Original author: insights 4.vc

Original translation: TechFlow

Since 2020, major U.S. banks, asset managers and payment institutions have gradually shifted from cautious observation of cryptocurrencies to active investment, cooperation or launch of related products.

As of early 2025, institutional investors hold approximately 15% of the Bitcoin supply, and nearly half of hedge funds have begun to allocate digital assets.

Key trends driving this integration include the launch of regulated crypto investment vehicles (such as the listing of the first U.S. spot Bitcoin and Ethereum ETFs in January 2024), the rise of tokenization of real-world assets (RWAs) on the blockchain, and the growing institutional use of stablecoins for settlement and liquidity management.

Institutions generally view blockchain networks as an effective tool to simplify traditional back-end systems, reduce costs and enter new markets.

Many banks and asset managers are piloting permissioned decentralized finance (DeFi) platforms that combine the efficiency of smart contracts with KYC (know your customer) and AML (anti-money laundering) compliance.

At the same time, they are also exploring permissionless public DeFi in a controlled manner. The strategic logic is clear: DeFis automated and transparent protocols enable faster settlement, 24/7 market operations, and new revenue opportunities, thereby solving the long-standing inefficiencies of traditional finance (TradFi).

However, significant headwinds remain, including regulatory uncertainty in the United States, technology integration challenges, and market volatility, which have slowed adoption.

Overall, as of March 2025, the interaction between traditional finance and cryptocurrencies is showing a cautious but gradually accelerating trend. Traditional finance is no longer just a bystander in the crypto field, but has begun to cautiously get involved in some use cases with tangible advantages (such as digital asset custody, on-chain lending, and tokenized bonds). The next few years will be a critical period to determine whether TradFi and DeFi can be deeply integrated in the global financial system.

Paradigm Report - The Future of Traditional Finance (March 2025)

Paradigm, a leading crypto venture capital fund, surveyed 300 traditional finance (TradFi) practitioners from multiple developed economies in its latest report. Here are some of the most interesting statistics and insights from the report .

Which areas contribute most to the cost of providing financial services?

What cost-cutting strategies does your organization use in providing financial services?

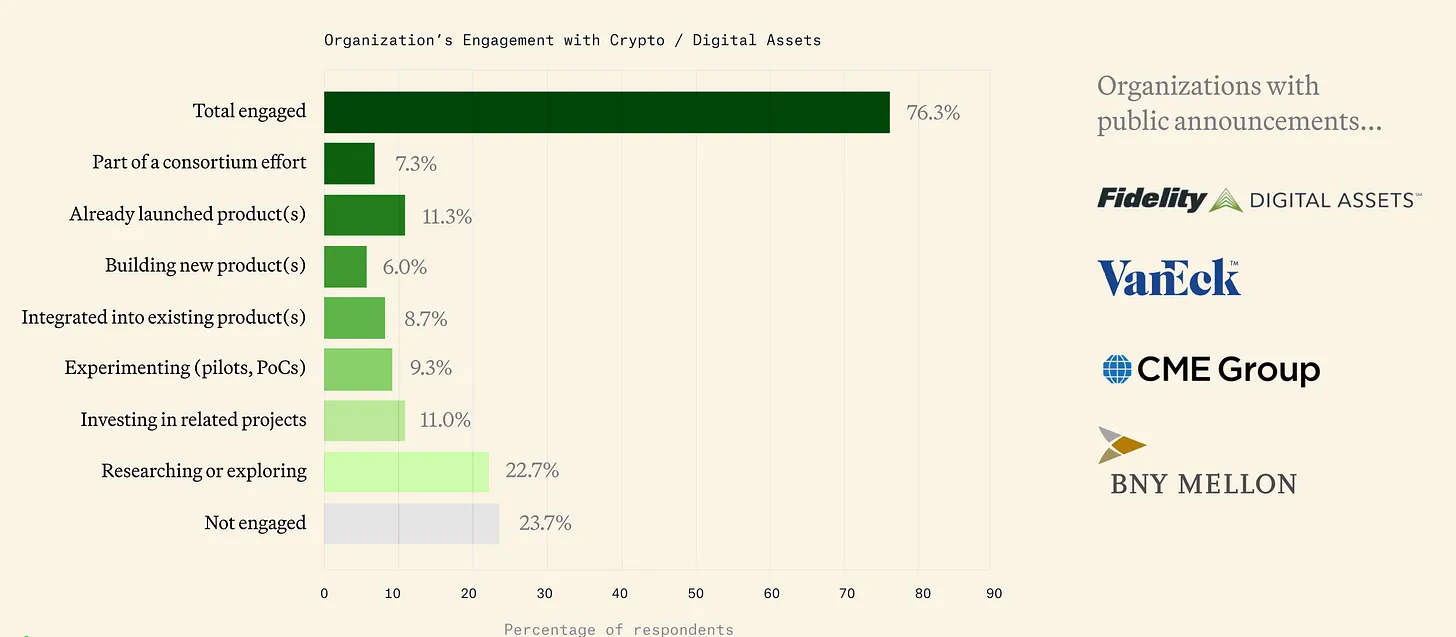

Currently around 76% of companies are involved in cryptocurrencies.

