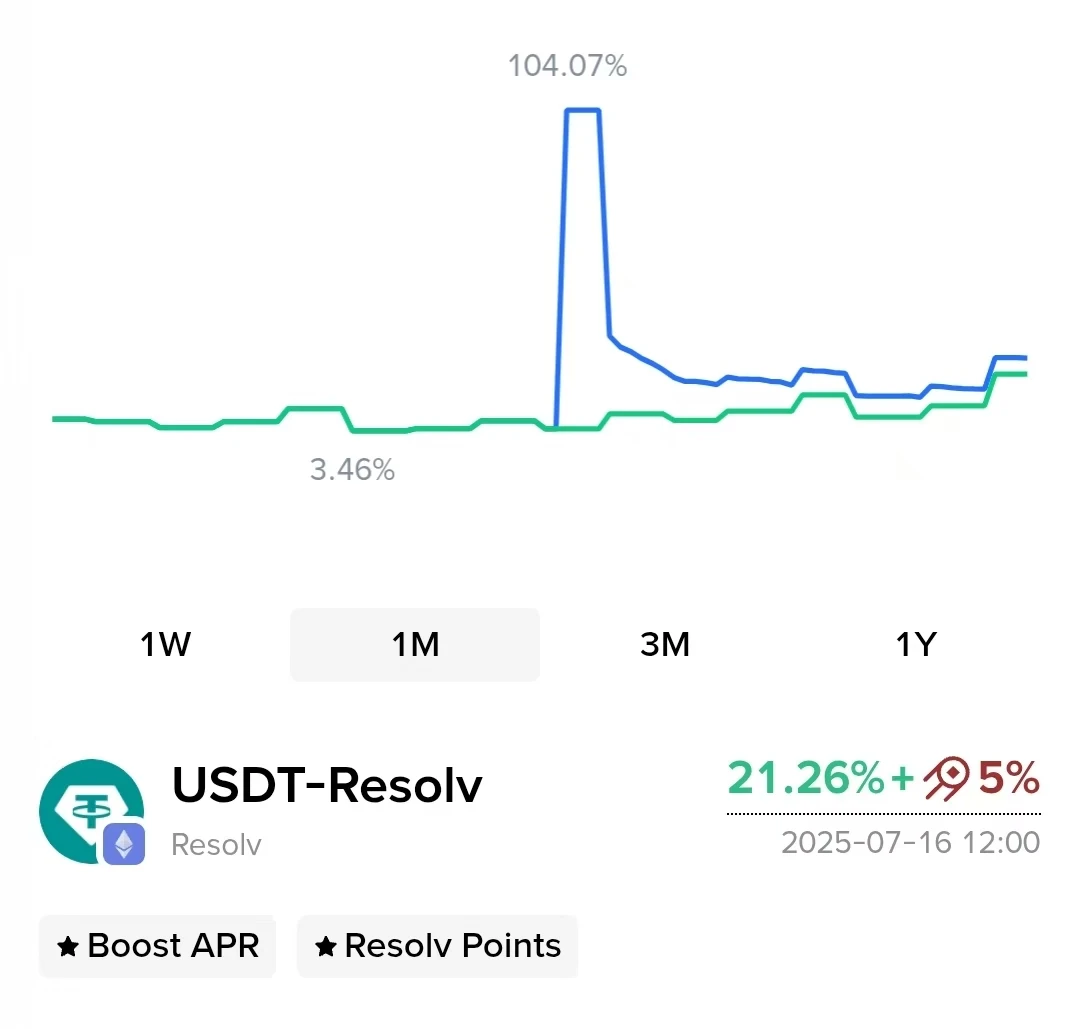

On July 9, the interest-bearing stablecoin Resolv announced a partnership with Binance Wallet to launch a deposit campaign. By depositing stablecoins such as USDT into Resolv through the Binance Wallet channel in exchange for wstUSR, users can obtain the basic interest-bearing rate of USR, plus Resolv Season 2 points rewards, and additional incentives totaling $600,000.

The Binance Wallet homepage shows that the current real-time APR for this deposit activity is temporarily reported as 26.26%. In addition, the points correspond to the second round of Resolv airdrops, and the combined yield is quite attractive.