After Bitcoin broke through its all-time high, the crypto markets attention is quietly turning to high-Beta assets such as Ethereum and Solana . Multiple on-chain data and capital flow signals show that a round of market dominated by altcoins may have quietly started.

Ethereum and Solana performed strongly, and major funds entered the market at an accelerated pace

Recently, the market performance of Ethereum and Solana has been particularly eye-catching. According to the market data of Huobi HTX platform, as of now, Ethereum (ETH) has risen from 2474 USDT to 3857 USDT since the beginning of July, an increase of more than 55%.

This significant rise is not accidental. Data from the on-chain monitoring platform Lookonchain shows that from July 1 to 21, 23 whales or institutions have bought a total of 681,103 Ethereum, equivalent to approximately US$2.6 billion, indicating that ETH is becoming a core target for the markets main funds to increase their holdings.

At the same time, the ETF market also released positive signals. According to Trader T monitoring, on July 21, the net inflow of ETH spot ETF reached 297 million US dollars, setting a record for the highest single-day inflow in history, accounting for 80% of the Bitcoin ETF trading volume, and it was also a continuous 12-day net inflow, and the trend of capital tilt was very obvious.

On the other hand, Solana, once known as the Ethereum killer, also performed well. Huobi HTX platform market data shows that Solana (SOL) has risen from 157.8 USDT to 204.6 USDT, an increase of 29.6%. At the same time, Solana ecological tokens have generally risen. As of 10:00 on July 22, RAY has risen by 21.01% in the past 24 hours; PENGU has risen by 20.5% in the past 24 hours; JUP has risen by 17.14% in the past 24 hours; AI16Z has risen by 14.73% in the past 24 hours.

The strengthening of ETH and SOL is not just a single-point outbreak of individual mainstream assets, but more like a structural signal - funds are shifting from Bitcoin to the more volatile and growing altcoin sector, and the prelude to the altcoin season may have officially begun.

BTC market share continues to decline, and the altcoin seasonal index strengthens

As ETH and SOL rose in turn, the market structure also quietly changed. Bitcoins market dominance is gradually being eroded, providing space for funds to flow into alt assets.

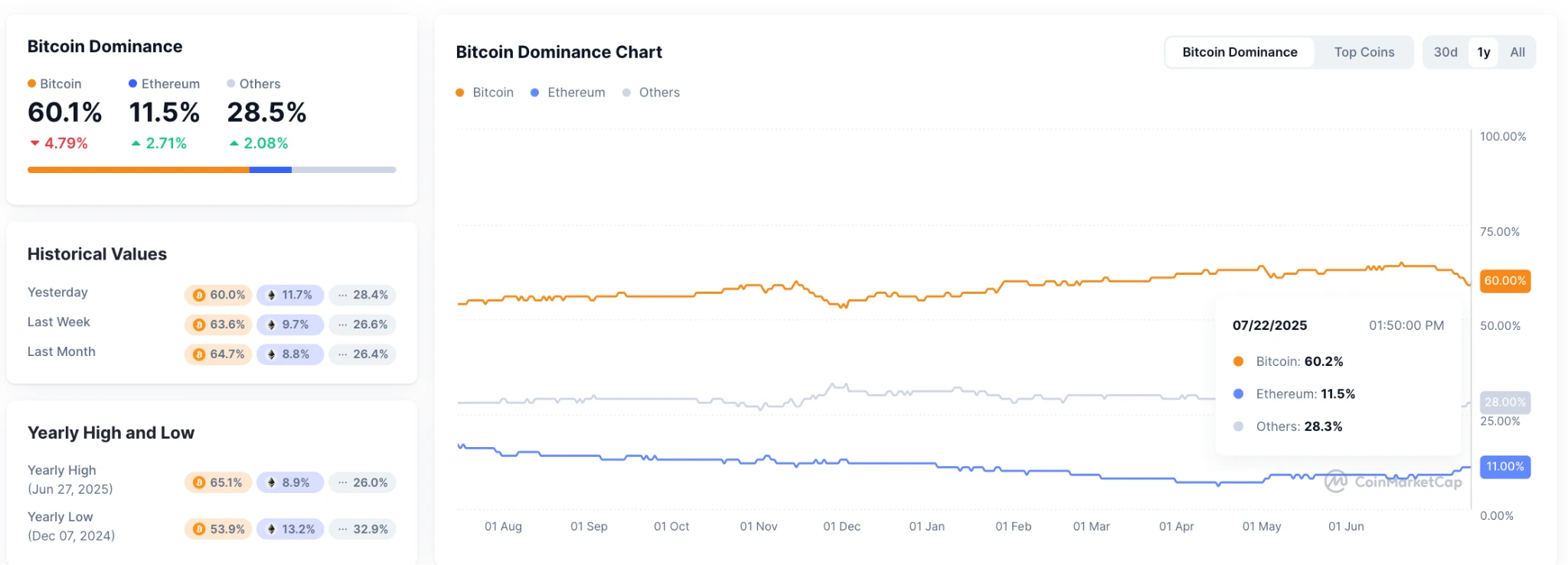

According to Coinmarketcap data, Bitcoins market share has continued to decline, now at 60.1%, a new low since March this year. At the same time, the Altcoin Season Index rose, reaching a high of 55 on July 21 and now at 50. The index shows that in the past 90 days, about 50 of the top 100 cryptocurrencies by market value have outperformed Bitcoin.

Data source: CoinMarketCap

Data source: CoinMarketCap

Chloe (@ChloeTalk 1), a columnist at HTX DeepThink and researcher at HTX Research, believes that Bitcoin’s strong breakthrough of its historical high has stimulated the market’s general expectations for the “altcoin activation season”. Bitcoin’s current rise is due to its safe-haven attributes and its USD credit asset label. At a time when Japanese government bond yields are rising and the global interest rate structure may be facing an inflection point, combined with the bullish structure of the options market, this constitutes an important structural basis for funds to switch from BTC to altcoin assets.

Market view: The real altcoin bull market may still be behind

QCP Capital pointed out in its latest research report that multiple indicators show that the altcoin season may have quietly begun. The altcoin season index has exceeded 50, setting a new high since December last year. The passage of the GENIUS Act provides a clear regulatory framework for the issuance of stablecoins, prompting corporate finance departments to regard ETH, SOL, XRP, ADA, etc. as a new generation of crypto reserve assets. In addition, if the pledged Ethereum spot ETF is approved, it is expected to further promote the transfer of institutions from Bitcoin ETF to ETH allocation. Last week, the net inflow of ETH spot ETF exceeded BTC for two consecutive days, and the confidence of institutions such as BlackRock has increased significantly. The options market also showed strong bullish signals, and the market outlook for the fourth quarter is optimistic.

James Wynn, a contract whale, believes that BTC may reach around $145,000 by the end of July. After that, a sharp correction is expected to fall back to $110,000. In the next 1 to 2 months, there will be a strong altcoin bull market, which is the stage when everyone really starts FOMO. He also predicts that Bitcoins dominance has been maintained for too long and altcoins are gradually rising. When the Federal Reserve begins to cut interest rates in the fourth quarter, Bitcoin will usher in a new round of increases, possibly to between $160,000 and $240,000.