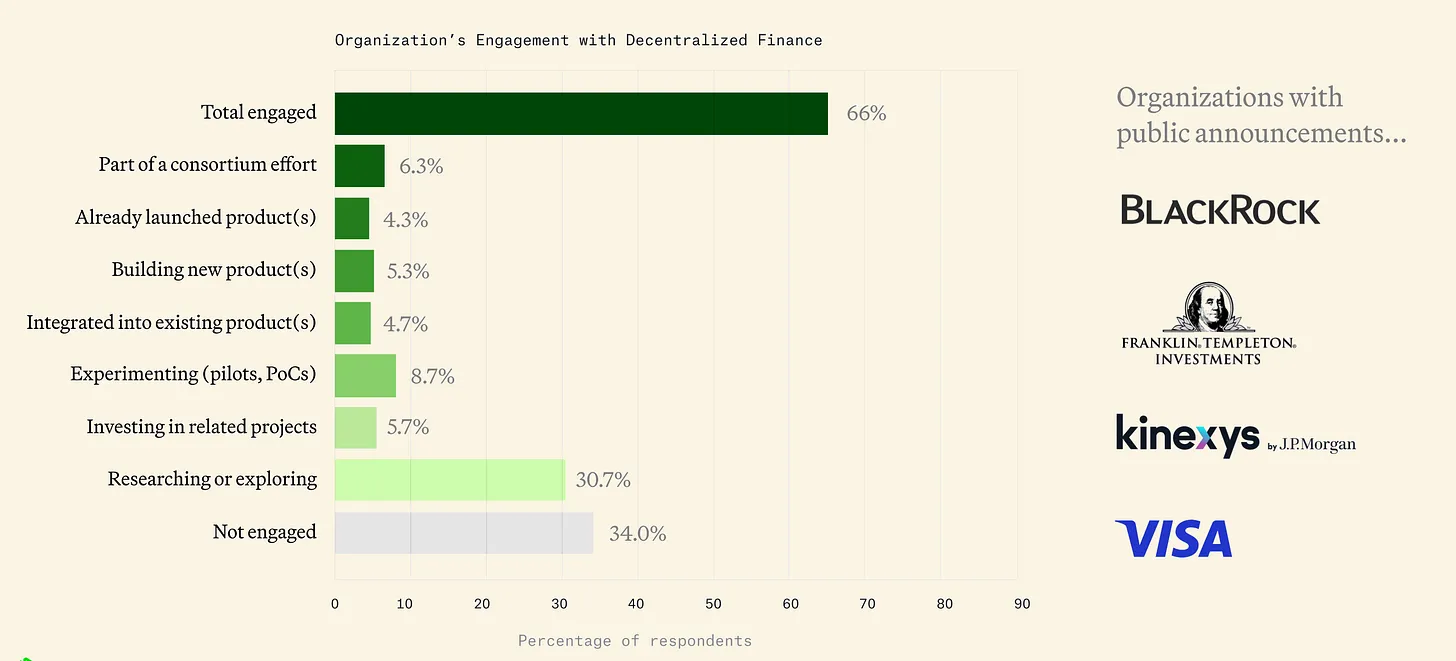

About 66% of traditional financial companies are becoming associated with decentralized finance (DeFi).

Some 86% of companies are currently involved in blockchain and distributed ledger technology (DLT).

Timeline of Institutional Entry into Crypto (2020-2024)

2020 - Initial Exploration:

Banks and traditional financial institutions have begun to tentatively enter the crypto market. In mid-2020, the U.S. Office of the Comptroller of the Currency (OCC) made it clear that banks can custody crypto assets, opening the door for custodians like BNY Mellon.

BNY Mellon subsequently announced digital asset custody services in 2021. That same year, corporate treasuries also began to get involved in the crypto space: MicroStrategy and Square made high-profile Bitcoin purchases as reserve assets, signaling growing institutional confidence.

Payment giants are also taking action - PayPal launched a cryptocurrency buying and selling service for US customers at the end of 2020, bringing digital assets to millions of users. These moves mark the beginning of mainstream institutions recognition of cryptocurrency as a legitimate asset class.

2021- Rapid Expansion:

With the bull market in full swing, 2021 has seen an acceleration in the integration of traditional finance and the crypto space. The milestones of Tesla’s purchase of $1.5 billion in Bitcoin and Coinbase’s listing on the Nasdaq in April 2021 have become important bridges between Wall Street and the crypto space.

Investment banks also responded to customer demand: Goldman Sachs restarted its crypto trading department, and Morgan Stanley began to provide wealthy clients with access to Bitcoin funds. In October of the same year, the first Bitcoin futures ETF (ProShares BITO) in the United States was officially launched, providing institutions with regulated crypto investment tools.

Major asset managers such as Fidelity and BlackRock have also begun to establish dedicated digital asset departments. In addition, Visa and Mastercard have established partnerships with stablecoins (such as Visas USDC pilot project), demonstrating their confidence in crypto payment networks.

The report clearly depicts the path of how traditional finance has gone from initial exploration to rapid expansion, laying the foundation for the further integration of crypto and traditional finance in the coming years.

2022 — Bear Market and Infrastructure Construction:

Despite the crypto market’s downturn in 2022 (marked by events such as the Terra crash and FTX bankruptcy), institutions continue to build infrastructure. In August of that year, BlackRock, the world’s largest asset management company, partnered with Coinbase to provide crypto trading services to institutional clients and launched a private Bitcoin trust for investors, a move that released strong market confidence.

Traditional exchanges and custodians are also expanding digital asset services. For example, BNY Mellon has launched crypto asset custody services for some clients, while Nasdaq has developed a custody platform. Meanwhile, JPMorgan uses blockchain for interbank transactions through its Onyx division, and JPM Coin has processed hundreds of billions of dollars in wholesale payments.

Tokenization pilot projects are also gradually emerging: institutions such as JPMorgan Chase have simulated DeFi transactions of tokenized bonds and foreign exchange using public blockchains in the Project Guardian project.

However, U.S. regulators have taken a stricter approach to market turmoil, leading some companies, such as Nasdaq in late 2023, to pause or slow down the launch of crypto products pending clearer rules.

2023 – Renewed institutional interest:

2023 saw a cautious resurgence of institutional interest. In the middle of the year, BlackRock submitted an application for a spot Bitcoin ETF, followed by Fidelity, Invesco and others. This wave of applications was an important turning point, especially considering the SECs previous rejections of similar proposals. In the same year, traditional financial-backed crypto infrastructure began to come online: EDX Markets, a digital asset exchange backed by Charles Schwab, Fidelity and Citadel, officially started operations in 2023, providing institutions with a compliant trading platform.

Meanwhile, the tokenization of traditional assets has accelerated — for example, private equity giant KKR tokenized part of its fund on the Avalanche blockchain, while Franklin Templeton moved its tokenized money market fund holding U.S. Treasuries to a public blockchain.

The international regulatory environment has also improved (the European Union passed the Markets in Crypto-Assets Act (MiCA) and Hong Kong reopened crypto trading under new rules), further pushing US institutions to prepare for a globally competitive landscape.

By the end of 2023, the Ethereum futures ETF was approved, and the market was looking forward to the approval of the spot ETF. At the end of the year, institutional adoption of crypto assets showed a trend that would accelerate if regulatory barriers were cleared.

Early 2024 – Spot ETF Approval:

In January 2024, the U.S. Securities and Exchange Commission (SEC) finally approved the first U.S. spot Bitcoin ETF (followed by an Ethereum ETF). This milestone event marked the mainstreaming of crypto assets on U.S. exchanges and unlocked billions of dollars for pension funds, registered investment advisors (RIAs), and conservative portfolios that previously could not hold crypto assets.

Within weeks, crypto ETFs attracted massive inflows, significantly expanding investor participation. Institutional crypto products continued to expand during this period - from stablecoin initiatives such as PayPals PYUSD stablecoin to banks such as Deutsche Bank and Standard Chartered investing in digital asset custody startups. As of March 2025, almost every major US bank, brokerage firm, and asset manager has launched crypto-related products or formed strategic partnerships in the crypto ecosystem, reflecting the full entry of institutions into the crypto space since 2020.

Traditional Finance’s View on DeFi in 2023-2025

Traditional finance (TradFi) has a curious but cautious attitude towards decentralized finance (DeFi).

On the one hand, many institutions recognize the innovative potential of permissionless DeFi - public liquidity pools and automated markets continue to perform well in crises (for example, decentralized exchanges continued to operate smoothly even during the market turmoil in 2022). In fact, industry surveys show that most TradFi practitioners foresee that public blockchain networks will gradually become an important part of their business in the future.

On the other hand, compliance and risk management concerns have made most institutions prefer permissioned DeFi environments in the short term. These platforms are usually private or semi-private blockchains, which retain the efficiency advantages of DeFi while limiting participants to audited entities.

A typical example is JPMorgans Onyx network, which runs a proprietary stablecoin (JPM Coin) and payment channels to serve institutional clients - essentially a walled garden version of DeFi. Similarly, Aave Arc launched a permissioned liquidity pool in 2023, and all participants are required to undergo KYC certification by the whitelist audit agency Fireblocks, combining DeFi technology with TradFis compliance requirements.

This dual-track perspective — embracing automation and transparency while exerting control over participants — becomes a key feature of traditional finance’s exploration of DeFi before 2025.

Institutional DeFi Pilot Projects

Between 2023 and 2025, several well-known institutions explored the potential of decentralized finance (DeFi) through a series of high-profile pilot projects. JPMorgans Onyx platform worked with other banks and regulators to participate in Project Guardian, led by the Monetary Authority of Singapore (MAS), to complete tokenized bond transactions and foreign exchange swaps on a public blockchain, achieving instant atomic settlement through smart contracts.

These experiments show that even permissionless protocols (such as Aave and Uniswap, after KYC compliance modifications) can be used by regulated entities with appropriate security measures. Asset management giant BlackRock launched the BlackRock USD Digital Liquidity Fund (BUIDL) in late 2023 to tokenize a U.S. Treasury money market fund.

Distributed to accredited investors via the Securitize platform, BUIDL provides institutions with a compliant way to hold tokenized yield assets on the Ethereum network, demonstrating that traditional finance’s acceptance of public blockchains is increasing while intermediaries ensure compliance.

Other examples include Goldman Sachs’ Digital Asset Platform (DAP), which issued tokenized bonds and facilitated digital repo trades, and HSBC’s use of the Finality blockchain platform for foreign exchange settlement.

These initiatives reflect a “learn by doing” strategy — with large institutions evaluating DeFi technology’s potential benefits in speed and efficiency through limited-scope trials on core activities such as payments, lending, and trading.

Venture-backed infrastructure development

A strong crypto infrastructure ecosystem is emerging, with venture capital and traditional financial institutions often backing the venture capital industry to bridge traditional finance (TradFi) and DeFi. Custody and security service providers such as Fireblocks, Anchorage, and Copper have raised significant funding to develop “institutional-grade” platforms for storing and trading digital assets (including tools for securely accessing DeFi protocols).

Compliance technology companies such as Chainalysis and TRM Labs provide transaction monitoring and analysis, enabling banks to meet anti-money laundering (AML) requirements when interacting with public blockchains. In addition, brokers and fintech startups are simplifying the complexity of DeFi and providing institutions with user-friendly interfaces.

For example, crypto prime brokers can now provide access to yield farming or liquidity pools as a service, while handling the technical operations off-chain. This venture-driven construction of wallets, APIs, identity solutions, and risk management layers is gradually solving the operational barriers for traditional finance to enter DeFi, paving the way for deeper integration in the future.

By 2025, decentralized exchanges (DEX) and lending platforms have begun integrating institutional portals to ensure that counterparty identities are verified.

Overall, the traditional financial (TradFi) view of DeFi has changed profoundly: DeFi is no longer seen as the Wild West that needs to be avoided, but a collection of financial innovations that can be carefully utilized within a compliance framework. Large banks are becoming early adopters of DeFi in a controlled manner, recognizing that ignoring the growth of DeFi may mean falling behind in the next revolution in finance.

The U.S. regulatory environment and global comparison

In the crypto space, regulatory clarity in the United States has lagged behind the pace of technological innovation, which has created both friction and opportunities for traditional finance to enter the crypto space. The U.S. Securities and Exchange Commission (SEC) has taken a tough stance: In 2023, the SEC filed several high-profile lawsuits against major exchanges, accusing them of offering unregistered securities, and proposed rules that could classify many DeFi platforms as securities exchanges. This regulatory environment has caused U.S. institutions to be more cautious when participating in DeFi, as most DeFi tokens lack a clear legal status.

However, in late 2024 and early 2025, the regulatory environment underwent an important shift. Under pressure from all sides, the SEC approved a spot crypto ETF, marking a pragmatic shift in its attitude. At the same time, court decisions such as the Grayscale case in 2024 began to clarify the scope of the SECs regulatory authority. The Commodity Futures Trading Commission (CFTC) also played a role, and its position on treating Bitcoin and Ethereum as commodities remained clear. Despite this, the CFTC punished some DeFi protocol operators for non-compliance requirements in 2023, while also advocating for a clearer framework to support innovation.

At the same time, the U.S. Treasury Department has set its sights on DeFi from an anti-money laundering (AML) perspective. In 2023, the Treasury Department released a DeFi Illegal Financial Risk Assessment Report, which pointed out that the anonymity of DeFi could be exploited by criminals, which laid the groundwork for the imposition of KYC (know your customer) obligations on decentralized platforms in the future. Actions similar to the sanctions against Tornado Cash in 2022 show that even code-based services cannot escape legal scrutiny if they are related to illegal capital flows.

For banks, U.S. banking regulators (OCC, Federal Reserve, FDIC) have issued guidance restricting direct exposure to crypto assets, effectively directing institutional participation to regulated custody services and ETFs rather than direct use of DeFi protocols. As of March 2025, the U.S. Congress has not passed comprehensive cryptocurrency legislation, but several proposals (such as stablecoin regulation and clarification of the definition of securities and commodities) have entered the advanced discussion stage. This means that traditional financial institutions in the United States need to be extremely cautious when participating in DeFi: they usually limit DeFi activities to sandbox experiments or offshore subsidiaries, waiting for clearer regulatory guidance. Clarity in the field of stablecoins, in particular (which federal law may designate as a new payment instrument) and custody rules (such as the SECs custody proposal), will have a significant impact on the depth of institutional participation in DeFi protocols within the United States.

Europe: MiCA and forward-looking rules

In stark contrast to the United States, the European Union has adopted a comprehensive crypto regulatory framework, the Markets in Crypto-Assets Act (MiCA). As of 2024, MiCA provides clear rules for the issuance of crypto assets, stablecoins, and the operation of service providers in each member state. Combined with a pilot program for tokenized securities trading, MiCA provides innovative certainty for European banks and asset managers. By early 2025, European companies have a clear understanding of how to apply for operating licenses for crypto exchanges or wallet services, while guidelines for institutional stablecoins and even DeFi are also being developed. This relatively clear regulatory environment has promoted pilot projects in tokenized bonds and on-chain funds by traditional European financial institutions.

For example, several EU commercial banks have issued digital bonds through regulatory sandbox programs and legally handle tokenized deposits under regulatory supervision. The UK has taken a similar path, explicitly stating that it wants to become a crypto hub. As of 2025, the UK Financial Conduct Authority (FCA) is developing rules for crypto trading and stablecoins, while the UK Law Commission has included crypto assets and smart contracts in legal definitions. These initiatives may enable London-based institutions to launch DeFi-based services earlier than their US counterparts (within certain limits).

Asia: Regulatory balance and innovation drive

Singapore and Hong Kong provide a stark contrast in global regulation. The Monetary Authority of Singapore (MAS) has implemented a strict licensing system for crypto companies since 2019, but has also actively explored DeFi innovations through public-private partnerships.

For example, DBS, a major Singaporean bank, has launched a regulated crypto trading platform and has participated in DeFi transactions (such as tokenized bond trading in partnership with JPMorgan Chase). Singapore’s approach treats permissioned DeFi as a controlled area of exploration, reflecting the idea of developing reasonable rules through regulated experiments.

After years of restrictions, Hong Kong changed its policy direction in 2023 and launched a new framework to license virtual asset exchanges and allow retail crypto trading under supervision. This policy shift, supported by the government, attracted global crypto companies and encouraged banks in Hong Kong to consider providing digital asset services in a regulated environment.

In addition, Switzerland has promoted the development of tokenized securities through the Distributed Ledger Technology Act (DLT Act), while the UAE has developed dedicated crypto rules through the Dubai Virtual Asset Regulatory Authority (VARA). These examples further show that around the world, regulatory attitudes range from cautious acceptance to active promotion, showing the diversity and potential of crypto-finance development.

Impact and Differences of DeFi Participation

For financial institutions in the United States, due to the fragmentation of regulatory rules, most of the possibilities for direct participation in DeFi remain limited until a compliance solution emerges. Currently, US banks are more focused on consortium blockchains or trading tokenized assets that meet existing legal definitions. In contrast, in jurisdictions with clearer regulatory frameworks, institutions are more relaxed about interacting with similar DeFi platforms.

For example, an asset manager in Europe might provide liquidity to a permissioned lending pool, while a bank in Asia might use a decentralized trading protocol internally to trade foreign exchange swaps while keeping regulators informed. However, the lack of uniform rules around the world also presents challenges: a multinational institution needs to balance strict rules in one region with opportunities in another. Many have called for international standards or “safe harbor” policies specifically for decentralized finance to unlock the potential of DeFi (such as efficiency and transparency) without compromising financial integrity.

In summary, regulation remains the biggest determinant of how fast traditional finance (TradFi) will participate in DeFi. As of March 2025, while some progress has been made—such as the approval of spot crypto ETFs in the United States and the issuance of customized licenses by global regulators—more work is still needed to establish sufficient legal clarity to enable institutions to fully embrace permissionless DeFi at scale.

Key DeFi protocols and infrastructure: a bridge to traditional finance

Many leading DeFi protocols and infrastructure projects are directly addressing the needs of traditional finance, creating entry points for institutional use:

Aave Arc (Institutional Lending Market)

Aave Arc is a permissioned version of the popular Aave liquidity protocol, launched between 2022 and 2023, designed for institutional users. It provides a private lending pool that only allows participants who have passed whitelist authentication and completed KYC (Know Your Customer) verification to conduct lending operations for digital assets. By introducing anti-money laundering (AML) and KYC compliance mechanisms (powered by whitelist agents such as Fireblocks) and accepting only pre-approved collateral, Aave Arc solves the key needs of traditional financial institutions (TradFi) - trust in counterparties and regulatory compliance. At the same time, it retains the lending efficiency driven by DeFi smart contracts. This design enables banks and fintech lenders to use DeFis liquidity to obtain secured loans without being exposed to the anonymity risks of public liquidity pools.

Maple Finance (On-chain capital market)

Maple is an institutionalized low-collateralized loan market on the chain, which can be compared to the syndicated loan market on the blockchain. Through Maple, certified institutional borrowers (such as trading companies or medium-sized enterprises) can obtain liquidity from lenders worldwide, and the transaction terms are due diligenced and facilitated by Pool Delegates. This model fills a gap in traditional finance: low-collateralized loans often rely on relationship networks and lack transparency, while Maple brings transparency and 24-hour settlement capabilities to such loans. Since its launch in 2021, Maple has facilitated hundreds of millions of dollars in loans, demonstrating how creditworthy companies can raise funds more efficiently on the chain. For traditional financial lenders, the Maple platform provides a way to earn stablecoin returns by lending to vetted borrowers, effectively simulating the private debt market while reducing operating costs. Maple shows how DeFi can significantly reduce administrative costs by simplifying loan issuance and servicing (such as interest payments) through smart contracts. This innovation provides traditional financial institutions with an efficient and compliant on-chain capital market solution.

Centrifuge (real-world asset tokenization)

Centrifuge is a decentralized platform focused on bringing real-world assets (RWAs) into DeFi as collateral. It allows asset originators (such as lenders in trade finance, receivables factoring, or real estate) to tokenize assets such as invoices or loan portfolios into fungible ERC-20 tokens. These tokens can then be financed through DeFi liquidity pools (Centrifuges Tinlake platform). This mechanism effectively connects traditional financial assets with DeFi liquidity - for example, invoices from small businesses can be pooled and funded by stablecoin lenders around the world. For institutions, Centrifuge provides a template for turning illiquid assets into investable on-chain instruments while reducing investment risk through a transparent risk stratification mechanism. It solves one of the core pain points in traditional finance: the difficulty of obtaining credit for certain industries. Through blockchain technology, Centrifuge is able to tap into a global investor pool of capital, and by 2025, even large protocols like MakerDAO will introduce collateral through Centrifuge, while traditional financial institutions are also watching how this technology can reduce capital costs and unlock new sources of financing.

Ondo Finance (Tokenized Yield Product)

Ondo Finance offers tokenized funds that bring traditional fixed income opportunities to crypto investors. Notably, Ondo has launched products such as OUSG (Ondo Short-Term U.S. Treasury Bond Fund) - a token fully backed by a short-term U.S. Treasury bond ETF - and USDY, a tokenized share of a high-yield money market fund. These tokens are sold to qualified investors under Regulation D and can be traded on-chain 24/7. Ondo effectively acts as a bridge, packaging real-world bonds into DeFi-compatible tokens.

For example, stablecoin holders can exchange their assets for OUSG, earn about 5% on short-term treasury bonds, and then seamlessly exit back to stablecoins. This innovation solves a common problem in traditional finance and crypto: it brings the security and returns of traditional assets to the digital asset space, while opening up new distribution channels for traditional fund managers through DeFi. Ondos tokenized treasury products (issued in the hundreds of millions of dollars) have triggered competitors and traditional financial institutions to follow suit, blurring the line between money market funds and stablecoins. This model not only provides investors with more options, but also further promotes the integration of traditional finance and DeFi.

EigenLayer (Restaking and Decentralized Infrastructure)

EigenLayer is a new Ethereum-based protocol that will be launched in 2023 and supports the Restaking function, which is to protect new networks or services by reusing the security of staked ETH. Although this technology is still in its infancy, it is of great significance to institutions in terms of infrastructure scalability. EigenLayer allows new decentralized services (such as oracle networks, data availability layers, and even institutional settlement networks) to inherit the security of Ethereum without having to build a separate validator network. For traditional financial institutions (TradFi), this means that future decentralized trading or clearing systems can run on the existing trust network (Ethereum) without having to build it from scratch. In practical applications, banks may deploy a smart contract service in the future (for example, for interbank loans or foreign exchange transactions) and ensure that the service is secured by billions of staked ETH through restaking - this level of security and decentralization is almost impossible to achieve on a permissioned ledger. EigenLayer represents the cutting edge of decentralized infrastructure, and while not currently used directly by TradFi, it could become a foundational pillar for the next generation of institutional-grade DeFi applications by 2025-2027.

These examples show that the DeFi ecosystem is actively developing solutions that converge with TradFi needs - whether its compliance (Aave Arc), credit analysis (Maple), real-world asset access (Centrifuge/Ondo), or robust infrastructure (EigenLayer). This convergence is a two-way street: TradFi is learning how to use DeFi tools, and DeFi projects are constantly adapting to meet TradFi requirements. This interaction will ultimately lead to a more mature, interconnected financial system, paving the way for future financial innovation.

The Prospect of Tokenization of Real Assets

One of the most substantial intersections between traditional finance (TradFi) and the cryptocurrency sector is the tokenization of real-world assets (RWA) - the migration of traditional financial instruments (such as securities, bonds, and funds) to the blockchain. As of March 2025, institutional participation in the tokenization field has moved from the proof-of-concept stage to the implementation of actual products:

Tokenized Funds and Deposits

Several large asset managers have launched tokenized versions of their funds. For example, BlackRock’s BUIDL fund and Franklin Templeton’s OnChain U.S. Government Money Fund (which uses a public blockchain to record shares) allow qualified investors to trade fund shares in the form of digital tokens. WisdomTree has launched a series of blockchain-based fund products (covering treasuries, gold, etc.) that aim to enable 24/7 trading and simplify investor participation. These programs are often conducted under existing regulatory structures (such as private securities issued through exemptions), but they mark an important step in the trading of traditional assets on blockchain infrastructure.

In addition, some banks have also explored tokenized deposits (i.e., regulated liability tokens) that represent bank deposits but can circulate on the blockchain, attempting to combine bank-level security with the transaction speed of cryptocurrencies. These projects show that institutions see tokenization as an effective way to increase liquidity and shorten the settlement time of traditional financial products.

Tokenized Bonds and Debt

The bond market is one of the early success stories of tokenization. In 2021-2022, institutions such as the European Investment Bank issued digital bonds on Ethereum, with participants completing the settlement and custody of the bonds through the blockchain rather than relying on traditional clearing systems. By 2024, institutions such as Goldman Sachs and Santander facilitated bond issuance through their private blockchain platforms or public networks, demonstrating that even large-scale debt issuance can be completed through distributed ledger technology (DLT).

Tokenized bonds bring instant settlement (T+0, compared to traditional T+2), programmable interest payments, and more convenient fragmented ownership. This not only reduces issuance and management costs for issuers, but also provides investors with wider market access and real-time transparency. Even some government finance ministries have begun to study the application of blockchain in bonds. For example, the Hong Kong government issued a tokenized green bond in 2023.

Although the market size of on-chain bonds is still relatively small (approximately hundreds of millions of dollars), the growth of this field is accelerating as the legal and technical frameworks gradually improve.

Tokenization of Private Market Securities

Private equity and venture capital firms are using tokenization to partially convert traditionally illiquid assets (such as private equity fund shares or pre-IPO stocks) into a tradable form to provide liquidity to investors. For example, KKR and Hamilton Lane have partnered with fintech companies (such as Securitize and ADDX) to launch tokenized fund shares, allowing qualified investors to purchase tokens representing economic rights in these alternative assets. Although currently limited in scale, these attempts foreshadow that in the future, secondary markets for private equity or real estate may run on the blockchain, thereby reducing the liquidity premium that investors demand for these assets.

From an institutional perspective, the core of tokenization is to expand asset distribution channels and unlock capital potential by turning traditionally locked assets into small tradable units. This innovation not only improves the accessibility of assets, but also injects new vitality into traditional finance.

The rise of DeFi native platforms

It’s worth noting that the tokenization trend isn’t limited to traditional financial institutions — DeFi-native real-world asset platforms are also addressing the same problem from another angle. Protocols like Goldfinch and Clearpool (as well as Maple and Centrifuge mentioned above) are driving on-chain financing and supporting real-world economic activity without waiting for big banks to act.

For example, Goldfinch uses liquidity provided by cryptocurrency holders to fund real-world loans (such as fintech lenders in emerging markets), essentially acting as a decentralized global credit fund. Clearpool provides a marketplace for institutions to launch unsecured loan pools with anonymous identities (combined with credit scores) that are priced and funded by the market.

These platforms often cooperate with traditional institutions to form a hybrid model that combines DeFi transparency with TradFi trust mechanisms. For example, fintech borrowers in Goldfinchs lending pool may undergo financial audits through third parties. This cooperation model not only ensures the transparency of on-chain operations, but also introduces the prudent trust system of traditional finance, providing a solid foundation for the further development of tokenization.

The future of tokenization of real-world assets (RWAs) is promising. In the current high-interest rate environment, the crypto market has a strong demand for real-world asset yields, which has further driven the tokenization of bonds and credit (Ondos success is a typical example). For institutions, the efficiency gains brought by tokenized markets are very attractive: trades can be settled in seconds, markets can operate 24/7, and there is less reliance on intermediaries such as clearing houses. Industry group estimates suggest that if regulatory hurdles are resolved, trillions of dollars of real-world assets could be tokenized in the next decade. By 2025, we are already seeing the early network effects of tokenization. For example, a tokenized Treasury bond can be used as collateral in a DeFi lending protocol, which means that institutional traders can borrow stablecoins against tokenized bonds to obtain short-term liquidity, which is not possible in the traditional financial environment. This composability, which is uniquely enabled by blockchain, has the potential to revolutionize collateral management and liquidity management for financial institutions.

In summary, tokenization is bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi) more directly than any other trend. It not only allows traditional assets to enter the DeFi ecosystem (providing stable collateral and real cash flow on the chain), but also provides a testing ground for traditional financial institutions (because tokenized instruments can usually be restricted to operating in a licensed environment or issued under a known legal structure). In the coming years, we may see larger-scale pilot projects - such as major stock exchanges launching tokenization platforms and central banks exploring wholesale central bank digital currencies (CBDCs) that interoperate with tokenized assets - further consolidating the core position of tokenization in the future of the financial industry.

Challenges and strategic risks of traditional finance in decentralized finance

Regulatory uncertainty

Despite the huge opportunities, traditional financial institutions face many challenges and risks when integrating into the DeFi and crypto space. Among them, regulatory uncertainty is the primary issue. Due to the lack of clear and consistent regulations, banks are worried that cooperation with DeFi protocols may be identified by regulators as illegal securities transactions or unregistered asset transactions, resulting in enforcement actions. Before the law is perfected, institutions face potential regulatory backlash or penalties, which makes legal and compliance teams cautious about approving DeFi-related plans. This uncertainty is global, and differences in rules across jurisdictions further complicate the cross-border use of crypto networks.

Compliance and KYC/AML

Public DeFi platforms often allow anonymous or pseudonymous participation, which conflicts with banks’ Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations. Institutions must ensure that counterparties are not sanctioned or involved in money laundering activities. Although the technology to achieve on-chain compliance through whitelisting, on-chain identity authentication, or dedicated compliance oracles is still developing, this field is not yet mature. The operational risk of institutions inadvertently facilitating illicit fund flows in DeFi poses a significant reputational and legal threat, which also forces traditional financial institutions to prefer a permissioned or highly regulated environment.

Hosting and Security

New solutions are needed to securely custody crypto assets. The custody risks posed by private key management are particularly prominent - once a private key is lost or stolen, the consequences can be catastrophic. Institutions often rely on third-party custodians or internal cold wallet storage, but frequent high-profile hacks in the crypto space have made senior management concerned about security issues. In addition, smart contract risks are also a significant factor - funds locked in DeFi smart contracts may be lost due to vulnerabilities or attacks. These security issues have led institutions to generally limit their exposure to crypto assets or require strong insurance, and digital asset insurance is still in its infancy.

Market volatility and liquidity risk

Crypto markets are known for their high volatility. For institutions that provide liquidity to DeFi pools or hold crypto assets on their balance sheets, they must withstand dramatic price swings, which may directly affect returns or regulatory capital. In addition, in times of crisis, liquidity in DeFi markets may dry up quickly, and institutions may face slippage risks when trying to close large positions, or even counterparty risks due to defaults by protocol users (such as low-collateralized loan defaults). This unpredictability is in stark contrast to the more controllable volatility in traditional markets and the bottoming mechanisms provided by central banks.

Integration and technical complexity

Integrating blockchain systems with traditional IT infrastructure is a complex and expensive process. Banks must upgrade their systems to interact with smart contracts and manage real-time data around the clock, which is a daunting task. In addition, the shortage of professional talent is also a major problem - evaluating DeFi codes and risks requires special knowledge and skills, which means that institutions need to recruit or train experts in a highly competitive talent market. These factors lead to high initial entry costs.

Reputational risk

Financial institutions also need to consider public and customer perception. Participation in crypto is a double-edged sword: despite demonstrating innovation, it may raise concerns among conservative clients or board members, especially after events such as exchange crashes. If an institution is involved in a DeFi hack or scandal, its reputation may be damaged. Many institutions are therefore cautious and choose to conduct pilots behind the scenes until they are confident in risk management. In addition, reputational risks extend to unpredictable regulatory opinion - negative comments from officials on DeFi may cast a shadow on the relevant institutions.

Legal and accounting challenges

There are still unresolved legal questions about the ownership and enforceability of digital assets. For example, if a bank holds a token representing a loan, is it legally considered to own the loan? The lack of mature legal precedent for smart contract-based agreements further adds to the uncertainty. In addition, although accounting treatment is improving (it is expected to be allowed to be measured at fair value by 2025), there have been many problems in the accounting treatment of digital assets in the past (such as impairment rules), and regulators have high capital requirements for crypto assets (such as the Basel Accord that treats unsecured crypto assets as high-risk assets). These factors make it economically unattractive to hold or use crypto assets from a capital perspective.

Faced with the above challenges, many institutions are taking a strategic approach to risk management: starting with small pilot investments, testing the waters through subsidiaries or partners, and proactively communicating with regulators to strive for favorable outcomes. In addition, institutions are actively participating in industry alliances to promote the development of standards for compliant DeFi (such as identity-embedded tokens or DeFi passport proposals designed specifically for institutions). Overcoming these obstacles is critical to achieving broader adoption, and the timeline will depend primarily on the clarity of the regulatory framework and the continued maturity of crypto infrastructure toward institutional standards.

Outlook 2025-2027: Scenario Analysis of the Integration of Traditional Finance and DeFi

Looking ahead, the degree of integration between traditional finance and decentralized finance may develop along a variety of paths in the next 2-3 years. Here is an overview of optimistic, pessimistic, and neutral scenarios:

Optimistic scenario (rapid convergence)

In this positive scenario, regulatory clarity improves significantly by 2026.

For example, the United States could pass a federal law clarifying the crypto asset class and establishing a regulatory framework for stablecoins and even DeFi protocols (perhaps creating new charters or licenses for compliant DeFi platforms). As the rules become clear, large banks and asset managers could accelerate their crypto strategies—offering crypto trading and yield products directly to clients and using DeFi protocols in certain back-office functions (such as using stablecoins for overnight funding markets).

Regulation of stablecoins, in particular, could be a key catalyst: if dollar-backed stablecoins receive official approval and insurance, banks could start using them on a large scale for cross-border settlement and liquidity management, and embed stablecoins into traditional payment networks.

Improvements in technical infrastructure also play an important role in the optimistic scenario: Ethereum’s planned upgrades and Layer-2 scaling technologies make transactions faster and cheaper, while robust custody and insurance solutions become industry standards. This allows institutions to enter the DeFi space with lower operational risk.

By 2027, we could see the majority of interbank lending, trade finance, and securities settlement taking place on hybrid decentralized platforms. In an optimistic scenario, even ETH staking integration becomes common.

For example, the financial department of a company will use the pledged ETH as a yield asset (similar to a digital bond), adding a new asset class to the institutional portfolio. This scenario foresees the deep integration of traditional finance and DeFi: traditional financial institutions not only invest in crypto assets, but also actively participate in the governance and infrastructure construction of DeFi, promoting the formation of a regulated, interoperable DeFi ecosystem that complements the traditional market.

Pessimistic scenario (stagnation or retreat)

In the pessimistic scenario, regulatory crackdowns and adverse events will severely hinder the integration of traditional finance and DeFi. What may happen is that the SEC and other regulators increase enforcement without providing new compliance paths - effectively prohibiting banks from accessing open DeFi and only allowing access to a few approved crypto assets. In this case, by 2025/2026, most institutions still choose to wait and see, limited to investing in ETFs (exchange-traded funds) and a few permissioned networks, but stay away from public DeFi due to legal risks.

In addition, one or two high-profile failures could further dampen sentiment. For example, a major stablecoin collapses, or a systemic DeFi protocol is hacked, leading to losses for institutional players, reinforcing the impression that “crypto is too risky.” In this scenario, the global market is split: the EU and Asia may continue to advance crypto integration, while the United States lags behind, which could lead to U.S. companies losing competitiveness or even lobbying against crypto in order to maintain fair competition in the market. Traditional financial institutions may even adopt a resistant attitude towards DeFi, especially if they see DeFi as a threat without viable regulatory support. This could lead to a slowdown in innovation (e.g., banks only promote private distributed ledger technology (DLT) solutions and dissuade customers from participating in on-chain finance). In essence, the pessimistic scenario depicts a situation where the promise of the synergistic development of traditional finance and DeFi fails to materialize, and the crypto sector remains a niche or minor institutional investment area before 2027.

Neutral scenario (gradual and steady consolidation)

The most likely scenario is somewhere in between — a continued gradual integration that proceeds slowly but surely. In this baseline scenario, regulators will continue to issue guidance and some narrow rules (e.g., stablecoin legislation could be passed by 2025, the SEC could adjust its stance, perhaps exempting certain institutional-grade DeFi activities, or approving more crypto products on a case-by-case basis). While there won’t be a sweeping regulatory overhaul, each year will bring some new clarity.

Traditional financial institutions are cautiously expanding their involvement in the crypto space: more banks will offer custody and execution services, more asset managers will launch crypto or blockchain-themed funds, and more pilot projects will go live, connecting banking infrastructure with public blockchains (particularly in the areas of trade finance documents, supply chain payments, and secondary market trading of tokenized assets). We may see consortium-led networks selectively interconnected with public networks - for example, a group of banks may run a permissioned lending protocol and bridge to a public DeFi protocol when additional liquidity is needed, all under agreed rules.

In this scenario, stablecoins may be widely used as a settlement tool by fintechs and some banks, but have not yet replaced major payment networks. ETH staking and crypto yield products begin to enter institutional portfolios on a small scale (for example, some pension funds put a small amount of their allocations into yield-oriented digital asset funds). By 2027, in the neutral scenario, the integration of traditional finance with DeFi is significantly deeper than it is today - for example, 5-10% of trading volume or loans in some markets occur on-chain, but it remains a parallel track to traditional systems rather than a complete replacement. More importantly, this trend line is upward: the success stories of early adopters will convince more conservative peers to participate, especially as competitive pressure and customer interest continue to increase.

Key drivers to watch

Across all scenarios, there are several key drivers that will determine the ultimate outcome of the convergence of traditional finance (TradFi) and decentralized finance (DeFi).

The first and foremost is the regulatory dynamic – any move that provides legal clarity (or conversely, imposes new restrictions) will have a direct impact on how institutions’ behaviour changes.

Among them, the evolution of stablecoin policies is particularly critical: secure and regulated stablecoins may become the core cornerstone of institutional-level DeFi transactions. The maturity of technology is another important driving force - the continued improvement of blockchain scalability (through the Ethereum Layer 2 network, alternative high-performance chains or interoperability protocols) and the improvement of tools (such as better compliance integration, privacy transaction options, etc.) will make institutions more receptive to DeFi.

In addition, macroeconomic factors may also have an impact: if traditional yields remain high, the urgent need for DeFi returns by institutions may weaken, thereby reducing interest; but if traditional yields fall, the attractiveness of DeFis additional returns may rise again.

Finally, market education and industry performance are also crucial - every year that the resilience of DeFi protocols is verified, and every successful pilot project (such as a large bank successfully settling $100 million through blockchain) will increase market trust.

By 2027, we expect the debate on “should traditional finance adopt DeFi” to shift to “how can traditional finance better use DeFi”, similar to how cloud computing was gradually widely adopted after initial skepticism in the banking industry. Overall, the next few years may witness traditional finance and DeFi moving from cautious exploration to deeper cooperation, and the pace will be determined by the interaction between technological innovation and regulatory frameworks.

Highly recommended

The Future of TradFi: DeFi and the Rise of Scalable Finance

Risk Disclaimer:

insights 4.vc and its newsletter provide research and information for educational purposes only and should not be considered professional advice of any kind. We do not advocate any investment behavior, including buying, selling or holding digital assets.

The content of this article only represents the authors personal opinion and is not financial advice. Please be sure to do your own due diligence before participating in cryptocurrency, DeFi, NFT, Web3 or related technologies, as these areas are high-risk and have significant value fluctuations.

Note: This research report is not sponsored by any of the companies mentioned.